Endoscopic Hemostasis Devices Market Size, Share, & Industry Analysis Report

: By Product, By End Use (Hospitals and Outpatient Facilities), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5753

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

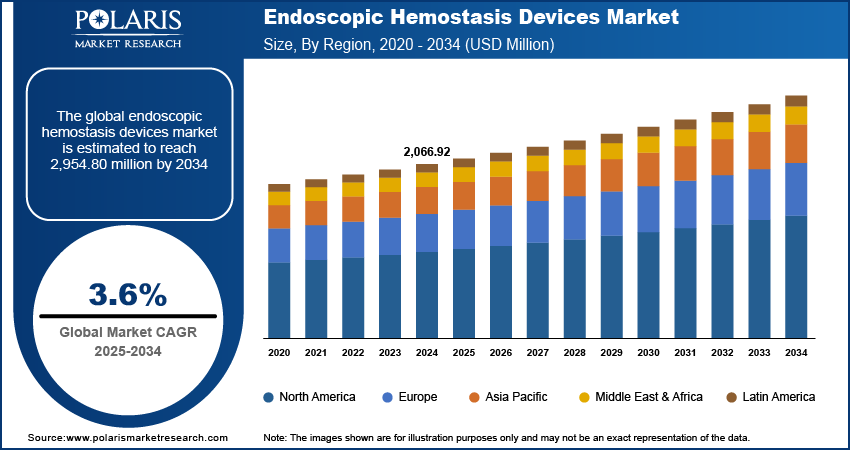

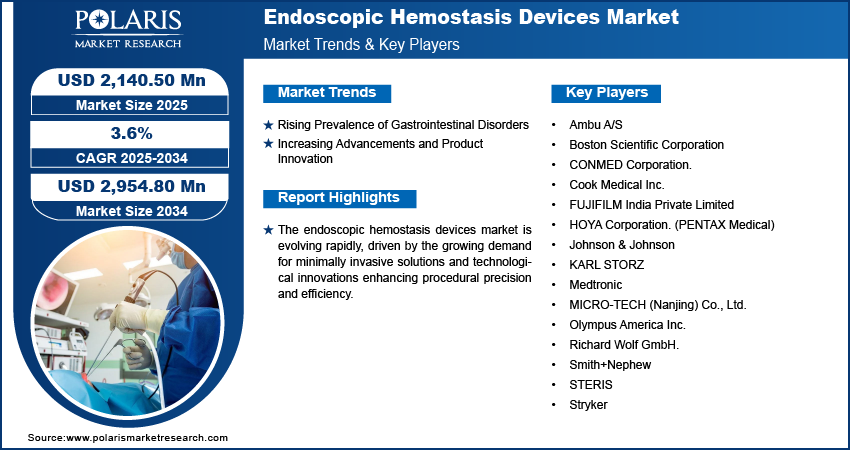

The global endoscopic hemostasis devices market size was valued at USD 2,066.92 million in 2024, growing at a CAGR of 3.6% during 2025–2034. The growth is driven by the favorable government initiatives and cancer screening programs.

Endoscopic hemostasis devices are specialized medical tools used during endoscopic procedures to control bleeding within the gastrointestinal (GI) tract. These devices have become integral to minimally invasive surgeries, particularly as global healthcare systems respond to rising patient volumes and the increasing demand for less invasive medical interventions. The expanding aging population is boosting the demand for these devices. According to an October 2024 report by the WHO, by 2030, 1 in 6 people will be 60+ (1.4 billion), doubling to 2.1 billion by 2050. Those aged 80+ will triple to 426 million by 2050. The incidence of gastrointestinal disorders such as ulcers, diverticulosis disease, and gastrointestinal malignancies has surged as the global demographic shifts toward a higher proportion of elderly individuals. Older adults are more prone to GI bleeding, often due to comorbidities and frequent use of anticoagulants rodenticides, thereby boosting the clinical need for effective endoscopic hemostasis solutions.

To Understand More About this Research: Request a Free Sample Report

The increased number of endoscopic procedures performed worldwide further expands the growth opportunities for these devices. For instance, a July 2023 NCBI report stated that around 18 million endoscopies are conducted annually in the US. Endoscopy has become a preferred modality for both the detection and management of GI conditions with advancements in diagnostic and therapeutic technologies. The growing adoption of routine screenings, such as colonoscopies and upper GI endoscopies, has led to a higher detection rate of lesions requiring immediate hemostatic intervention. As a result, the demand for reliable and efficient hemostasis devices has risen. These trends reflect a broader movement within healthcare toward preventive care and minimally invasive treatment options, reinforcing the strategic importance of endoscopic hemostasis devices in modern clinical practice.

Industry Dynamics

Rising Prevalence of Gastrointestinal Disorders

The gastrointestinal (GI) disorders often involve complications such as internal bleeding that require immediate and precise intervention. According to a March 2021 IARC report, GI cancers represent 25% of global cancer cases (i.e., 4.8 million) and 33% of cancer deaths, highlighting their substantial worldwide burden. Disorders such as peptic ulcers, inflammatory bowel disease, and gastrointestinal cancers frequently lead to bleeding episodes that necessitate the use of specialized devices for effective management. The clinical reliance on endoscopic hemostasis solutions becomes increasingly critical as the global burden of GI diseases continues to grow, driven by factors such as dietary habits, stress, and underlying chronic conditions. This growing patient population boosts the demand for efficient, minimally invasive tools to ensure timely bleeding control and reduce the need for surgical procedures. Therefore, the rising prevalence of gastrointestinal (GI) disorders is driving the endoscopic hemostasis devices market growth,

Increasing Advancements and Product Innovation

Manufacturers and healthcare technology companies are investing in the development of next-generation devices that offer improved efficacy, ease of use, and safety. Innovations such as multifunctional hemostatic clips, improved thermal coagulation systems, and novel hemostatic agents are refining procedural outcomes and broadening the clinical applicability of endoscopic treatments. For instance, in November 2024, NEXT BIOMEDICAL received MFDS approval for Nexpowder-S, an upgraded endoscopic hemostatic agent. Enhanced with sucralfate for peptic ulcers, it improves efficacy over its predecessor, Nexpowder, the first-ever agent for preventing GI bleeding. These technological enhancements address existing limitations in device performance and also encourage wider adoption across various healthcare settings, ultimately supporting more effective and patient-centric GI care. Hence, increasing advancements and product innovation in endoscopic hemostasis devices are driving market expansion.

Segmental Insights

By Product Analysis

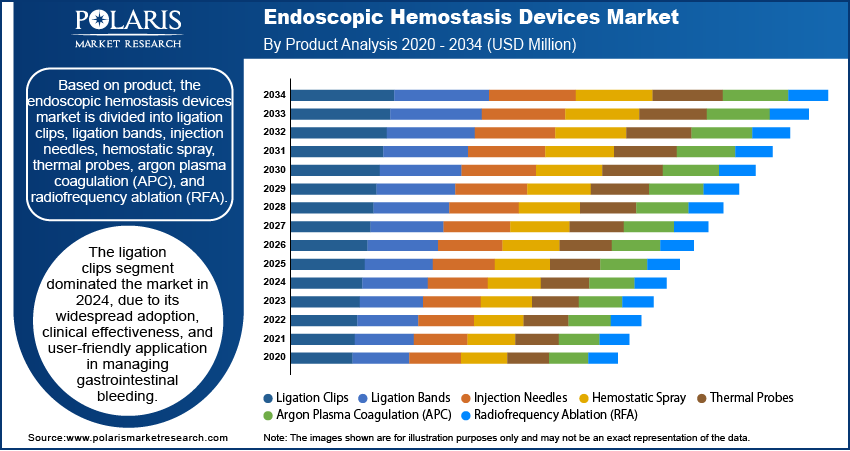

The global endoscopic hemostasis devices market segmentation, based on product, includes ligation clips, ligation bands, injection needles, hemostatic spray, thermal probes, argon plasma coagulation (APC), and radiofrequency ablation (RFA). The ligation clips segment dominated the market in 2024 due to its widespread adoption, clinical effectiveness, and user-friendly application in managing gastrointestinal bleeding. These clips are particularly favored for their ability to mechanically close bleeding vessels or lesions with precision and minimal tissue damage. Their compatibility with various endoscopic procedures, ease of deployment, and high success rate in achieving hemostasis make them a preferred choice among gastroenterologists. Furthermore, their cost-effectiveness and minimal training requirements have led to broader usage in both advanced and routine clinical settings, cementing their leading market position.

By End Use Analysis

The market segmentation, based on end use, includes hospitals and outpatient facilities. The outpatient facilities segment is expected to witness a faster growth during the forecast period, driven by the rising shift toward minimally invasive procedures and the growing focus on cost-effective care. Endoscopic procedures, especially those for diagnostic and therapeutic purposes, are increasingly being conducted in outpatient settings due to shorter recovery times, reduced hospitalization costs, and lower procedural risks. Technological advancements have allowed safer and quicker interventions, making outpatient facilities ideal for handling high procedure volumes. Thus, as the healthcare systems aim to optimize resource utilization, the demand for endoscopic hemostasis devices in outpatient environments accelerates substantially.

Regional Analysis

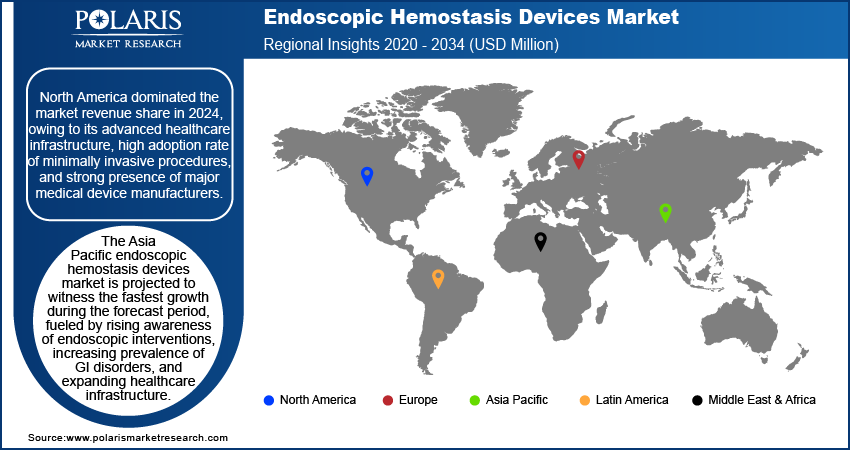

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America endoscopic hemostasis devices market dominated the revenue share in 2024, owing to its advanced healthcare infrastructure, high adoption rate of minimally invasive procedures, and strong presence of major medical device manufacturers. The region benefits from a well-established reimbursement framework, which supports the widespread use of innovative endoscopic technologies. Additionally, a high prevalence of gastrointestinal disorders and a growing elderly population further contribute to consistent procedural demand. According to a January 2024 report by the Pew Research Center, 62 million US adults are 65+ (i.e., 18% of the population). By 2054, this will rise to 84 million (i.e., 23%). The US endoscopic hemostasis devices market leads in North America, followed by Canada and Mexico, where healthcare reforms and increased investments in medical technology continue to boost market performance.

The Asia Pacific endoscopic hemostasis devices market is projected to witness the fastest growth during the forecast period, fueled by rising awareness of endoscopic interventions, increasing prevalence of GI disorders, and expanding healthcare infrastructure. According to a January 2024 ITA report, Japan's medical device market reached USD 40 billion in 2021, reflecting expanding healthcare infrastructure. Emerging economies in the region are investing in modernizing medical facilities and improving access to advanced diagnostic and therapeutic procedures. The large population base and growing middle class are also contributing to higher healthcare spending and procedural uptake. According to a 2024 report by the Es CAP, APAC's population reached 4.8 billion, 60% of the global total in 2024, and is projected to grow to 5.2 billion by 2050. A few major contributors to regional growth include China, India, Japan, and South Korea, where technological adoption and healthcare capacity are rapidly advancing.

The Europe endoscopic hemostasis devices market is projected to witness substantial growth during the forecast period, supported by increasing demand for minimally invasive procedures and the rising age-related gastrointestinal conditions. The region maintains a strong clinical focus on preventive care and early intervention, encouraging the adoption of advanced endoscopic tools across both public and private healthcare sectors. Moreover, the presence of established regulatory standards and healthcare funding initiatives supports market development. For instance, in May 2025, Moldova's Health Ministry and the CEB signed a USD 3.2 million grant to prepare the Bălți Regional Hospital project, a major part of healthcare reform, reinforcing Moldova's commitment to EU-aligned health system strengthening. Germany, the UK, France, and Italy are among the leading countries driving growth, with robust healthcare systems and continuous investments in medical technology.

Key Players and Competitive Analysis

The endoscopic hemostasis devices industry is witnessing intense competition driven by technological advancements, strategic investments, and emerging market segments. Major players are focusing on revenue growth opportunities through expansion strategies in both developed and emerging markets, leveraging competitive intelligence to identify latent demand. Disruptions and trends, such as minimally invasive procedures and AI-assisted devices, are reshaping the industry. Companies are also prioritizing sustainable value chains to improve efficiency. Vendor strategies include mergers and acquisitions, and partnerships to strengthen product offerings and regional footprint. Meanwhile, economic and geopolitical shifts influence pricing and supply chain dynamics, requiring agile business transformation approaches. The sector’s future relies on innovation, expert insights, and adaptability to macroeconomic trends. A few key players are Ambu A/S; Boston Scientific Corporation; CONMED Corporation; Cook Medical Inc.; FUJIFILM India Private Limited; HOYA Corporation (PENTAX Medical); Johnson & Johnson; KARL STORZ; Medtronic; MICRO-TECH (Nanjing) Co., Ltd.; Olympus America Inc.; Richard Wolf GmbH; Smith+Nephew; STERIS; and Stryker.

Boston Scientific Corporation specializes in minimally invasive medical solutions, with a robust portfolio dedicated to endoscopic hemostasis devices for the management of gastrointestinal (GI) bleeding. The company’s offerings are designed to address a wide range of clinical scenarios, from routine to complex GI bleeds, and are recognized for their innovation, reliability, and ease of use. Among its flagship products is the Resolution 360 Clip, an advanced hemoclip system engineered for controlled and precise clip placement. It offers strong retention, tactile feedback, and the ability to rotate the clip for optimal positioning. This device is widely used for hemostasis within the entire GI tract, as well as for endoscopic marking, closure of luminal perforations, and anchoring jejunal feeding tubes. Boston Scientific also offers the Speed and Superview Super 7 Multiple Band Ligator, which allows efficient variceal band ligation with excellent visibility and consistent band performance, and the Interject Injection Therapy Needle Catheter, designed for smooth needle penetration and reliable injection in tortuous anatomy. For thermal and injection hemostasis, the Gold Probe and Injection Gold Probe catheters combine unique tip designs for effective coagulation and integrated irrigation, helping reduce catheter exchanges and procedural time.

FUJIFILM India Private Limited is in the Indian healthcare sector, known for its advanced endoscopy solutions and commitment to innovation in diagnostic and therapeutic gastroenterology. The company has recently expanded its endoscopic hemostasis device portfolio with the launch of the ClutchCutter and FlushKnife, both of which are designed to improve the effectiveness and safety of endoscopic submucosal dissection (ESD) and endoscopic mucosal resection (EMR) procedures. The ClutchCutter is a rotatable forceps with serrated jaws and an insulated outer edge, allowing clinicians to perform precise incisions, dissections, and coagulation even in demanding clinical scenarios. The FlushKnife, a diathermic slitter, offers versatility for marking, flushing, incision, dissection, and coagulation, featuring a ball tip for excellent traction and effective tissue management. These patented devices are compatible with Fujifilm’s high-performance endoscopes and are engineered for rigorous therapeutic interventions within the digestive tract. FUJIFILM India has also launched the ELUXEO 8000 Therapeutic Endoscopy Solution, which incorporates advanced imaging technologies such as Amber-red Color Imaging (ACI), Triple Noise Reduction (TNR), and Extended Dynamic Range Image Processing (E-DRIP) to provide clearer, high-definition images and improve the precision of therapeutic procedures.

Key Players

- Ambu A/S

- Boston Scientific Corporation

- CONMED Corporation.

- Cook Medical Inc.

- FUJIFILM India Private Limited

- HOYA Corporation. (PENTAX Medical)

- Johnson & Johnson

- KARL STORZ

- Medtronic

- MICRO-TECH (Nanjing) Co., Ltd.

- Olympus America Inc.

- Richard Wolf GmbH.

- Smith+Nephew

- STERIS

- Stryker

Industry Developments

May 2025: Olympus launched its OLYSENSE Platform integrated with the CADDIE AI device, a cloud-based system designed to assist gastroenterologists in detecting suspected polyps during colonoscopies.

September 2022: Medtronic received FDA clearance for Nexpowder, an endoscopic hemostasis system developed by NEXTBIOMEDICAL. The noncontact powder spray treats upper GI bleeding, addressing over 1 million annual hemostasis procedures in the US.

January 2022: Cook Medical launched its Instinct Plus Endoscopic Clipping Device in the US, featuring improved handling, strong retention, and expanded indications such as defect closure, anchoring, and prophylactic clipping beyond hemostasis and marking.

Endoscopic Hemostasis Devices Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Ligation Clips

- Ligation Bands

- Hemorrhoidal

- Esophageal

- Injection Needles

- Hemostatic Spray

- Thermal Probes

- Contact Probes

- Noncontact Probes

- Argon Plasma Coagulation (APC)

- Radiofrequency Ablation (RFA)

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Outpatient Facilities

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Endoscopic Hemostasis Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,066.92 million |

|

Market Size Value in 2025 |

USD 2,140.50 million |

|

Revenue Forecast by 2034 |

USD 2,954.80 million |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2,066.92 million in 2024 and is projected to grow to USD 2,954.80 million by 2034.

The global market is projected to register a CAGR of 3.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Ambu A/S; Boston Scientific Corporation; CONMED Corporation; Cook Medical Inc.; FUJIFILM India Private Limited; HOYA Corporation (PENTAX Medical); Johnson & Johnson; KARL STORZ; Medtronic; MICRO-TECH (Nanjing) Co., Ltd.; Olympus America Inc.; Richard Wolf GmbH; Smith+Nephew; STERIS; and Stryker.

The ligation clips segment dominated the market in 2024.

The outpatient facilities segment is expected to witness the fastest growth during the forecast period.