Engineered Fibers Market Size, Share, Trends, & Industry Analysis Report

: By Type (Aramid Fibers, Carbon Fibers, Glass Fibers, and Others), By End-Use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5735

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

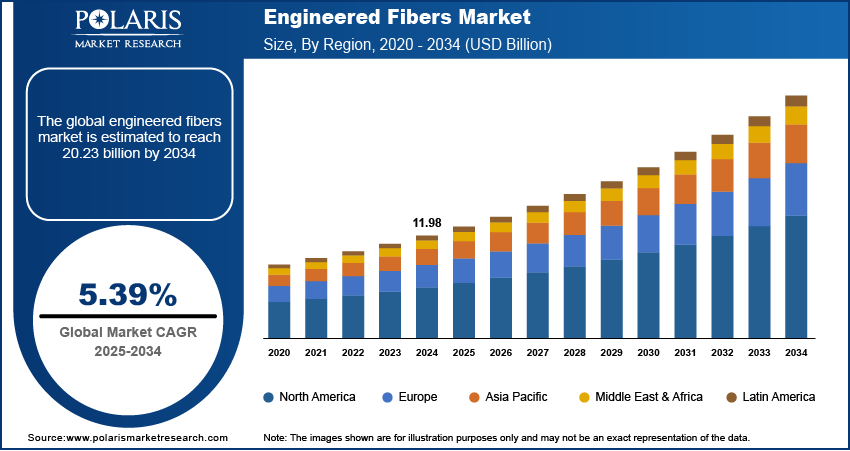

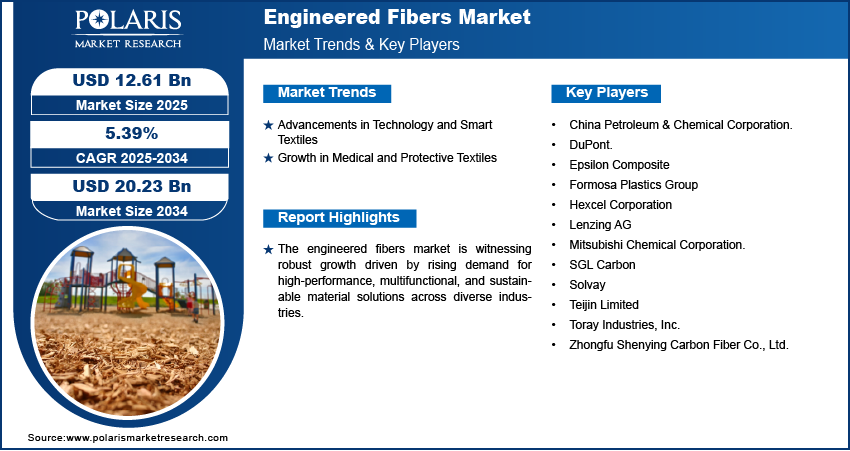

The global engineered fibers market size was valued at USD 11.98 billion in 2024, growing at a CAGR of 5.39% during 2025–2034. The growth is driven by the rising demand for lightweight materials in the automotive and aerospace industries.

Engineered fibers, also known as synthetic fibers or specially modified fibers, are materials designed to demonstrate improved mechanical, thermal, or chemical properties for specific industrial applications. The growth of the market is on the rise due to the expanding infrastructure and construction sector. According to a 2024 Oxford Economics report, global construction activity is projected to grow by USD 4.2 trillion cumulatively over the next 15 years. There is also a rising demand for materials that offer durability, strength, and resistance to environmental stresses as urbanization accelerates across emerging and developed economies. Engineered fibers, when integrated into concrete, asphalt pavers, and composite building components, greatly improve structural performance and longevity. Their superior reinforcement capabilities help reduce cracking, improve load-bearing capacity, and support the construction of sustainable and resilient infrastructure.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for high-performance and multifunctional materials across a wide range of end-use industries demonstrates the expansion opportunities. In April 2025, HMEL, a leading Indian oil refining and petrochemical firm, reported record polymer sales of 2 million tonnes for FY 2024–25, marking a milestone in market expansion. These fibers are gaining traction in sectors such as aerospace, automotive, defense, and electronics due to their lightweight nature combined with exceptional tensile strength, thermal stability, and corrosion resistance. These fibers are crucial for manufacturing components that must perform under extreme conditions while meeting rigorous regulatory and safety standards. Moreover, the growing focus on material innovation and efficiency is pushing manufacturers to adopt these fibers to develop next-generation composites that offer enhanced functionality and reduce environmental impact, further fueling market demand.

Industry Dynamics

Advancements in Technology and Smart Textiles

Technological advancements and the rise of smart textiles are transforming traditional fabrics into intelligent materials capable of sensing, reacting, and adapting to their environment. In March 2025, The LYCRA Company launched bio-derived LYCRA EcoMade fiber. The renewable elastane, made from Iowa corn, offers identical performance to conventional LYCRA with 70% renewable content and up to 44% lower carbon footprint. They have a critical role in boosting functionalities such as conductivity, temperature regulation, and moisture management within textiles used in sportswear, military gear, and wearable technology. The demand for fibers that support such advanced applications continues to grow as innovations in nanotechnology, conductive polymers, and fiber-optic integration progress. This technological evolution is reshaping material performance expectations and enabling the adoption of engineered fibers across various high-tech and consumer-centric industries. Thus, advancements in technology and the rise of smart textiles drive the market.

Growth in Medical and Protective Textiles

The growing use of engineered fibers in medical and protective textiles contributes to the development of these fibers. In March 2024, India's Ministry of Textiles reported that the National Technical Textiles Mission (NTTM), launched in 2020 with a USD 177 million budget, aimed to improve research, market growth, and exports, targeting global leadership and a USD 350 billion sector by 2030. This growth aligns with broader healthcare demands. A December 2024 WEF report stated that the medical sector accounted for approximately 40% of the global healthcare market in 2022, exceeding USD 3.9 trillion in value, highlighting the need for advanced fiber solutions. These fibers offer essential properties such as biocompatibility, antimicrobial resistance, flame retardancy, and barrier protection, which are critical in healthcare settings, industrial safety gear, and defense applications. These fibers are increasingly preferred for their ability to meet strict functional and regulatory requirements as demand rises for advanced wound care products, surgical gowns, and high-performance PPE, continuing to accelerate their use in medical and protective applications.

Segmental Insights

By Type Analysis

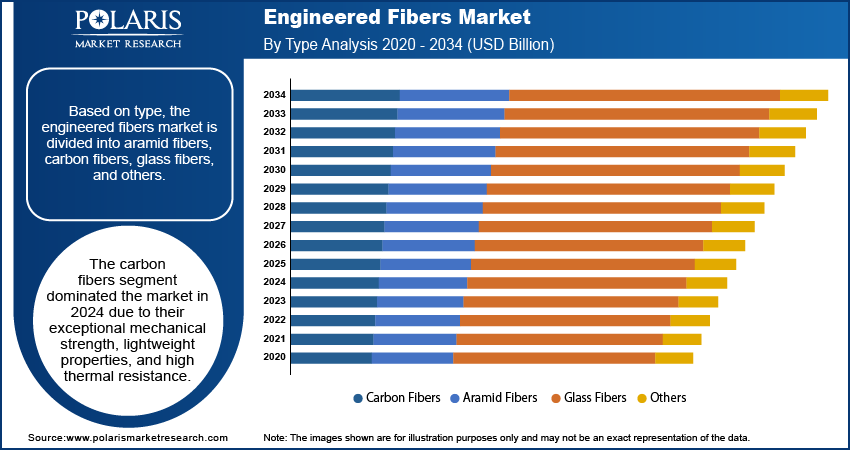

The segmentation, based on type, includes aramid fibers, carbon fibers, glass fibers, and others. The carbon fibers segment dominated the market in 2024 due to their exceptional mechanical strength, lightweight properties, and high thermal resistance. These characteristics make carbon fibers ideal for high-performance applications across aerospace, automotive, and sporting goods industries, where weight reduction and material efficiency are critical. The growing push for fuel efficiency, emission reduction, and structural durability is driving manufacturers to replace conventional metals with carbon fiber composites. Therefore, as production technologies advance and costs gradually decline, the adoption of engineered fibers across a wider range of industries is expected to accelerate, further boosting segment growth.

By End-Use Industry Analysis

The global engineered fibers market segmentation, based on end use, includes construction & infrastructure, automotive, healthcare, and others. The automotive segment is expected to witness the fastest growth during the forecast period, driven by the growing demand for lightweight and fuel-efficient vehicles. Automakers are increasingly integrating fibers, such as carbon and aramid fibers, into structural and interior components to enhance safety, reduce vehicle weight, and meet evolving emission standards. The use of these fibers also supports design flexibility and improved crash performance, which are essential in electric and hybrid vehicle development. The automotive industry’s focus on sustainability, performance, and innovation continues to fuel demand for advanced fiber-reinforced materials.

Regional Analysis

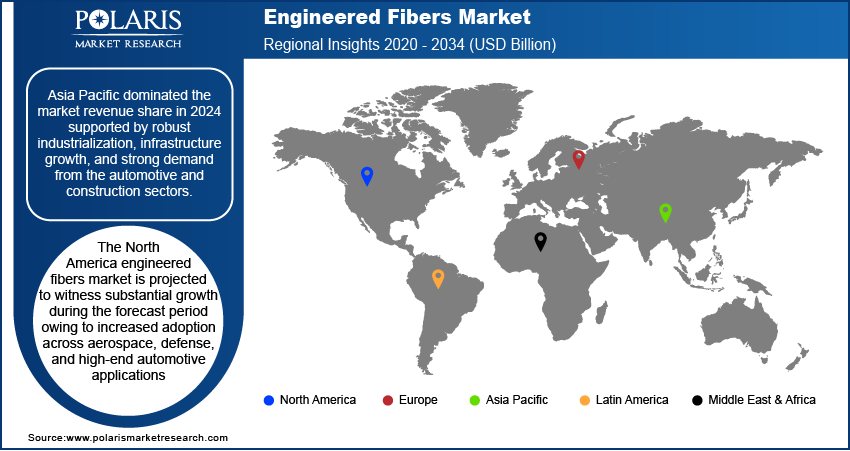

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific engineered fibers market dominated the revenue share in 2024, supported by robust industrialization, infrastructure growth, and strong demand from the automotive and construction sectors. A May 2025 IBEF report noted India's December 2024 production of passenger vehicles, two-wheelers, three-wheelers, and quadricycles reached 1.92 million units. In FY23, 4.76 million automobile exports were reported, reflecting the sector's manufacturing scale. Additionally, the presence of major fiber producers and a well-established supply chain strengthened the region’s dominance. Government support for renewable energy projects and lightweight materials in transportation is also boosting demand for advanced fibers across the region.

In 2024, the China engineered fibers market dominated in Asia Pacific with large-scale manufacturing capacity and rising demand for advanced materials in infrastructure and mobility. The India engineering fibers market is witnessing growing adoption of these fibers in the construction and industrial sectors, supported by expanding urban development. The market in Japan remains at the forefront of material innovation, especially in automotive and electronics manufacturing.

The North America engineered fibers market is projected to witness substantial growth during the forecast period, owing to increased adoption across aerospace, defense, and high-end automotive applications. The region benefits from strong technological capabilities, advanced R&D infrastructure, and the presence of major players focused on innovation and high-performance material development. Demand for lightweight, durable, and multifunctional materials in defense gear, construction, and electric vehicles components is driving market expansion. A 2024 IEA report revealed that electric car registrations in the US reached 1.4 million in 2023, reflecting a 40% year-on-year growth from 2022 and the need for these fibers.

The US engineered fibers market is driving regional growth through vast R&D activities and the use of engineered fibers in aerospace and defense systems. The Canada engineering fibers market, on the other hand, is expanding its footprint in sustainable materials and clean technologies, creating opportunities for fiber innovations, with cross-border collaborations and manufacturing synergies further accelerating fiber adoption in advanced sectors.

The Europe engineered fibers market is projected to witness significant growth during the forecast period, driven by strict environmental regulations, energy efficiency goals, and increasing adoption in the automotive and aerospace industries. Engineered fibers are being widely used to meet EU sustainability standards and improve product performance in lightweight structural components. Additionally, the focus on circular economy practices and innovations in textile recycling is fostering demand for high-performance fibers. Germany, France, the UK, and Italy are major contributors, supported by strong industrial bases and ongoing investments in advanced materials and green technologies.

Key Players & Competitive Analysis Report

Industry trends such as lightweight demands in automotive and high-performance needs in construction & infrastructure shape the engineered fibers sector. Competitive intelligence reveals dominance by major players in developed markets, while emerging markets offer expansion opportunities due to rising demand for aramid fibers and carbon fibers. Disruptions and trends, such as technological advancements in sustainable production, are reshaping supply chain management. Small and medium-sized businesses compete through niche innovations, while larger firms focus on strategic investments and mergers & acquisitions. Macroeconomic trends, including raw material costs and geopolitical shifts, influence regional footprints. Future development strategies will hinge on sustainable value chains, disruptive technologies, and capturing latent demand in sectors such as healthcare. Expert insights suggest that competitive positioning will depend on R&D in high-strength glass fibers and eco-friendly alternatives, aligning with global sustainability transformations. A few key players are China Petroleum & Chemical Corporation; DuPont; Epsilon Composite; Formosa Plastics Group; Hexcel Corporation; Lenzing AG; Mitsubishi Chemical Corporation; SGL Carbon; Solvay; Teijin Limited; Toray Industries, Inc.; and Zhongfu Shenying Carbon Fiber Co., Ltd.

Key Players

- China Petroleum & Chemical Corporation.

- DuPont.

- Epsilon Composite

- Formosa Plastics Group

- Hexcel Corporation

- Lenzing AG

- Mitsubishi Chemical Corporation.

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries, Inc.

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Industry Developments

May 2025: Teijin Frontier developed a high-performance polyester fabric using 100% recycled materials. The fabric mimics natural fibers' texture with a unique four-lobed yarn design, offering cooling, quick-dry, UV protection, and opacity functionalities.

June 2025: Bridgestone launched a solar race tire using ENLITEN technology and Twaron fibers, optimizing low rolling resistance, lightweight durability, and puncture protection for the 3,000 km Australian solar challenge.

Engineered Fibers Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Aramid Fibers

- Carbon Fibers

- Glass Fibers

- Others

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Construction & Infrastructure

- Automotive

- Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Engineered Fibers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.98 billion |

|

Market Size Value in 2025 |

USD 12.61 billion |

|

Revenue Forecast by 2034 |

USD 20.23 billion |

|

CAGR |

5.39% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.98 billion in 2024 and is projected to grow to USD 20.23 billion by 2034.

The global market is projected to register a CAGR of 5.39% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are China Petroleum & Chemical Corporation; DuPont; Epsilon Composite; Formosa Plastics Group; Hexcel Corporation; Lenzing AG; Mitsubishi Chemical Corporation; SGL Carbon; Solvay; Teijin Limited; Toray Industries, Inc.; and Zhongfu Shenying Carbon Fiber Co., Ltd.

The automotive segment dominated the market in 2024.

The carbon fibers segment is expected to witness the fastest growth during the forecast period.