Esoteric Testing Market Size, Share, Trends, Industry Analysis Report

By Type (Oncology Testing, Infectious Disease Testing, Genetic Testing), By Technology, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5979

- Base Year: 2024

- Historical Data: 2020-2023

Overview

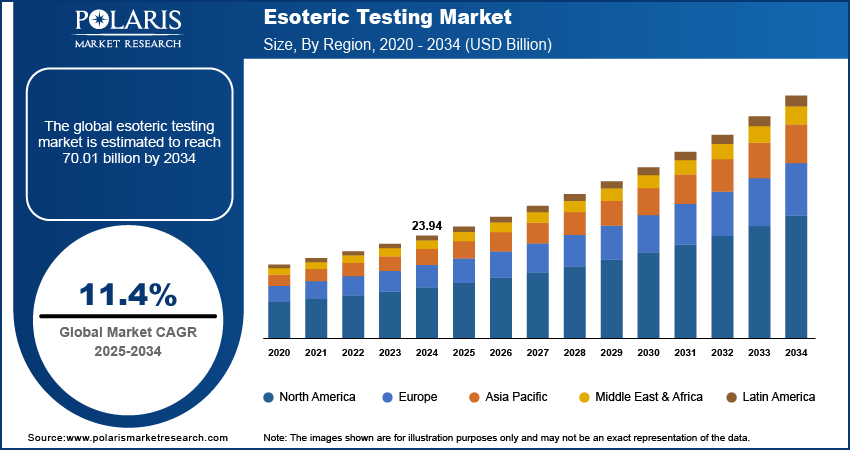

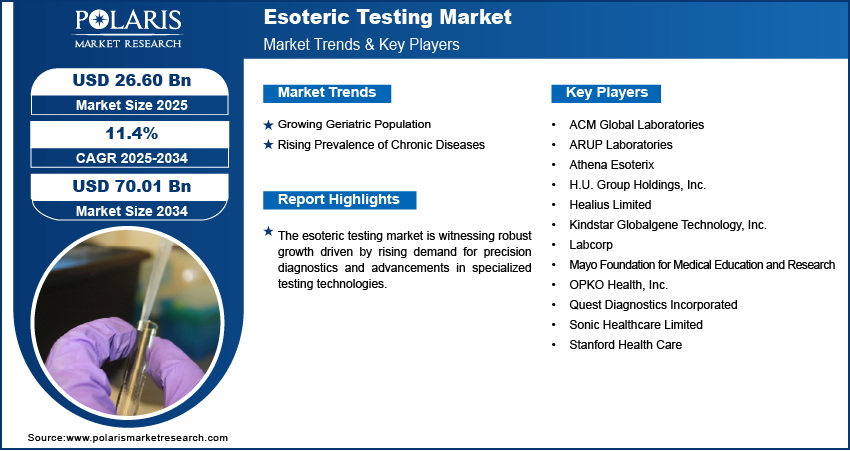

The global esoteric testing market size was valued at USD 23.94 billion in 2024, growing at a CAGR of 11.4% from 2025 to 2034. Key factors driving demand for esoteric testing include the advancements in biotechnology and diagnostic technologies, growing geriatric population, and rising prevalence of chronic diseases.

Key Insights

- The oncology testing segment dominated the market in 2024.

- The enzyme-linked immunosorbent assay segment is expected to register a significant CAGR during the forecast period.

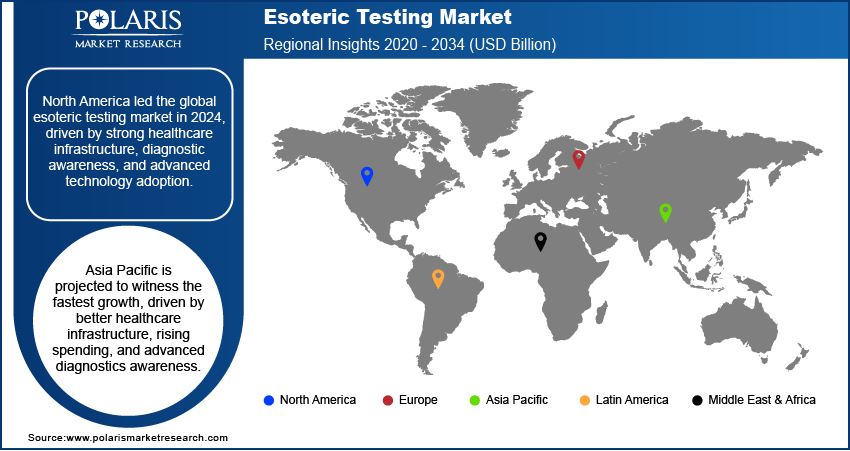

- The North America esoteric testing market accounted for the largest revenue share in 2024.

- The U.S. held the largest share of the North America esoteric testing landscape in 2024.

- The market in Asia Pacific is expected to witness fastest growth during the forecast period.

- The China market is expanding due to ongoing improvements in healthcare accessibility.

Esoteric testing refers to specialized laboratory tests that are not routinely performed and often require advanced instrumentation, methodologies, or expertise to detect rare or complex medical conditions. Rapid advancements in biotechnology and diagnostic technologies, such as CRISPR-based gene editing, artificial intelligence in medical imaging, and digital molecular diagnostics, primarily drive the growth opportunities. These technological innovations have enhanced the sensitivity, specificity, and efficiency of complex diagnostic tests, enabling the early and accurate detection of rare diseases, genetic disorders, and various chronic conditions. Additionally, the integration of automation, next-generation sequencing (NGS), and high-throughput platforms has also contributed to reducing turnaround times and increasing accessibility to specialized tests, thus advancing the standard of patient care and expanding the application scope across clinical laboratories.

To Understand More About this Research: Request a Free Sample Report

The increased global focus on rare diseases and the corresponding expansion of research into these conditions has boosted the demand for esoteric testing. In March 2025, Mayo Clinic launched a study on autosomal dominant leukodystrophy, a rare neurodegenerative disorder. The global study will track disease progression through medical records, imaging, and genetic analysis to identify biomarkers and improve diagnostics for future therapies. There is a growing demand for precise diagnostic tools that facilitate the timely identification and monitoring of these low-prevalence but high-impact conditions as awareness among healthcare professionals, patients, and policymakers increases. Esoteric testing plays a vital role in supporting personalized medicine biomarkers approaches by delivering critical insights into rare disease biomarkers and genetic mutations. Moreover, the ongoing investment in rare disease research by governments, academic institutions, and pharmaceutical companies is further accelerating the development of novel esoteric assays, thereby reinforcing the relevance and demand for these specialized diagnostic services.

Industry Dynamics

- The increasing elderly population is fueling demand for esoteric testing, as older adults face higher risks of complex health conditions that necessitate specialized diagnostic assessments.

- Growing rates of chronic illnesses are accelerating esoteric test utilization, as healthcare providers seek more precise diagnostic tools to improve treatment strategies.

- High costs and limited insurance coverage for esoteric tests restrict patient access, particularly in resource-constrained settings. Complex regulatory approvals for novel assays further slow market penetration.

- Advancements in AI and multi-omics technologies (e.g., proteomics, genomics) enable development of faster, more accurate esoteric tests, creating potential for earlier disease detection and personalized treatment pathways.

Growing Geriatric Population: The growing geriatric population is a significant driver of the esoteric testing market, as aging individuals are more prone to developing complex and multifactorial health conditions that often require advanced diagnostic evaluations. The risk of disorders such as neurodegenerative diseases, certain cancers, metabolic syndromes, and immunological imbalances increases, necessitating specialized tests beyond routine diagnostics, with age. An October 2024 WHO report stated that, by 2030, 1 in 6 people globally will be 60 years or older (1.4 billion), doubling to 2.1 billion by 2050. The population aged 80 and above is projected to triple, reaching 426 million by 2050. Esoteric testing enables clinicians to detect subtle biochemical and genetic changes in elderly patients, facilitating earlier diagnosis, more accurate prognoses, and tailored treatment strategies. This demographic shift is directly influencing the demand for high-precision testing solutions that serve the unique and evolving health profiles of older adults.

Rising Prevalence of Chronic Diseases: The rising prevalence of chronic diseases is driving the adoption of esoteric testing as healthcare systems aim to enhance disease management through precision diagnostics. Conditions such as cardiovascular diseases, diabetes, autoimmune disorders, and certain types of cancer often present with overlapping symptoms and complex pathophysiology, making conventional testing insufficient for definitive diagnosis or monitoring. According to a December 2024 WHO report, noncommunicable diseases (NCDs) caused 43 million deaths in 2021, accounting for 75% of all non-pandemic-related fatalities worldwide. These tests offer deeper molecular insights and biomarker identification, which are essential for understanding disease progression and treatment response. Therefore, as chronic illnesses become increasingly prevalent across populations, there is a growing need for specialized diagnostic tools to support effective long-term care and personalized medicine initiatives.

Segmental Insights

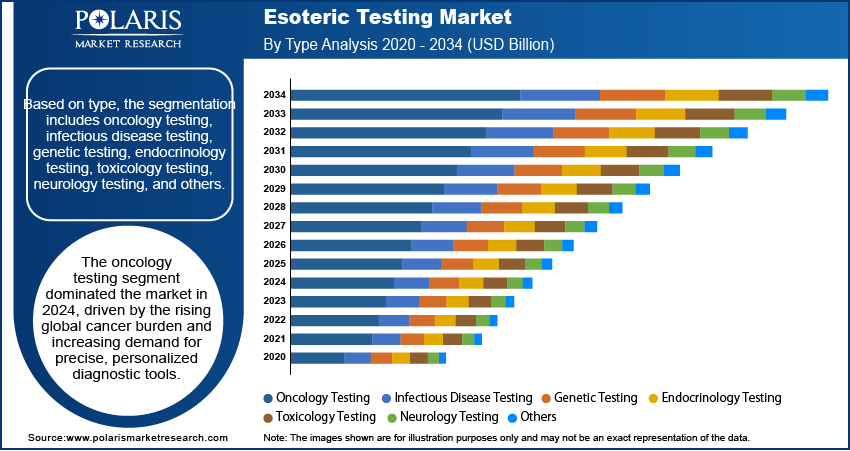

Type Analysis

Based on type, the segmentation includes oncology testing, infectious disease testing, genetic testing, endocrinology testing, toxicology testing, neurology testing, and others. The oncology testing segment dominated the market in 2024, driven by the rising global cancer burden and increasing demand for precise, personalized diagnostic tools. Oncology-related esoteric tests offer high sensitivity and specificity in detecting cancer biomarkers, enabling early diagnosis, prognosis assessment, and monitoring of treatment response. Continuous innovations in cancer genomics and molecular diagnostics have further expanded the utility of these specialized tests. Additionally, the growing focus on precision medicine and the need for early cancer detection have positioned oncology testing as a critical component of advanced diagnostic protocols, driving its dominance across the healthcare system.

Technology Analysis

In terms of technology, the segmentation includes chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real time polymerase chain reaction, flow cytometry, and others. The enzyme-linked immunosorbent assay segment is expected to register a significant CAGR during the forecast period owing to its versatility, cost-effectiveness, and broad applicability across multiple disease areas. ELISA is widely used for detecting proteins, antibodies, and antigens, making it a preferred method for various esoteric tests, especially in immunology and infectious diseases. Its ease of automation, scalability, and consistent accuracy support its integration in both high-throughput and specialized laboratory environments. Therefore, as demand grows for reliable, rapid, and affordable testing solutions, ELISA continues to gain traction as a major technology in the evolving landscape of these tests.

By End Use Outlook

The segmentation, based on end use, includes hospital-based laboratories, independent and reference laboratories, and other. The hospital-based laboratories segment is expected to witness substantial revenue growth during the forecast period, due to the rising demand for integrated diagnostic services within clinical settings. These laboratories are equipped with advanced technologies and infrastructure, enabling them to conduct complex esoteric tests on-site with faster turnaround times. The growing focus on comprehensive patient care, supported by timely and accurate diagnostics, is encouraging hospitals to expand their testing capabilities. Additionally, increased collaboration between hospital labs and specialized test developers is enhancing access to a wider range of esoteric diagnostics, further driving segment growth.

Regional Analysis

The North America esoteric testing market accounted for the largest revenue share in 2024, supported by a well-established healthcare infrastructure, high diagnostic awareness, and widespread adoption of advanced testing technologies. The growing incidence of chronic and rare diseases in the population has boosted the demand for esoteric tests, reinforcing North America's dominant position in the global market. A November 2024 FDA report indicated that more than 30 million Americans are affected by over 7,000 rare diseases. Moreover, the region benefits from significant investments in clinical research, favorable reimbursement frameworks, and the presence of major companies offering specialized diagnostic solutions.

U.S. Esoteric Testing Market Insight

The U.S. held the largest share of the North America esoteric testing landscape in 2024 due to its advanced healthcare infrastructure, strong presence of leading diagnostic laboratories, and high adoption of specialized testing technologies. Continuous innovation in molecular diagnostics and precision medicine, supported by extensive research funding, has further strengthened the country’s leadership. Additionally, the growing burden of chronic and rare diseases has accelerated the demand for accurate and early detection tools, reinforcing the uptake of esoteric testing services.

Asia Pacific Esoteric Testing Market Trends

The market in Asia Pacific is expected to witness the fastest growth during the forecast period due to improving healthcare infrastructure, increasing healthcare spending, and growing awareness of advanced diagnostics. The rising prevalence of complex diseases, coupled with government-led initiatives to expand access to quality diagnostics, is fostering demand for specialized testing services. Additionally, the surge in partnerships between global diagnostic companies and regional laboratories is accelerating the adoption of esoteric testing technologies across emerging economies, positioning Asia Pacific as a high-growth region.

China Esoteric Testing Market Overview

The market in China is expanding due to ongoing improvements in healthcare accessibility, increasing investments in diagnostic innovation, and increasing focus on personalized medicine. The rising incidence of complex diseases has created greater demand for advanced laboratory testing solutions across urban and emerging regions. Furthermore, the government's commitment to strengthening domestic biotech capabilities is enabling collaborations and technology transfers, enabling the wider adoption of esoteric tests in clinical settings.

Europe Esoteric Testing Market Outlook

The Europe market is projected to hold a substantial share by 2034 due to its strong regulatory framework, established diagnostic networks, and a growing focus on preventive and precision medicine. The region has demonstrated a proactive approach to integrating advanced diagnostics into clinical pathways, supported by funding from both public health agencies and private organizations. Increasing investments in rare disease research and the widespread availability of refined laboratory infrastructure are improving the growth of esoteric tests, contributing to the region’s sustained market presence.

UK Esoteric Testing Market

The UK market growth is driven by the integration of genomics and rare disease testing into national healthcare strategies, along with a rising focus on early disease detection. A well-structured public health system and support for precision diagnostics have facilitated wider access to esoteric testing, particularly in oncology and genetic disorders. Continued focus on research partnerships and data-driven healthcare initiatives is further supporting the nationwide adoption of specialized diagnostics.

Key Players and Competitive Analysis

The esoteric testing landscape is shaped by technological advancements and strategic investments, with major players such as Mayo Clinic, Labcorp, and ARUP Laboratories dominating developed markets through specialized assays for rare diseases genetic testing and complex conditions. Industry trends reveal a shift toward AI-powered diagnostics and next-generation sequencing (NGS), driven by latent demand for precision medicine. Emerging markets present opportunities for expansion, driven by rising healthcare expenditures and partnerships with local laboratories. Small and medium-sized businesses are gaining traction in niche segments, such as proteomics and metabolomics.

Competitive intelligence highlights vendor strategies centered on sustainable value chains, with a focus on laboratory-developed tests (LDTs) and automation to minimize supply chain disruptions. Additionally, revenue growth is driven by oncology and neurology testing, while economic and geopolitical shifts pose challenges. Future development strategies will rely on joint ventures and regional footprint optimization to capitalize on growth opportunities in personalized medicine.

A few major companies operating in the Esoteric Testing industry include ACM Global Laboratories; ARUP Laboratories; Athena Esoterix; H.U. Group Holdings, Inc.; Healius Limited; Kindstar Globalgene Technology, Inc.; Labcorp; Mayo Foundation for Medical Education and Research; OPKO Health, Inc.; Quest Diagnostics Incorporated; Sonic Healthcare Limited; and Stanford Health Care.

Key Players

- ACM Global Laboratories

- ARUP Laboratories

- Athena Esoterix

- H.U. Group Holdings, Inc.

- Healius Limited

- Kindstar Globalgene Technology, Inc.

- Labcorp

- Mayo Foundation for Medical Education and Research

- OPKO Health, Inc.

- Quest Diagnostics Incorporated

- Sonic Healthcare Limited

- Stanford Health Care

Industry Developments

- April 2025: Quest Diagnostics launched AD-Detect, a blood test that combines measurements of amyloid beta and p-tau217 to assess Alzheimer’s risk in patients with mental decline. The test uses mass spectrometry and immunoassay results to generate a proprietary likelihood score.

- April 2024: Labcorp introduced the first commercially available nationwide blood test for GFAP, a biomarker aiding early detection of neurodegenerative diseases such as Alzheimer's, MS, glioblastoma, and neurological injuries.

Esoteric Testing Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Oncology Testing

- Infectious Disease Testing

- Genetic Testing

- Endocrinology Testing

- Toxicology Testing

- Neurology Testing

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Chemiluminescence Immunoassay

- Enzyme-Linked Immunosorbent Assay

- Mass Spectrometry

- Real Time Polymerase Chain Reaction

- Flow Cytometry

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospital-based laboratories

- Independent and reference laboratories

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Esoteric Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 23.94 Billion |

|

Market Size in 2025 |

USD 26.60 Billion |

|

Revenue Forecast by 2034 |

USD 70.01 Billion |

|

CAGR |

11.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 23.94 billion in 2024 and is projected to grow to USD 70.01 billion by 2034.

The global market is projected to register a CAGR of 11.4% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are ACM Global Laboratories; ARUP Laboratories; Athena Esoterix; H.U. Group Holdings, Inc.; Healius Limited; Kindstar Globalgene Technology, Inc.; Labcorp; Mayo Foundation for Medical Education and Research; OPKO Health, Inc.; Quest Diagnostics Incorporated; Sonic Healthcare Limited; and Stanford Health Care.

The oncology testing segment dominated the market in 2024.

The enzyme-linked immunosorbent assay segment is expected to register a significant CAGR during the forecast period.