Europe Plant-Based Meat Market Size, Share, Trends, Industry Analysis Report

By Source (Soy, Wheat), By Product, By Distribution Channel, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6305

- Base Year: 2024

- Historical Data: 2020-2023

Overview

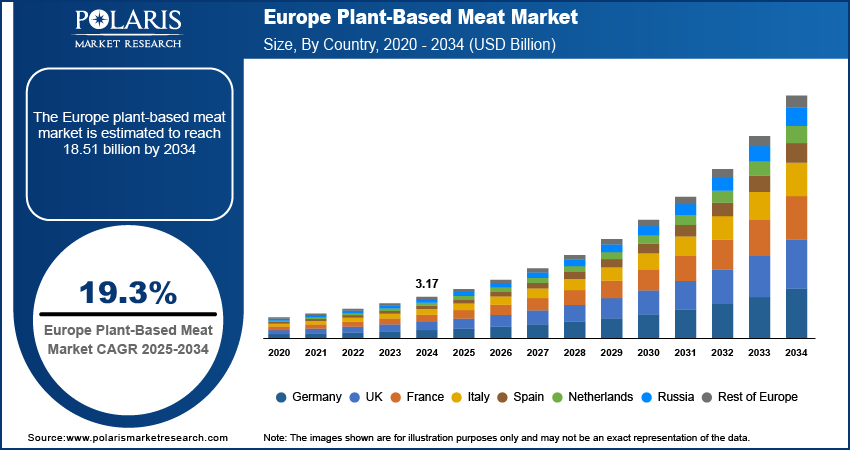

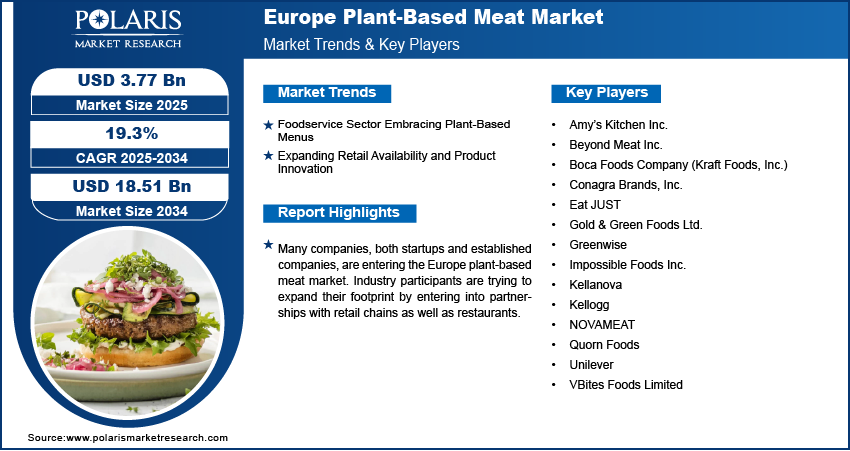

The Europe plant-based meat market size was valued at USD 3.17 billion in 2024, growing at a CAGR of 19.3% from 2025 to 2034. Key factors driving demand is foodservice sector embracing plant-based menus and expanding retail availability and product innovation.

Key Insights

- The soy segment is expected to register a CAGR of 19.6% during the forecast period, supported by its high protein value, versatility in applications, and strong consumer familiarity.

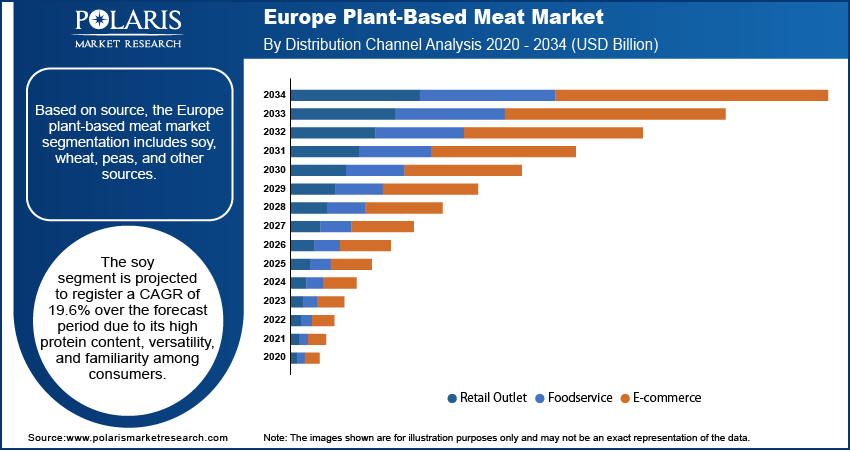

- In 2024, the e-commerce segment accounted for 10.68% of the revenue share, driven by the growth of online grocery shopping and increasing demand for convenient access to plant-based specialty products.

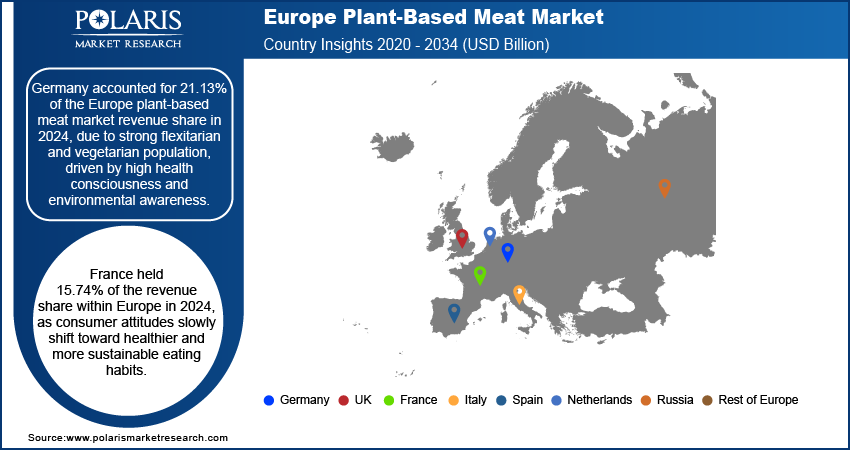

- Germany represented 21.13% of the Europe plant-based meat market revenue in 2024, fueled by a large flexitarian and vegetarian population, along with strong health and environmental awareness.

- France held 15.74% of Europe’s revenue share in 2024, reflecting a gradual shift in consumer preferences toward healthier, more sustainable dietary choices.

Industry Dynamics

- The foodservice sector embracing plant-based menus is driving the demand for plant-based meat.

- Expanding retail availability and product innovation are driving the Europe plant-based meat market growth.

- Industry participants are trying to expand their footprint by entering into partnerships with retail chains, as well as restaurants.

- High product prices compared to conventional meat limit the industry growth.

Market Statistics

- 2024 Market Size: USD 3.17 Billion

- 2034 Projected Market Size: USD 18.51 Billion

- CAGR (2025–2034): 19.3%

- Germany: Largest Market Share

AI Impact on Europe Plant-Based Meat Market

- AI accelerates product development by analyzing vast datasets on taste, texture, and nutritional profiles to create meat alternatives that closely mimic animal-based products.

- Integration of AI enables predictive modeling to improve ingredient combinations and formulations, enhancing flavor, texture, and shelf life.

- AI automates supply chain and production optimization, reducing food waste, lowering costs, and improving efficiency in plant-based meat manufacturing.

Plant-based meat products are manufactured by using plant ingredients that mimic animal-derived meat both in terms of taste and appearance. The products are designed in a way to be indistinguishable from animal meat. These products are made by using sources such as peas, wheat, soy, and others. They directly substitute animal meat hence are often referred to as meat products.

Government bodies and the European Union are actively promoting sustainable food systems, which favor plant-based diets. The European Green Deal and Farm to Fork Strategy aim to reduce the environmental impact of food production, encouraging lower meat consumption. Some governments provide subsidies or funding for alternative protein research and innovation. Additionally, many schools and public institutions are integrating plant-based meals into their offerings. This policy support creates a favorable environment for plant-based meat companies, encouraging investment, innovation, and consumer adoption throughout Europe, particularly in Western and Northern European countries, thereby driving the growth.

European consumers are highly environmentally conscious and are increasingly aware of the impact of traditional meat production on the environment. Plant-based meat offers a sustainable alternative, using fewer resources and causing less environmental damage. Many European brands emphasize these environmental benefits on their packaging and in marketing campaigns. Additionally, eco-conscious habits are becoming more common, especially among younger generations, due to which environmental considerations remain a strong force behind the growing popularity of plant-based meat in Europe, thereby fueling the industry growth.

Drivers & Opportunities

Foodservice Sector Embracing Plant-Based Menus: Restaurants, cafés, and fast-food chains across Europe are rapidly adopting plant-based options to meet changing consumer preferences. Major chains such as McDonald’s and Burger King are planning to introduce plant-based burgers and meals in several European countries. Fine dining and casual eateries are further expanding vegan menus to attract flexitarians and meat-reducers. This widespread adoption is helping consumers try plant-based meat in familiar formats. The foodservice industry’s growing commitment to offering sustainable and inclusive menus is increasing the visibility and appeal of plant-based meat across Europe, thereby boosting the industry growth.

Expanding Retail Availability and Product Innovation: Supermarkets and grocery chains across Europe, such as Tesco, Lidl, and Carrefour, are significantly expanding their plant-based offerings. Dedicated sections for vegan and vegetarian products are now common in many stores. At the same time, companies are investing in R&D to develop plant-based meat products that better replicate the taste and texture of traditional meat. European startups and established food manufacturers are launching innovative products, including burgers, sausages, nuggets, and deli slices. The increased accessibility and improved quality of plant-based meat in the retail space are making it easier for consumers to make the switch, thereby driving market adoption.

Segmental Insights

Source Analysis

Based on source, the segmentation includes soy, wheat, peas, and other sources. The soy segment is projected to register a CAGR of 19.6% over the forecast period due to its high protein content, versatility, and familiarity among consumers. Soy is widely used in plant-based meat products like sausages, burgers, and nuggets, offering a texture and taste that closely mimics traditional meat. European consumers are further aware of soy’s nutritional benefits, including its ability to serve as a complete protein source. Additionally, advancements in non-GMO and organic soy sourcing have helped address consumer concerns, especially in Western Europe, thereby driving the growth.

The wheat segment is expected to witness a significant share during the forecast period due to its dense, chewy texture that closely resembles real meat. European brands are using wheat to produce deli slices, meat strips, and sausages that appeal to both vegetarians and flexitarians. The affordability and availability of wheat as a raw material further make it attractive for manufacturers. In regions such as Germany and the UK, consumers are familiar with wheat-based meat substitutes and consider them a natural choice. This familiarity and texture advantage are driving the segment growth.

Product Analysis

In terms of product, the segmentation includes burger patties, sausages, strips & nuggets, meatballs, and other products. The burger patties held 33.50% of revenue share in 2024 due to high consumer familiarity with traditional burgers and the successful rollout of plant-based versions in both supermarkets and fast-food chains. European consumers, especially flexitarians, are adopting plant-based patties as a convenient and satisfying meat alternative. Widespread availability in retail, product quality improvements, and growing restaurant adoption such as McDonald’s McPlant or Burger King’s plant-based Whopper are accelerating this segment’s growth.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes retail outlet, foodservice, and e-commerce. The e-commerce segment held a significant revenue share in 2024, holding 10.68% driven by rising online grocery shopping and demand for convenient access to specialty products. Many European consumers are exploring plant-based options through online retail platforms due to broader selection, home delivery, and direct-to-consumer (D2C) offers from emerging brands. In countries such as the UK, Germany, and the Netherlands, strong internet penetration and consumer trust in online smart retail are helping plant-based meat products gain traction, thereby propelling the segment growth.

Country Analysis

The Germany plant-based meat market accounted for 21.13% of revenue share in 2024 due to strong flexitarian and vegetarian population, driven by high health consciousness and environmental awareness. German consumers are increasingly reducing their meat intake due to concerns about sustainability, animal welfare, and personal health. Government initiatives supporting plant-based diets and sustainable food systems further encourage the shift. Major retailers such as Lidl, Aldi, and Edeka have expanded their plant-based offerings, making products more accessible. Moreover, continuous product innovation and strong consumer demand further drive the growth of the country.

France Plant-Based Meat Market Insights

France held 15.74% of the revenue share within Europe in 2024, as consumer attitudes slowly shift toward healthier and more sustainable eating habits. Growing awareness about the environmental impact of animal agriculture and health concerns related to red meat are prompting more French consumers to explore plant-based alternatives. Younger generations are more open to trying new products, while traditional food culture poses some resistance. Government efforts to promote sustainable food in schools and public institutions further contribute to growth. Moreover, increased retail presence, media influence, and product variety are helping drive demand for plant-based meat across French urban centers, fueling the growth.

UK Plant-Based Meat Market Trends

The market in the UK is expected to register a CAGR of 19.2% during the forecast period due to a large and growing flexitarian population and a well-established vegan community. Campaigns such as “Veganuary” have become mainstream, supported by active media coverage and celebrity endorsements. Supermarkets such as Tesco and Sainsbury’s have heavily invested in their plant-based ranges, while fast-food chains have rolled out plant-based menus nationwide. Health awareness, ethical concerns, and environmental sustainability are key motivators among British consumers. The UK’s openness to innovation and supportive regulatory environment further fuel the adoption, thereby boosting the growth.

Netherlands Plant-Based Meat Market Overview

The demand for plant-based meat in the Netherlands is rising due to its progressive consumer base and strong focus on sustainability. Dutch consumers are highly receptive to meat alternatives, driven by ethical concerns and environmental awareness. The country is further home to several innovative plant-based food companies, including The Vegetarian Butcher, which has helped shape consumer perceptions. Government-backed sustainability campaigns and research into alternative proteins support the industry’s growth. Retailers such as Albert Heijn and Jumbo have significantly increased their plant-based offerings, thereby fueling the expansion in the country.

Key Players & Competitive Analysis

The industry is characterized by strong competition among established food companies and emerging startups. Major players such as Beyond Meat and Impossible Foods have built significant market presence through product innovation and brand recognition. Traditional food manufacturers, including Kellogg (MorningStar Farms), Conagra Brands (Gardein), Unilever (The Vegetarian Butcher), Maple Leaf Foods, and Amy’s Kitchen, continue to expand their plant-based offerings by utilizing their existing production and distribution capabilities. Companies such as Quorn Foods, Tofurky, Gold & Green Foods, and Sunfed also contribute to a diverse range of products across categories. Newer entrants such as NOVAMEAT, v2food, OmniPork, VBites, and Eat JUST bring technological innovation and Country-specific products to the market. The competitive landscape remains dynamic, with companies focusing on product quality, nutrition, and sustainability to differentiate themselves.

Key Players

- Amy’s Kitchen Inc.

- Beyond Meat Inc.

- Boca Foods Company (Kraft Foods, Inc.)

- Conagra Brands, Inc.

- Eat JUST

- Gold & Green Foods Ltd.

- Greenwise

- Impossible Foods Inc.

- Kellanova

- Kellogg

- NOVAMEAT

- Quorn Foods

- Unilever

- VBites Foods Limited

Europe Plant-Based Meat Industry Developments

In August 2025, Eat Just launched its new plant-based chicken line under the JUST Meat brand, featuring Original, Buffalo, and Sesame Ginger flavors. Spotted at Sprouts and listed on H-E-B, the products offer 18g of protein and quick frozen preparation.

Europe Plant-Based Meat Market Segmentation

By Source Outlook (Revenue, USD Billion, 2021–2034)

- Soy

- Wheat

- Peas

- Other Sources

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Burger Patties

- Sausages

- Strips & Nuggets

- Meatballs

- Other Products

By Distribution Channel Outlook (Revenue, USD Billion, 2021–2034)

- Retail Outlet

- Foodservice

- E-commerce

By Country Outlook (Revenue, USD Billion, 2021–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Plant-Based Meat Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.17 Billion |

|

Market Size in 2025 |

USD 3.77 Billion |

|

Revenue Forecast by 2034 |

USD 18.51 Billion |

|

CAGR |

19.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.17 billion in 2024 and is projected to grow to USD 18.51 billion by 2034.

The market is projected to register a CAGR of 19.3% during the forecast period.

Germany dominated the market in 2024.

A few of the key players in the market are Amy’s Kitchen Inc.; Beyond Meat Inc.; Boca Foods Company (Kraft Foods, Inc.); Conagra Brands, Inc.; Eat JUST; Gold & Green Foods Ltd.; Greenwise; Impossible Foods Inc.; Kellanova; Kellogg; NOVAMEAT; Quorn Foods; Unilever; and VBites Foods Limited.

The soy segment dominated the market revenue share in 2024.

The e-commerce segment is projected to witness the fastest growth during the forecast period.