Europe Veterinary 3D Printing Market Size, Share, Trends, Industry Analysis Report

: By Product (Implants, Prosthetics & Orthotics, Anatomical Models, and Masks), Technology, Application, Material, End Use, and Country (Germany, France, UK, Italy, and Rest of Europe) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5609

- Base Year: 2024

- Historical Data: 2020-2023

Europe Veterinary 3D Printing Market Overview

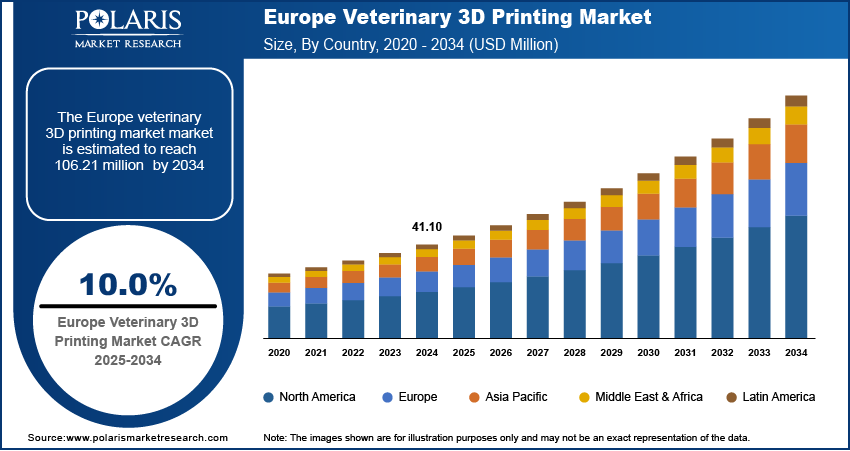

The Europe veterinary 3D printing market size was valued at USD 41.10 million in 2024. The market is projected to grow from USD 45.12 million in 2025 to USD 106.21 million by 2034, exhibiting a CAGR of 10.0% from 2025 to 2034.

Veterinary 3D printing in Europe is revolutionizing animal healthcare by enabling the creation of customized medical solutions tailored to the specific needs of animals. This technology is widely applied in producing dental implants and prosthetics, anatomical models, and surgical guides. It enhances precision in orthopedic procedures, such as creating specific implants for conditions like tibial plateau leveling osteotomy (TPLO). The technology has also been employed in groundbreaking procedures, such as the creation of 3D-printed titanium & titanium alloy dental implants and a skull roof for a dog after tumor removal. Additionally, 3D printing supports pre-surgical planning by allowing veterinarians to study complex fractures or deformities using detailed anatomical models, thereby reducing complications during surgery.

The rising adoption of pets across Europe is propelling the Europe veterinary 3D printing market growth. For instance, as per the data published by the European Pet Food Industry Federation, there were around 352 million pets in Europe in 2022. A growing pet population, particularly dogs and cats with longer lifespans, leads to a higher incidence of age-related conditions such as arthritis, bone fractures, and dental issues, all of which benefit from customized 3D-printed implants, prosthetics, and orthotics. Additionally, the trend of treating pets as family members drives demand for innovative solutions such as anatomical models for surgical planning and 3D-printed masks for radiation oncology. Veterinary clinics and hospitals are expanding their use of 3D printing technologies to meet these expectations, offering faster, more precise, and cost-effective treatments.

To Understand More About this Research: Request a Free Sample Report

The Europe veterinary 3D printing market demand is driven by the rising advancements in material technology and printing techniques. Innovations in biocompatible materials, such as titanium alloys, medical-grade polymers, and resorbable ceramics, allow veterinarians to create durable implants, flexible orthotics, and lightweight prosthetics that closely mimic natural bone and tissue. Improved printing methods, such as selective laser sintering (SLS) and digital light processing (DLP), enhance precision, reducing production time while maintaining high accuracy for complex anatomical structures. These advancements also expand the range of applications, from dental implants for small mammals to cranial reconstructions for exotic animals. Additionally, the development of hybrid materials that promote bone integration and reduce infection risks increases confidence in 3D-printed solutions, encouraging wider adoption across the veterinary industry in Europe.

Europe Veterinary 3D Printing Market Dynamics

Increasing Investment in Animal Healthcare

Governments, private investors, and veterinary institutions are increasingly allocating funds toward advanced medical technologies, enabling clinics and research centers to adopt 3D printers for customized implants, prosthetics, and surgical planning tools. Pharmaceutical and medtech companies are also investing in veterinary-specific 3D printing solutions, driving the development of specialized materials and printers tailored for animal anatomy. Additionally, rising funding for veterinary research institutions supports studies into new 3D printing applications, such as bio-printed tissues for reconstructive surgeries, further pushing the technology into mainstream practice. Pet insurance providers are increasingly covering 3D-printed treatments, reducing financial barriers for owners and encouraging wider adoption. Therefore, the increasing investment in animal healthcare is fueling the Europe veterinary 3D printing market expansion.

Growing Demand for Personalized Veterinary Care

Pet owners are increasingly seeking customized medical interventions that match the unique anatomical and physiological needs of their animals, especially in cases involving complex surgeries, mobility issues, or dental conditions. This drives veterinarians to turn to 3D printing to produce personalized implants, prosthetics, surgical guides, and anatomical models that enhance precision and improve outcomes. This technology also allows practitioners to plan surgeries more effectively, reduce operation time, and minimize the risk of complications. Hence, as personalized care becomes a standard expectation among pet owners, clinics and hospitals are adopting 3D printing to deliver higher-quality, individualized services.

Europe Veterinary 3D Printing Market Segment Insights

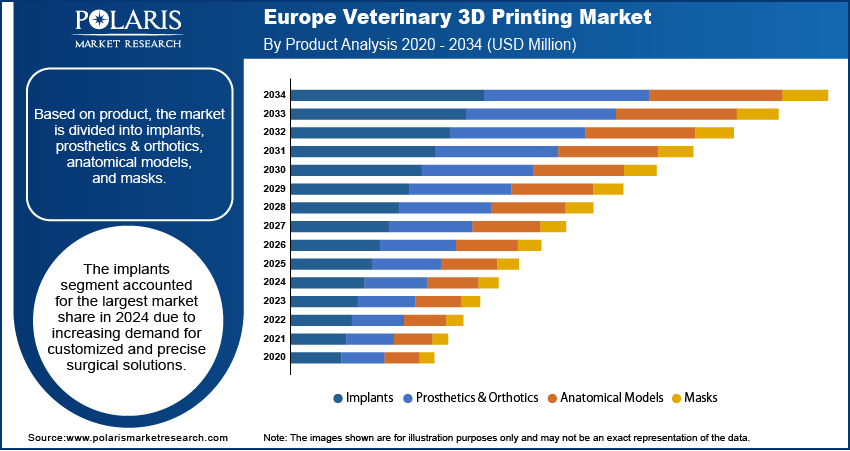

Europe Veterinary 3D Printing Market Evaluation by Product

Based on product, the market is divided into implants, prosthetics & orthotics, anatomical models, and masks. The implants segment dominated the market in 2024 due to increasing demand for customized and precise surgical solutions. Veterinarians and pet owners prefer 3D-printed implants due to their ability to match the unique anatomical structures of animals, improving surgical outcomes. The rise in orthopedic conditions among pets, such as hip dysplasia and fractures, has further fueled demand for 3D-printed implants. Additionally, advancements in biocompatible materials, such as titanium and polyether ether ketone (PEEK), have enhanced the durability and safety of these implants, making them a reliable choice for complex procedures. The growing adoption of 3D printing technology in veterinary hospitals and specialty clinics has also contributed to the segment's dominance.

The prosthetics & orthotics segment is expected to grow at a robust pace in the coming years owing to the rising incidence of traumatic injuries and congenital limb deformities in pets, as well as the growing awareness of animal rehabilitation options. The ability of 3D printing to produce lightweight, precisely tailored prosthetic limbs has revolutionized mobility solutions for animals, making them more affordable and accessible. Veterinary specialists are increasingly turning to additive manufacturing to meet the unique anatomical and biomechanical needs of individual animals, improving comfort and functionality. Moreover, advancements in scanning technologies and design software have streamlined the production process of prosthetics & orthotics, encouraging broader adoption across specialized veterinary centers and animal rehabilitation facilities.

Europe Veterinary 3D Printing Market Insight by Application

In terms of application, the market is segregated into orthopedic implants & prosthetics, dental applications, surgical guides & models, customized medical devices, and tissue engineering. The surgical guides & models segment is projected to hold a major market share in the coming years owing to the 3D printer's crucial role in enhancing surgical planning and accuracy. Veterinarians increasingly rely on 3D-printed anatomical models and guides to simulate procedures, especially for complex cases involving tumors, deformities, or reconstructive surgeries. This preoperative visualization improves surgical precision, reduces operating time, and minimizes complications. The ability of 3D printed technology to customize each model based on the animal's exact anatomy not only enhances surgical outcomes but also supports client education and communication. The use of 3D-printed guides and models continues to grow as more veterinary institutions invest in advanced diagnostic tools like CT and MRI scanners.

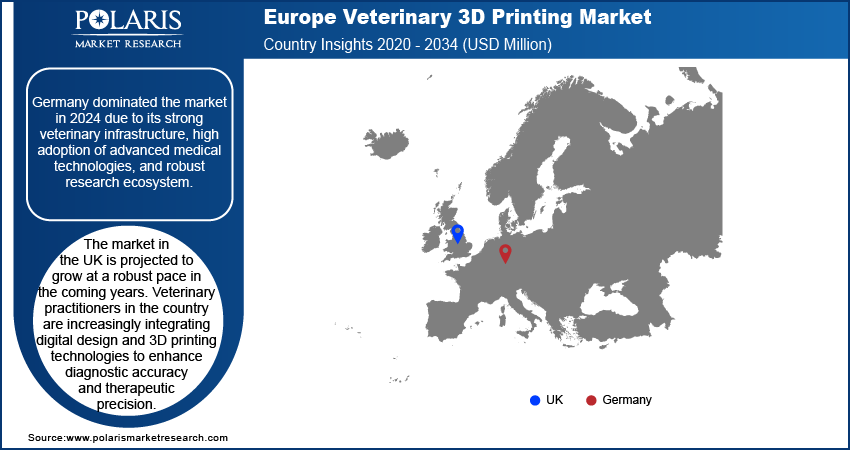

Europe Veterinary 3D Printing Market Country Analysis

By country, the Europe veterinary 3D printing market report provides insight into Germany, France, the UK, Italy, and the Rest of Europe. Germany dominated the market in 2024 due to its strong veterinary infrastructure, high adoption of advanced medical technologies, and robust research ecosystem. German veterinary clinics and academic institutions have invested heavily in 3D printing solutions to deliver personalized care, particularly in orthopedic and dental procedures. The country’s well-established regulatory framework, combined with significant funding for veterinary innovation, has accelerated the integration of 3D manufacturing in animal healthcare. Additionally, the presence of major 3D printing companies and collaborations between veterinary universities and tech firms has contributed to Germany’s dominance in the region. For instance, since 2012, Rita Leibinger Medical, a German innovative veterinarian medicine company, and 3D Systems have collaborated to develop a revolutionary orthopedic knee implant for dogs.

The market in the UK is projected to grow at a robust pace in the coming years. Veterinary practitioners in the country are increasingly integrating digital design and 3D printing technologies to enhance diagnostic accuracy and therapeutic precision. The growing focus on pet wellness and the rising demand for personalized veterinary treatments have driven clinics to adopt 3D-printed surgical models, implants, and prosthetics. Supportive government initiatives promoting innovation in animal health, alongside a rising number of specialty veterinary centers and rehabilitation facilities, further strengthen the country’s position. The UK’s rising culture of pet ownership and its emphasis on animal welfare continue to boost investment in 3D printing veterinary solutions, positioning it as a key country in the region. For instance, according to data published by the Health for Animals, more than two million people adopted a pet during the UK’s pandemic lockdowns.

Europe Veterinary 3D Printing Market – Key Players and Competitive Insights

The Europe veterinary 3D printing market is highly competitive, with key players leveraging strategic mergers and acquisitions, partnerships, and collaborations to strengthen their market position. Companies such as 3D Systems and Stratasys are expanding their footprint through acquisitions of niche 3D printing firms specializing in 3D imaging and other veterinary applications, enhancing their technological capabilities. Collaborations between veterinary hospitals and 3D printing manufacturers are also increasing, facilitating customized solutions for orthopedic implants, prosthetics, and surgical models. Product portfolio diversification remains a critical strategy, with major players introducing advanced veterinary-specific 3D printers, such as compact, high-precision systems for clinics. Emerging startups are gaining traction by offering cost-effective, on-demand 3D-printed veterinary devices, intensifying competition. Additionally, strategic alliances with veterinary pharmaceutical companies are enabling integrated solutions, such as 3D-printed drug delivery systems. Regional players are also expanding through collaborations with distributors to improve market penetration. The competitive landscape is further shaped by innovations in digital dentistry and patient-specific implants, driving demand for 3D-printed solutions.

The Europe veterinary 3D printing market is fragmented, with the presence of numerous global and regional market players. Major players in the market are 3D Systems Inc., bio3Dvet, CABIOMEDE Vet, Formlabs, Materialise, Ortho Vet 3D, OrthoDesigns, r3volutionD AG, Stratasys, Vet 3D, Vimian, and WIMBA.

WIMBA is a Poland-based startup revolutionizing veterinary care through its innovative use of 3D printing technology to create highly personalized orthopedic solutions for pets. It develops tailored orthoses and prostheses that fit seamlessly with the animal's anatomy by leveraging advanced technologies such as WimbaSCAN for precise 3D scans of affected areas. The production process integrates artificial intelligence to optimize design and functionality, ensuring maximum comfort and mobility for pets. The devices are lightweight, durable, and customized, providing superior rehabilitation outcomes compared to traditional methods.

bio3Dvet is a pioneering company in the field of veterinary 3D printing, specializing in creating customized prosthetics, implants, and anatomical models for animals. It designs patient-specific solutions that cater to the unique anatomical needs of each animal by utilizing advanced imaging techniques such as CT and MRI scans. The company’s focus on biocompatible materials ensures that its products are safe and effective, reducing the risks of rejection and enhancing integration with the animal’s body. bio3Dvet is also exploring the potential of 3D bioprinting, which uses bio-inks composed of living cells to fabricate functional tissues and organs, creating the way for regenerative therapies in veterinary medicine.

List of Key Companies in Europe Veterinary 3D Printing Market

- 3D Systems Inc.

- bio3Dvet

- CABIOMEDE Vet

- Formlabs

- Materialise

- Ortho Vet 3D

- OrthoDesigns

- Stratasys

- Vet 3D

- Vimian

- WIMBA

Europe Veterinary 3D Printing Industry Developments

October 2024: WIMBA, a provider of custom-fit, ultra-light 3D-printed pet orthotics, announced the opening of its brand-new 3D printing facility at its headquarters in Kraków, Poland.

August 2024: AniCura's veterinary team achieved a groundbreaking medical feat by successfully removing a tumor from a dog’s skull with the aid of 3D printing technology, which allowed them to create precise surgical models and implants tailored to the dog’s anatomy.

Europe Veterinary 3D Printing Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Implants

- Prosthetics & Orthotics

- Anatomical Models

- Masks

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Fused Deposition Modeling (FDM)

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Orthopedic Implants & Prosthetics

- Dental Applications

- Surgical Guides & Models

- Customized Medical Devices

- Tissue Engineering

By Material Outlook (Revenue, USD Million, 2020–2034)

- Metals

- Ceramics

- Polymers

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Clinics

- Academic & Research Institutions

- Others

By Country Outlook (Revenue, USD Million, 2020–2034)

- Germany

- France

- UK

- Italy

- Rest of Europe

Europe Veterinary 3D Printing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 41.10 million |

|

Market Size Value in 2025 |

USD 45.12 million |

|

Revenue Forecast by 2034 |

USD 106.21 million |

|

CAGR |

10.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Europe veterinary 3D printing market size was valued at USD 41.10 million in 2024 and is projected to grow to USD 106.21 million by 2034.

The global market is projected to register a CAGR of 10.0% from 2025 to 2034.

Germany had the largest share of the global market in 2024.

Some of the key players in the market are 3D Systems Inc., bio3Dvet, CABIOMEDE Vet, Formlabs, Materialise, Ortho Vet 3D, OrthoDesigns, r3volutionD AG, Stratasys, Vet 3D, Vimian, and WIMBA.

The implants segment dominated the market in 2024.

The surgical guides & models segment is expected to grow at the fastest pace in the coming years.