Sepsis Diagnostics Market Size, Share, Trends, Industry Analysis Report

: By Product (Instrument, Blood Culture Media, Assay Kits & Reagents, and Software), Technology, Testing Type, End User, Pathogen, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 116

- Format: PDF

- Report ID: PM1279

- Base Year: 2024

- Historical Data: 2020-2023

Sepsis Diagnostics Market Overview

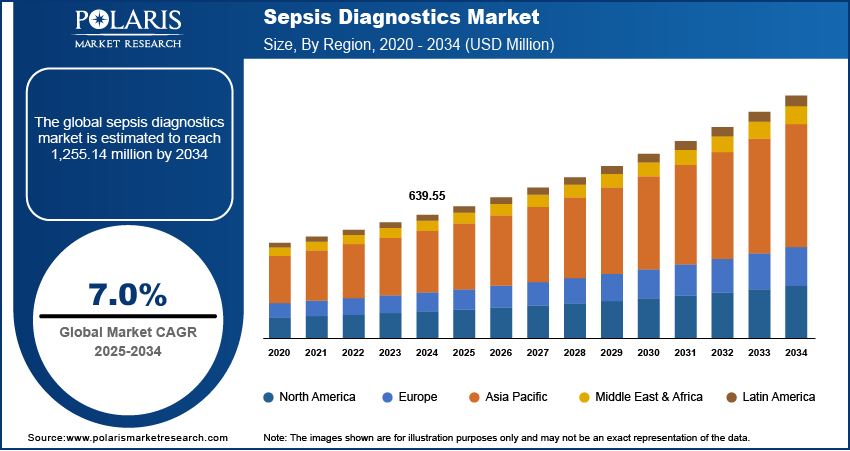

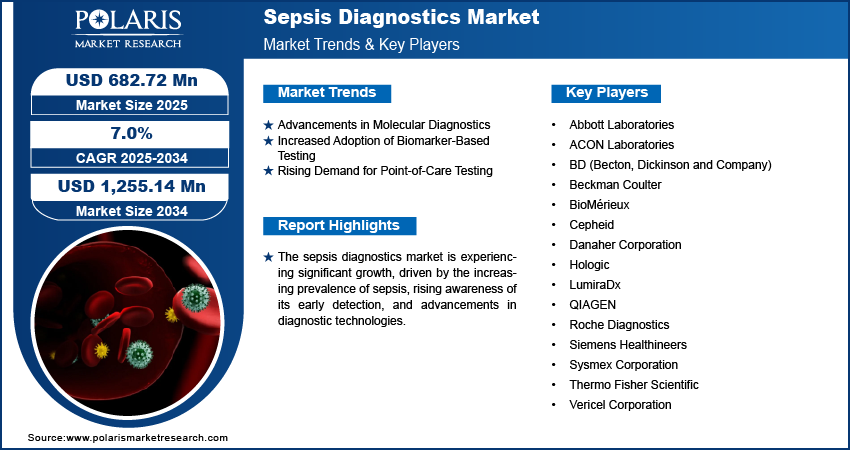

The sepsis diagnostics market size was valued at USD 639.55 million in 2024. The market is projected to grow from USD 682.72 million in 2025 to USD 1,255.14 million by 2034, exhibiting a CAGR of 7.0% during 2025–2034.

The sepsis diagnostics market encompasses technologies and solutions used for the early detection, identification, and management of sepsis, a life-threatening condition caused by the body’s response to infection. Key drivers of the market growth include the increasing prevalence of sepsis, rising awareness of early diagnosis, advancements in diagnostic technologies, and growing demand for point-of-care testing. Emerging trends in the market include the integration of artificial intelligence in diagnostic systems, the development of rapid molecular diagnostic tools, and increasing focus on biomarker-based tests for precise and timely diagnosis. These factors collectively contribute to the sepsis diagnostics market demand by addressing the critical need for faster and more accurate identification of sepsis to improve patient outcomes.

To Understand More About this Research: Request a Free Sample Report

Sepsis Diagnostics Market Dynamics

Advancements in Molecular Diagnostics

Molecular diagnostic technologies are transforming the sepsis diagnostics market by enabling faster and more accurate detection of pathogens and antimicrobial resistance markers. Techniques such as digital polymerase chain reaction (PCR) and next-generation sequencing (NGS) are gaining prominence for their ability to deliver rapid results compared to conventional blood culture methods, which may take 24–72 hours. For example, studies have shown that PCR-based assays can reduce the time to identify pathogens to less than six hours, significantly improving clinical decision-making. The growing adoption of multiplex assay, which can simultaneously detect multiple pathogens, is further driving this trend, addressing the complexity of sepsis diagnosis.

Increased Adoption of Biomarker-Based Testing

Biomarker-based tests are emerging as a key trend in the sepsis diagnostics market, offering enhanced sensitivity and specificity. Common biomarkers such as procalcitonin (PCT), C-reactive protein (CRP), and interleukins are widely used for the early detection and monitoring of sepsis. According to research published in Critical Care Medicine, PCT-guided antibiotic therapy has been shown to reduce antibiotic exposure by up to 22%, supporting antimicrobial stewardship initiatives. The integration of biomarker panels with diagnostic platforms is further enhancing their utility, providing comprehensive insights into the patient’s condition while reducing the likelihood of false positives.

Rising Demand for Point-of-Care Testing

The increasing need for rapid and decentralized diagnostics is driving the adoption of point-of-care (POC) diagnostics. These tests allow healthcare providers to quickly assess critical biomarkers and infection parameters at the bedside, reducing the time to treatment initiation. A study in The Lancet Infectious Diseases highlighted that early intervention facilitated by POC testing can lower mortality rates in sepsis patients by up to 25%. The development of portable and user-friendly diagnostic devices, combined with the growing use of POC technologies in emergency and low-resource settings, is expanding their market reach.

Sepsis Diagnostics Market Segment Insights

Sepsis Diagnostics Market Assessment – Product-Based Insights

The sepsis diagnostics market, by product, is segmented into instruments, blood culture media, assay kits and reagents, and software. The assay kits and reagents segment holds the largest market share due to their critical role in the routine diagnosis and monitoring of sepsis. These products are widely used in laboratory settings for their precision and ability to identify pathogens and relevant biomarkers. The consistent demand for assay kits, driven by advancements in molecular and immunoassay technologies, underpins their dominance in the market. Their application across a broad range of diagnostic platforms and adaptability to evolving testing protocols further solidify their position.

The software segment is registering the highest growth rate, fueled by the increasing integration of artificial intelligence and machine learning in diagnostic workflows. Software solutions are enhancing the efficiency of sepsis diagnostics by enabling real-time data analysis, interpretation, and reporting. These advancements are particularly beneficial for predictive analytics and clinical decision support systems, which are becoming essential in improving sepsis management outcomes. The rising adoption of digital health tools and connectivity in healthcare facilities is also driving the demand for software in this market.

Sepsis Diagnostics Market Assessment – Technology-Based Insights

The sepsis diagnostics market, segmented by technology, includes microbiology, molecular diagnostics, immunoassays, flow cytometry, and others. The microbiology segment holds the largest market share due to its established role in the identification and analysis of pathogens causing sepsis. Techniques such as blood culture remain the gold standard in clinical diagnostics despite their longer turnaround times. The reliability and widespread availability of microbiology-based methods in healthcare settings make them indispensable, particularly in regions with limited access to advanced diagnostic technologies. Continuous developments in automation and culture-based systems further reinforce the dominance of microbiology in the market.

The molecular diagnostics segment is experiencing the highest growth rate, driven by its ability to deliver rapid and accurate results. Technologies such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) are increasingly adopted for their capacity to detect specific pathogens and resistance genes in a matter of hours. The demand for these advanced techniques is growing in response to the global emphasis on early and precise diagnosis of sepsis to improve clinical outcomes. The integration of molecular diagnostics into point-of-care platforms and the development of multiplex assays capable of detecting multiple pathogens simultaneously are key factors contributing to the rapid growth of this segment.

Sepsis Diagnostics Market Assessment – Testing Type-Based Insights

The sepsis diagnostics market, by testing type, is segmented into laboratory testing and point-of-care testing. The laboratory testing segment holds a larger market share due to its widespread use in hospitals and diagnostic centers for its comprehensive analysis and high accuracy in identifying sepsis-related pathogens and biomarkers. These tests are typically conducted in centralized facilities equipped with advanced instruments, allowing for detailed and reliable results. The continued reliance on laboratory testing is supported by its ability to process large sample volumes and deliver detailed insights into sepsis progression, making it a cornerstone of clinical diagnostics.

The point-of-care testing segment is witnessing a higher growth rate, driven by its ability to provide rapid results and facilitate timely clinical interventions. The growing adoption of portable diagnostic devices and bedside testing in emergency care settings enhances the demand for point-of-care solutions, especially in critical cases where early diagnosis can significantly improve patient outcomes. Advances in miniaturized technologies and the increasing integration of user-friendly interfaces in point-of-care devices are further propelling this segment growth, particularly in remote and resource-limited areas.

Sepsis Diagnostics Market Assessment – End User-Based Insights

The sepsis diagnostics market segmentation, by end user, includes hospitals and clinics, pathology and reference laboratories, research institutes, and others. The hospitals and clinics segment holds the largest market share, driven by the high volume of sepsis cases managed in these settings. These facilities rely on advanced diagnostic tools and technologies for rapid and accurate detection of sepsis to facilitate timely treatment. The availability of integrated diagnostic services and multidisciplinary care in hospitals further supports the dominance of this segment, as sepsis management often requires immediate and comprehensive clinical interventions.

The pathology and reference laboratories segment is registering the highest growth rate due to the increasing outsourcing of diagnostic services to specialized laboratories. These facilities provide precise and cost-effective diagnostic solutions, supported by high-throughput instruments and skilled personnel. Advancements in molecular and microbiological diagnostic technologies are further enhancing the capabilities of reference laboratories, making them critical in addressing complex sepsis cases. The growing trend of decentralization in healthcare and the need for specialized expertise are key factors contributing to the rapid growth of this segment.

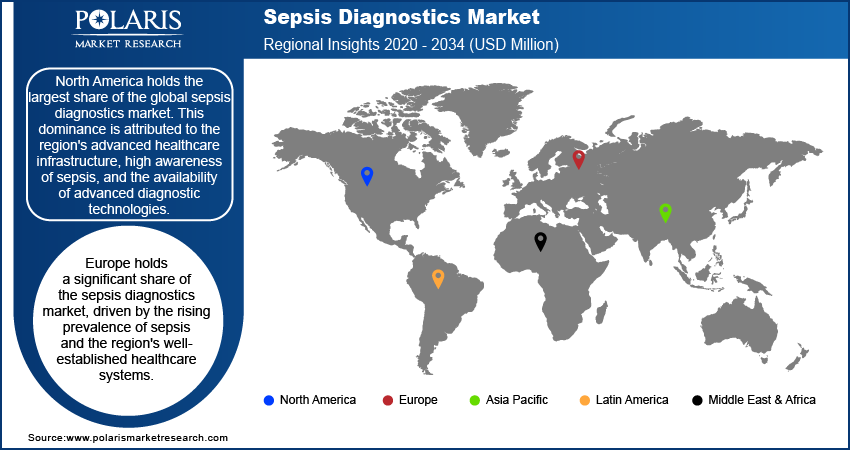

Sepsis Diagnostics Market Regional Insights

By region, the study provides sepsis diagnostics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share. This dominance is attributed to the region's advanced healthcare infrastructure, high awareness of sepsis, and the availability of advanced diagnostic technologies. The prevalence of sepsis cases, coupled with strong government initiatives and investments in early diagnostic programs, further strengthens the market in North America. Additionally, the presence of leading diagnostic companies and ongoing research into innovative solutions drive the adoption of advanced sepsis diagnostics in the region, ensuring its leading position in the global market.

Europe holds a significant share of the sepsis diagnostics market revenue, driven by the rising prevalence of sepsis and the region's well-established healthcare systems. Countries such as Germany, the UK, and France are at the forefront due to their strong focus on early diagnosis and advancements in diagnostic technologies. Government initiatives promoting sepsis awareness and funding for research and development are further supporting market growth in the region. Additionally, the presence of key diagnostic companies and collaborations between healthcare providers and research institutions contribute to the robust demand for sepsis diagnostic solutions in Europe.

The Asia Pacific sepsis diagnostics market is experiencing rapid growth, primarily due to increasing healthcare expenditure, a growing patient population, and improving healthcare infrastructure in countries such as China, India, and Japan. The rising prevalence of infectious diseases and sepsis, particularly in developing nations, is driving the adoption of diagnostic technologies. Efforts to enhance sepsis awareness and access to affordable diagnostic tools are also playing a critical role in the sepsis diagnostics market expansion in Asia Pacific. Furthermore, the growing presence of global diagnostic companies and local manufacturing initiatives is strengthening the market in the region.

Sepsis Diagnostics Market – Key Players and Competitive Insights

Key players in the sepsis diagnostics market include companies such as Thermo Fisher Scientific, Abbott Laboratories, BioMérieux, Danaher Corporation, Roche Diagnostics, Siemens Healthineers, BD (Becton, Dickinson and Company), QIAGEN, Sysmex Corporation, Beckman Coulter, Hologic, LumiraDx, Cepheid, ACON Laboratories, and Vericel Corporation. These companies are actively involved in the development, manufacturing, and distribution of advanced diagnostic technologies, including molecular diagnostics, immunoassays, and microbiological systems, to enhance the detection and management of sepsis. A few of these companies, such as Abbott and Thermo Fisher, have robust product portfolios and a global presence, making them significant players in both developed and emerging markets.

In terms of competition, these companies are focusing on the development of faster, more accurate diagnostic tools to address the growing need for early sepsis detection. There is a notable emphasis on technological innovation, with players integrating artificial intelligence and machine learning into their diagnostic platforms to improve accuracy and reduce the time to results. Companies such as BioMérieux and Roche Diagnostics are also expanding their diagnostic portfolios to include rapid molecular testing and multiplex assays, which allow for the detection of multiple pathogens in a single test. Additionally, partnerships and collaborations with healthcare providers, research institutions, and other diagnostic firms are common strategies used to strengthen their market positions.

The sepsis diagnostics market is characterized by significant research and development activity, as companies strive to introduce products that meet the increasing demand for point-of-care diagnostics and customizable testing solutions. Regulatory approvals for new diagnostic systems and platforms also play a crucial role in shaping the competitive landscape. As sepsis diagnosis moves toward more personalized and integrated approaches, companies are focusing on providing end-to-end solutions, from testing devices to data management systems, to enhance clinical workflows and patient outcomes. This trend is expected to intensify competition and further drive technological advancements in the market.

Abbott Laboratories is a global healthcare company that offers diagnostic tools, including systems for detecting sepsis-related pathogens and biomarkers. The company is known for its focus on innovative diagnostic technologies and has a strong presence in hospital and point-of-care settings.

BioMérieux, based in France, is another major player in the market, providing diagnostic solutions across various medical conditions, including sepsis. The company is recognized for its expertise in microbiology and molecular diagnostics, offering tools that help in the identification of pathogens responsible for sepsis.

List of Key Companies in Sepsis Diagnostics Market

- Abbott Laboratories

- ACON Laboratories

- BD (Becton, Dickinson and Company)

- Beckman Coulter

- BioMérieux

- Cepheid

- Danaher Corporation

- Hologic

- LumiraDx

- QIAGEN

- Roche Diagnostics

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific

- Vericel Corporation

Sepsis Diagnostics Industry Developments

- In November 2023, Abbott launched its ID NOW sepsis test, which provides rapid results in under an hour, improving patient care by identifying infections quickly.

- In October 2023, BioMérieux announced the launch of its new VIDAS sepsis panel, designed to deliver faster results and improve the speed of diagnosis, especially in emergency care settings. The company’s focus remains on enhancing diagnostic accuracy to reduce mortality rates associated with sepsis.

Sepsis Diagnostics Market Segmentation

By Product Outlook

- Instrument

- Blood Culture Media

- Assay Kits & Reagents

- Software

By Technology Outlook

- Microbiology

- Molecular Diagnostics

- Immunoassays

- Flow Cytometry

- Others

By Testing Type Outlook

- Laboratory Testing

- Point-of-Care Testing

By End User Outlook

- Hospitals & Clinics

- Pathology & Reference Laboratories

- Research Institutes

- Others

By Pathogen Outlook

- Bacterial Sepsis

- Gram Positive Bacteria

- Gram Negative Bacteria

- Fungal Sepsis

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sepsis Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 639.55 million |

|

Market Size Value in 2025 |

USD 682.72 million |

|

Revenue Forecast by 2034 |

USD 1,255.14 million |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The sepsis diagnostics market has been segmented on the basis of product, technology, testing type, end user, and pathogen. Moreover, the study provides the reader with a detailed understanding of the different segments at both global and regional levels.

Growth/Marketing Strategy

The sepsis diagnostics market growth strategy focuses on technological innovation, expanding product portfolios, and improving diagnostic speed and accuracy. Companies are investing in research and development to introduce advanced diagnostic tools such as molecular tests, rapid assays, and multiplex panels. Partnerships and collaborations with healthcare providers, academic institutions, and other diagnostic firms are also crucial for expanding market reach. Additionally, key players are focusing on increasing their presence in emerging markets through localized manufacturing and distribution channels. Regulatory approvals for new diagnostic technologies and expanding point-of-care testing solutions are also driving market growth.

FAQ's

The sepsis diagnostics market size was valued at USD 639.55 million in 2024 and is projected to grow to USD 1,255.14 million by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period

North America held the largest share of the market in 2024.

The assay kits and reagents segment accounted for the largest share of the sepsis diagnostics market revenue in 2024.

The assay kits and reagents segment accounted for the largest share of the sepsis diagnostics market revenue in 2024.

The microbiology segment accounted for the largest share of the market in 2024.

Sepsis diagnostics refers to the technologies and tools used to detect and identify sepsis, a life-threatening condition caused by the body's extreme response to an infection. The diagnostic process involves detecting biomarkers or pathogens in the blood or other bodily fluids, often through blood cultures, molecular tests, immunoassays, or other diagnostic methods. Early detection of sepsis is critical for timely treatment, as the condition can rapidly progress and lead to organ failure or death if not addressed quickly. Sepsis diagnostics includes laboratory-based and point-of-care testing systems aimed at improving patient outcomes by enabling faster and more accurate diagnosis

A few key trends in the market are described below: Integration of Artificial Intelligence (AI): AI and machine learning are being incorporated into diagnostic platforms to enhance accuracy and speed in detecting sepsis. Advancements in Molecular Diagnostics: Increasing adoption of PCR and next-generation sequencing (NGS) technologies for rapid pathogen identification and antimicrobial resistance detection. Biomarker-Based Testing: Growing use of biomarkers such as procalcitonin (PCT) and C-reactive protein (CRP) for early diagnosis and monitoring of sepsis. Point-of-Care Testing: Expansion of portable and easy-to-use diagnostic devices for faster diagnosis and treatment initiation at the bedside or in emergency settings

A new company entering the sepsis diagnostics market must focus on developing rapid, accurate, and cost-effective diagnostic solutions, particularly in point-of-care testing. By integrating artificial intelligence and machine learning into diagnostic tools, the company can enhance accuracy and reduce the time to results. Focusing on molecular diagnostics, especially multiplex testing that can detect multiple pathogens simultaneously, would cater to the demand for comprehensive solutions. Additionally, expanding in emerging markets with tailored, affordable products could help the company capture a broader customer base. Building strong partnerships with healthcare providers and research institutions can also accelerate product development and market entry.

Companies manufacturing, distributing, or purchasing sepsis diagnostics-related products and equipment and other consulting firms must buy the report