Granite Market Size, Share, Trends, & Industry Analysis Report

By Product (Granite Slabs, Granite Tiles, and Other Products), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5883

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

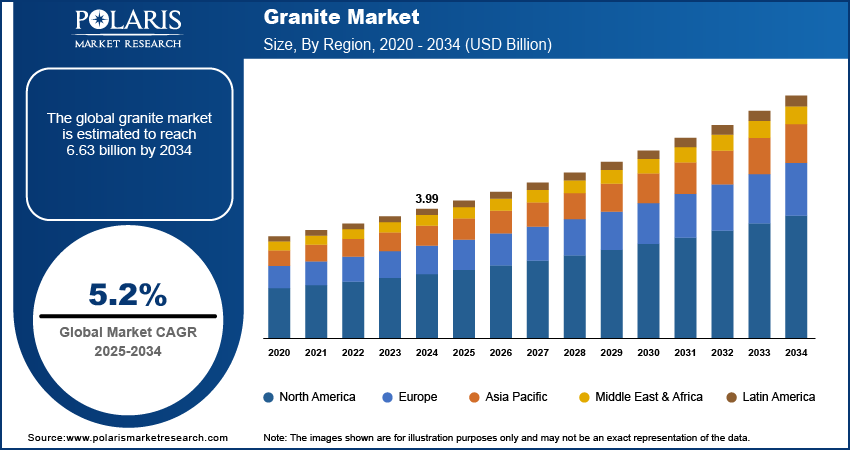

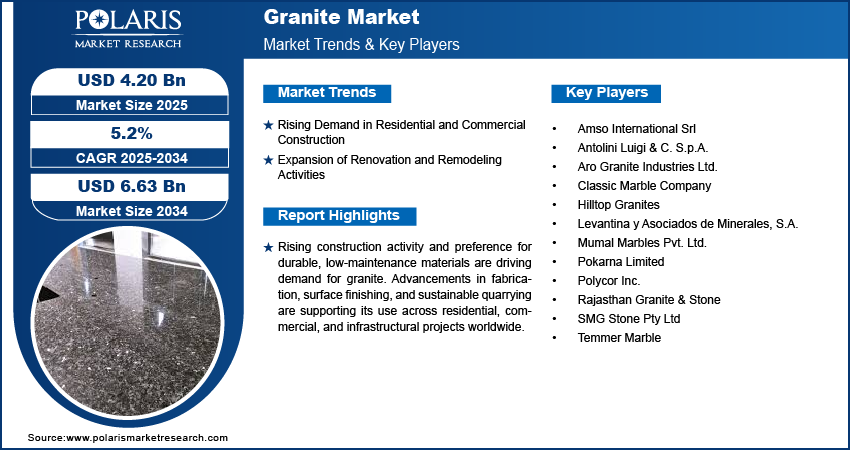

The global granite market size was valued at USD 3.99 billion in 2024, growing at a CAGR of 5.2% during 2025–2034. Increasing construction activity in residential, commercial, and renovation projects fuels the demand for the granite industry.

Granite is a coarse-grained, hard, and durable igneous rock composed mainly of quartz, feldspar, and mica. Granite is widely used in construction, interior design, and infrastructure development due to its durability, aesthetic appeal, and resistance to wear. Processing facilities are increasingly incorporating automated cutting and polishing technologies to improve operational efficiency and reduce material wastage. The demand for dimensionally accurate and customized slabs is leading manufacturers to invest in advanced computer numerical control machine and digital fabrication tools. The industry is also witnessing a rapid shift toward sustainable practices with the integration of efficient water recycling systems, dust suppression units, and energy-efficient equipment to reduce environmental impact.

Fabricators are focusing on improving operational efficiency and productivity with the adoption of compact machinery layouts, integrated material handling solutions, and real-time process monitoring to optimize space and reduce manual intervention. Regulations focused on occupational safety, emissions control, and waste management are driving companies to modernize quarrying and processing practices. Innovations such as resin-treated surfaces, anti-slip textures, and high-gloss finishes are expanding the use of granite across high-traffic commercial spaces and customized residential applications. These advancements are helping manufacturers meet quality expectations while improving cost control across large-scale projects.

Growing infrastructure development in urban areas and increasing focus on durable, low-maintenance construction materials are driving demand for granite across architectural and interior design services. According to the United Nations, 68% of the world’s population is expected to live in urban areas by 2050, up from 55% in 2018. This boost the adoption of granite-based products in cities to expand infrastructure and services. In large commercial developments, granite is being selected for its ability to withstand high foot traffic, resist surface degradation, and deliver a refined natural appearance. With real estate developers seeking materials that balance longevity and aesthetics, granite continues to be integrated into façades, floors, and countertops. Rising innovations in processing technologies are enabling fabricators to offer customized textures, edge profiles, and surface finishes, expanding the scope of granite use across modern and traditional designs.

Growing government investments in smart cities and public infrastructure projects are driving the adoption of granite in urban planning, landscaping, and transit structures. Municipal authorities are incorporating granite into pavements, monuments, and civic buildings due to its structural integrity and minimal upkeep. At the production level, compact processing equipment and improved cutting accuracy are helping manufacturers reduce resource usage while maintaining output quality. Rising demand for green building initiatives that are focused on environmentally responsible construction are boosting the use of natural materials including granite, sourced through sustainable quarrying and low-waste processing. These developments are making granite a key material in long-term infrastructure planning.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Rising Demand in Residential and Commercial Construction

Rising demand in residential construction is contributing to the increasing use of granite as homeowners seek durable, low-maintenance, and aesthetically appealing materials for interior and exterior applications. As per the Statistics Canada, in December 2024, investment in Canada's building construction rose 1.1% to nearly USD 14 billion, driven by a 1.7% increase in residential construction. The granite’s long service life and ability to retain its appearance over time make it a preferred choice for modern housing developments focused on quality and longevity. Additionally, the availability of multiple finishes and color variations allows homeowners and designers to incorporate granite into various architectural styles, from contemporary to traditional.

In commercial construction, granite continues to be used in high-traffic environments such as office buildings, retail complexes, hotels, and institutional spaces. Its ability to withstand heavy use without surface degradation supports its application in lobbies, staircases, countertops, and exterior paving. As commercial developers aim to create lasting structures that require minimal upkeep, granite serves as a reliable material that enhances both functionality and design. Growing investments in infrastructure and real estate are reinforcing the adoption of granite in large-scale construction, where material performance, visual appeal, and long-term cost efficiency are key decision-making factors.

Expansion of Renovation and Remodeling Activities

Expansion of renovation and remodeling activities is creating demand for granite across residential and commercial sectors. According to the International Energy Agency (IEA), making older buildings zero-carbon-ready is crucial to meet 2030 and 2050 climate goals. Since over 40% of buildings in developed countries were built before 1980, reaching this target requires deep renovations of at least 2% of existing buildings each year through 2030. Thus, it is pushing the demand for the granite stones globally. Moreover, homeowners are upgrading kitchens, bathrooms, and living spaces using granite surfaces due to the material’s refined appearance and proven durability. Its ability to resist scratches, heat, and moisture makes it an ideal choice for areas that require both functionality and aesthetic enhancement. Growing shift toward premium and natural materials in home improvement projects, there is a rising demand for the granite for supporting its position as a value-adding element in interior upgrades.

Commercial establishments are also investing in remodeling initiatives to modernize spaces and improve brand perception. Granite is commonly used in reception areas, staircases, and common areas to convey a professional and upscale appearance while maintaining ease of maintenance. Hotels, retail stores, and office buildings are incorporating granite to update interior layouts and refresh outdated surfaces without compromising structural integrity. The trend toward sustainable renovations are further supporting the use of granite, as it offers long product life, recyclability, and minimal upkeep. These factors are reinforcing its role in both aesthetic enhancements and functional improvements during refurbishment projects.

Segmental Insights

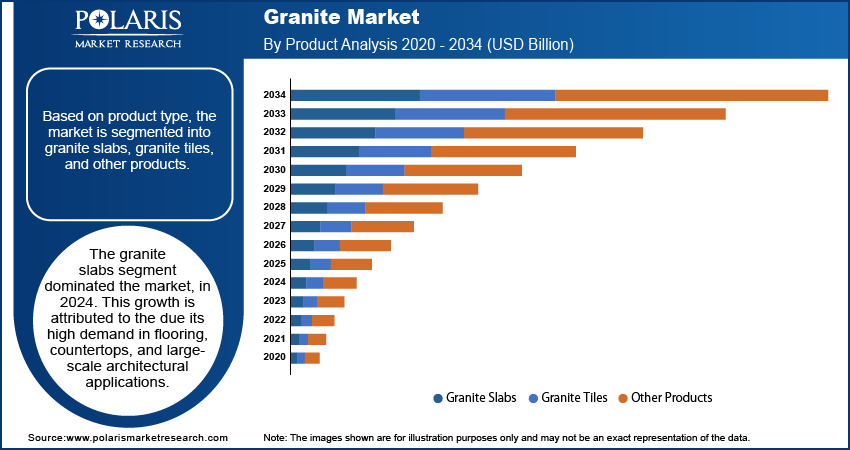

By Product Analysis

The segmentation, based on product includes, granite slabs, granite tiles, and other products. The granite slabs segment dominated the market in 2024. This growth is attributed to their widespread use in flooring, kitchen countertops, wall cladding, and large architectural applications. Their structural stability, broad surface area, and ease of customization support their usage in both residential and commercial spaces. Slabs are preferred for premium installations that demand uniformity and long-term durability. Builders and designers select granite slabs for their ability to provide seamless finishes and a variety of edge profiles. Ongoing developments in cutting and polishing technologies are enhancing the quality and dimensional accuracy of slabs, reinforcing their position as the preferred choice across large-scale construction projects.

The granite tiles segment is projected to grow at a robust pace in the coming years, due to rising demand for cost-effective, space-efficient, and versatile materials in interior design and renovation. Their suitability for modular flooring, bathroom walls, and decorative accents is driving adoption across residential and commercial projects. Tiles are lighter and easier to handle compared to slabs, making them ideal for vertical applications and smaller installations. Improved production techniques have allowed manufacturers to offer granite tiles in various finishes, thicknesses, and textures. Their appeal in do-it-yourself (DIY) remodeling projects and mid-range construction contributes to their increasing popularity, particularly in high-density urban housing developments.

By Application Analysis

The segmentation, based on application includes, monuments, floors, paths and patios, cladding and building blocks, kitchen worktops, and other application. The kitchen worktops segment accounted for significant market share in 2024, due to its resistance to heat, stains, and abrasion, which aligns with daily usage in high-contact areas. The polished finish and natural patterns of granite enhance aesthetic value while offering strong functional performance. For instance, in November 2023, GTA Countertop Pro launched a new and diverse range of kitchen countertops in Toronto, featuring materials like quartz, granite, and marble. The collection aims to offer homeowners stylish, durable, and customizable surface options. As homeowners and builders seek durable and attractive surfaces for kitchens, granite continues to be preferred for both new construction and remodeling projects. The demand for personalized and premium kitchen interiors has further elevated the use of granite worktops. Custom fabrication capabilities and the availability of various color tones contribute to the continued strength of this segment.

The cladding and building blocks segment is projected to grow at a significant pace during the assessment phase, as architectural designs increasingly incorporate natural materials for exterior treatments. Granite’s resistance to weathering, fire, and pollutants makes it suitable for facade applications and structural facing elements. As construction standards evolve to emphasize durability and energy efficiency, granite is being used for cladding in institutional, commercial, and upscale residential buildings. Pre-cut blocks and panel-based installations are enabling faster application on building exteriors. Enhanced visual impact, reduced maintenance, and compatibility with sustainable construction practices are helping drive the growth of this segment across infrastructure and commercial property developments.

By End User Analysis

The segmentation, based on end user includes, residential, commercial, industrial, and infrastructural. The residential segment dominated the market, in 2024, due to granite’s use in kitchen countertops, flooring, and wall cladding within individual homes and multi-family housing. The material’s natural appeal, low maintenance, and long service life align well with homeowners’ expectations for value and performance. Granite also supports varied design themes, making it suitable for both traditional and modern interiors. Urbanization and real estate development are further expanding its adoption in mid to high-end housing. Builders are incorporating granite into model homes and high-spec units to meet consumer demand for durable, high-quality materials that enhance living spaces over the long term.

The infrastructural segment is expected to witness fastest growth, as public and private investments focus on durable and aesthetically consistent materials for urban development. According to the Oxford Economics Global Infrastructure Outlook, global spending on infrastructure is projected to reach USD 94 trillion by 2040. An additional USD 15 trillion is expected to meet the UN Sustainable Development Goals. Granite is being used in pavements, railway stations, airport terminals, and civic structures where longevity, resistance to heavy loads, and visual appeal are essential. Its minimal upkeep and capacity to withstand environmental stress make it suitable for long-term use in high-traffic public zones. Government-led infrastructure modernization and city beautification initiatives are contributing to increased granite consumption. The trend toward sustainable infrastructure is also reinforcing the material’s relevance, particularly in projects that aim to integrate natural and regionally sourced resources.

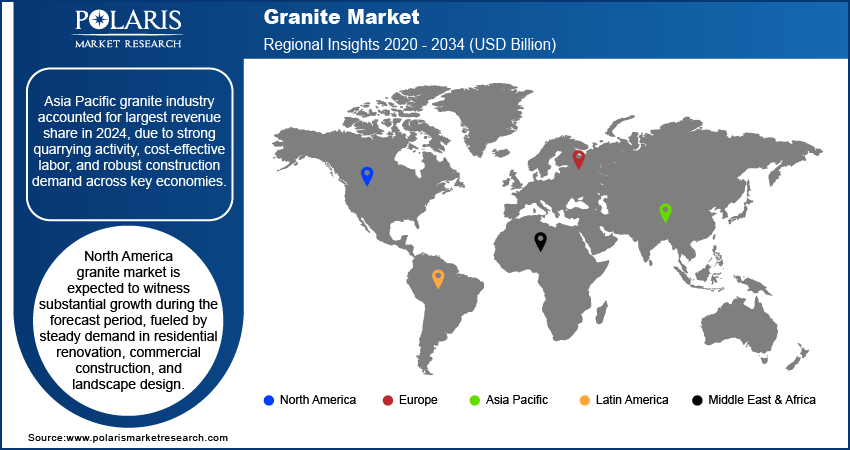

Regional Analysis

Asia Pacific granite industry accounted for largest revenue share in 2024, due to strong quarrying activity, cost-effective labor, and robust construction demand across key economies. India remains the primary contributor, with a wide range of granite variants and established export routes to Europe, the Middle East, and North America. China’s growing infrastructure and urban housing development also support regional consumption. Advanced processing facilities in India and China offer slabs, tiles, and finished products for both domestic and export markets. Rising investments in urban renewal, public spaces, and luxury housing continue to support product demand across applications such as flooring, façades, kitchen surfaces, and paving.

India Granite Market Insight

The India granite dominated the regional market share in 2024. Its dominance stems from vast natural stone reserves, government incentives for mining modernization, and cost-efficient processing hubs in Andhra Pradesh, Tamil Nadu, and Karnataka. Export-friendly policies and improved logistics infrastructure have enabled Indian manufacturers to cater to large-scale orders from the US, Middle East, and European regions. Domestically, smart city missions and large housing projects are increasing the use of granite in public and residential construction. According to the Government of India, the country’s real estate sector is projected to grow from USD 200 billion in 2021 to USD 1 trillion by 2030 and contributing 13% to the national GDP in 2025. Quarrying reforms, improved safety standards, and machinery upgrades are helping streamline supply and enhance product quality.

MEA Granite Market

The MEA granite market is projected to reach substantial share by 2034. The growth is driven by expanding urban landscapes, tourism-centric architecture, and public infrastructure modernization. For instance, Saudi Arabia plans to invest USD 1 trillion in infrastructure by 2030 as part of its Vision 2030 goals, focusing on transportation, logistics, and urban development. This massive investment aims to position the Kingdom as a global trade and investment hub. Increasing construction of luxury hotels, civic monuments, transportation terminals, and cultural institutions is fueling demand for high-quality granite across the region. Natural stone is being preferred for its aesthetic consistency, durability, and ability to withstand climatic variations. Government-backed development plans are focusing on high-end and long-lasting materials, reinforcing the use of granite in both exterior and interior applications. Growing imports, supported by trade relationships and simplified logistics, are enabling steady supply for regional construction needs.

North America Granite Market Overview

North America granite market is expected to witness substantial growth during the forecast period, fueled by steady demand in residential renovation, commercial construction, and landscape design. As per the National Association of the Remodeling Industry (NARI), US citizen spent approximately USD 603 billion on home remodeling in 2024. Among NARI members, 42% reported higher demand for remodeling services, while 57% observed an increase in project scale, often involving multiple rooms or larger renovations. The region exhibits strong consumer preference for natural materials that offer durability, minimal maintenance, and long-term value. Granite is widely installed in kitchen countertops, flooring systems, building facades, and exterior pathways across private and public spaces. Remodeling trends and custom interior upgrades continue to boost demand across both single-family homes and multi-unit buildings. The market also benefits from consistent imports, advanced fabrication capabilities, and the presence of established distributors that cater to changing design preferences and project specifications.

Key Players & Competitive Analysis Report

The granite industry is highly competition, driven by rising demand for high-performance natural materials in residential, commercial, and infrastructural construction. Key manufacturers focus on large-scale quarrying, automated fabrication, and global distribution to meet the growing need for dimensional accuracy, surface customization, and reliable supply. Market participants are expanding processing capacities, improving logistics, and offering diversified product lines that address varied design and structural requirements. Emphasis on sustainable quarrying practices, water-efficient processing systems, and compliance with environmental standards is strengthening the industry’s position across regulated markets. Strategic partnerships with real estate developers, construction firms, and architectural consultants are helping players secure long-term contracts and project-specific deployments.

Key companies in the granite industry include Levantina y Asociados de Minerales, S.A., Pokarna Limited, Classic Marble Company, Antolini Luigi & C. S.p.A., Polycor Inc., Aro Granite Industries Ltd., Temmer Marble, Hilltop Granites, Rajasthan Granite & Stone, Mumal Marbles Pvt. Ltd., SMG Stone Pty Ltd, and Amso International Srl.

Key Players

- Amso International Srl

- Antolini Luigi & C. S.p.A.

- Aro Granite Industries Ltd.

- Classic Marble Company

- Hilltop Granites

- Levantina y Asociados de Minerales, S.A.

- Mumal Marbles Pvt. Ltd.

- Pokarna Limited

- Polycor Inc.

- Rajasthan Granite & Stone

- SMG Stone Pty Ltd

- Temmer Marble

Industry Developments

October 2024: Polycor Inc., announced to invest over USD 15 million to upgrade its plants in Quebec and Indiana to boost production capacity and efficiency. This investment is expected to strengthen granite supply and support growing demand in construction and design markets.

April 2021: Polycor Inc., announced to achieve carbon neutrality by 2025 through emission reductions and sustainable quarrying practices. This initiative enhances granite’s appeal as an eco-friendly material in sustainable construction.

Granite Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Granite Slabs

- Granite Tiles

- Other Products

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Monuments

- Floors

- Paths and Patios

- Cladding and Building Blocks

- Kitchen Worktops

- Other Application

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

- Infrastructural

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Granite Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.99 Billion |

|

Market Size in 2025 |

USD 4.20 Billion |

|

Revenue Forecast by 2034 |

USD 6.63 Billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.99 billion in 2024 and is projected to grow to USD 6.63 billion by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Levantina y Asociados de Minerales, S.A., Pokarna Limited, Classic Marble Company, Antolini Luigi & C. S.p.A., Polycor Inc., Aro Granite Industries Ltd., Temmer Marble, Hilltop Granites, Rajasthan Granite & Stone, Mumal Marbles Pvt. Ltd., SMG Stone Pty Ltd, Amso International Srl.

The granite slabs segment dominated the market share in 2024, due to their widespread use in high-precision residential and commercial applications to offer structural stability, seamless finishes, and compatibility.

The infrastructural segment is expected to witness the fastest growth during the forecast period, driven by its rapid usage in public projects for its durability, low maintenance, and suitability for high-traffic urban environments.