Gynecology Devices Market Size, Share, Trends, Industry Analysis Report

By Product (Surgical Devices, Handheld Instruments, Diagnostic Imaging Systems), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5927

- Base Year: 2024

- Historical Data: 2020-2023

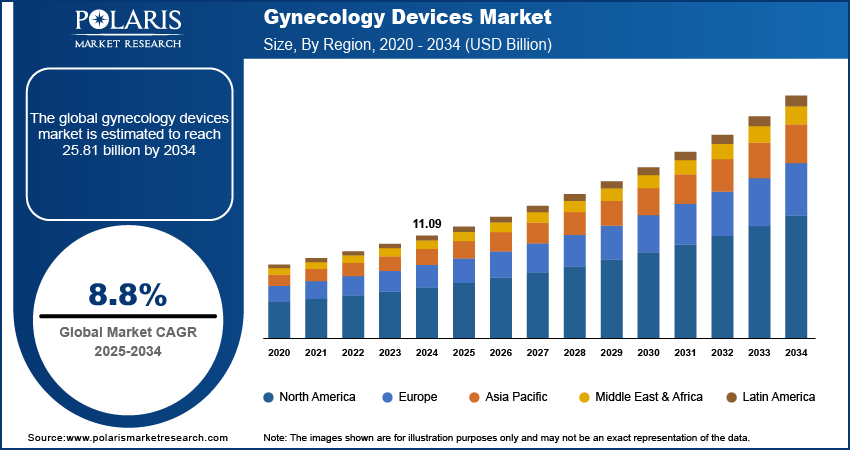

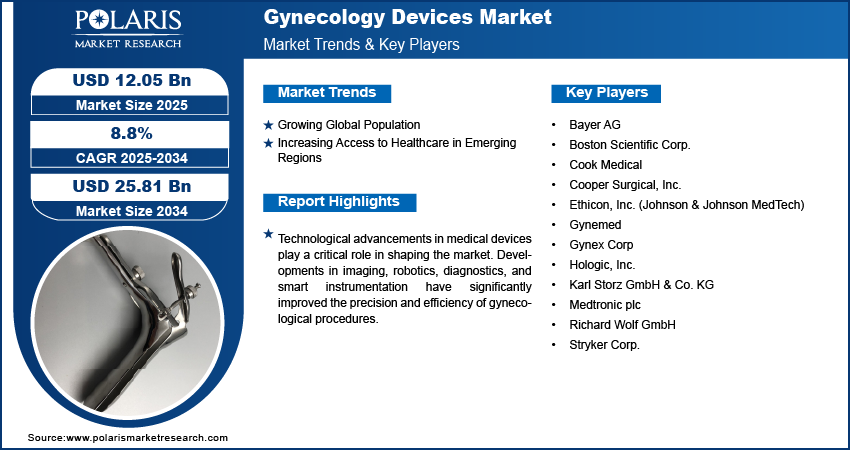

The global gynecology devices market size was valued at USD 11.09 billion in 2024, growing at a CAGR of 8.8% from 2025 to 2034. The global gynecology devices market is growing due to rising population, improved healthcare access in emerging regions, technological advancements, increasing gynecological disorders, and greater adoption of minimally invasive procedures, driving demand for advanced diagnostic and therapeutic solutions.

Market Overview

Gynecology devices are medical tools and equipment specifically designed for diagnosing, monitoring, and treating conditions related to the female reproductive system. These devices include instruments for procedures such as hysteroscopy, laparoscopy, colposcopy, and IUD insertion. They are used in both diagnostic and surgical settings to manage issues such as abnormal uterine bleeding, infertility, and uterine fibroids.

The growing emphasis on women's health at both policy and social levels is contributing to the expansion of the industry. Governments, NGOs, and healthcare institutions are increasingly investing in programs that address women-specific health concerns, including reproductive health, menstrual hygiene, and early cancer detection. Public health campaigns and educational outreach efforts are encouraging more women to undergo regular screenings and seek medical advice earlier. This increased attention is improving awareness about the importance of timely diagnosis and treatment of gynecological conditions, which, in turn, drives demand for diagnostic and therapeutic devices. Moreover, as more women become aware of their health options, they are more likely to opt for specialized procedures, further supporting the growth.

Technological advancements in medical devices play a critical role in shaping the market. Developments in imaging, robotics, diagnostics, and smart instrumentation have significantly improved the precision and efficiency of gynecological procedures. High-definition hysteroscopes and laparoscopes allow better visualization during surgeries, while robotic-assisted systems enable surgeons to perform complex operations with greater control. Additionally, new diagnostic tools detect abnormalities at earlier stages, improving treatment outcomes. These innovations lead to better patient satisfaction, fewer complications, and reduced procedural time, which benefits healthcare providers as well. Healthcare facilities are more willing to adopt advanced devices that support high-quality care as manufacturers invest in research and development to meet the specific needs of gynecology. Consequently, the integration of new technologies is one of the primary drivers encouraging wider use and replacement of traditional gynecological instruments, thereby driving the growth.

Industry Dynamics

Growing Global Population

The global aging population, particularly among women, is fueling the demand for gynecology devices. According to the United States Census Bureau, in the U.S. alone, 0.65% of the total population was female aged 40 years in 2024. The risk of developing gynecological conditions such as uterine prolapse, ovarian cysts, and postmenopausal complications increases as women age. Older populations require more frequent and specialized gynecological care, including surgeries that depend on advanced devices. At the same time, there is a growing demand for fertility treatments, partly due to delayed childbearing. Assisted reproductive technologies (ART), such as in vitro fertilization (IVF), require specialized diagnostic and surgical tools, including devices for egg retrieval and embryo implantation. This dual pressure is expanding the scope of the gynecology devices landscape. Healthcare providers are thus seeking versatile and reliable devices that support a broad range of procedures, from diagnostic screening to reproductive health support, driving further investments in the industry.

Increasing Access to Healthcare in Emerging Regions

Emerging economies are experiencing significant improvements in healthcare infrastructure, which is expanding the demand for gynecology devices. Many countries in Asia, Latin America, and Africa are investing in hospitals, clinics, and diagnostic centers to meet the growing healthcare needs of their populations. According to the Government of India, Indian government launched Ayushman Bharat under which 27,742 hospitals, including 11,973 private hospitals with 1.33 million beds, were newly opened as of 2024. These improvements include better access to trained medical professionals, improved insurance coverage, and government-led health initiatives focusing on women’s health. As a result, more women in these regions are able to access medical services, including gynecological consultations, diagnostics, and surgeries. Patients are also more willing to seek medical intervention for gynecological issues with rising disposable incomes and urbanization. Additionally, healthcare providers in these regions are adopting cost-effective and portable gynecology devices to serve remote or underserved areas. This increased accessibility is opening up new markets for medical device manufacturers and contributing to overall growth.

Segmental Insights

Product Analysis

The segmentation, based on type, includes surgical devices, handheld instruments, and diagnostic imaging systems. In 2024, the surgical devices segment dominated with the largest share due to the rising prevalence of gynecological conditions such as uterine fibroids, endometriosis, and ovarian cysts, which require surgical intervention. Minimally invasive procedures, including laparoscopy and robotic-assisted surgeries, have gained popularity due to faster recovery times and reduced complications, further boosting the demand for surgical instruments. Additionally, technological advancements in surgical tools such as electrosurgical devices, morcellators, and endoscopy systems have improved precision and patient outcomes, encouraging wider adoption in both hospitals and ambulatory surgical settings. More gynecologists are getting trained in these techniques and patients are showing a preference for less invasive options. Moreover, continued investments in improving surgical safety and efficiency are further driving the segment growth.

The diagnostics imaging segment is expected to experience a significant growth during the forecast period, driven by the growing emphasis on early detection and accurate diagnosis of gynecological disorders. Imaging equipment such as ultrasound device, MRI, and hysterosalpingography are increasingly being used to diagnose conditions such as infertility, pelvic pain, and abnormal bleeding. Advances in imaging technology have improved the resolution and accuracy of diagnostic tools, enabling better assessment of reproductive health and facilitating timely treatment planning. Additionally, increased awareness among women about routine health check-ups and the rising availability of imaging services in both urban and semi-urban areas are expected to fuel demand, thereby driving the segment growth.

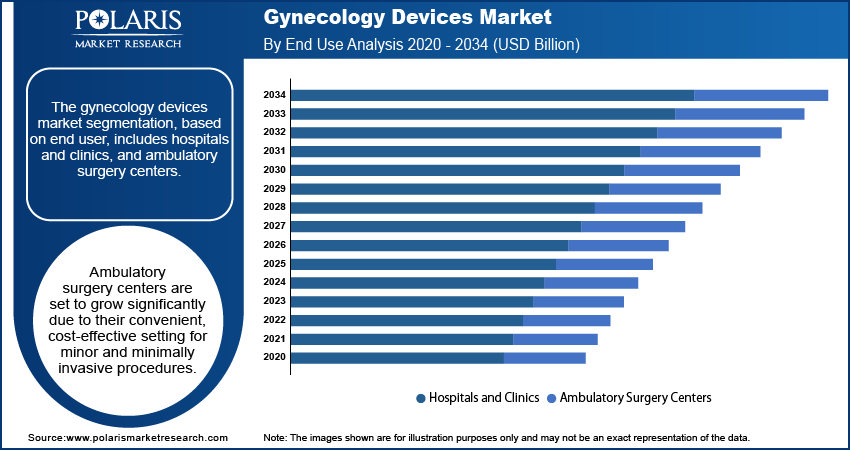

End User Analysis

The segmentation, based on end user, includes hospitals and clinics, and ambulatory surgery centers. The ambulatory surgery centers segment is expected to experience significant growth during the forecast period as these facilities offer a convenient and cost-effective setting for minor and minimally invasive procedures, making them increasingly popular among patients and healthcare providers. The shift toward outpatient care is supported by advancements in surgical equipment and anesthesia techniques, which allow for quicker recovery and same-day discharge. Ambulatory care service further benefits from shorter wait times and lower overhead costs compared to traditional hospitals, which has led to a higher number of gynecological procedures being performed in these settings. The role of ASCs is expanding as healthcare systems seek to reduce the burden on hospitals and improve patient access. Moreover, their growing adoption of modern gynecology devices and procedures is further driving the segment growth.

The hospitals and clinics segment dominated with the largest share in 2024 as these facilities offer comprehensive care and are equipped with advanced diagnostic and surgical infrastructure, making them the preferred choice for managing both routine and complex gynecological cases. Hospitals handle a high volume of inpatient and emergency procedures, contributing significantly to the demand for a wide range of gynecology devices. Additionally, the availability of skilled professionals and multidisciplinary teams enables effective diagnosis, treatment, and post-operative care under one roof. Clinics, especially those specializing in women’s health, continue to play a vital role in delivering outpatient services and preventive care. The central role of hospitals and clinics in healthcare delivery, combined with continued investments in equipment upgrades and staff training, is driving the segment growth.

Regional Analysis

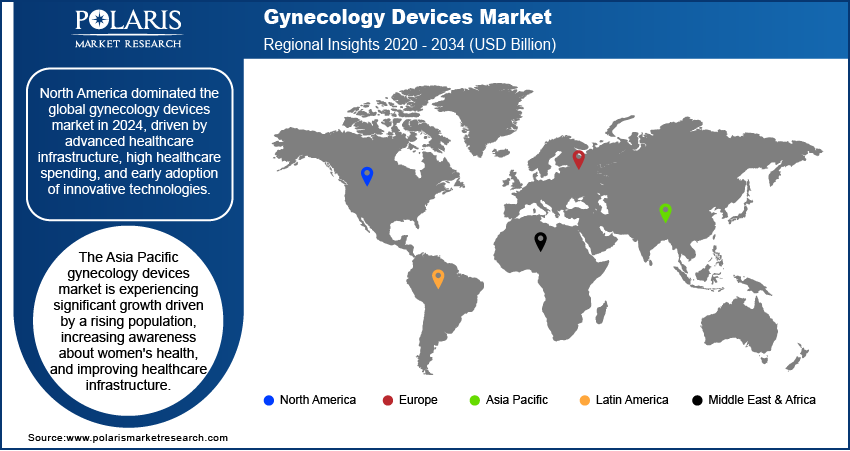

North America Gynecology Devices Market Trend

North America dominated the global market with the largest revenue share in 2024, driven by advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative technologies. The region benefits from well-established medical systems that adopt the use of modern gynecological equipment across both hospitals and outpatient facilities. Increased awareness about women’s health, along with supportive policies and access to health insurance, contributes to high rates of preventive screenings and elective procedures. Additionally, the presence of leading medical device manufacturers in the region accelerates the availability of new technologies. North America further experiences a high incidence of gynecological conditions such as uterine fibroids and endometriosis, further fueling demand for diagnostic and surgical devices. Continued emphasis on minimally invasive techniques and personalized care is expected to support growth in the region during the forecast period.

U.S. Gynecology Devices Market Insights

The market in the U.S. is expected to witness significant growth in the coming years driven by a high volume of gynecological procedures, strong R&D investments, and early access to next-generation technologies. Healthcare institutions in the country are equipped with advanced surgical and diagnostic systems, allowing for effective management of a wide range of gynecological disorders. The increasing focus on women’s health, coupled with government and private sector initiatives for screening and awareness, encourages regular medical visits and diagnostic evaluations. Additionally, a growing preference for outpatient care has led to more procedures being conducted in ambulatory surgical centers, boosting demand for portable and minimally invasive devices. Regulatory support through agencies such as the FDA ensures quality and innovation, though it also requires companies to meet high standards, thereby driving the growth.

Asia Pacific Gynecology Devices Market Analysis

The market in Asia Pacific is projected to witness substantial growth during the forecast period, driven by a rising population, increasing awareness about women's health, and improving healthcare infrastructure. Countries across the region are investing in expanding access to medical services, especially in urban and semi-urban areas. Growth is supported by economic development, which is enabling more women to seek medical care and undergo gynecological procedures. Additionally, government programs promoting maternal health and early disease detection are increasing the demand for diagnostic and surgical devices. Ongoing advancements in healthcare delivery and growing private sector involvements are improving access to gynecological care, thereby driving the growth.

Gynecology Devices Market in China

The market in China is expected to experience significant growth in the future, as rapid urbanization, economic growth, and healthcare reforms have significantly improved access to women’s health services in recent years. There is a rising demand for diagnostic and surgical procedures due to increased awareness, a growing middle-class population, and higher health insurance coverage. Government initiatives aimed at improving maternal and reproductive health, along with investments in public hospital infrastructure, are supporting the adoption of modern gynecology devices. The private healthcare sector is also expanding, offering more technologically advanced options for patients seeking quality care. China’s focus on innovation, medical training, and technology integration is creating a favorable environment for expansion. The demand for gynecology devices is expected to rise as healthcare policies continue to support modernization, thereby driving the growth.

Europe Gynecology Devices Market Insight

The Europe market growth is expected to be driven by its well-developed healthcare systems, aging population, and strong focus on women’s health. The region benefits from universal healthcare access in many countries, which encourages routine gynecological check-ups, early diagnosis, and preventive care. European nations have been early adopters of minimally invasive surgical technologies and advanced diagnostic imaging tools, especially in Western Europe. Rising awareness about reproductive health and government-backed screening programs have contributed to higher procedure volumes. Moreover, the region has a strong presence of leading medical device companies and research institutions, which drive innovation and adoption of new technologies. Nonetheless, the increasing investments in digital health, surgical robotics, and outpatient care facilities are driving the growth of the industry.

Gynecology Devices Market in Germany

The market in Germany is experience growth due to its robust healthcare infrastructure, high per capita health expenditure, and strong emphasis on medical technology. The country is known for its extensive network of hospitals and specialized clinics that offer a wide range of gynecological services, from diagnostics to complex surgeries. Germany has been proactive in adopting innovative devices, including laparoscopic instruments and advanced imaging systems, for improved patient outcomes. A growing elderly female population and high awareness of reproductive health contribute to consistent demand for both preventive and interventional care. Furthermore, Germany’s strong manufacturing base in medical technology supports local innovation and reduces reliance on imports. Public and private insurers cover many gynecological procedures, increasing accessibility for a broad population, thereby driving the growth.

Key Players and Competitive Analysis

The gynecology devices market features a competitive landscape with a mix of global medical device giants and specialized companies. Key players such as Medtronic plc, Boston Scientific Corp., and Stryker Corp. have diversified portfolios and strong R&D capabilities, giving them a robust presence across gynecological diagnostics, surgical tools, and minimally invasive systems. Ethicon, Inc. (part of Johnson & Johnson MedTech) and Hologic, Inc. focus heavily on women’s health, offering advanced surgical and diagnostic technologies. Karl Storz GmbH & Co. KG and Richard Wolf GmbH specialize in endoscope and visualization systems, widely used in gynecological procedures. Cooper Surgical, Inc., Cook Medical, and Gynex Corp cater specifically to reproductive and surgical needs with tailored solutions. Bayer AG maintains a presence in hormonal devices such as intrauterine systems, while Gynemed supports assisted reproduction. Continuous product innovation, regulatory approvals, and geographic expansion remain key strategies shaping the competition within this evolving and technologically driven market.

Key Players

- Bayer AG

- Boston Scientific Corp.

- Cook Medical

- Cooper Surgical, Inc.

- Ethicon, Inc. (Johnson & Johnson MedTech)

- Gynemed

- Gynex Corp

- Hologic, Inc.

- Karl Storz GmbH & Co. KG

- Medtronic plc

- Richard Wolf GmbH

- Stryker Corp.

Industry Developments

In May 2025, Minerva Surgical launched the HERizon Hysto-Kit, a single-use, pre-assembled hysteroscopy kit designed to streamline office-based procedures, improve setup efficiency, and support OB/GYNs in delivering consistent, high-quality care with reduced preparation time and inventory management.

In February 2025, Aspivix launched Carevix, a new cervical device designed to reduce pain and bleeding during transcervical procedures. Clinically proven as a gentler alternative to the tenaculum, Carevix became available in the U.S., EU, UK, and Brazil.

In April 2024, Moon Surgical and the Franche-Comté Polyclinic successfully introduced the Maestro System for gynecological laparoscopic procedures, enabling eight surgeons to complete hysterectomy, cystectomy, adnexectomy, and ovariectomy cases after a one-hour training, expanding Maestro’s clinical use in France.

Gynecology Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Surgical Devices

- Gynecological Endoscopy Devices

- Endoscopic Imaging Systems

- Fluid Management Systems

- Female Sterilization/Contraceptive Devices

- Handheld Instruments

- Diagnostic Imaging Systems

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Ambulatory Surgery Centers

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Gynecology Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.09 Billion |

|

Market Size in 2025 |

USD 12.05 Billion |

|

Revenue Forecast by 2034 |

USD 25.81 Billion |

|

CAGR |

8.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.09 billion in 2024 and is projected to grow to USD 25.81 billion by 2034.

The global market is projected to register a CAGR of 8.8% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Bayer AG; Boston Scientific Corp.; Cook Medical; Cooper Surgical, Inc.; Ethicon, Inc. (Johnson & Johnson MedTech); Gynemed; Gynex Corp; Hologic, Inc.; Karl Storz GmbH & Co. KG; Medtronic plc; Richard Wolf GmbH; and Stryker Corp.

The surgical devices segment dominated the market share in 2024.

The ambulatory surgical centers segment is expected to witness the significant growth during the forecast period.