High Content Screening Market Size, Share, Trends, Industry Analysis Report

: By Product and Services (Software, Instruments, and Consumables and Accessories), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5670

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

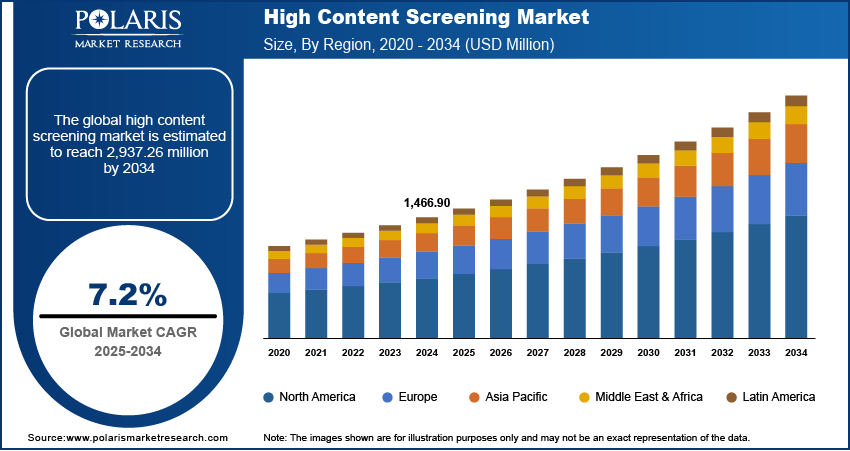

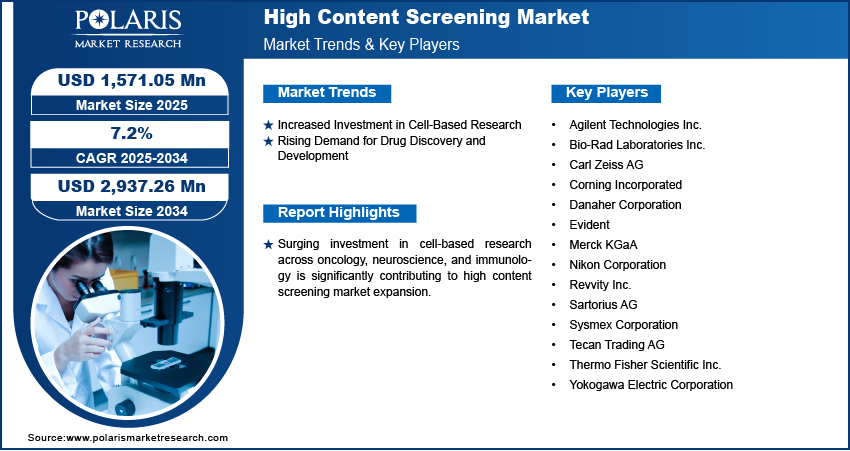

High content screening market size was valued at USD 1,466.90 million in 2024, exhibiting a CAGR of 7.2% during the forecast period. The market is driven by growing investments in cellbased research, innovations in high-resolution imaging and automation, and rising demand for faster, data-rich drug discovery.

Key Insights

- Consumables dominated the market due to recurring demand for assay kits and reagents in screening workflows.

- Drug discovery holds the largest application share, leveraging HCS for target validation and toxicity profiling.

- North America leads the market with a robust R&D infrastructure and regulatory support; Asia Pacific grows fastest.

- Increasing collaborations between research institutions and industry boost innovation and HCS adoption worldwide.

Industry Dynamics

- Increased investments in cell-based research accelerate the adoption of high-content screening technologies.

- Advancements in microscopy, AI, and automation improve the speed, accuracy, and scalability of HCS platforms.

- Growing demand from drug discovery for faster, multiparametric screening fuels market expansion.

- Rising use of 3D cell models and stem cell technologies drives the need for advanced analytical tools.

- High cost and technical complexity restrict market growth, especially in smaller labs and emerging markets.

Market Statistics

2024 Market Size: USD 1,466.90 million

2034 Projected Market Size: USD 2,937.26 million

CAGR (2025–2034): 7.2%

North America: Largest market in 2024

AI Impact on High Content Screening Market

- AI enhances image analysis accuracy, enabling precise identification of cellular features and phenotypes.

- Machine learning accelerates data processing, reducing time and cost in drug discovery workflows.

- AI-powered automation improves the scalability and throughput of high content screening experiments.

- Integration of AI enables predictive modeling for better decision-making in toxicity and efficacy studies.

- AI facilitates handling of complex, multiparametric datasets, advancing personalized medicine applications.

To Understand More About this Research: Request a Free Sample Report

The high content screening (HCS) market encompasses the development, production, and application of automated microscopy-based platforms integrated with quantitative image analysis, designed for cell-based screening in biological research and drug discovery. HCS enables researchers to extract multiparametric data from complex biological systems by analyzing cellular events, morphology, and biochemical processes in a high-throughput format. These platforms combine high-resolution imaging, robust data analytics, and advanced instrumentation, making them indispensable in fields such as pharmacology, toxicology, and systems biology. The market comprises instruments, software, reagents, and services used in both academic and industrial research environments. The increasing adoption of stem cell technologies and 3D cell models in biomedical research is driving demand for advanced analytical tools like HCS, thereby contributing to the market growth

Innovations in high-resolution microscopy, machine learning-based image analysis, and robotic automation are enhancing the speed, accuracy, and scalability of HCS platforms, fueling market expansion. Additionally, the demand for high-throughput phenotypic screening and cellular profiling in personalized therapeutic strategies is driving broader adoption of HCS in clinical research settings.

Market Dynamics

Increased Investment in Cell-Based Research

Surging investment in cell-based research across oncology, neuroscience, and immunology is significantly contributing to high content screening market expansion. Funding from both public institutions and private stakeholders is fueling extensive research into complex cellular mechanisms and disease pathways, driving the demand for advanced, high-throughput analytical platforms. For instance, in January 2025, Pluri secured a USD 6.5 million strategic investment to acquire a controlling interest in Kokomodo, a producer of cell-based cacao technology. High content screening (HCS) provides unparalleled capabilities for multipara metric analysis of live cells, enabling researchers to assess cell behavior, morphology, and intracellular signaling in real time. The ability to generate quantitative, image-based data supports more accurate modeling of disease states and therapeutic responses. This alignment between funding priorities and HCS technology adoption is reinforcing its role in modern research workflows and further accelerating market growth across life sciences.

Rising Demand for Drug Discovery and Development

Escalating pressure on pharmaceutical and biotechnology companies to reduce time-to-market for new drugs is contributing to high content screening market growth. HCS platforms are increasingly integrated into early-stage drug discovery pipelines to identify hit compounds, evaluate mechanism of action, and detect off-target effects using rich, cellular-level data. The ability to conduct multiparametric screening with high fidelity enables deeper insights into compound efficacy and toxicity profiles, improving decision-making during lead optimization. As drug development becomes more data-driven and personalized, the adoption of HCS is expanding across preclinical research environments, driving market expansion through enhanced screening precision and accelerated development cycles.

Segment Insights

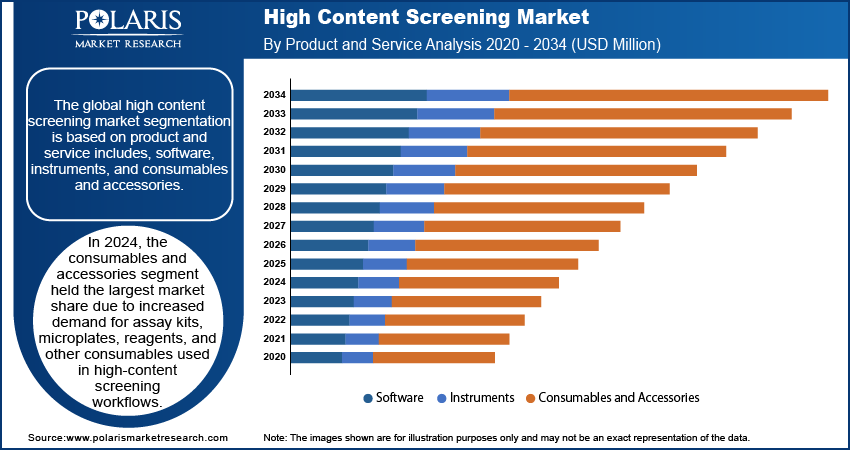

Market Assessment by Product and Service Outlook

The global high content screening market segmentation is based on product and service includes, software, instruments, and consumables and accessories. In 2024, the consumables and accessories segment held the largest market share due to increased demand for assay kits, microplates system, reagents, and other consumables used in high-content screening workflows. Continuous experimentation in drug discovery, toxicology testing, and cell-based assays necessitates frequent replenishment of these materials, making them indispensable for routine operations. The recurring nature of consumable purchases, coupled with the customization required for specific assays, is contributing to high content screening market growth. Additionally, the proliferation of 3D cell models and advanced imaging protocols requires highly specialized consumables to maintain assay fidelity, further reinforcing segment dominance in both academic and commercial settings.

The instruments segment is expected to witness significant growth over the forecast period, driven technological advancements in automated imaging systems, multiplexed readers, and integrated robotic platforms that enhance throughput and data quality. Demand for high-resolution, real-time cellular imaging tools is accelerating among pharmaceutical companies and research institutions aiming to streamline preclinical analysis. Adoption of AI-powered image analysis and machine learning-integrated instruments is expanding capabilities in phenotypic screening and rare cell detection. This innovation-driven environment, combined with increasing capital investments in laboratory automation, is contributing to high content screening market expansion through the instruments segment.

Market Evaluation by Application Outlook

The global high content screening market segmentation is based on application includes, drug discovery and development, toxicology, basic research, and others. The drug discovery and development segment accounted for the largest market share in 2024 due to its critical reliance on high-content screening for hit identification, target validation, and toxicity profiling in early drug development phases. Pharmaceutical companies are deploying HCS platforms to reduce lead time and enhance the predictive accuracy of preclinical testing. HCS enables multiparametric evaluation of compound libraries in disease-relevant models, providing deep insights into cellular behavior and drug efficacy. The push for more efficient, data-rich screening processes in AI in precision medicine is further contributing to high content screening market growth in this segment.

The basic research segment is expected to grow significantly over the forecast period due to expanding use of HCS in academic and institutional laboratories for studying cell signaling, gene expression, and intracellular processes. Increasing focus on understanding complex biological phenomena at the single-cell level is creating strong demand for high-resolution, high-throughput imaging tools. Research into stem cells, neurobiology, and immunology is benefiting from the ability of HCS platforms to perform quantitative, multiparametric analyses across large cell populations. Rising public and private research funding and a growing emphasis on data-driven experimentation are contributing to high content screening market expansion within the basic research domain.

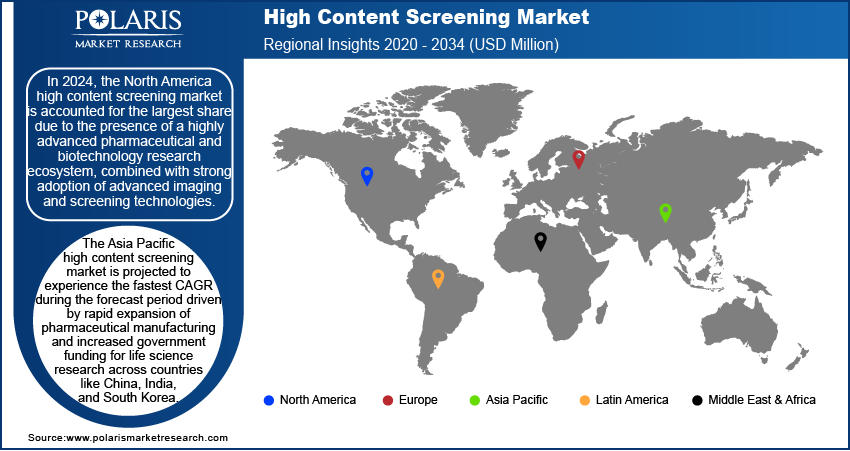

Market Share by Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America high content screening market is accounted for the largest share due to the presence of a highly advanced pharmaceutical and biotechnology research ecosystem, combined with strong adoption of advanced imaging and screening technologies. Substantial R&D investments by both private sector firms and government bodies have positioned the region at the forefront of drug discovery, toxicological analysis, and personalized medicine key application areas for high content screening. The robust infrastructure of academic and clinical research institutions, along with a mature regulatory framework that supports high-throughput testing and safety profiling, is contributing to the market growth. For instance, the U.S. Food and Drug Administration released updates in 2023 on regulatory frameworks supporting high-throughput testing, emphasizing its role in accelerating drug approvals. Additionally, widespread implementation of AI-integrated analytical tools and automation platforms is reinforcing North America's leadership in high-content analytics.

The Asia Pacific high content screening market is projected to experience the fastest CAGR during the forecast period driven by rapid expansion of pharmaceutical manufacturing and increased government funding for life science research across countries like China, India, and South Korea. For instance, the Department of Biotechnology (DBT) in India launched new schemes in 2023 to support oncology research and translational studies, encouraging local Contract Research Organizations (CROs) to adopt global standards in preclinical evaluation using HCS technologies. Emerging economies in the region are investing heavily in biotech innovation, stem cell research, and oncology studies domains that increasingly rely on high content screening technologies. Local research institutions and CROs are adopting HCS platforms to meet global standards in drug discovery and preclinical evaluation. The growing emphasis on translational research and increasing collaborations with global pharma players are further contributing to high content screening market expansion in the Asia Pacific region.

Key Market Players & Competitive Analysis Report

The competitive landscape of the high content screening (HCS) market is characterized by intense innovation, strategic consolidation, and a growing emphasis on advanced imaging technologies. Industry analysis reveals that key players are pursuing market expansion strategies centered on joint ventures, strategic alliances, and cross-border collaborations to strengthen global distribution networks and access emerging research hubs. Mergers and acquisitions are increasingly shaping the market, allowing companies to enhance their product portfolios and integrate complementary capabilities, particularly in AI-powered image analysis and automation.

Post-merger integration efforts are focused on aligning R&D operations and streamlining product development to accelerate time-to-market for next-generation HCS systems. Frequent product launches targeting specific applications in oncology clinical trials, stem cell biology, and neurodegenerative disease research reflect the sector’s responsiveness to evolving scientific demands. Technology advancements in multiplexed imaging, machine learning-based data interpretation, and 3D cell model compatibility are creating clear competitive differentiation. Additionally, strategic partnerships with academic research institutes and pharmaceutical companies are enabling collaborative innovation, fostering adoption across both drug discovery and basic research domains.

Thermo Fisher Scientific Inc. is engaged in providing services to the scientific community. They are improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, increasing lab productivity, or creating and producing therapies that will change people's lives. Through there industry-leading brands, which include Thermo Scientific, Invitrogen, Applied Biosystems, Unity Lab Services, Fisher Scientific, Patheon, and PPD, our worldwide team offers an unmatched mix of cutting-edge technology, buying ease, and pharmaceutical services. Thermo Scientific's instruments, apparatus, software, services, and consumables enable scientists to address challenging analytical problems in pharmaceutical, biotechnology, academic, governmental, industrial, environmental, and clinical laboratory research

Carl Zeiss AG is engaged in the development, production, and commercialization of a broad range of precision technologies, serving sectors such as semiconductor manufacturing, industrial metrology, biomedical research, medical technology, and consumer optics. Specializing in advanced imaging and optical systems, Carl Zeiss AG’s product portfolio includes semiconductor lithography equipment, light, electron and ion microscopes, coordinate-measuring machines, photomask systems, medical devices, ophthalmic diagnostic and therapeutic products, eyeglass lenses, camera and cine lenses, binoculars, spotting scopes, telescopes, and planetarium projectors. Carl Zeiss AG is engaged in the high content screening market, offering advanced imaging instruments and software solutions that support cell-based analysis and drug discovery research. The company’s expertise in microscopy and optical technologies positions it as a key player in providing high content screening systems for biomedical applications.

List Of Key Companies

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Carl Zeiss AG

- Corning Incorporated

- Danaher Corporation

- Evident

- Merck KGaA

- Nikon Corporation

- Revvity Inc.

- Sartorius AG

- Sysmex Corporation

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

High Content Screening Industry Developments

In February 2024, SCIEX launched the Echo MS+ system at SLAS 2024. This system combines Acoustic Ejection Mass Spectrometry and Open Port Interface (OPI) sampling with either the ZenoTOF 7600 or Triple Quad 6500+ systems, providing precise qualitative and quantitative results for high-throughput screening workflows.

In January 2024, Yokogawa Electric Corporation introduced the CellVoyager High-Content Analysis System CQ3000, part of its CellVoyager HCA portfolio, which includes advanced cell observation and image analysis tools.

High Content Screening Market Segmentation

By Product and Service Outlook (Revenue USD Million 2020 - 2034)

- Software

- Instruments

- Consumables and Accessories

By Application Outlook (Revenue USD Million 2020 - 2034)

- Drug Discovery and Development

- Toxicology

- Basic Research

- Others

By End User Outlook (Revenue USD Million 2020 - 2034)

- Pharmaceutical and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organization and Contract Development and Manufacturing Organization

- Others

By Regional Outlook (Revenue USD Million 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Content Screening Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,466.90 million |

|

Market Size Value in 2025 |

USD 1,571.05 million |

|

Revenue Forecast in 2034 |

USD 2,937.26 million |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue, USD Million; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global high content screening market size was valued at USD 1,466.90 million in 2024 and is projected to grow to USD 2,937.26 million by 2034.

The global market is projected to grow at a CAGR of 7.2% during the forecast period.

In 2024, the North America high content screening market is accounted for the largest share due to the presence of a highly advanced pharmaceutical and biotechnology research ecosystem, combined with strong adoption of advanced imaging and screening technologies.

Some of the key players in the market are Agilent Technologies Inc., Bio-Rad Laboratories Inc., Carl Zeiss AG, Corning Incorporated, Danaher Corporation, Evident, Merck KGaA, Nikon Corporation, Revvity Inc., Sartorius AG, Sysmex Corporation, Tecan Trading AG, Thermo Fisher Scientific Inc., Yokogawa Electric Corporation.

In 2024, the consumables and accessories segment held the largest market share due to increased demand for assay kits, microplates, reagents, and other consumables used in high-content screening workflows.

The drug discovery and development segment accounted for the largest market share in 2024 due to its critical reliance on high-content screening for hit identification, target validation, and toxicity profiling in early drug development phases.