High-Temperature Composite Resins Market Size, Share, & Industry Analysis Report

: By Resin Type (Epoxy Resin, Polyimide, Bismaleimide, Phenolic Resin, and Others), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5728

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

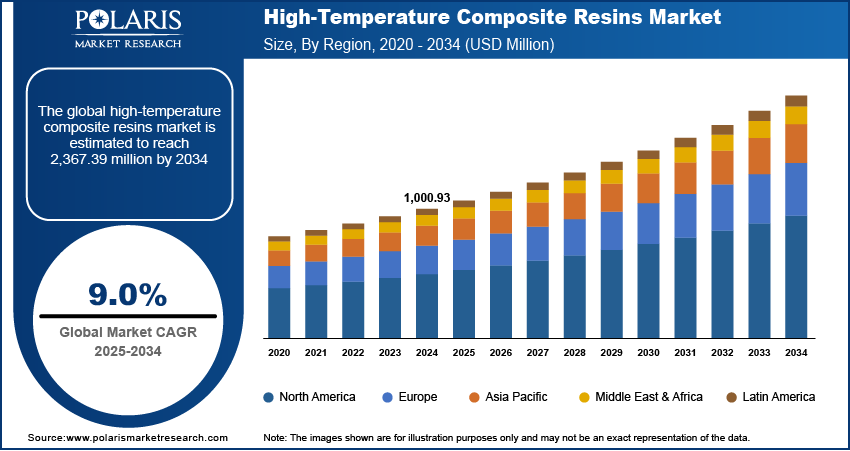

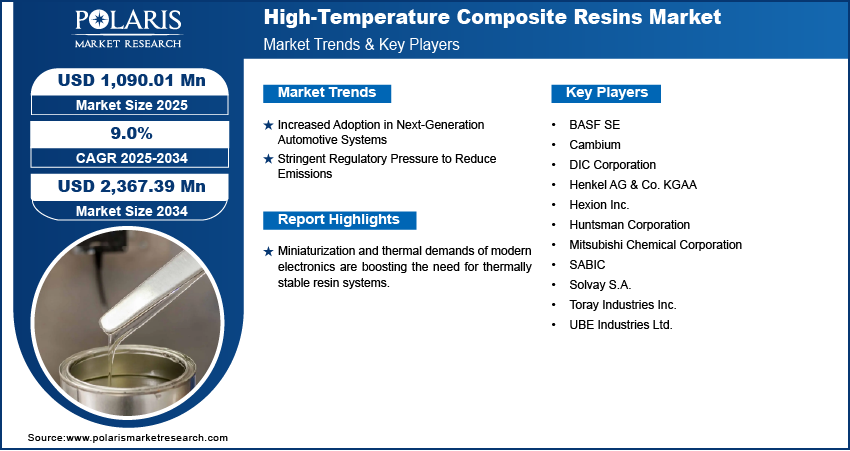

The global high-temperature composite resins market size was valued at USD 1,000.93 million in 2024 and is projected to register a CAGR of 9.0% during 2025–2034. High-temperature composite resins are essential in jet engines, airframe structures, and thermal insulation where extreme thermal and structural performance is non-negotiable, which is driving overall growth.

The high-temperature composite resins market is a segment of the advanced materials industry. It focuses on the production and application of composite resin systems engineered to withstand high temperatures, typically above 200°C. These resins such as polyimides, cyanate esters, bismaleimide, and phenolic resins are used in conjunction with reinforcement fibers (e.g., carbon, aramid, and glass) to produce composite structures with excellent thermal stability, mechanical strength, and chemical resistance. They are crucial in aerospace, automotive, electronics, and industrial applications where performance under extreme thermal stress is critical. High-performance resins are being increasingly utilized in aircraft, satellites and space vehicles due to their dimensional stability and resistance to outgassing in vacuum environments. For instance, in September 2024, Toray Advanced Composites launched Toray Cetex TC1130 PESU, a high-performance thermoplastic composite material designed for lightweight and environmentally sustainable aircraft interiors, providing key advantages for the aerospace industry.

To Understand More About this Research: Request a Free Sample Report

Ongoing R&D in high-performance polymers is improving processability, cost-efficiency, and thermal endurance of composite resins. Additionally, miniaturization and thermal demands of modern electronics are boosting the need for thermally stable resin systems.

Industry Dynamics

Increased Adoption in Next-Generation Automotive Systems

Increased integration of electrified drivetrains and advanced electronic systems in next-generation vehicles is elevating the performance requirements for materials used in under-the-hood and structural components. High-temperature composite resins offer a distinct advantage due to their ability to maintain mechanical integrity and thermal stability under extreme conditions, such as those found in electric powertrains, battery enclosures, and inverter housings. Automakers are increasingly turning to these advanced materials to reduce overall vehicle weight, manage heat more effectively, and ensure long-term reliability in critical subsystems. Their excellent resistance to heat-induced degradation and compatibility with high-voltage environments make them ideal for next-generation e-mobility platforms, where traditional polymers or metals fail to meet evolving design and performance standards.

Stringent Regulatory Pressure to Reduce Emissions

The imposition of stringent global emissions regulations is compelling automotive manufacturers to aggressively pursue light weighting strategies, which directly influence fuel economy and carbon output. In April 2023, the Biden-Harris Administration proposed new regulatory standards for chemical and polymer manufacturing to reduce cancer-related airborne toxic substances. The initiative emphasizes stricter emissions controls and enhanced safety protocols to protect community health. High-temperature composite resins are being adopted as a viable alternative to heavier metallic counterparts in structural and thermal protection applications. Their inherent strength-to-weight ratio, combined with resistance to high thermal loads, enables OEMs to design components that contribute to significant vehicle mass reduction without compromising safety or performance. These materials are particularly valuable in hybrid and electric vehicle architectures where weight savings translate into extended range and lower energy consumption. Regulatory compliance initiatives such as CAFE standards and Euro 7 norms are accelerating the adoption of such advanced composites across both established and emerging vehicle platforms, reinforcing their role in sustainable automotive engineering.

Segment Insights

Market Assessment by Resin Type

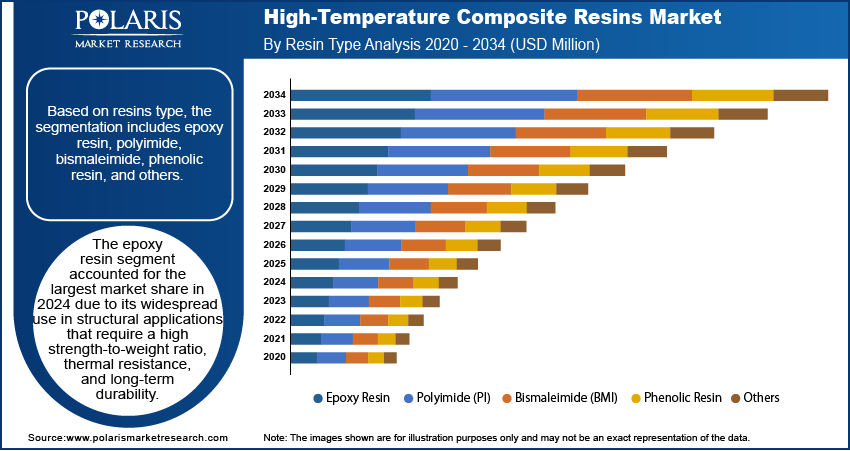

Based on resin type, the segmentation includes epoxy resin, polyimide, bismaleimide, phenolic resin, and others. The epoxy resin segment accounted for the largest market share in 2024 due to its widespread use in structural applications that require a high strength-to-weight ratio, thermal resistance, and long-term durability. Its relatively lower processing cost and compatibility with various reinforcement fibers have made it the preferred choice in high-performance applications, particularly in aerospace interiors, secondary aircraft structures, and automotive components. Demand from advanced manufacturing sectors, including wind energy and industrial tooling, has further solidified its position. The resin's excellent adhesive properties and dimensional stability under thermal cycling conditions also make it suitable for high-stress environments, supporting its dominance in the high-temperature composite resin market.

The polyimide resin segment is projected to record the highest CAGR during the forecast period due to its exceptional thermal stability, mechanical retention at elevated temperatures, and superior chemical resistance. These properties are driving adoption in extreme-temperature applications such as aircraft engine components, heat shields, and space structures. Its ability to withstand prolonged exposure to temperatures exceeding 300°C makes it indispensable for next-generation aerospace and satellite systems. Growing interest in hypersonic technologies and high-speed air mobility platforms is also expanding polyimide usage. Despite its higher processing complexity and cost, the resin's performance in critical thermal environments has attracted attention from OEMs focused on advanced propulsion and high-temperature electronics systems.

Market Evaluation by End Use

Based on end use, the segmentation includes aerospace & defense, automotive & transportation, electrical & electronics, and others. The aerospace and defense segment captured the largest share in 2024 due to the sector’s reliance on high-temperature composite resins for structural integrity, weight reduction, and extreme thermal endurance. These materials are integral to the design of airframe components, engine housings, leading edges, and interior systems that must meet stringent performance and safety criteria. Composite resins such as epoxy, phenolic, and polyimide are tailored for use in lightweight yet high-strength applications, enabling increased payload capacity and improved fuel efficiency. Sustained investments in military aircraft modernization, space exploration missions, and commercial aviation have maintained high demand for thermal-resistant composite technologies in this vertical.

The automotive and transportation segment is projected to register the highest CAGR during the forecast period due to accelerating demand for thermal management solutions in electric vehicle architectures and lightweight materials for fuel-efficient internal combustion models. The evolution of EV platforms has amplified the need for composite materials that can endure thermal stress in battery enclosures, e-motor components, and power control modules. Regulatory mandates to lower vehicle emissions and extend EV driving ranges are intensifying the shift from metal to composite parts. Innovations in processing techniques, such as resin transfer molding for high-performance composites, are also enabling faster and cost-effective production, driving broader adoption in mainstream automotive manufacturing.

Regional Analysis

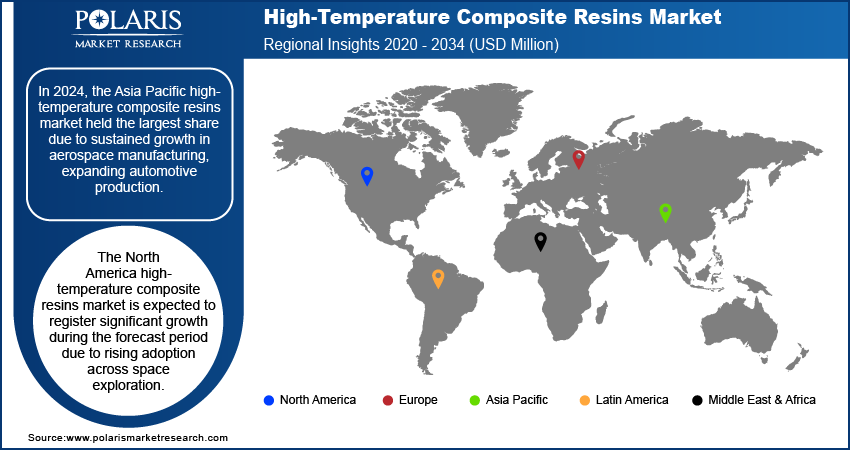

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific high-temperature composite resins market held the largest share due to sustained growth in aerospace manufacturing, expanding automotive production, and substantial investment in high-performance materials research. According to the State Council of the People's Republic of China, from January to September 2024, China produced around 21.47 million vehicles, a 1.9% increase year-on-year, while sales reached ∼21.57 million units, up 2.4% from the previous year. Strong government backing for indigenous aircraft and defense programs, especially across economies such as China, India, and Japan, has significantly accelerated the demand for advanced composite resins capable of withstanding elevated thermal loads. Rapid industrialization and infrastructure development are also increasing the integration of high-temperature composites in industrial and electrical applications. Local suppliers’ rising capacity to manufacture high-performance resins, coupled with cost-effective labor and production ecosystems, has reinforced the region’s dominance across multiple verticals demanding thermal durability and weight reduction.

The China high-temperature composite resins market is being propelled by strategic initiatives to localize aerospace and defense manufacturing and scale electric vehicle production. Investments in developing advanced materials for satellite systems, aircraft components, and thermal shielding technologies are contributing to a surge in demand for polyimide, epoxy, and bismaleimide resins. Leading Chinese automotive OEMs are also incorporating thermal-resistant composites into lightweight body structures and battery modules to meet evolving emissions and performance standards. National policies that prioritize technological self-reliance and support R&D infrastructure have enabled domestic producers to close the gap with global resin manufacturers. Enhanced collaboration between research institutions and manufacturers is fostering innovation in processing techniques, further solidifying China’s role as a critical growth hub for high-temperature composite applications.

The North America high-temperature composite resins market is expected to register significant growth during the forecast period due to rising adoption across space exploration, defense modernization, and electric mobility sectors. Government-funded programs focused on hypersonic weapons, reusable launch vehicles, and thermal protection systems are creating strong demand for composite resins with superior heat resistance and mechanical integrity. The Pentagon, headquarters of the US Department of Defense, in FY 2025, requested USD 6.9 billion for hypersonic research, up from USD 4.7 billion in FY 2024. Electric vehicle manufacturers are intensifying efforts to integrate advanced composites into battery enclosures and underbody protection to improve thermal management and crashworthiness. Rapid prototyping and localized manufacturing capabilities, combined with access to high-end processing technologies, are enabling North American companies to commercialize next-generation resins that meet strict regulatory and mission-specific performance standards.

The US high-temperature composite resins market benefits from a deeply integrated supply chain, a mature aerospace sector, and continuous innovation in thermosetting and thermoplastic composite systems. Adoption of lightweight, heat-resistant resins in critical defense platforms, commercial aircraft, and NASA-led space initiatives is driving domestic demand. OEMs and tier suppliers are prioritizing materials that reduce lifecycle costs while enhancing thermal tolerance and structural reliability. Emerging applications in hydrogen storage systems, electric propulsion, and advanced avionics are further diversifying the end-use landscape. The presence of leading material science firms and an extensive R&D ecosystem enables rapid material validation and certification, supporting market expansion across both commercial and strategic domains.

The Europe high-temperature composite resins market expansion is being supported by sustained advancements in lightweighting initiatives and robust regulatory frameworks focused on sustainability and emissions reduction. Aerospace programs such as Clean Sky and Eurofighter modernization are incorporating high-performance composite solutions that demand thermally stable resins. Automotive OEMs are also pursuing composite integration to meet stringent CO₂ targets under Euro 7 standards. Collaboration among research institutes, raw material suppliers, and tier-1 manufacturers is fostering the development of novel resin systems optimized for processing efficiency and recyclability. Strong emphasis on circular economy practices and eco-friendly material solutions positions Europe as a critical hub for sustainable innovation in high-temperature composite technologies.

Key Players & Competitive Analysis Report

The competitive landscape of the high-temperature composite resins market is defined by rapid material innovation, aggressive market expansion strategies, and a steady stream of strategic alliances. Industry analysis reveals a sharp focus on developing resins capable of withstanding extreme thermal environments while maintaining mechanical integrity for aerospace, defense, and advanced mobility applications. Companies are leveraging joint ventures to establish regional manufacturing hubs and secure access to localized supply chains. Mergers and acquisitions are reshaping the competitive dynamics, particularly in the aerospace composites sector, enabling firms to integrate vertically and streamline resin-to-prepreg conversion processes. Post-merger integration efforts often focus on aligning R&D capabilities and enhancing product portfolios to meet stringent regulatory and performance requirements. Technology advancements in polymer chemistry, including next-generation polyimide and bismaleimide formulations, are enabling higher temperature thresholds and improved processability. Launches of customizable, application-specific resin systems are increasingly prevalent, targeting lightweight structural components, thermal insulation panels, and engine bay parts. Strategic partnerships with OEMs and composite fabricators ensure early adoption and long-term supply contracts, especially in mission-critical sectors. Competitive differentiation is also emerging through digital manufacturing compatibility and the development of sustainable resin alternatives, aligning the market with broader trends in environmental compliance and circular material innovation.

List of Key Companies

- BASF SE

- Cambium

- DIC Corporation

- Henkel AG & Co. KGAA

- Hexion Inc.

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- SABIC

- Solvay S.A.

- Toray Industries Inc.

- UBE Industries Ltd.

High-Temperature Composite Resins Industry Developments

In July 2024, Cambium launched a high-temperature resin system for aerospace manufacturing that streamlines the production of hypersonic components, reducing fabrication time by 70–80%. This efficiency is vital for meeting the demands of next-generation aerospace applications, emphasizing thermal stability and precision.

In February 2024, Mitsubishi Chemical Group developed a carbon fiber-reinforced ceramic matrix composite (C/SiC) that resists temperatures up to 1,500 °C. This advanced material is tailored for high-performance applications, particularly in the space industry, where exceptional thermal resistance is essential.

In June 2023, Karman Space & Defense expanded its production capacity for Carbon-Carbon (C-C) Composite Components to meet increasing demand for MG Resin and Ultra-High Temperature Materials used in space and defense. The expansion involves new facilities and equipment for larger components and enhanced testing capabilities.

High-Temperature Composite Resins Market Segmentation

By Resin Type Outlook (Revenue, USD Million, 2020–2034)

- Epoxy Resin

- Polyimide (PI)

- Bismaleimide (BMI)

- Phenolic Resin

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Aerospace & Defense

- Automotive & Transportation

- Electrical & Electronics

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

High-Temperature Composite Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,000.93 million |

|

Market Size Value in 2025 |

USD 1,090.01 million |

|

Revenue Forecast by 2034 |

USD 2,367.39 million |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,000.93 million in 2024 and is projected to grow to USD 2,367.39 million by 2034.

The global market is projected to register a CAGR of 9.0% during the forecast period.

In 2024, the Asia Pacific high-temperature composite resins market held the largest share due to sustained growth in aerospace manufacturing, expanding automotive production.

A few of the key players include BASF SE, Cambium, DIC Corporation, Henkel AG & Co. KGAA, Hexion Inc., Huntsman Corporation, Mitsubishi Chemical Corporation, SABIC, Solvay S.A., Toray Industries Inc., and UBE Industries Ltd.

In 2024, the epoxy resin segment accounted for the largest market share due to its widespread use in structural applications that require a high strength-to-weight ratio, thermal resistance, and long-term durability.

The automotive and transportation segment is projected to register the highest CAGR during the forecast period due to accelerating demand for thermal management solutions in electric vehicle architectures and lightweight materials.