Higher Alpha Olefins Market Size, Share, Trends, & Industry Analysis Report

By Type (C6-C8, C10-C14, and C16), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5806

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

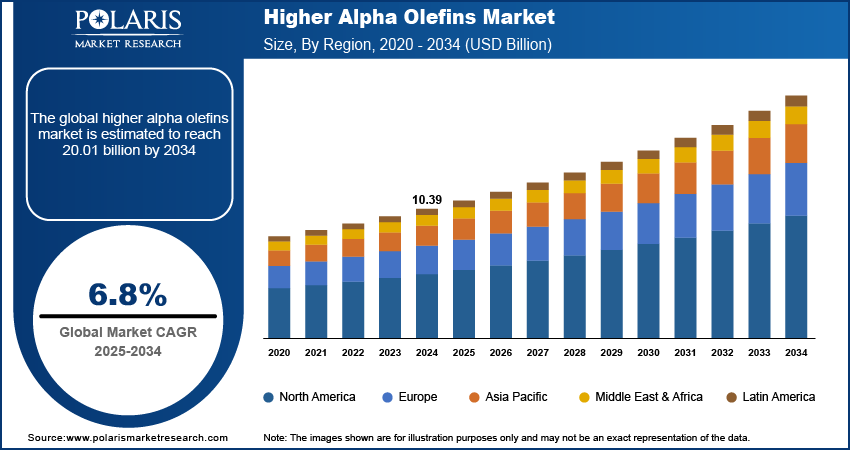

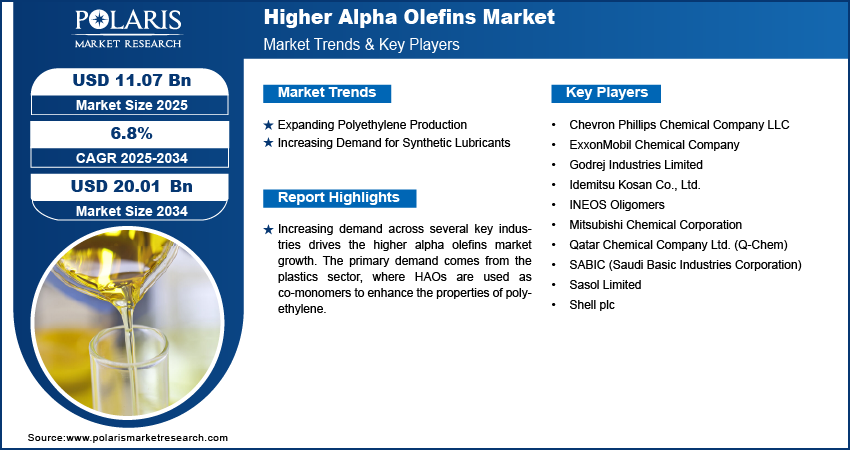

The global higher alpha olefins market size was valued at USD 10.39 billion in 2024 and is anticipated to register a CAGR of 6.8% from 2025 to 2034. The increasing demand for polyethylene, especially in the packaging and consumer goods industries, drives the market. Also, the growing use of synthetic lubricants, which use higher alpha olefins as a key ingredient, is a major growth driver.

Higher alpha olefins (HAO) are a type of chemical building block, mainly made from ethylene, with a double bond at the end of their carbon chain. This unique structure makes them highly reactive and useful in making many products, such as plastics, detergents, and synthetic lubricants.

The increasing demand for polyethylene, particularly linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), propels the requirement for HAOs as they are used as co-monomers to improve product properties such as flexibility and strength. Another important factor is the rising adoption of synthetic lubricants, which offer superior performance compared to traditional mineral-based lubricants in various industries. The growing awareness and demand for household and personal care products, specifically detergents and surfactants, also contribute significantly to the HAO market expansion.

Another significant factor propelling the HAO market demand is the expanding polyethylene industry. Polyethylene is a versatile plastic widely used in packaging, construction, and consumer goods due to its durability, flexibility, and cost-effectiveness. The global demand for polyethylene continues to rise, driven by increasing e-commerce activities and a rising preference for lightweight, durable packaging materials. For instance, the US EPA states that plastics such as polyethylene are commonly used in packaging applications due to their protective qualities for food and other goods. This sustained demand directly fuels the need for higher alpha olefins as essential raw materials in polyethylene production.

Industry Dynamics

Expanding Polyethylene Production

The growing global demand for polyethylene (PE) drives the higher alpha olefins (HAO) market. HAOs are crucial co-monomers in producing various types of polyethylene, such as linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which are widely used in films, packaging, pipes, and consumer goods. As many industries such as packaging and construction expand, the need for these enhanced polyethylene grades increases, directly boosting the demand for HAOs.

According to an article published by the US EPA in 2023, plastics such as polyethylene are extensively used in packaging applications due to their protective qualities for food and other products. This highlights the foundational role of polyethylene in various sectors. The continuous global economic development and urbanization further contribute to the rising consumption of polyethylene products or polyolefins, making the steady supply of higher alpha olefins essential for the plastics industry. This sustained demand for polyethylene products significantly drives the growth.

Increasing Demand for Synthetic Lubricants

The rising adoption of synthetic lubricants is another significant growth factor. Higher alpha olefins, particularly polyalphaolefins (PAOs), are key base oils in formulating high-performance synthetic lubricants. These lubricants offer superior properties such as better thermal stability, oxidation resistance, and lower volatility than conventional mineral oils. They are preferred in many demanding applications across the automotive, industrial, and aviation sectors.

A press release by the Press Information Bureau, Government of India, in 2025, titled "Researchers develop eco-friendly lubricant with superior performance," discusses the development of environmentally friendly lubricant formulations that significantly enhance friction reduction and wear resistance. This indicates the ongoing innovation and demand for advanced lubricant technologies, which often rely on synthetic components such as HAOs. As industries seek more efficient and durable machinery, and stricter environmental regulations promote high-performance and eco-friendly lubricants, the consumption of synthetic lubricants, and by extension, higher alpha olefins, is expected to continue its upward trend.

Segmental Insights

By Type

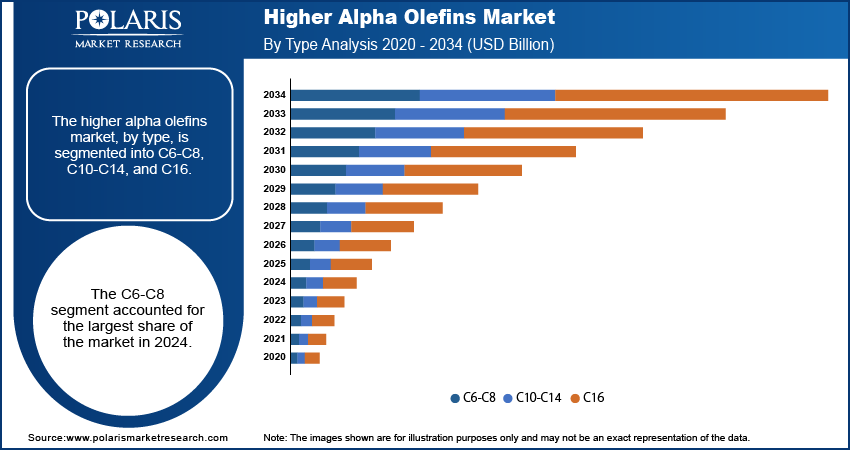

The C6-C8 segment held the largest market revenue share in 2024. These lighter alpha olefins, such as 1-hexene and 1-octene, are widely used as co-monomers in the production of polyethylene, particularly linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). Their incorporation improves the properties of these plastics, making them more flexible, strong, and easier to process, which are essential for applications such as packaging films, pipes, and various molded articles. The extensive use of C6-C8 HAOs in the booming plastics sectors, driven by global packaging demand and infrastructure development, contributes significantly to their dominance.

The C10-C14 segment is anticipated to register the highest growth rate during the forecast period. These mid-chain alpha olefins are increasingly in demand for specialized applications, particularly in producing synthetic lubricants and high-performance surfactants. Synthetic lubricants, often made with polyalphaolefin (PAO) base oils derived from C10-C14 HAOs, offer superior performance under extreme conditions, making them ideal for automotive, industrial, and aerospace applications.

By Application

The polyethylene comonomers segment held the largest share in 2024. Higher alpha olefins, particularly lighter fractions such as 1-hexene and 1-octene, are essential for producing various grades of polyethylene, such as linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). These plastics are widely used in critical sectors such as packaging, consumer goods, and construction due to their enhanced properties, including improved strength, flexibility, and processing ease.

The lubricants and synthetic oils segment is anticipated to register the highest growth rate during the forecast period. Higher alpha olefins are crucial in manufacturing high-performance synthetic lubricants, which are increasingly preferred over traditional mineral-based oils due to their superior thermal stability, oxidation resistance, and extended drain intervals. These advanced lubricants are vital for modern automotive, industrial, and aerospace machinery, which require robust performance under demanding conditions.

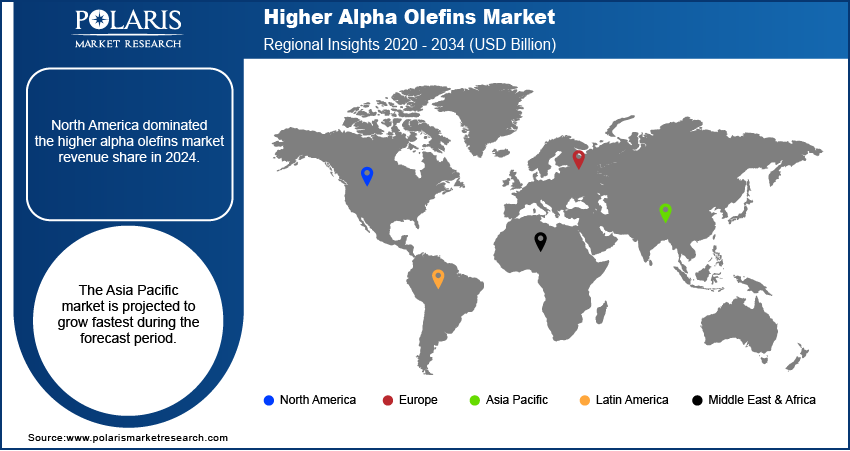

Regional Analysis

The North America higher alpha olefins market held the largest share in 2024, largely due to its strong petrochemical industry and abundant access to feedstock. The shale gas boom in the US has provided a cost-effective source of ethylene, a key raw material for HAO production, fostering a competitive manufacturing environment. The region witnesses considerable demand from the polyethylene sector for packaging and industrial applications and the growing synthetic lubricants market, particularly in the automotive and industrial machinery segments. Major HAO producers and advanced infrastructure support the regional market's robust position.

US Higher Alpha Olefins Market Insight

The US plays a dominant role in the North America market. This is primarily attributed to its well-established petrochemical infrastructure, ongoing investments in research and development, and a strong focus on advanced material formulations. The country's demand for HAOs is driven by a thriving plastics processing sector that uses them as co-monomers to create high-performance polyethylene for various applications, including packaging films and containers. Additionally, the increasing need for high-performance synthetic lubricants in industries such as automotive and aviation further boosts the consumption of higher alpha olefins in the US.

Europe Higher Alpha Olefins Market

Europe represents a substantial share of the market, characterized by its mature industrial base and a strong emphasis on sustainability and specialized chemical production. The region exhibits steady demand for higher alpha olefins across various applications, including polyethylene production, particularly for packaging and construction, and the growing synthetic lubricants market. European manufacturers are also increasingly focused on developing specialty chemicals and high-performance products, which often incorporate HAOs to achieve desired characteristics such as improved efficiency and reduced environmental impact. The Germany higher alpha olefins market contributes to the larger share in Europe. Germany's advanced manufacturing sector, particularly in automotive, chemicals, and consumer goods, generates significant demand for HAOs in applications such as high-performance lubricants and specialty olefin polymers. The country's strong commitment to research and innovation and its robust industrial infrastructure support the continuous development and consumption of higher alpha olefins. German companies are actively optimizing production processes and exploring new applications for these versatile chemicals.

Asia Pacific Higher Alpha Olefins Market Overview

The Asia Pacific market is anticipated to register the highest growth rate during the forecast period, driven by widespread industrialization, urbanization, and a growing middle class. The surging demand for polyethylene in developing economies across the region, particularly for packaging and consumer goods, is a major consumption driver. Furthermore, the increasing adoption of synthetic lubricants in the automotive and industrial sectors, alongside the expanding personal care and detergent industries, significantly contributes to the demand for higher alpha olefins in Asia Pacific. The China higher alpha olefins market is showcasing substantial growth due to its massive manufacturing base and continuous industrial expansion. The country's extensive production of polyethylene, coupled with its booming automotive and construction sectors, creates a strong demand for higher alpha olefins as essential raw materials. Moreover, the increasing focus on advanced materials and the rising consumer awareness of high-quality lubricants and detergents fuel the consumption of HAOs in China, positioning it as a significant market player.

Key Players and Competitive Insights

The competitive landscape of the higher alpha olefins (HAO) market is characterized by a few large, integrated players who have significant production capacities and well-established global supply chains. These companies benefit from their access to raw materials and proprietary technologies, which allow them to produce a wide range of higher alpha olefin products.

A few prominent companies in the industry include Chevron Phillips Chemical Company LLC; Shell plc; INEOS Oligomers; ExxonMobil Chemical Company; Sasol Limited; SABIC (Saudi Basic Industries Corporation); Qatar Chemical Company Ltd. (Q-Chem); Idemitsu Kosan Co., Ltd.; Godrej Industries Limited; and Mitsubishi Chemical Corporation.

Key Players

- Chevron Phillips Chemical Company LLC

- ExxonMobil Chemical Company

- Godrej Industries Limited

- Idemitsu Kosan Co., Ltd.

- INEOS Oligomers

- Mitsubishi Chemical Corporation

- Qatar Chemical Company Ltd. (Q-Chem)

- SABIC (Saudi Basic Industries Corporation)

- Sasol Limited

- Shell plc

Industry Developments

May 2025: Chevron Phillips Chemical announced that the shareholders of Chevron Phillips Singapore Chemicals have agreed to sell their interest to Aster Chemicals and Energy. This involves a high-density polyethylene manufacturing facility, showing a strategic portfolio adjustment.

April 2025: Shell Eastern Trading Pte. Ltd., a subsidiary of Shell plc, completed the acquisition of 100% of the shares in Pavilion Energy Pte. Ltd.

Higher Alpha Olefins Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- C6-C8

- C10-C14

- C16

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Polyethylene Comonomers

- Lubricants & Synthetic Oils

- Detergents & Surfactants

- Other Applications

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Higher Alpha Olefins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.39 billion |

|

Market Size in 2025 |

USD 11.07 billion |

|

Revenue Forecast by 2034 |

USD 20.01 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 10.39 billion in 2024 and is projected to grow to USD 20.01 billion by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Chevron Phillips Chemical Company LLC; Shell plc; INEOS Oligomers; ExxonMobil Chemical Company; Sasol Limited; SABIC (Saudi Basic Industries Corporation); Qatar Chemical Company Ltd. (Q-Chem); Idemitsu Kosan Co., Ltd.; Godrej Industries Limited; and Mitsubishi Chemical Corporation.

The C6-C8 segment accounted for the largest share of the market in 2024.

The C10-C14 segment is expected to grow fastest during the forecast period.