Cyclic Olefin Polymer Market Size, Share, Trends, Industry Analysis Report

: By Type (Homopolymers and Copolymers), Process Type, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 118

- Format: PDF

- Report ID: PM5576

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

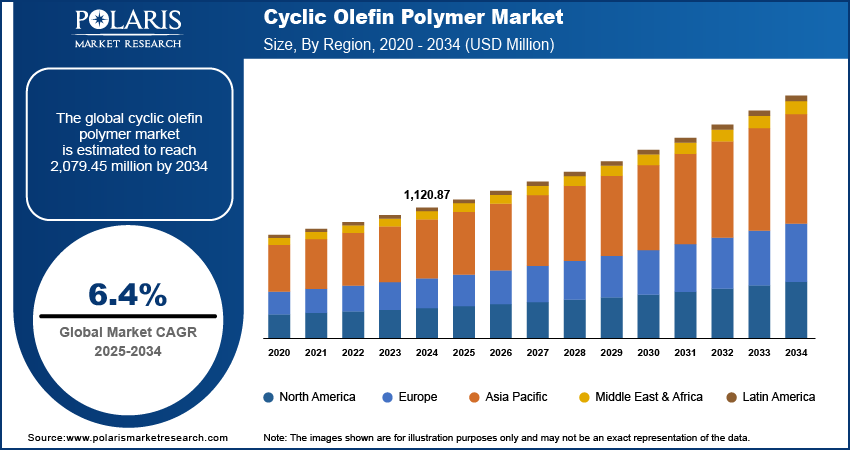

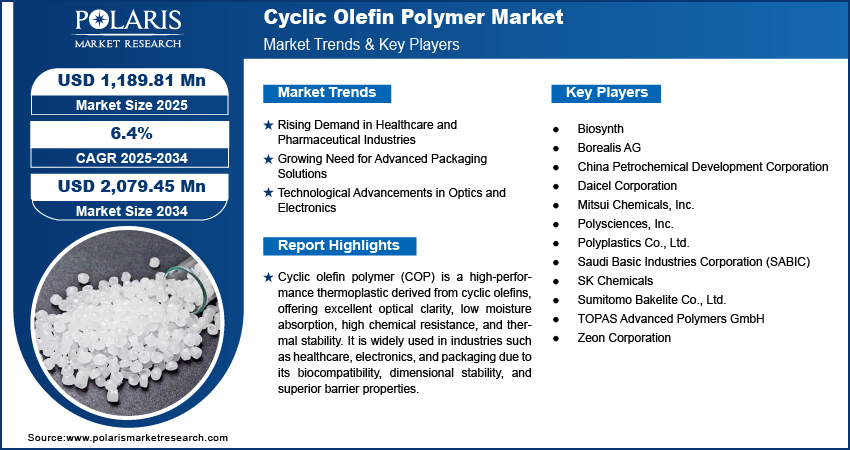

The cyclic olefin polymer market size was valued at USD 1,120.87 million in 2024, exhibiting a CAGR of 6.4% during 2025–2034. Growing healthcare needs, advanced packaging demands, and innovations in optics and electronics drive the market.

Key Insights

- The copolymers segment leads the market due to excellent chemical resistance, low moisture absorption, and high optical clarity, driving demand across packaging, pharmaceuticals, electronics, and optics industries.

- Injection molding dominates the process type segment, favored for producing precise, complex healthcare and electronics components using COPs.

- Packaging also shows significant growth, supported by COPs’ barrier properties, transparency, and durability that enhance product protection and shelf life.

- Asia Pacific dominates the regional market with strong growth in pharmaceuticals, healthcare, electronics, and optics, bolstered by manufacturing capabilities and R&D investments.

- Europe faces market challenges from reduced plastics production, stringent climate regulations, high energy costs, and competition from lower-cost global producers.

Industry Dynamics

- The expanding e-commerce industry drives demand for durable, high-performance packaging materials, ensuring product safety during shipping.

- Development of sustainable, recyclable packaging materials enhances product protection and reduces environmental impact.

- Rising healthcare needs increase demand for biocompatible, sterilizable polymers for medical devices.

- Technological advancements in optics push demand for high-clarity, dimensionally stable materials in lenses and displays.

- High manufacturing costs and processing complexities limit broader adoption in electronics and optics sectors.

Market Statistics

2024 Market Size: USD 1,120.87 million

2034 Projected Market Size: USD 2,079.45 million

CAGR (2025–2034): 6.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Cyclic olefin polymers (COPs) are amorphous thermoplastics characterized by exceptional optical clarity, high chemical resistance, and low moisture absorption. These properties make them suitable for diverse applications across industries such as packaging, healthcare, electronics, and optics. In the packaging sector, COPs are utilized for producing shrink films, labels, and protective packaging due to their durability and lightweight nature. In healthcare, their biocompatibility and stability under sterilization processes make them ideal for manufacturing medical devices such as syringes, vials, and diagnostic services.

The expanding e-commerce industry has increased the demand for high-performance packaging materials that ensure product safety and integrity during transit, which is further contributing to the cyclic olefin polymers market growth. Additionally, the rapid growth of the pharmaceutical and healthcare sectors, particularly in regions such as Asia Pacific, has heightened the need for contamination-free packaging solutions, which is further propelling the cyclic olefin polymers market expansion. Technological advancements in electronics and optics, requiring materials with superior transparency and dimensional stability, also contribute to the market's expansion.

Market Dynamics

Rising Demand in Healthcare and Pharmaceutical Industries

The healthcare and pharmaceutical sectors are experiencing significant growth, leading to an increased demand for materials that offer precision, reliability, and safety. COPs are particularly well-suited for medical applications due to their high purity, excellent barrier properties, and compatibility with sterilization processes. These characteristics make them ideal for manufacturing medical devices such as syringes, vials, and diagnostic equipment. For instance, a study published in the Journal of Applied Polymer Science in 2021 highlights the use of COPs in microfluidic devices for point-of-care diagnostics, emphasizing their superior performance compared to traditional materials. Additionally, in 2021, the US Food and Drug Administration (FDA) recognized the suitability of COPs for pharmaceutical packaging, citing their ability to maintain drug stability and extend shelf life. Therefore, the rising demand for COPs in healthcare and pharmaceutical industries propels the cyclic olefin polymers market growth.

Growing Need for Advanced Packaging Solutions

The packaging industry is evolving to meet the demands of globalization, e-commerce, and consumer preferences for transparency and sustainability. COPs offer exceptional durability, lightweight properties, and recyclability, making them an attractive choice for various packaging applications, including food and beverage containers, personal care products, and pharmaceuticals. According to a 2022 report by the European Commission, the adoption of high-performance polymers such as COPs in packaging has contributed to enhanced product protection and reduced environmental impact through material reduction and improved recyclability. Furthermore, research published in the Journal of Cleaner Production in 2021 demonstrates that COP-based packaging materials exhibit superior barrier properties against moisture and gases, thereby extending the shelf life of perishable goods and reducing food waste. Thus, the growing need for advanced packaging solutions drives the cyclic olefin polymers market demand.

Technological Advancements in Optics and Electronics

The rapid progression of technology in the optics and electronics industries necessitates materials that can meet stringent performance requirements. COPs are increasingly used in the production of optical lenses, light guides, and display panels due to their excellent optical clarity, low birefringence, and dimensional stability. A 2021 study published in Optical Materials highlights the application of COPs in the development of high-resolution lenses for augmented reality (AR) and virtual reality (VR) devices, noting their ability to enhance visual performance while reducing weight. Additionally, the National Institute of Standards and Technology reported in 2022 that COPs are being explored for use in advanced photonic devices, owing to their favorable optical properties and ease of processing. Thus, technological advancements in optics and electronics contribute to the cyclic olefin polymers market opportunities.

Segment Insights

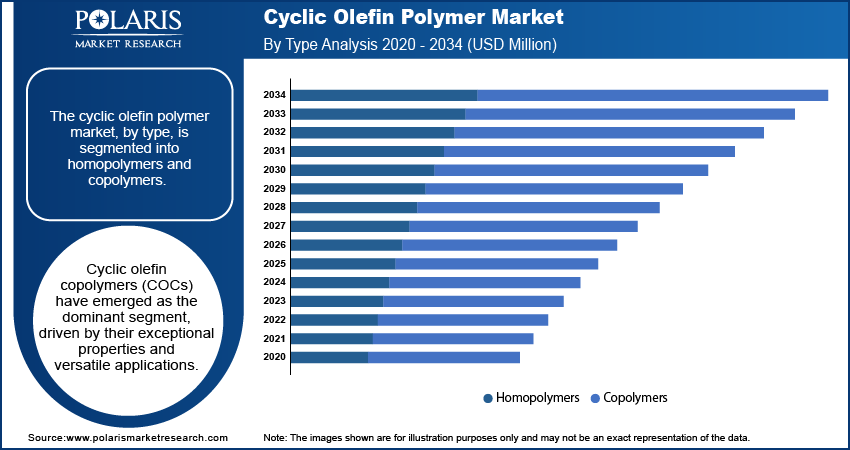

Market Assessment by Type

The cyclic olefin polymers market, by type, is segmented into homopolymers and copolymers. In 2024, the copolymers segment dominated the cyclic olefin polymer market share, driven by their exceptional properties and versatile applications. Cyclic olefin copolymers (COCs) are particularly favored in the packaging industry for their excellent chemical resistance, low moisture absorption, and high optical clarity, which are essential for preserving the integrity and extending the shelf life of sensitive products. The pharmaceutical sector also relies heavily on COCs for medical devices and drug delivery systems due to their biocompatibility and stability under sterilization processes. Additionally, the electronics and optics industries benefit from the superior transparency and dimensional stability of COCs, making them ideal for components such as lenses and display panels. The growing demand across these diverse sectors underscores the significant market share and robust growth trajectory of the copolymer segment.

The homopolymers segment is expected to experience the highest CAGR during the forecast period due to its high purity and thermal stability. Homopolymers are predominantly utilized in applications requiring stringent material performance, such as specific optical components and high-precision medical devices. However, the broader applicability and adaptability of copolymers across multiple high-growth industries have positioned them as the leading segment in the cyclic olefin polymer market. This trend reflects the increasing preference for materials that offer a balanced combination of performance, versatility, and cost-effectiveness in meeting the evolving demands of modern applications.

Market Evaluation by Process Type

The cyclic olefin polymers market, by process type, is segmented into injection molding and extrusion. Injection molding has established itself as the leading process in the market, primarily due to its ability to produce complex and precise components with high efficiency. This method is particularly favored in industries such as healthcare, optics, and electronics, where the demand for intricate and high-quality parts is paramount. The inherent properties of COPs, including low moisture absorption, excellent chemical resistance, and superior optical clarity, make them well-suited for injection molding applications. For instance, in the medical sector, injection-molded COPs are utilized in the production of syringes, vials, and diagnostic devices, ensuring both precision and reliability. Similarly, in the electronics industry, these polymers are employed to manufacture components such as lenses and display panels, benefiting from their dimensional stability and transparency. The versatility and performance advantages offered by injection molding have significantly contributed to its dominant position in the COP market.

The extrusion segment is expected to experience the fastest CAGR over the forecast period due to the increasing demand for high-performance packaging materials in industries such as pharmaceuticals, food, and electronics. Extrusion processes enable the production of thin, transparent, and durable films that offer excellent barrier properties against moisture, gases, and chemicals, making them ideal for sensitive applications. Additionally, advancements in extrusion technologies are enhancing production efficiency and enabling cost-effective manufacturing of COP-based products. The growing adoption of sustainable packaging solutions further drives this segment's growth, as extruded COP materials are recyclable and lightweight, aligning with global environmental regulations and consumer preferences.

Cyclic Olefin Polymer Market Outlook by End-Use Industry

The cyclic olefin polymers market, by end-use industry, is segmented into packaging, automotive, healthcare & medical, food & beverages, and electrical & electronics. The healthcare and medical segment leads the cyclic olefin polymer market share, driven by the material's exceptional properties that align with the stringent requirements of medical applications. COPs offer high purity, biocompatibility, and chemical resistance, making them ideal for pharmaceutical packaging and medical devices. Their use in manufacturing syringes, vials, and diagnostic equipment ensures drug integrity and patient safety. The increasing global demand for advanced healthcare solutions, coupled with the rise in chronic diseases and an aging population, has further propelled the adoption of COPs in this sector. Additionally, COPs' ability to withstand sterilization processes without compromising integrity enhances their suitability for medical environments. According to a 2021 report by the U.S. Food and Drug Administration (FDA), the use of high-performance polymers such as COPs in medical applications has been instrumental in improving device reliability and patient outcomes.

The packaging industry also exhibits significant growth in the COP market, particularly within the pharmaceutical and food sectors. COPs' excellent barrier properties, transparency, and durability make them well-suited for packaging applications that require product protection and extended shelf life. The increasing emphasis on sustainable and high-performance packaging solutions has led to a greater adoption of COP-based materials. Research published in the Journal of Applied Polymer Science in 2021 highlights the advantages of COPs in packaging, noting their contribution to reducing food waste through improved preservation. Furthermore, the European Commission's 2022 report on packaging materials underscores the role of advanced polymers such as COPs in meeting evolving regulatory and consumer demands for safety and sustainability.

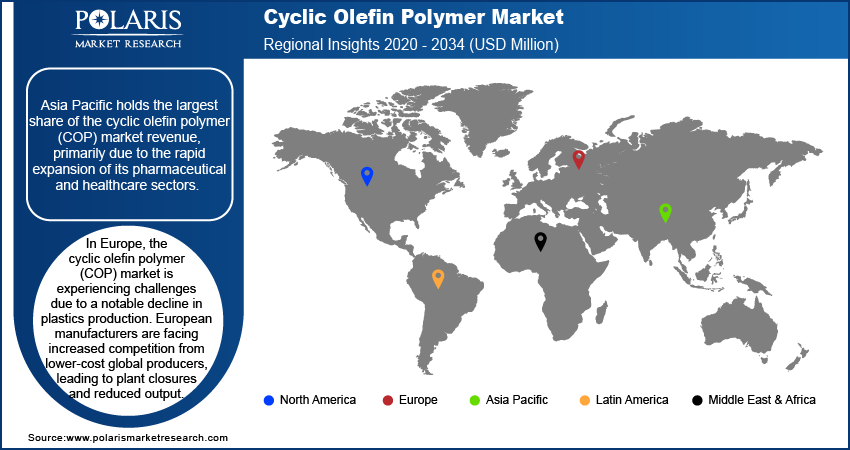

Regional Insights

By region, the study provides cyclic olefin polymer market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific held the largest share of the cyclic olefin polymer market revenue, primarily due to the rapid expansion of its pharmaceutical and healthcare sectors. The increasing demand for high-performance and contamination-free packaging materials in these industries is fueling the adoption of COPs, owing to their superior transparency, excellent chemical resistance, and low extractables. Additionally, the region's thriving electronics and optical industries are amplifying COP consumption, as the material offers exceptional optical clarity, dimensional precision, and advanced molding characteristics, making it ideal for applications such as lenses, display panels, and precision components. With strong manufacturing capabilities, growing R&D investments, and a shift toward high-purity, performance-enhancing polymers, Asia Pacific is expected to remain the largest and fastest-growing regional market for cyclic olefin polymers throughout the forecast period.

According to the COP market statistics, the market in Europe is experiencing challenges due to a notable decline in plastics production. European manufacturers are facing increased competition from lower-cost global producers, leading to plant closures and reduced output. In 2023, European plastic production decreased by 8.3%, contrasting with a global production increase of 3.4%, primarily driven by China and the US. Factors such as stringent climate regulations, high energy prices, and an oversupply of cheaper materials have contributed to this downturn.

Key Players and Competitive Insights

The cyclic olefin polymer (COP) market features several active companies that have not been acquired and continue to operate independently. A few notable participants include Mitsui Chemicals, Inc.; Polyplastics Co., Ltd.; Sumitomo Bakelite Co., Ltd.; JSR Corporation; Borealis AG; Polysciences, Inc.; Biosynth; Tuoxin Technology (Quzhou) Co., Ltd.; Zeon Corporation; China Petrochemical Development Corporation; TOPAS Advanced Polymers GmbH; SABIC; Johnson & Johnson; SK Chemicals; and Daicel Corporation.

These companies are actively engaged in the development, production, and distribution of COP materials, catering to diverse industries such as healthcare, electronics, and packaging. Their commitment to innovation and quality has solidified their positions in the market. For instance, Zeon Corporation has been at the forefront of COP innovation, developing the first commercially accessible crystalline COP, ZEONEX C2420, which offers enhanced heat resistance and chemical resilience. Similarly, Mitsui Chemicals, Inc. offers cyclic olefin copolymer under the brand "APEL," with applications in smartphones, head-mount displays, automotive camera lenses, and medical packages.

In the competitive landscape of the cyclic olefin polymer market, these companies focus on strategic initiatives such as product innovation, material development, strategic partnerships, research collaborations, acquisitions, and global distribution agreements to strengthen their market positions. Their continuous focus on high-performance polymer solutions, application-specific customization, and sustainability-driven advancements is a key driver of competitiveness and long-term growth within the cyclic olefin polymer industry. For example, in June 2024, Zeon Corporation announced plans to establish a new COP production facility in Japan, reinforcing its position in the specialty plastics market. Similarly, in May 2023, Borealis launched Stelora, a new family of engineering polymers produced using an innovative technique that combines polypropylene with cyclic olefin copolymers, creating a high-purity, transparent material ideal for advanced applications.

Mitsui Chemicals, Inc., headquartered in Tokyo, Japan, is a diversified chemical company engaged in the production and sale of a wide range of chemical products, including petrochemicals, performance materials, and functional polymeric materials. The company serves various industries such as automotive, healthcare, packaging, and agriculture. Mitsui Chemicals is recognized for its focus on innovation and sustainability in developing advanced materials and solutions.

Zeon Corporation, also based in Tokyo, Japan, specializes in the manufacture of specialty chemicals, elastomers, and polymers. The company's product portfolio includes synthetic rubbers, specialty resins, and electronic materials. Zeon serves industries such as automotive, electronics, and healthcare, emphasizing research and development to create high-performance materials that meet evolving market needs.

List of Key Companies

- Biosynth

- Borealis AG

- China Petrochemical Development Corporation

- Daicel Corporation

- Mitsui Chemicals, Inc.

- Polysciences, Inc.

- Polyplastics Co., Ltd.

- Saudi Basic Industries Corporation (SABIC)

- SK Chemicals

- Sumitomo Bakelite Co., Ltd.

- TOPAS Advanced Polymers GmbH

- Zeon Corporation

Cyclic Olefin Polymer Industry Developments

- May 2024: Sumitomo Bakelite introduced an additive polymer along with an additive copolymerized cyclo-olefin polymer under the SUMILITERESIN PRZ Series. This product, derived from an aliphatic cyclic main chain, offers key properties such as high transparency, elevated glass transition temperature (Tg), superior rigidity, low dielectric constant, and minimal water absorption.

- May 2023: Borealis AG, in collaboration with TOPAS Advanced Polymers, developed Stelora using an innovative process that combines cyclic olefin copolymers, a new category of clear, high-purity polymers with polypropylene (PP). This method results in an advanced material known as ethylene-propylene-norbornene (EPN), which is highly suitable for a broad range of technically demanding applications, particularly in e-mobility and renewable energy sectors.

Cyclic Olefin Polymer Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Homopolymers

- Copolymers

By Process Type Outlook (Revenue – USD Million, 2020–2034)

- Injection Molding

- Extrusion

- Others

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- Packaging

- Automotive

- Healthcare & Medical

- Food & Beverages

- Electrical & Electronics

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Cyclic Olefin Polymer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,120.87 million |

|

Market Size Value in 2025 |

USD 1,189.81 million |

|

Revenue Forecast by 2034 |

USD 2,079.45 million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The cyclic olefin polymer market has been segmented into detailed segments of type, process type, and end-use industry. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the cyclic olefin polymer market focus on growth and marketing strategies that include product innovation, strategic partnerships, and geographical expansion. Manufacturers invest in research and development to enhance polymer properties, making them suitable for high-performance applications in healthcare, electronics, and packaging. Collaborations with pharmaceutical and medical device companies help expand market reach, while sustainability initiatives, such as recyclable polymer solutions, align with regulatory trends. Additionally, companies leverage digital marketing, trade shows, and direct customer engagement to strengthen brand presence and cater to evolving industry demands.

FAQ's

The cyclic olefin polymer market size was valued at USD 1,120.87 million in 2024 and is projected to grow to USD 2,079.45 million by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period.

North America held the largest share of the market in 2024

The cyclic olefin polymer market features several active companies that have not been acquired and continue to operate independently. A few notable participants include Mitsui Chemicals, Inc.; Polyplastics Co., Ltd.; Sumitomo Bakelite Co., Ltd.; Borealis AG; Polysciences, Inc.; Biosynth; Zeon Corporation; China Petrochemical Development Corporation; TOPAS Advanced Polymers GmbH; SABIC; SK Chemicals; and Daicel Corporation.

The copolymers segment accounted for the larger share of the market in 2024.

Cyclic olefin polymer (COP) is a high-performance thermoplastic polymer derived from cyclic olefins. It is known for its exceptional optical clarity, low birefringence, high chemical resistance, and excellent moisture barrier properties. COP is widely used in industries such as healthcare, electronics, and packaging due to its biocompatibility, dimensional stability, and ability to withstand sterilization processes. Unlike conventional plastics, COP offers superior purity and does not contain additives such as plasticizers, making it suitable for medical devices, pharmaceutical packaging, optical lenses, and electronic components.