Home Infusion Therapy Market Size, Share, Trend, Industry Analysis Report

By Type (Product, Service), By Application (Anti-infective, Endocrinology, Hydration Therapy, Chemotherapy, Enteral Nutrition, Parenteral Nutrition), By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5987

- Base Year: 2024

- Historical Data: 2020-2023

Overview

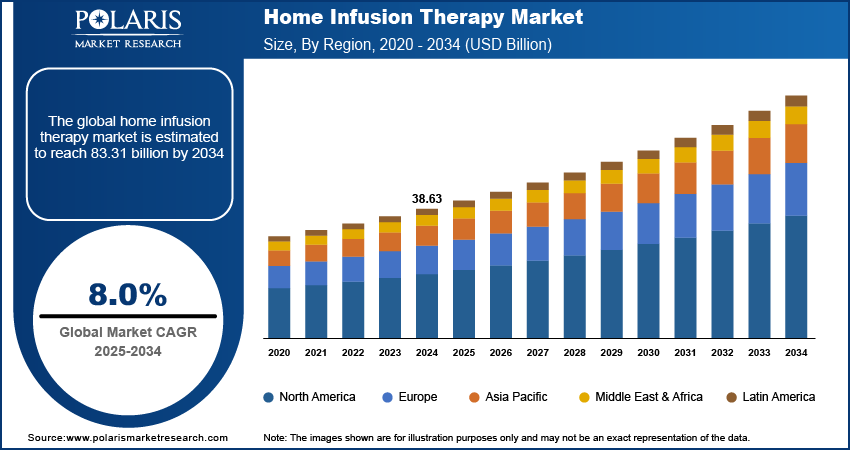

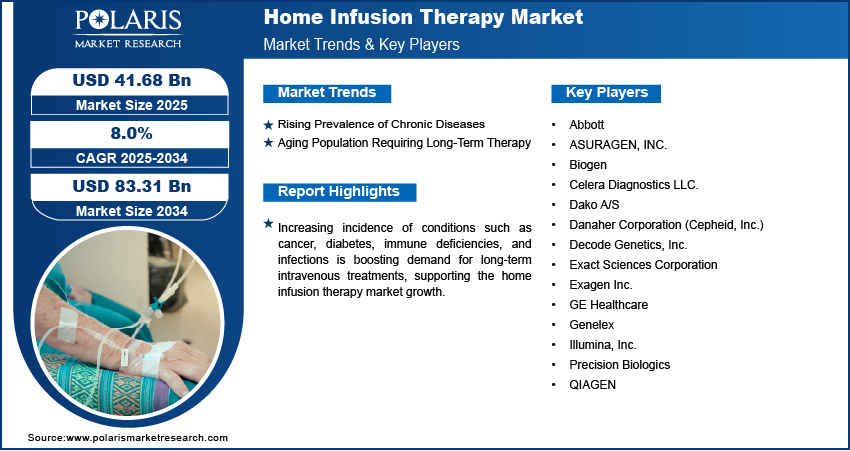

The global home infusion therapy market size was valued at USD 38.63 billion in 2024, growing at a CAGR of 8.0% from 2025 to 2034. Increasing incidence of conditions such as cancer, diabetes, immune deficiencies, and infections is boosting demand for long-term intravenous treatments, supporting demand for home-based infusion services to manage disease progression efficiently outside clinical settings.

Key Insights

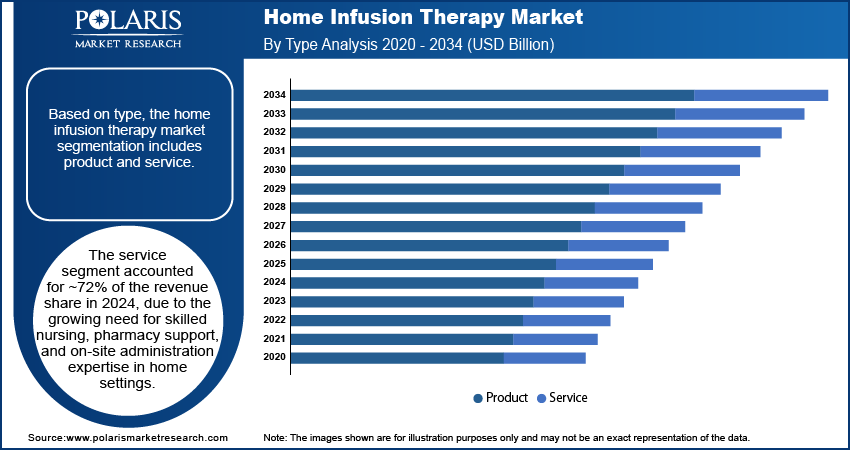

- The service segment accounted for ~72% of the revenue share in 2024.

- The anti-infective segment accounted for the largest revenue share in 2024.

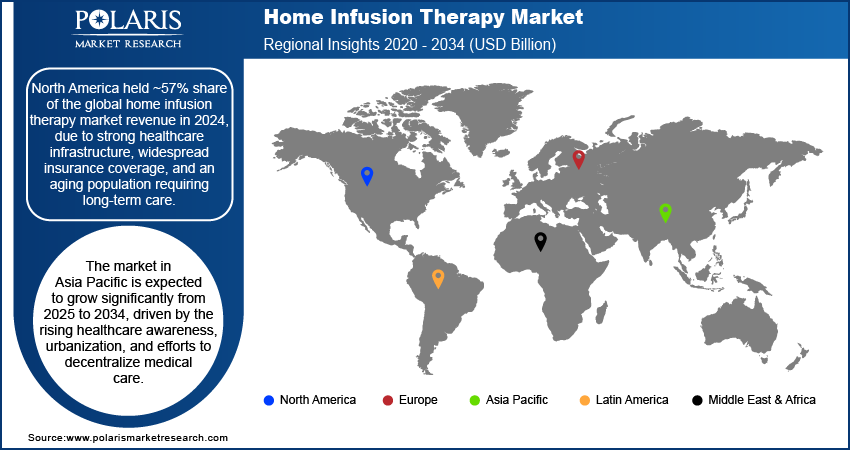

- North America accounted for ~57% share of the global home infusion therapy market revenue in 2024.

- The market in the U.S. is expected to grow during the forecast period, driven by the increasing prevalence of chronic diseases and higher demand for convenient care models.

- The Asia Pacific market is expected to grow significantly from 2025 to 2034 due to rising healthcare awareness, urbanization, and efforts to decentralize medical care.

- The home infusion therapy landscape in Europe is growing significantly due to expanding use of home healthcare in managing long-term conditions and reducing inpatient costs.

Home infusion therapy refers to the provision of intravenous or subcutaneous administration of biologics, medications, nutrients, or fluids in a patient's home. It involves therapies such as antibiotics, chemotherapy, parenteral nutrition, and pain management, delivered through infusion pumps, catheters, and other devices, typically under the supervision of healthcare professionals. This market serves as an alternative to inpatient care, aiming to reduce hospital stays, lower treatment costs, and enhance patient comfort and convenience. Home infusion reduces the need for prolonged hospital stays and in-hospital resources, significantly lowering healthcare costs. Payers and providers are increasingly favoring home-based models to improve economic efficiency without compromising quality of care.

To Understand More About this Research: Request a Free Sample Report

Improved portability, user-friendly interfaces, and automation in infusion pumps, alongside stable formulations of biologics and antibiotics, have made it easier to deliver treatments effectively at home, supporting adoption across therapeutic categories. Moreover, greater emphasis on enhancing patient comfort, autonomy, and outcomes is driving healthcare systems toward decentralized care models, where home infusion fits seamlessly into post-acute and long-term disease management strategies.

Industry Dynamics

- Growing numbers of individuals are being diagnosed with chronic illnesses such as cancer, diabetes, and autoimmune conditions, many of which require regular intravenous therapy over extended periods.

- Older adults are particularly vulnerable to chronic and degenerative diseases that require sustained medical treatment, often through infusion-based therapies.

- Government and private insurance support for home-based services, especially for infusion therapies, is expanding access.

- High costs of infusion equipment, limited reimbursement policies, and a shortage of trained healthcare professionals restrict market growth.

Rising Prevalence of Chronic Diseases: Growing numbers of individuals are being diagnosed with chronic illnesses such as cancer, diabetes, and autoimmune conditions. The World Health Organization projects that the global incidence of cancer will reach over 35 million new cases by 2050, reflecting a substantial increase of 77% compared to the estimated 20 million cases reported in 2022. Patients of these conditions require regular intravenous therapy over extended periods. Home infusion therapy has become a practical solution for these patients, allowing them to receive critical treatments without frequent hospital visits. This approach reduces the burden on healthcare facilities and improves patient adherence and comfort by delivering care in familiar surroundings. Long-term management of infections, immune deficiencies, and other progressive disorders is now more achievable at home through professionally administered infusion services. The demand for home-based care continues to increase as physicians, insurers, and patients recognize the clinical and economic benefits of this model.

Aging Population Requiring Long-Term Therapy: Older people are particularly vulnerable to chronic and degenerative diseases that require sustained medical treatment, often through infusion-based therapies. According to projections by the World Health Organization, by the year 2050, ~80% of the global population aged 65 and above will reside in low- and middle-income countries. Many seniors face mobility challenges, making repeated hospital or clinic visits both difficult and risky. Home infusion therapy offers a more comfortable and safer alternative that aligns with the needs of aging patients. It helps manage conditions such as osteoporosis, cancer, and heart failure while minimizing exposure to infections commonly acquired in healthcare settings. Growing investments in geriatric care models are encouraging providers to expand home-based solutions that improve quality of life. The elderly population’s preference for aging in place further supports the demand for infusion therapy delivered in home environments. Therefore, the rising geriatric population requiring long-term therapies drives the market growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes product and service. The service segment accounted for ~72% of the revenue share in 2024, due to the growing need for skilled nursing, pharmacy support, and on-site administration expertise in home settings. Rising demand for continuous monitoring, dose adjustment, and infusion management at home has made service providers essential in delivering safe and personalized care. Complex therapies such as chemotherapy and specialty drug infusion require professional oversight, contributing to the high dependence on service-based delivery. Home infusion providers are expanding their capabilities to include 24/7 clinical support, remote patient management, and adherence tracking, further reinforcing the segment's prominence.

The product segment is growing due to the increasing adoption of advanced infusion pumps, IV catheters, and portable administration sets designed for home use. Technological improvements have enhanced usability, safety, and automation, allowing patients and caregivers to manage therapies more independently. Rising acceptance of disposable and pre-filled infusion products is also improving convenience while reducing contamination risks. Demand for specialized infusion kits tailored to drug classes, including anti-infectives and biologics, continues to rise. Companies are investing in smart, connected devices that integrate data monitoring features, supporting both clinical outcomes and remote care coordination, driving further growth in this segment.

Application Analysis

In terms of application, the segmentation includes anti-infective, endocrinology, hydration therapy, chemotherapy, enteral nutrition, parenteral nutrition, specialty pharmaceuticals, and others. The anti-infective segment accounted for the largest revenue share in 2024 due to the widespread use of intravenous antibiotics to treat infections such as osteomyelitis, cellulitis, and endocarditis in outpatient settings. Physicians increasingly prescribe long-term antimicrobial therapy at home for patients who require extended treatment durations. Home administration reduces hospitalization time, lowers infection exposure, and supports continuity of care. The rising prevalence of resistant pathogens and the need for targeted IV drug regimens have expanded reliance on home infusion services to manage infectious diseases effectively. Insurance support for outpatient parenteral antimicrobial therapy (OPAT) and clinical guidelines favoring early discharge further supported this segment’s dominance.

The chemotherapy segment is projected to witness the highest CAGR during the forecast period, as oncology care models shift toward home-based delivery to reduce hospital burden and enhance patient quality of life. Oncologists are increasingly recommending home infusion of select chemotherapy drugs, particularly for maintenance and palliative regimens. Demand is rising for portable infusion pumps, remote monitoring, and caregiver training to ensure safe and effective cancer treatment in nonclinical environments. The growing use of targeted biologics and immunotherapies also supports this transition. Favorable reimbursement structures and advancements in oncology infusion protocols are enabling broader adoption of home chemotherapy, driving robust market expansion over the next decade.

Regional Analysis

The North America home infusion therapy market accounted for ~57% of the revenue share in 2024, due to strong healthcare infrastructure, widespread insurance coverage, and an aging population requiring long-term care. Growth is driven by the need to reduce hospital overcrowding and offer more cost-effective treatment models. The increasing preference among physicians for outpatient parenteral antimicrobial therapy (OPAT) and biologics administration at home has resulted in expanded service networks and technology integration. The rise of value-based care frameworks is also incentivizing providers to deliver more efficient and outcome-driven services at home, contributing to the region’s significant share.

U.S. Home Infusion Therapy Market Insight

The market in U.S. is expected to grow during forecast period due to increasing prevalence of chronic diseases and higher demand for convenient care models. A large base of elderly patients, coupled with strong home healthcare support systems, is fueling the use of infusion therapies outside traditional facilities. The adoption of portable infusion devices and real-time patient monitoring devices is streamlining home-based treatment. Government and private payers are also increasingly reimbursing home infusion services, making them more accessible to a broader patient population. According to the Centers for Medicare & Medicaid Services, in June 2024, home infusion therapy services covered under Medicare Part B witnessed a 19% increase in utilization in 2023 compared to the previous year, driven by expanded coverage policies and growing patient preference for home-based care. Rising oncology, immunotherapy, and pain management cases will continue to boost demand over the next decade.

Asia Pacific Home Infusion Therapy Market Trends

The Asia Pacific market is expected to grow significantly from 2025 to 2034, due to rising healthcare awareness, urbanization, and efforts to decentralize medical care. Rising geriatric population and increasing the number of chronic disease patients seeking in-home treatment. Investments in home health startups and telehealth platforms are helping expand access to infusion services beyond metropolitan hospitals. Public and private health systems are exploring cost-effective outpatient care models, leading to a broader policy support for home infusion. Enhanced training of home care professionals and growing availability of affordable infusion products will further contribute to regional market expansion.

China Home Infusion Therapy Market Overview

China accounted for the dominant share in Asia Pacific in 2024, due to rapid healthcare system modernization and growing demand for post-acute and chronic disease management outside hospitals. Rising incidence of cancer, long-term infections, and autoimmune disorders propelled the use of intravenous therapies. Home infusion providers in China are scaling up services in Tier 1 and Tier 2 cities, supported by digital health innovations and remote monitoring tools. The government’s push for healthcare reform has improved coverage for home-based care and increased the availability of clinical-grade devices. Patient preference for in-home treatment due to cost, convenience, and reduced exposure to hospital-acquired infections supports continued growth.

Europe Home Infusion Therapy Market Outlook

The home infusion therapy market in Europe is growing significantly due to expanding use of home healthcare in managing long-term conditions and reducing inpatient costs. Aging populations and healthcare cost containment policies are encouraging payers and providers to shift infusion services to outpatient or home-based models. Clinical guidelines increasingly support home treatment for therapies such as parenteral nutrition, antibiotics, and cancer care. Growth in digital health infrastructure and remote monitoring platforms is improving treatment adherence and outcomes. Favorable reimbursement policies, particularly in countries such as Germany and the UK, are facilitating broader access and provider participation in home infusion programs.

Key Players and Competitive Analysis

The competitive landscape of the home infusion therapy market is characterized by consolidation, innovation, and strategic alliances among key players aiming to expand market presence and optimize service delivery. Industry analysis reveals increasing interest in vertical integration and mergers and acquisitions to streamline supply chains and enhance care coordination. Companies are pursuing expansion strategies through the launch of comprehensive infusion service networks and entry into high-growth regions supported by telehealth infrastructure.

Joint ventures between healthcare providers and infusion service firms are gaining momentum to strengthen regional coverage and offer personalized care solutions. Post-merger integration efforts are focusing on harmonizing data systems, standardizing clinical protocols, and improving patient engagement. Strategic alliances with device manufacturers and digital health startups are enabling access to advanced infusion pumps, remote monitoring technologies, and AI-driven analytics. Emphasis on technology advancements is driving the development of portable, user-friendly infusion systems that enhance treatment compliance and reduce the burden on caregivers. Sustainability and value-based care models are further shaping competition as companies position themselves as cost-effective, outcome-focused partners in chronic disease management.

Key Players

- Amedisys, Inc.

- B. Braun SE

- Baxter

- BD

- CareCentrix, Inc.

- Coram LLC.

- Fresenius Kabi AG

- ICU Medical, Inc.

- JMS Co. Ltd.

- Moog Inc.

- Option Care Health, Inc.

- PharMerica Corporation

- Terumo Corporation

Industry Developments

February 2024: Dynamic Access, LLC launched Dynamic Infusion, which offers home infusion nursing services for patients suffering from chronic conditions such as autoimmune disorders, hemophilia, Crohn's disease, rheumatoid arthritis, and multiple sclerosis.

June 2023: Baxter International introduced the Progressa+ Next Gen ICU bed, designed to meet the complex care needs of patients receiving critical care at home.

Home Infusion Therapy Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Home Infusion Therapy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 38.63 billion |

|

Market Size in 2025 |

USD 41.68 billion |

|

Revenue Forecast by 2034 |

USD 83.31 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 38.63 billion in 2024 and is projected to grow to USD 83.31 billion by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period.

The North America home infusion therapy market accounted for ~57% of the revenue share in 2024, due to strong healthcare infrastructure, widespread insurance coverage, and an aging population requiring long-term care.

A few of the key players in the market are Amedisys, Inc.; B. Braun SE; Baxter; BD; CareCentrix, Inc.; Coram LLC.; Fresenius Kabi AG; ICU Medical, Inc.; JMS Co. Ltd.; Moog Inc.; Option Care Health, Inc.; PharMerica Corporation; and Terumo Corporation.

The service segment accounted for ~72% of the revenue share in 2024 due to the growing need for skilled nursing, pharmacy support, and on-site administration expertise in home settings.

The anti-infective segment accounted for the largest revenue share in 2024 due to the widespread use of intravenous antibiotics to treat infections such as osteomyelitis, cellulitis, and endocarditis in outpatient settings.