Hospital Outsourcing Market Size, Share, Trends, Industry Analysis Report

: By Hospital Size (Small & Medium Hospitals and Large Hospitals), Hospital, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 115

- Format: PDF

- Report ID: PM1777

- Base Year: 2024

- Historical Data: 2020-2023

Hospital Outsourcing Market Overview

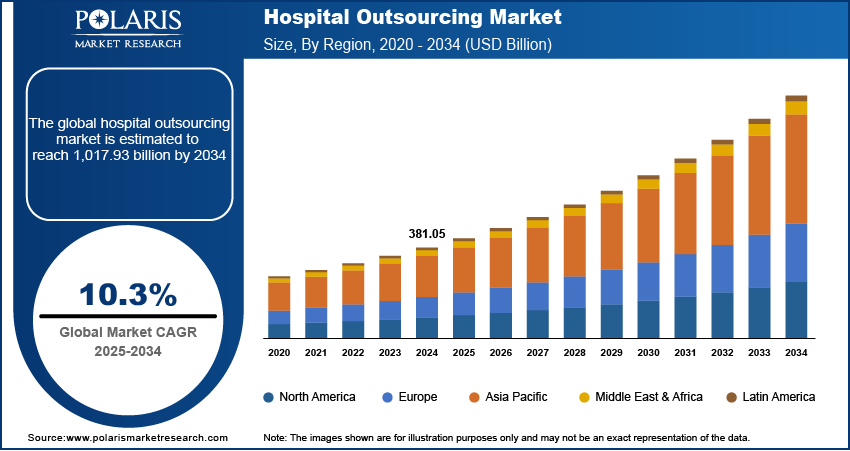

The hospital outsourcing market size was valued at USD 381.05 billion in 2024. The market is projected to grow from USD 419.54 billion in 2025 to USD 1,017.93 billion by 2034, exhibiting a CAGR of 10.3% during 2025–2034.

The hospital outsourcing market refers to the practice of healthcare institutions outsourcing specific services or functions, such as medical billing, IT management, laboratory services, facility management, and staffing, from third-party vendors. This trend is driven by factors such as the need for cost reduction, the demand for specialized expertise, and the increasing complexity of healthcare operations. Hospitals are increasingly outsourcing non-core functions to improve efficiency, reduce administrative burdens, and focus on patient care. Key hospital outsourcing market trends are the growing use of technology to streamline outsourced services and the shift toward value-based care models, which emphasize cost-effectiveness and quality outcomes. The market is also seeing a rise in the outsourcing of healthcare analytics and telemedicine services.

To Understand More About this Research: Request a Free Sample Report

Hospital Outsourcing Market Dynamics

Increased Adoption of Healthcare IT Outsourcing

The adoption of healthcare IT outsourcing is becoming a significant trend as hospitals seek to streamline operations and reduce costs associated with managing complex IT systems. Outsourcing IT functions such as electronic health record (EHR) management, cybersecurity, and cloud services allows healthcare providers to focus on core patient care services. According to a 2023 report by Healthcare IT News, over 70% of hospitals have increased their use of managed IT services in the last five years to ensure better data security and system interoperability. This trend is also driven by the growing need to comply with regulations such as HIPAA (Health Insurance Portability and Accountability Act), which mandates strict security and privacy standards for patient data. Outsourcing IT services provides hospitals with the expertise needed to keep systems secure and efficient, particularly as cyberattacks on healthcare institutions become more frequent. Thus, the increasing adoption of healthcare IT outsourcing boosts the hospital outsourcing market demand.

Shift Toward Outsourcing Noncore Functions

Hospitals are increasingly outsourcing noncore functions such as medical billing, facility management, and human resources to external providers. By delegating these operations, hospitals can reduce overhead costs and reallocate resources to improve patient care and clinical services. A 2022 survey by the American Hospital Association found that 53% of hospitals outsource at least one nonclinical service, with administrative tasks such as billing and payroll accounting for the largest portion of outsourced functions. The main driver behind this trend is the need for operational efficiency, especially owing to the rising healthcare costs and staffing shortages. Outsourcing administrative and non-medical tasks allows hospitals to reduce staff costs, mitigate human error in billing, and ensure compliance with increasingly complex regulations. Hence, the rising shift toward outsourcing noncore functions propels the hospital outsourcing market growth.

Growth in Outsourcing for Telemedicine and Remote Care Services

The expansion of telemedicine and remote care services is a major trend in hospital outsourcing. As healthcare delivery increasingly shifts toward virtual consultations and remote monitoring, hospitals are turning to specialized vendors to provide telehealth platforms, remote patient monitoring systems, and telemedicine staffing. According to a 2024 report by the American Telemedicine Association, nearly 40% of healthcare systems have outsourced some form of telemedicine service in the past two years. This trend has been accelerated by the COVID-19 pandemic and continues to grow as patients seek more convenient healthcare options. Outsourcing these services allows hospitals to scale quickly, improve patient access to care, and manage the technological and regulatory complexities associated with remote health services. Therefore, the growing outsourcing for telemedicine and remote care services fuels the hospital outsourcing market development.

Hospital Outsourcing Market Segment Insights

Hospital Outsourcing Market Outlook – Hospital Size-Based Insights

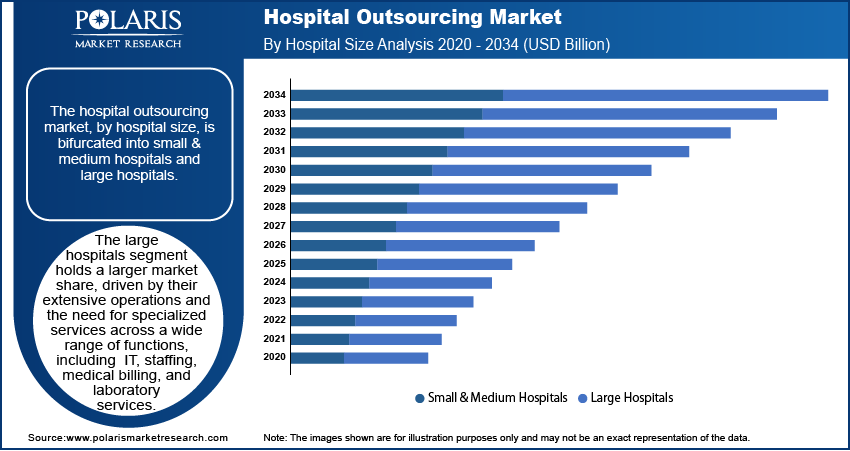

The hospital outsourcing market, by hospital size, is bifurcated into small & medium hospitals and large hospitals. The large hospitals segment holds a larger market share, driven by their extensive operations and the need for specialized services across a wide range of functions, including IT, staffing, medical billing, and laboratory services. These hospitals tend to have more complex administrative needs and higher patient volumes, which makes outsourcing a cost-effective solution to improve operational efficiency and reduce overhead. The demand for outsourcing is particularly high in large hospitals due to their capacity to integrate advanced technologies and large-scale operations, which often require specialized vendors with expertise in managing diverse functions. Additionally, large hospitals often outsource clinical and nonclinical services to improve patient care and ensure compliance with healthcare regulations.

The small & medium hospitals segment is registering the highest growth in outsourcing adoption. These hospitals, often with limited in-house resources, are increasingly turning to outsourcing to manage costs, enhance service quality, and ensure operational continuity. Outsourcing enables smaller hospitals to access specialized services that would otherwise be costly to implement internally. This segment's rapid growth can be attributed to the need for smaller hospitals to remain competitive by adopting efficient, cost-saving models while focusing on core patient care services. Moreover, small and medium-sized hospitals are adopting outsourcing solutions in various areas such as administrative functions, telemedicine, and IT services at a faster pace, which is driving the growth in this segment.

Hospital Outsourcing Market Assessment – Hospital Type-Based Insights

The hospital outsourcing market, by hospital type, is segmented into public hospitals and private hospitals. The private hospitals segment holds a larger market share, primarily due to their ability to invest in advanced technology, specialized services, and comprehensive outsourcing solutions to improve operational efficiency. These hospitals have higher budgets and greater flexibility in adopting outsourcing models to address many noncore functions such as IT management, medical billing, staffing, and telemedicine. The inclination toward outsourcing in private hospitals is driven by the need to maintain high-quality patient care while reducing costs. Moreover, private hospitals often seek innovative, patient-centered services, and outsourcing allows them to access expertise in niche areas, such as telemedicine and healthcare analytics, ensuring they remain competitive in the healthcare industry.

The public hospitals segment, while holding a smaller hospital outsourcing market share than the private hospitals segment, is experiencing a higher growth in outsourcing adoption. This segment is increasingly outsourcing nonclinical services to reduce operational costs and address staffing shortages. With growing pressures to improve service delivery and meet public health requirements amidst budget constraints, public hospitals are looking to external vendors for solutions that provide efficiency and cost savings. As public healthcare systems worldwide face increasing financial challenges, outsourcing becomes an attractive strategy to optimize resources and focus on delivering essential healthcare services. The growth in this segment is also attributed to the need for public hospitals to comply with regulatory demands and improve patient satisfaction without overwhelming internal resources.

Hospital Outsourcing Market Evaluation – End User-Based Insights

The hospital outsourcing market, by end user, is segmented into clinics, nursing homes & assisted living, general medical & surgical hospitals, specialty hospitals, emergency & other outpatient care centers, and others. The general medical and surgical hospitals segment holds the largest market share, largely due to their broad range of services and the high demand for outsourcing across various functions such as medical billing, administrative tasks, IT management, and laboratory services. These hospitals, which cater to a wide spectrum of healthcare needs, benefit significantly from outsourcing to streamline operations, reduce costs, and improve service quality. The complexity and scale of operations in general medical and surgical hospitals make outsourcing an essential strategy to manage overheads, comply with healthcare regulations, and optimize patient care. Additionally, the integration of advanced technology and the growing need for specialized services in these hospitals contribute to the dominance of this segment.

The specialty hospitals segment is experiencing the highest growth in outsourcing adoption, driven by the increasing complexity of care provided and the need for specialized expertise. These hospitals, which focus on specific medical disciplines such as cardiology, oncology, or orthopedics, are increasingly outsourcing specialized services, including diagnostic testing, telemedicine, and administrative functions, to enhance patient care and operational efficiency. The growing demand for high-quality specialized care, coupled with financial constraints, is motivating specialty hospitals to leverage outsourcing solutions to access the latest technologies, reduce operational costs, and improve overall service delivery. This trend is expected to continue during the forecast period as specialty hospitals seek innovative and cost-effective ways to address the unique challenges in their specific healthcare domains.

Hospital Outsourcing Market Regional Insights

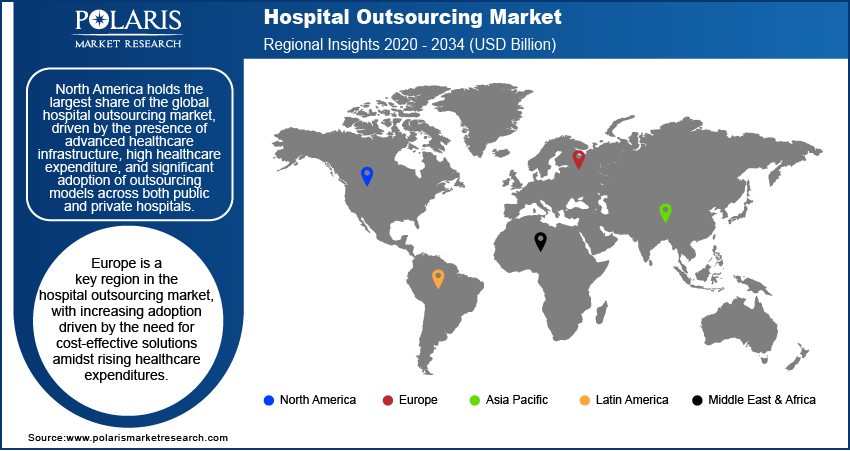

By region, the study provides hospital outsourcing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the hospital outsourcing market revenue, driven by the presence of advanced healthcare infrastructure, high healthcare expenditure, and the significant adoption of outsourcing models across both public and private hospitals. The US, in particular, is a major contributor due to its well-established healthcare system such as medical billing outsourcing, widespread use of technology, and the increasing need for cost optimization and efficiency in healthcare delivery. Factors such as stringent regulatory requirements, the push for value-based care, and the growing complexity of healthcare services have prompted many healthcare providers in the region to outsource noncore functions such as IT management, billing, and staffing. Additionally, the region's mature market for telemedicine and healthcare analytics outsourcing further drives growth. The dominance of North America is also attributed to a high level of investments in healthcare innovation and outsourcing solutions tailored to meet specific operational and regulatory needs.

Europe is a key region in the hospital outsourcing market, with increasing adoption driven by the need for cost-effective solutions amidst rising healthcare expenditures. The region’s healthcare systems are diverse, with countries such as the UK, Germany, and France leading in outsourcing adoption, particularly for noncore services, including administrative tasks, IT management, and medical billing. The push for efficiency, regulatory compliance, and the growing demand for specialized healthcare services are key drivers. Moreover, the trend toward digitalization in healthcare and a rising focus on telemedicine and remote care are boosting outsourcing opportunities. However, public healthcare funding constraints in many European nations are also pushing hospitals to adopt outsourcing models to reduce operational costs.

The Asia Pacific hospital outsourcing market is experiencing rapid growth, driven by the region's expanding healthcare infrastructure, increasing healthcare demands, and rising investments in technology. Countries such as India, China, Japan, and Australia are witnessing a surge in outsourcing, especially in medical billing, IT services, and telemedicine. The demand for cost-effective healthcare services in emerging markets is particularly strong, with hospitals outsourcing noncore functions to reduce overhead costs and improve service quality. Additionally, the growing prevalence of chronic diseases and an aging population in developed markets such as Japan and Australia are driving the need for specialized healthcare outsourcing services. The region's large population, combined with the increasing adoption of healthcare outsourcing, positions it for substantial market growth.

Hospital Outsourcing Market – Key Players and Competitive Insights

Key players in the hospital outsourcing market include companies such as Accenture, Cerner Corporation, Conduent Inc., Dell Technologies, IBM, HCL Technologies, and Cognizant Technology Solutions. These companies offer a wide range of outsourcing services across IT management, administrative functions, medical billing, and telemedicine solutions. Other important players, including Tata Consultancy Services (TCS), Infosys, Wipro, and Genpact, provide IT outsourcing and business process outsourcing solutions tailored for healthcare providers. Additionally, companies such as Medtronic, Siemens Healthineers, and Philips Healthcare play a significant role in offering specialized outsourcing solutions for medical equipment maintenance and healthcare analytics. These companies are known for their ability to integrate technology with healthcare operations, helping hospitals improve efficiency and reduce operational costs.

Competitive dynamics in the hospital outsourcing market are influenced by a combination of technological expertise, cost-effectiveness, and the ability to offer specialized solutions that cater to the unique needs of healthcare providers. Players in this market are leveraging technology to offer digital solutions such as cloud-based platforms, data analytics, and telemedicine services. Companies such as Cerner and IBM focus on providing healthcare-specific IT solutions, whereas others such as Accenture and Cognizant emphasize a broader range of outsourcing services, from business processes to back-office operations. As hospitals continue to adapt to the challenges of healthcare management, there is a growing demand for vendors who can provide a combination of IT services, regulatory compliance support, and specialized healthcare solutions.

One key area of competition is the ability to scale solutions effectively to meet the varying needs of small clinics and large hospitals. Companies such as Dell Technologies and IBM are well-positioned to provide large-scale, secure IT systems for hospitals. In contrast, smaller players such as Conduent and Genpact focus on more niche services, such as administrative outsourcing or telemedicine solutions. The growing trend toward value-based care models and regulatory changes is also prompting companies to differentiate themselves by offering compliance-focused outsourcing solutions. As the market evolves, partnerships and collaborations between healthcare providers and outsourcing companies are becoming more common, allowing for greater innovation and the development of tailored solutions to meet the needs of diverse healthcare settings.

Accenture is a global company that provides consulting, technology, and outsourcing services to various industries, including healthcare. The company offers a wide range of services to hospitals, such as IT management, data analytics, and digital transformation solutions. Accenture helps healthcare providers improve operational efficiency and patient care by providing solutions for noncore activities such as medical billing and administrative tasks.

Cerner Corporation specializes in health information technology solutions, particularly electronic health records (EHR), which are critical for hospitals and healthcare providers. The company offers outsourcing services related to IT infrastructure, data management, and healthcare analytics, enabling hospitals to focus on improving patient care.

Key Companies in Hospital Outsourcing Market

- Accenture

- Cerner Corporation

- Conduent Inc.

- Dell Technologies

- IBM

- HCL Technologies

- Cognizant Technology Solutions

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Genpact

- Medtronic

- Siemens Healthineers

- Philips Healthcare

- Oracle (after acquiring Cerner Corporation)

Hospital Outsourcing Industry Developments

- September 2024: Flatworld Solutions announced the establishment of a new office in Ahmedabad, India. By utilizing the city's talent pool for mobile and eCommerce development, the company aims to improve its service delivery capabilities and meet customer demands.

- In August 2024, Accenture announced a four-year global partnership with UNICEF’s Generation Unlimited (GenU), aimed at enhancing data security and patient privacy, helping the organization navigate complex regulatory frameworks.

- In June 2024, Oracle acquired Cerner, combining Cerner's healthcare expertise with Oracle's cloud and database capabilities. The acquisition is expected to strengthen Oracle's position in healthcare IT, allowing it to offer a broader range of services to hospitals and healthcare institutions globally.

- October 2023: Omega Healthcare unveiled its newest product, the Omega Digital Platform (ODP), which aims to improve financial performance and streamline administrative tasks for healthcare organizations.

Hospital Outsourcing Market Segmentation

By Hospital Size Outlook

- Small & Medium Hospitals

- Large Hospitals

By Hospital Type Outlook

- Public Hospitals

- Private Hospitals

By Hospital End User Outlook

- Clinics

- Nursing Homes & Assisted Living

- General Medical & Surgical Hospitals

- Specialty Hospitals

- Emergency & Other Outpatient Care Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hospital Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 381.05 billion |

|

Market Size Value in 2025 |

USD 419.54 billion |

|

Revenue Forecast by 2034 |

USD 1,017.93 billion |

|

CAGR |

10.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The hospital outsourcing market has been broadly segmented on the basis of hospital size, hospital type, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The hospital outsourcing market growth strategy focuses on expanding service offerings and enhancing technological capabilities to meet the evolving needs of healthcare providers. Companies are increasingly investing in cloud-based solutions, data analytics, and AI-driven tools to improve operational efficiency and patient outcomes. Strategic partnerships and collaborations with hospitals, along with the integration of telemedicine and remote monitoring services, are also key to market expansion. Additionally, players are targeting emerging markets in Asia Pacific and Latin America, where there is a growing demand for cost-effective healthcare outsourcing solutions. Focused marketing efforts highlight the benefits of outsourcing in terms of cost reduction, regulatory compliance, and access to specialized expertise.

FAQ's

? The market size was valued at USD 381.05 billion in 2024 and is projected to grow to USD 1,017.93 billion by 2034.

? The market is projected to register a CAGR of 10.3% during 2025–2034.

? North America held the largest share of the market.

? A few key players in the hospital outsourcing market are Accenture, Cerner Corporation, Conduent Inc., Dell Technologies, IBM, HCL Technologies, and Cognizant Technology Solutions. These companies offer a wide range of outsourcing services across IT management, administrative functions, medical billing, and telemedicine solutions.

? The large hospital segment accounted for a larger share of the market in 2024.

? The private hospital segment accounted for a larger share of the market in 2024.

? Hospital outsourcing refers to the practice of healthcare institutions contracting third-party service providers to manage certain noncore functions or specialized services. These outsourced functions include a few administrative tasks such as medical billing, human resources, IT management, and customer support, as well as clinical services such as laboratory testing, telemedicine, and radiology. By outsourcing these services, hospitals can reduce operational costs, improve efficiency, access specialized expertise, and allow internal resources to focus more on patient care and core healthcare services. This model is increasingly adopted as hospitals aim to streamline operations and address staffing or resource challenges.

? A few key trends in the hospital outsourcing market are described below: Increased Adoption of Healthcare IT Outsourcing: Hospitals are outsourcing IT functions such as electronic health record management, cybersecurity, and cloud services to improve data security and system efficiency. Shift Toward Outsourcing Noncore Functions: Growing adoption of outsourcing administrative tasks such as billing, payroll, and human resources to reduce operational costs and increase focus on patient care. Growth in Telemedicine and Remote Care Outsourcing: Rising demand for telemedicine services is driving outsourcing for platforms, telehealth staffing, and remote patient monitoring. Focus on Data Analytics and AI: Hospitals are outsourcing data analytics and AI services to improve decision-making, patient outcomes, and operational efficiencies.

? A new company entering the hospital outsourcing market must focus on offering specialized services that address the growing demand for technology-driven solutions, such as IT management, data analytics, and telemedicine. Emphasizing cloud-based platforms, cybersecurity, and AI tools for improving patient care and operational efficiency would appeal to hospitals looking to modernize their systems. Additionally, focusing on regulatory compliance services and providing customizable outsourcing solutions for smaller hospitals and clinics can create a competitive edge. Establishing strong partnerships with healthcare providers and ensuring scalable, cost-effective solutions will be key to standing out in this evolving market.

? Companies manufacturing, distributing, or purchasing hospital outsourcing and related products, and other consulting firms must buy the report.