HVDC Capacitor Market Size, Share, Trends, & Industry Analysis Report

By Type (DC-Link Capacitors, Snubber Capacitors, Coupling Capacitors), By Technology, By Installation Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5802

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

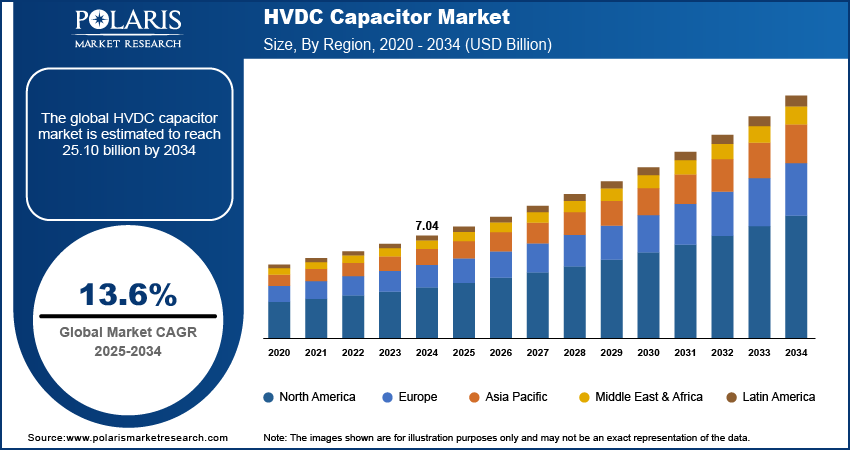

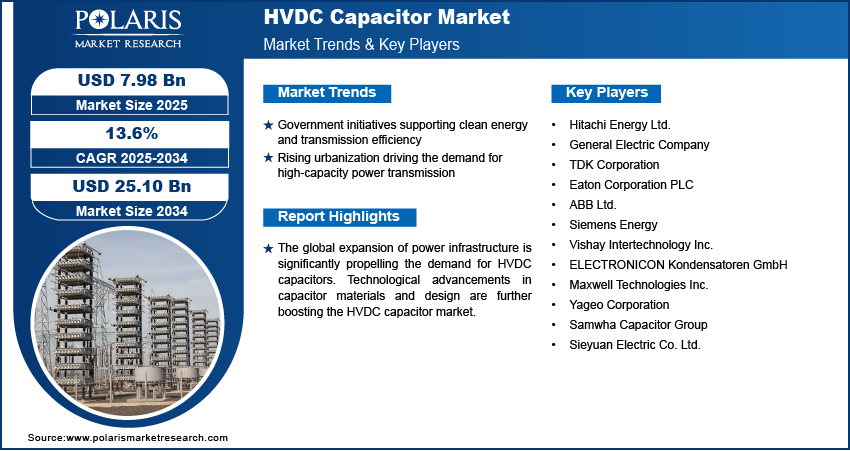

The global HVDC capacitor market size was valued at USD 7.04 billion in 2024, growing at a CAGR of 13.6% during 2025–2034. Government initiatives supporting clean energy and transmission efficiency are encouraging HVDC Capacitor adoption. Rising urbanization driving the demand for high-capacity power transmission is further expanding HVDC Capacitor’s demand.

High-voltage direct current (HVDC) capacitors are advanced electrical components designed to store and release energy in HVDC transmission systems, which are used for efficient long-distance power transmission. These capacitors are crucial in stabilizing voltage levels, reducing power losses, and ensuring reliable operation in high-voltage environments. HVDC capacitors help manage the reactive power in HVDC systems, enabling smoother voltage regulation and supporting overall system stability. Typically built with specialized dielectric materials, these capacitors are engineered to withstand extreme electrical stresses and operate reliably under high-voltage conditions, making them essential for modern power infrastructure. HVDC capacitors are available in various configurations such as film capacitors, ceramic capacitors, and electrolytic capacitors, and are designed to handle a range of power frequencies and voltage ratings.

HVDC capacitors are widely deployed in large-scale transmission projects, offshore wind farms, interregional grid interconnections, and urban substations. Their demand is particularly high in long-distance and cross-border transmission systems, where alternating current (AC) systems become inefficient due to higher energy losses. HVDC capacitors support the shift from centralized power generation to distributed and renewable energy systems by improving grid flexibility and stability.

To Understand More About this Research: Request a Free Sample Report

The global expansion of power infrastructure is significantly propelling the demand for HVDC capacitors. According to the International Energy Agency (IEA), global energy investment surpassed USD 3 trillion for the first time in 2024, with over USD 2 trillion dedicated to clean energy technologies and infrastructure. This surge in investment reflects the rising development of solar farms, offshore wind projects, and interregional transmission corridors that requires robust HVDC infrastructure and, by extension, high-performance capacitors. The need for high-voltage direct current (HVDC) transmission systems is rapidly growing due to the rising transition toward low-emission energy systems and modernization of aging electrical grids. HVDC capacitors provides efficient long-distance electricity transmission, stabilizing voltage levels, and supporting reactive power management.

Technological advancements in capacitor materials and design are further boosting the HVDC capacitor market. Innovations in dielectric materials such as polypropylene films, ceramic composites, and advanced polymers are enhancing capacitor reliability, thermal performance, and voltage endurance. These improvements are critical in HVDC environments, where systems must operate continuously under high electrical stress. The development of compact and modular capacitor designs is also enabling easier integration into constrained spaces such as offshore converter stations and urban substations.

Market Overview

The global HVDC capacitor market size was valued at USD 7.04 billion in 2024, growing at a CAGR of 13.6% during 2025–2034. Government initiatives supporting clean energy and transmission efficiency are encouraging HVDC Capacitor adoption. Rising urbanization driving the demand for high-capacity power transmission is further expanding HVDC Capacitor’s demand.

High-voltage direct current (HVDC) capacitors are advanced electrical components designed to store and release energy in HVDC transmission systems, which are used for efficient long-distance power transmission. These capacitors are crucial in stabilizing voltage levels, reducing power losses, and ensuring reliable operation in high-voltage environments. HVDC capacitors help manage the reactive power in HVDC systems, enabling smoother voltage regulation and supporting overall system stability. Typically built with specialized dielectric materials, these capacitors are engineered to withstand extreme electrical stresses and operate reliably under high-voltage conditions, making them essential for modern power infrastructure. HVDC capacitors are available in various configurations such as film capacitors, ceramic capacitors, and electrolytic capacitors, and are designed to handle a range of power frequencies and voltage ratings.

HVDC capacitors are widely deployed in large-scale transmission projects, offshore wind farms, interregional grid interconnections, and urban substations. Their demand is particularly high in long-distance and cross-border transmission systems, where alternating current (AC) systems become inefficient due to higher energy losses. HVDC capacitors support the shift from centralized power generation to distributed and renewable energy systems by improving grid flexibility and stability.

The global expansion of power infrastructure is significantly propelling the demand for HVDC capacitors. According to the International Energy Agency (IEA), global energy investment surpassed USD 3 trillion for the first time in 2024, with over USD 2 trillion dedicated to clean energy technologies and infrastructure. This surge in investment reflects the rising development of solar farms, offshore wind projects, and interregional transmission corridors that requires robust HVDC infrastructure and, by extension, high-performance capacitors. The need for high-voltage direct current (HVDC) transmission systems is rapidly growing due to the rising transition toward low-emission energy systems and modernization of aging electrical grids. HVDC capacitors provides efficient long-distance electricity transmission, stabilizing voltage levels, and supporting reactive power management.

Technological advancements in capacitor materials and design are further boosting the HVDC capacitor market. Innovations in dielectric materials such as polypropylene films, ceramic composites, and advanced polymers are enhancing capacitor reliability, thermal performance, and voltage endurance. These improvements are critical in HVDC environments, where systems must operate continuously under high electrical stress. The development of compact and modular capacitor designs is also enabling easier integration into constrained spaces such as offshore converter stations and urban substations.

Industry Dynamics

Government Initiatives Supporting Clean Energy and Transmission Efficiency

Rising government initiatives aimed at accelerating the shift towards clean energy and improving grid efficiency are significantly driving the HVDC capacitors market. According to the International Energy Agency (IEA), governments across the globe invested nearly USD 2 trillion in direct investment support for clean energy initiatives since 2020, with approximately 80% of this investment concentrated in China, the European Union, and the US. These investments highlight a global consensus on upgrading power transmission frameworks, particularly through HVDC deployment. These regulatory and financial commitments are encouraging utilities and grid operators to transition from traditional AC transmission to HVDC systems. Thus, the demand for high-performance capacitors are significantly increasing that ensure system efficiency, safety, and reliability across transmission corridors.

High-voltage direct current (HVDC) technology is favored for its efficiency in transmitting electricity over long distances with minimal power loss, making it an essential element of modern grid architecture. HVDC capacitors are integral to these systems, providing voltage stabilization, reactive power support, and system reliability.

Rising Urbanization Driving the Demand for High-Capacity Power Transmission

The rapid pace of global urbanization is increasing pressure on existing power infrastructure, pushing utilities to adopt high-capacity, uninterrupted electricity transmission technologies such as HVDC. Supported by advanced capacitor solutions HVDC systems, are essential for delivering reliable power over long distances to densely populated urban areas where energy consumption is intensifying. According to a report by the United Nations, global urbanization is projected to add approximately 2.5 billion people to urban areas by 2050, driven by ongoing migration from rural regions and natural population growth in cities. This demographic shift is increasing the demand for reliable electricity, specifically for residential, industrial, and transportation applications. Growing cities are increasing the need for stable power supply and lower transmission losses, pushing urban planners and utility providers to focus on more efficient energy systems. HVDC capacitors play a crucial role in supporting voltage regulation, system protection, and harmonic filtering within HVDC transmission networks.

Energy infrastructure developers are increasingly integrating HVDC technologies with advanced capacitors to accommodate growing loads and ensure resilient, future-ready urban grids. Therefore, the continuous expansion of urban areas worldwide is further propelling the growth of the HVDC capacitor market.

Segmental Insights

By Type Analysis

The global segmentation, based on type, includes plastic film capacitor, aluminum electrolytic capacitor, ceramic capacitor, tantalum wet capacitor, reconstituted mica paper capacitor, glass capacitor, and others The plastic film capacitor segment dominated the market in 2024. This is attributed to the increased investment in grid modernization initiatives across major economies and rising demand for energy-efficient transmission solutions. Manufacturers are increasingly innovating in film capacitor design to cater to advanced HVDC applications. Companies are focusing on improved metallization techniques and encapsulation processes to increase voltage stability and reduce capacitor failure rates in demanding environments. Therefore, the plastic film capacitor segment continues to attract utilities and equipment manufacturers aiming for enhanced grid reliability and system performance. For instance, in May 2025, Panasonic introduced its ECW‑FJ Automotive Plastic Film Capacitors via Mouser, featuring rated voltages of 800 V and 1100 V, capacitance ranging up to several microfarads, and an operating temperature from 40 °C to +110 °C with AEC‑Q200 qualification.

The aluminum electrolytic capacitor segment is projected to grow at a robust pace in the coming years, fueled by the rapid expansion of renewable energy installations and electric vehicle (EV) infrastructure, that requires robust DC power management. Aluminum electrolytic capacitors are undergoing continuous innovation, with advancements in electrolyte composition, anode foil etching, and miniaturization, resulting in improved performance, durability, and thermal stability. For instance, in September 2024, KEMET launched the new C44P-T Aluminum Can Power Film Capacitors at Mouser, rated 550–850 VAC with up to 220,000 hours lifetime.

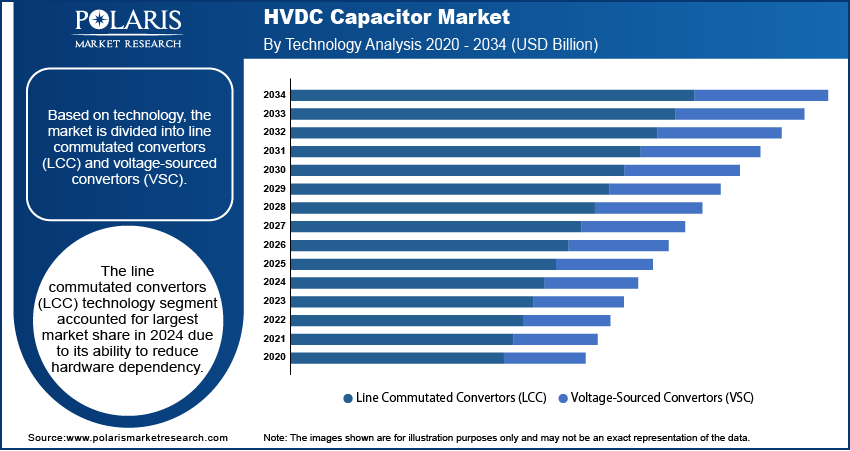

By Technology Analysis

The global segmentation, based on technology, includes line commutated convertors (LCC) and voltage-sourced convertors (VSC) The line commutated convertors (LCC) technology segment accounted for largest market share in 2024 due to its ability to reduce hardware dependency. This growth is due to the growing demand for large-scale cross-border transmission projects, particularly in countries such as China, India, and Brazil, is fueling the dominance of LCC in the global market. LCC-based HVDC systems rely on thyristor-based rectifiers and inverters, and their strong track record in transmitting power over thousands of kilometers makes them the preferred choice for utility operators worldwide. Additionally, manufacturers are enhancing converter station design to reduce footprint and improve fault tolerance, further strengthening the market potential. For instance, in May 2024, Hitachi Energy was selected by Marinus Link Pty Ltd to supply its HVDC Light voltage-source converter technology for the 345 km Marinus Link interconnector between mainland Victoria and Tasmania. It involved advanced converter station design at both ends, enabling two-way renewable energy flow with low electrical losses and compact infrastructure

The voltage-sourced converters (VSC) segment is projected to grow at a significant pace during the assessment phase, driven by the rising number of offshore wind farms, distributed generation projects, and urban substations. According to the US Department of Energy, global offshore wind deployments in 2023 added 6,326 MW of new capacity, marking the fourth-largest annual addition on record. By year-end, total installed capacity had reached 68,258 MW across 319 operational projects, comprising over 13,096 active offshore wind turbines. VSC-based HVDC systems use IGBT-based switching and can independently control both active and reactive power, providing better dynamic performance and easier integration with smart grid infrastructure. Furthermore, rising technological advancements in semiconductors and control systems are enhancing the efficiency and reliability of VSCs.

By Installation Type Analysis

The global segmentation, based on installation type, includes open rack capacitor banks, enclosed rack capacitor banks, and pole mounted capacitor banks. The open rack capacitor banks segment is expected to grow during the forecast period due to the growing investment in power infrastructure in developing economies, such as China and India, is increasing the deployment of outdoor capacitor banks in long-distance HVDC transmission networks. The robust design allows open rack capacitors to handle high voltage stress and withstand environmental conditions such as temperature fluctuations and dust exposure. For instance, China's State Grid announced to invest a record-breaking USD 88.7 billion in the nation's power grid in 2025. Rising demand for reliable, large-capacity capacitor systems is emphasizing the importance of open rack capacitor banks in modern power transmission infrastructure.

The enclosed rack capacitor banks segment is projected to witness the fastest growth during the forecast period. The rise in offshore energy projects and urban substations requiring secure and noise-reduced capacitor solutions is propelling the demand for enclosed rack configurations. According to the International Energy Agency, offshore electricity generation is projected to grow at twice the pace of onshore sources and is expected to contribute around 4% of global power generation by 2040. Additionally, advancements in enclosure materials, modular designs, and thermal management systems are enhancing the performance and scalability of enclosed capacitor banks.

By Application Analysis

The global segmentation, based on application, includes commercial, industrial, energy & power, defense, and others. The energy & power segment is projected to grow at a highest CAGR during the forecast period due to the increasing global shift toward renewable energy generation, expansion of HVDC transmission lines, and ongoing efforts to modernize aging power grids. The increasing investment by countries in cross-border electricity trade and large-scale grid integration of wind, solar, and hydropower, is driving the need for high-performance capacitor systems. For instance, the rapid development of inter-regional HVDC projects in China and Europe is fueling the adoption of HVDC capacitors across energy utilities. Capacitors in this segment are important for voltage regulation, harmonic filtering, and reactive power compensation, which are essential for maintaining system reliability during high-voltage operations.

The industrial segment is projected to grow at a robust pace during the forecast period, driven by the rapid electrification of heavy industries, rising energy demands, and the need for uninterrupted power supply in manufacturing hubs. HVDC systems are increasingly being adopted in large-scale industrial facilities such as mining operations, steel manufacturing plants, petrochemical refineries, and data centers each requiring stable, high-capacity power delivery to maintain operations. Technological advancements in compact capacitor designs and automation-compatible systems are also enabling smoother integration into industrial power networks, accelerating adoption in this segment. For instance, in June 2025, Panasonic launched the new ZVU Series hybrid aluminum capacitors, delivering high ripple current (3.3–4.6 A rms) and low ESR in compact case sizes (56–560 µF), rated up to 135 °C and AEC‑Q200 certified.

Regional Analysis

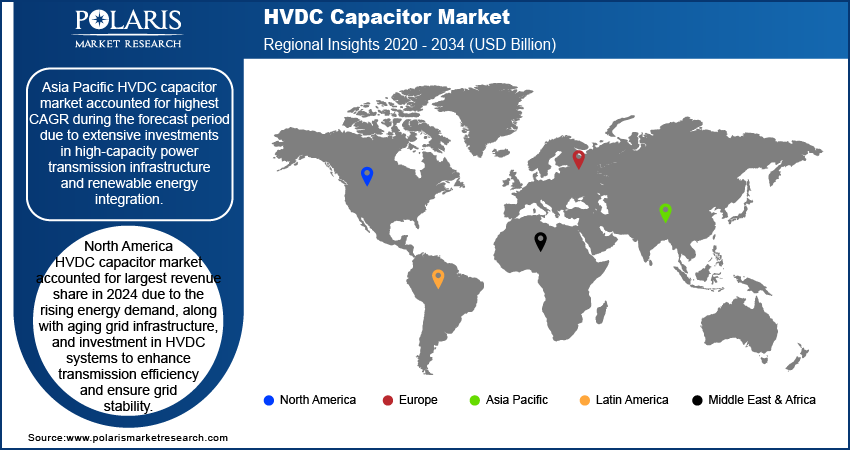

Asia Pacific HVDC capacitor market accounted for highest CAGR during the forecast period due to extensive investments in high-capacity power transmission infrastructure and renewable energy integration. Countries such as China and India are heavily investing in HVDC transmission lines to overcome geographic challenges and ensure efficient energy delivery across vast and diverse terrains. Also, the rise in clean energy initiatives and grid modernization efforts across Asia Pacific is further boosting the demand HVDC capacitors.

China HVDC Capacitor Market Insight

China, in particular, dominated the regional market, capturing regional market share. This dominance is attributed to the government’s strong emphasis on developing long-distance transmission networks connecting renewable-rich western regions with high-demand eastern cities. Under the China Power System Transformation initiative, the International Energy Agency estimates that by 2035, China estimated to reduce its annual power system operational costs by 15%, equivalent to USD 63 billion, while also cutting power sector CO₂ emissions by up to 750 million tonnes each year. Additionally, initiatives such as the Belt and Road Initiative (BRI) are driving demand for power infrastructure across partner countries, with Chinese companies exporting HVDC technology and equipment including capacitors globally. The strategic focus on reducing carbon emissions and improving power quality is sustaining long-term demand for HVDC capacitors within the nation.

Europe HVDC Capacitor Market

The Europe HVDC capacitor market is projected to grow substantially. This growth is driven by the region’s aggressive decarbonization targets, expansion of cross-border electricity trade, and investments in renewable energy integration. Countries such as Germany, the UK, and the Netherlands are leading HVDC adoption due to increasing need to stabilize power supply from intermittent renewable sources such as offshore wind. As of 2024, Germany continues to implement HVDC projects such as SuedLink and SuedOstLink, which require large-scale capacitor deployment for voltage regulation and harmonic filtering. Moreover, regulatory frameworks such as the EU Green Deal and Trans-European Networks for Energy (TEN-E) are promoting transnational HVDC grid development, thereby increasing demand for HVDC capacitors.

European manufacturers are also investing in R&D to develop advanced capacitor technologies, including high-temperature resistant materials and compact modular designs. These innovations support the growing need for efficient and space-saving solutions in urban and offshore installations. Europe’s focus on energy security and the decentralization of power supply is creating new opportunities for capacitor banks in HVDC converter stations across the region.

North America HVDC Capacitor Market Overview

North America HVDC capacitor market accounted for largest revenue share in 2024. The rising energy demand, along with aging grid infrastructure, is driving utilities across North America to invest in HVDC systems to enhance transmission efficiency and ensure grid stability. HVDC capacitors enhance voltage control, reduce transmission losses, and support grid reliability. Supportive government policies and incentives promoting clean energy and smart grid development are further fueling the adoption of HVDC technology across the region. Furthermore, initiatives from agencies such as the US Department of Energy to fund grid modernization projects, increased the demand for advanced components such as HVDC capacitors. For instance, the Bipartisan Infrastructure Law, passed in 2021, allocated a total of USD 973 billion through fiscal year 2026 to strengthen the nation’s infrastructure, with a significant focus on upgrading the power grid and integrating renewable energy sources. The US target of achieving net-zero emissions by 2050 is expected to boost significant growth in HVDC systems and their associated components.

Key Players & Competitive Analysis Report

The HVDC capacitor industry is highly competitive, marked by strong rivalry among leading players actively focusing on expanding their product portfolios, enhancing manufacturing capacities, and engaging in strategic collaborations, partnerships, and mergers and acquisitions (M&A) to solidify their market positions. These companies are continually investing in research and development to create innovative capacitor technologies that withstand higher voltage levels, offer better thermal performance, and enhance overall smart grid stability. The market is also witnessing increased investment in automation, smart manufacturing, and digitalization to improve operational efficiency and meet the growing global demand for HVDC systems.

Prominent companies in the HVDC Capacitor Market include Hitachi Energy Ltd., General Electric Company, TDK Corporation, Eaton Corporation PLC, ABB Ltd., Siemens Energy, Vishay Intertechnology Inc., ELECTRONICON Kondensatoren GmbH, Maxwell Technologies Inc., Yageo Corporation, Samwha Capacitor Group, and Sieyuan Electric Co. Ltd.

Key Players

- Hitachi Energy Ltd.

- General Electric Company

- TDK Corporation

- Eaton Corporation PLC

- ABB Ltd.

- Siemens Energy

- Vishay Intertechnology Inc.

- ELECTRONICON Kondensatoren GmbH

- Maxwell Technologies Inc.

- Yageo Corporation

- Samwha Capacitor Group

- Sieyuan Electric Co. Ltd.

Industry Developments

December 2024: The US Department of Energy (DOE) allocated USD 8 billion for R&D projects centered on high-voltage direct current power circuit breakers.

June 2025: Cosel launched new line of rugged HVDC converters engineered for use in demanding industrial and transportation environments. These converters are optimized for high voltage, durability, and performance under harsh conditions.

April 2025: Hitachi Energy, in partnership with BHEL, was selected by Adani Energy Solutions to design and deliver a 950 km, 6 GW ±800 kV bi-pole HVDC transmission system from Bhadla (Rajasthan) to Fatehpur (Uttar Pradesh), India.

November 2022: Vishay Intertechnology launched the VJ…W1HV series of surface-mount multilayer ceramic capacitors (MLCCs), offering ratings up to 3 kV with stable C0G and X7R dielectrics. These capacitors are ideal for filtering and snubber circuits in HVDC systems and come in compact 1206–2225 case sizes.

HVDC Capacitor Market Segmentation

By Type (Revenue, USD Billion, 2020–2034)

- Plastic Film Capacitor

- Aluminum Electrolytic capacitor

- Ceramic Capacitor

- Tantalum Wet Capacitor

- Reconstituted Mica Paper Capacitor

- Glass Capacitor

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Line Commutated Convertors (LCC)

- Voltage-sourced Convertors (VSC)

By Installation Type Outlook (Revenue, USD Billion, 2020–2034)

- Open Rack Capacitor Banks

- Enclosed Rack Capacitor Banks

- Pole Mounted Capacitor Banks

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Industrial

- Energy & Power

- Defense

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

HVDC Capacitor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.04 Billion |

|

Market Size in 2025 |

USD 7.98 Billion |

|

Revenue Forecast by 2034 |

USD 25.10 Billion |

|

CAGR |

13.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.04 billion in 2024 and is projected to grow to USD 25.10 billion by 2034.

The global market is projected to register a CAGR of 13.6% during the forecast period.

Asia-Pacific dominated the market share in 2024.

A few of the key players in the market are Hitachi Energy Ltd., General Electric Company, TDK Corporation, Eaton Corporation PLC, and ABB Ltd.

The line commutated convertors (LCC) technology segment accounted for largest market share in 2024.

The enclosed rack capacitor banks segment is projected to witness the fastest growth during the forecast period.