Hydrogen Aircraft Market Size, Share, Trends, Industry Analysis Report

: By Power Source (Hydrogen Combustion and Hydrogen Fuel Cell), Technology, Range, Passenger Capacity, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM5617

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

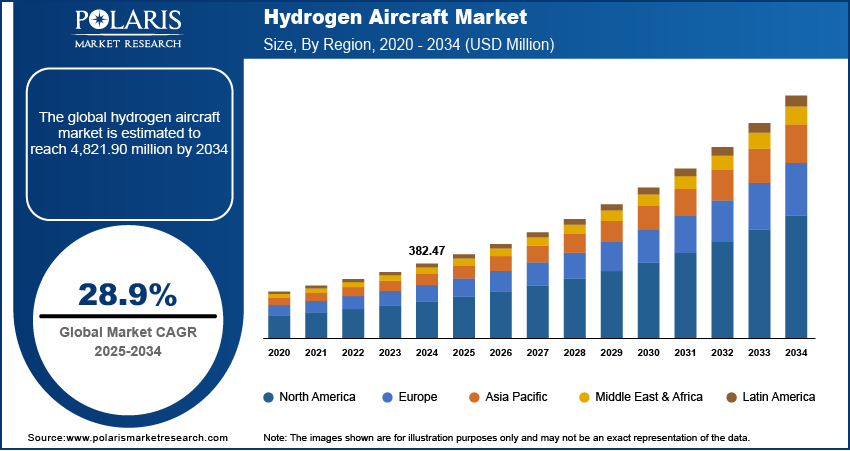

The hydrogen aircraft market size was valued at USD 382.47 million in 2024, exhibiting a CAGR of 28.9% during 2025–2034. Rising emission regulations, increasing jet fuel prices, growing air travel demand, and expanding hydrogen infrastructure collectively drive the growth of the market.

Key Insights

- The hydrogen fuel cell segment is expected to grow faster due to cleaner, quieter, and more efficient electricity generation onboard aircraft.

- The commercial application segment is growing rapidly with rising passenger numbers and stricter environmental regulations pushing cleaner air travel.

- North America leads the market with strong government support, aerospace investments, and established aviation infrastructure.

- Asia Pacific shows robust growth driven by rapid economic expansion, increased air travel, and strong investments in hydrogen infrastructure.

Industry Dynamics

- Strict emission regulations globally push airlines to adopt hydrogen aircraft for compliance and environmental benefits, fueling market growth.

- Rising jet fuel prices make hydrogen-powered aviation cost-effective, attracting airlines to switch for long-term fuel savings.

- Investment in hydrogen infrastructure, including fueling stations and green hydrogen hubs, supports wider adoption of hydrogen aircraft.

- Developing green hydrogen production facilities offers a sustainable fuel supply for hydrogen aircraft, enhancing market development.

- High costs and technical challenges in hydrogen storage and aircraft design limit immediate large-scale market adoption.

Market Statistics

2024 Market Size: USD 382.47 million

2034 Projected Market Size: USD 4,821.90 million

CAGR (2025–2034): 28.9%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A hydrogen aircraft uses hydrogen as its primary fuel source, either by burning it in a jet engine or converting it into electricity using fuel cells. This technology enables zero-emission flight, making it a promising solution for sustainable aviation.

Governments around the world are pushing for cleaner skies by imposing stringent emission regulations for the aviation industry. According to the European Union, all airlines operating in Europe, both European and non-European, are required under the EU ETS to monitor, report, and verify their emissions and to surrender allowances corresponding to those emissions. Hydrogen aircraft offer a zero-emission aircraft solution, helping airlines meet these new standards. There is growing pressure on airlines to adopt sustainable aircraft technology as countries work toward net-zero goals. Hydrogen, as an alternative aviation fuel, can replace polluting jet fuel, dramatically reducing carbon and nitrogen oxide emissions. This makes hydrogen-powered aviation a key component in the global shift to a clean-energy aviation future, thereby driving the hydrogen aircraft market growth.

Establishing the necessary infrastructure is essential for hydrogen aircraft to become mainstream. Airports and energy providers are investing in hydrogen fueling stations and cryogenic hydrogen storage systems to support these aircraft. Governments are further funding the development of green hydrogen hubs through initiatives, ensuring a steady supply of clean energy aviation fuel. For instance, in 2023, the Indian government approved the National Green Hydrogen Mission with an outlay of USD 2.41 billion. This rise in global interest in hydrogen as an alternative aviation fuel is fueling this expansion of hydrogen infrastructure, which, in turn, is expected to boost the hydrogen aircraft market demand during the forecast period.

Market Dynamics

Rising Jet Fuel Prices

Traditional jet fuel prices are becoming increasingly volatile and expensive due to global geopolitical conflicts, limited oil supplies, and environmental taxes. According to the spatial organization of transportation and mobility, jet fuel prices rose from USD 1 per gallon to USD 4 per gallon from April 2020 to April 2022. Consequently, airlines are looking at alternative aviation fuels such as hydrogen, which offer more price stability in the long term. Hydrogen-powered aviation becomes an attractive option not just for its environmental benefits but also for cost savings. Switching to sustainable aircraft technology powered by hydrogen helps airlines cut operational costs as fuel prices rise, thereby driving the hydrogen aircraft market expansion.

Increasing Air Travel

Air travel is growing worldwide, especially in developing countries and emerging economies. According to the IATA, total air traffic in 2023, measured in revenue passenger kilometers (RPKs), increased by 36.9% compared to 2022. There is a higher demand for sustainable aircraft technology to minimize the environmental impact of aviation with more flights. Hydrogen aircraft offer a scalable solution that aligns with this growth. Airlines can meet increasing demand while keeping emissions low using zero-emission aircraft. Governments and airlines are seeking green aviation solutions that handle more traffic without harming the environment as passenger numbers surge, thereby driving the hydrogen aircraft market development.

Segment Analysis

Market Assessment by Power Source Outlook

The market segmentation, based on power source, includes hydrogen combustion and hydrogen fuel cell. The hydrogen fuel cell segment is expected to record a higher CAGR during the forecast period as fuel cells offer a clean, efficient way to generate electricity onboard without harmful emissions. Compared to hydrogen combustion engines, fuel cells are quieter, more energy-efficient, and better suited for smaller regional aircraft. Fuel cell systems are becoming the preferred choice for sustainable aviation as technology improves and battery limitations become more evident, thereby driving the segmental growth.

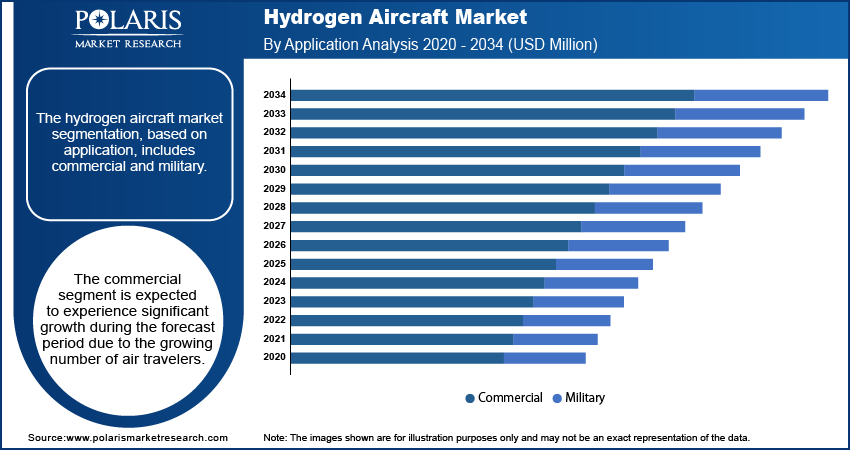

Market Evaluation by Application Outlook

The hydrogen aircraft market segmentation, based on application, includes commercial and military & defense. The commercial segment is expected to experience significant growth during the forecast period due to the rising focus on reducing emissions and achieving long-term sustainability targets, prompting a shift toward hydrogen-powered aircraft. The demand for cleaner, more efficient air travel continues to grow due to rising passenger numbers and stricter environmental regulations. Hydrogen fuel cell and combustion technologies present a compelling path to zero-emission operations, making them well-suited for short and medium-haul commercial routes. This transition is attracting strong market interest and driving substantial investments in the commercial aircraft sector, thereby driving the segmental growth.

Regional Analysis

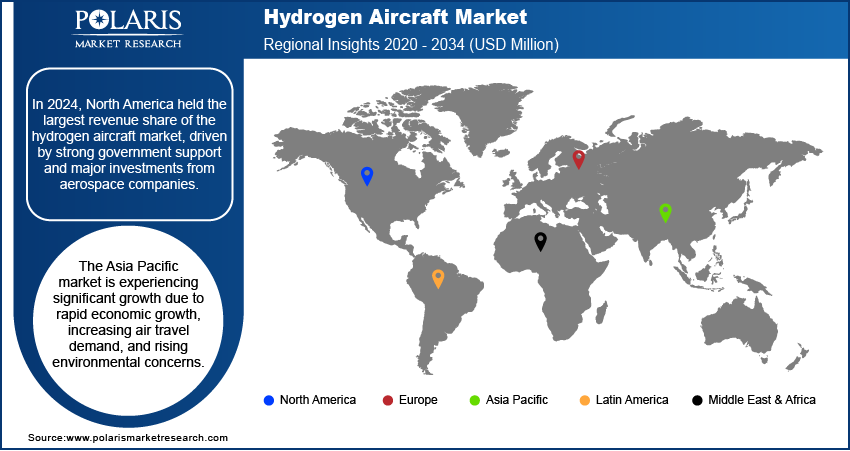

By region, the study provides the hydrogen aircraft market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share driven by strong government support and major investments from aerospace companies. The US has been actively funding clean aviation initiatives through programs such as NASA’s Sustainable Flight Demonstrator and the Department of Energy’s hydrogen strategies. Major players such as Boeing and ZeroAvia are investing heavily in hydrogen propulsion technologies. Additionally, the presence of a mature aviation infrastructure, a strong innovation ecosystem, and increasing pressure to reduce carbon emissions is driving the growth of the hydrogen aircraft market expansion in North America.

The Asia Pacific market is experiencing significant growth due to rapid economic growth, increasing air travel demand, and rising environmental concerns. Countries such as China, Japan, South Korea, and Australia are investing in green hydrogen production and exploring its use in aviation. Japan and South Korea, in particular, are leading hydrogen technology and infrastructure development. The growing aviation sector, coupled with regional efforts to cut carbon emissions, is further driving the hydrogen aircraft market demand in Asia Pacific.

The growing market in India is driven by government initiatives such as the National Green Hydrogen Mission to position the country as a global hub for hydrogen production and innovation. Rising domestic air travel demand and a strong focus on renewable energy solutions are driving interest in the hydrogen aviation sector. Indian aviation companies and research institutions are beginning to explore partnerships for hydrogen aircraft R&D. India is expected to record significant growth during the forecast period as infrastructure and policy support grow in the country.

Key Players & Competitive Analysis Report

The market is experiencing a significant paradigm shift, propelled by a diverse range of companies committed to innovation and differentiation. Established global players are securing a major portion of the market through robust investments in R&D and the integration of advanced technologies. These industry frontrunners are engaging in strategic activities such as mergers and acquisitions, partnerships, and joint ventures to boost their product lines and penetrate emerging sectors.

A wave of emerging startups is making notable advancements by developing innovative solutions designed to address specific niche market requirements. The heightened competition within the sector is further driven by continuous improvements in product performance and operational functionalities, fundamentally altering the landscape of hydrogen aircraft development and deployment. A few major players in the market are Aerodelft, Aerovironment Inc, Airbus SE, Alaka’i Technologies, Boeing, Fokker Next Gen, GKN Aerospace, H2FLY, Pipistrel D.O.O, and ZeroAvia Inc.

The Boeing Company, founded in 1916, is an American multinational corporation headquartered in Arlington, Virginia. It is one of the largest aerospace manufacturers worldwide, operating in the design, production, and sale of a wide range of aerospace products, including commercial airplanes, military aircraft, rotorcraft, rockets, satellites, and missiles. Boeing operates through three main divisions, which include Boeing Commercial Airplanes (BCA), Boeing Defense, Space & Security (BDS), and Boeing Global Services (BGS). The BCA division focuses on the production of commercial jetliners, with key models including the 737, 767, 777, and 787 families. This division has delivered over 10,000 aircraft globally. BDS is responsible for military aircraft and space systems, offering products such as the KC-46 with the aerial aircraft refueling system and the AH-64 Apache helicopter. This division serves both military and commercial sectors with a diverse portfolio that incorporates advanced technologies. BGS provides aftermarket support services for both commercial and defense customers. This division plays a critical role in maintaining and upgrading various aircraft types. Boeing's operations span more than 150 countries, supported by a global supplier network that facilitates economic engagement and operational capabilities. Boeing's hydrogen segment focuses on sustainable aviation, featuring hydrogen-powered aircraft and fuel cell technologies. Key projects include the Phantom Eye UAV and ecoDemonstrator, advancing renewable energy use, emissions reduction, and cryogenic fuel storage for future aerospace applications.

Airbus is a designer, manufacturer, and service provider of aeronautics, space, and others, with a comprehensive range of passenger airliners. The company also provides tankers, combat, transport, and mission aircraft in the Europe region. Further, Airbus offers civil and military rotorcraft solutions worldwide for helicopters. As of 2023, Airbus employs over 130,000 people across multiple locations in Europe, the Americas, and Asia and operates in the fields of commercial and military aircraft, helicopters, satellites, and defense systems. The company's product portfolio includes some of the world's most popular and advanced aircraft, such as the A320neo family of single-aisle aircraft, the A350 XWB wide-body aircraft, and the A330neo long-haul aircraft. In recent years, Airbus has been focused on developing sustainable aviation technologies, with a goal to reduce its carbon footprint and contribute to a more environmentally responsible industry. The company is also investing in new areas such as electric and hybrid-electric propulsion systems, autonomous systems, and urban air mobility. Airbus provides ZEROe, a hydrogen-powered, fully electric aircraft featuring four propellers driven by hydrogen fuel cells, offering near-zero emissions and aiming to revolutionize aviation sustainability by 2035.

List of Key Companies

- Aerodelft

- Aerovironment Inc

- Airbus SE

- Alaka’i Technologies

- Boeing

- Fokker Next Gen

- GKN Aerospace

- H2FLY

- Pipistrel D.O.O

- ZeroAvia Inc.

Hydrogen Aircraft Industry Developments

In March 2025, at the 2025 Airbus Summit, a revised ZEROe roadmap and hydrogen-powered aircraft concept were unveiled, showcasing advancements in fuel-cell technology aimed at enabling future zero-emission commercial aviation.

In March 2025, the world’s first hydrogen-powered VTOL aviation ecosystem was launched through a quadripartite MoU signed by BPCL, BluJ Aerospace, ANERT, and Cochin International Airport.

In April 2024, ZeroAvia’s electric and hydrogen aviation components offering was launched, and a new Propulsion Center-of-Excellence was opened in Everett, WA, to support advanced clean aviation manufacturing and R&D efforts.

Hydrogen Aircraft Market Segmentation

By Power Source Outlook (Revenue USD Million, 2020–2034)

- Hydrogen Combustion

- Hydrogen Fuel Cell

By Technology Outlook (Revenue USD Million, 2020–2034)

- Fully Hydrogen-Powered Aircraft

- Hybrid Electric Aircraft

By Range Outlook (Revenue USD Million, 2020–2034)

- Up to 1000 km

- 1000 km to 2000 km

- Over 2000 km

By Passenger Capacity (Revenue USD Million, 2020–2034)

- Up to 4 Passengers

- 5 to 10 Passengers

- More than 10 Passengers

By Application Outlook (Revenue USD Million, 2020–2034)

- Commercial

- Military & Defense

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Aircraft Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 382.47 million |

|

Market Size Value in 2025 |

USD 490.42 million |

|

Revenue Forecast by 2034 |

USD 4,821.90 million |

|

CAGR |

28.9% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 382.47 million in 2024 and is projected to grow to USD 4,821.90 million by 2034.

The global market is projected to register a CAGR of 28.9% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Aerodelft, Aerovironment Inc, Airbus SE, Alaka’i Technologies, Boeing, Fokker Next Gen, GKN Aerospace, H2FLY, Pipistrel D.O.O, and ZeroAvia Inc.

The hydrogen fuel cell segment is expected to record a higher CAGR during the forecast period as fuel cells offer a clean, efficient way to generate electricity onboard without harmful emissions.

The commercial segment is expected to experience significant growth during the forecast period due to the growing number of air travelers.