Hydrogen Generation Market Share, Size, Trends & Industry Analysis Report

By Technology (Coal Gasification, Steam Methane Reforming and Others); By Application; By System; By Source; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM1963

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

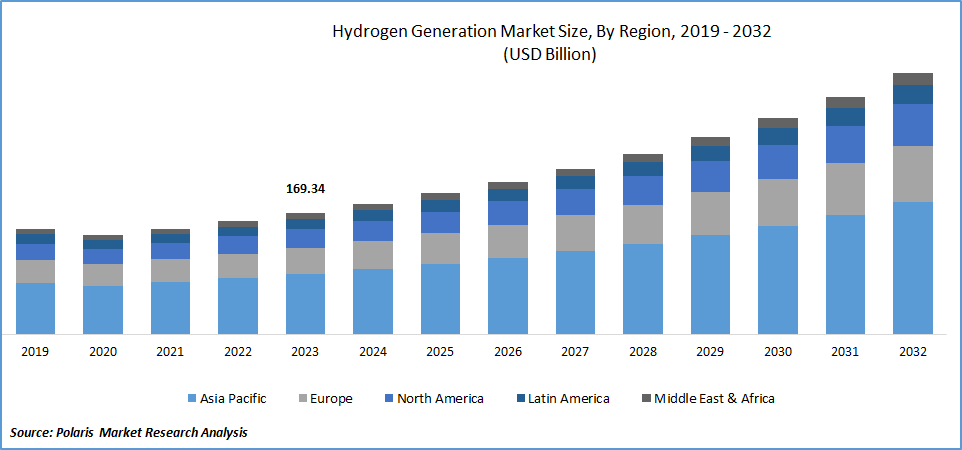

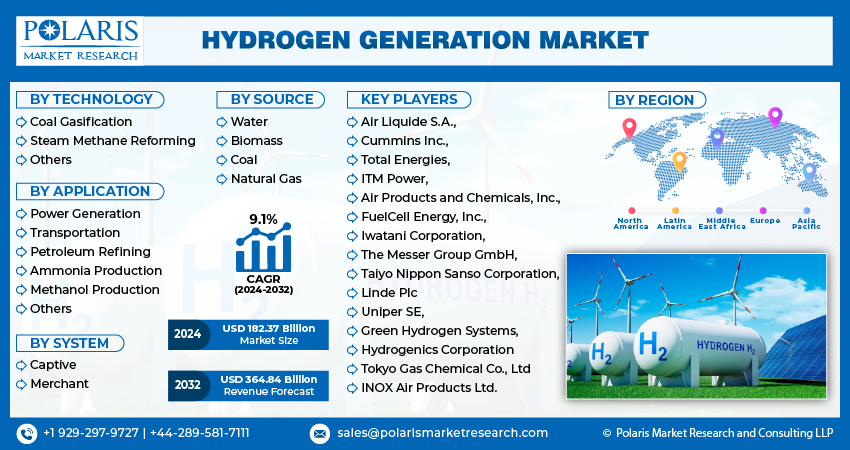

The global Hydrogen Generation Market was valued at USD 182.7 billion in 2024 and is anticipated to grow at a CAGR of 9.20% from 2025 to 2034. Increasing focus on clean energy alternatives and decarbonization initiatives is propelling market expansion.

Key Insights

- The steam methane reforming segment is expected to be led by technology during the forecast period, favored for its cost-effectiveness and established infrastructure.

- The ammonia production segment held the largest market share in 2024, driven by growing fertilizer demand and industrial applications.

- The merchant generation segment generated significant revenue in 2024, supported by increasing third-party hydrogen supply contracts and expanding initiatives in the hydrogen economy.

- In 2024, the Asia Pacific region dominated the market, contributing over 48% of the share, driven by rapid industrialization and high demand for ammonia and hydrogen production.

Industry Dynamics

- The growing demand for clean energy and increasing use of hydrogen in the transportation and industrial sectors are driving market growth.

- Government policies and investments supporting hydrogen infrastructure and green hydrogen production further accelerate adoption.

- High production costs and a lack of widespread infrastructure limit market expansion.

- Advancements in electrolysis technology and the integration of renewable energy offer significant growth opportunities for sustainable hydrogen generation.

Market Statistics

- 2024 Market Size: USD 182.7 billion

- 2034 Projected Market Size: USD 438.9 billion

- CAGR (2025-2034): 9.20%

- Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

The deployment of the generation systems is being driven by the increasing requirement to lower carbon emissions from refining activities. Throughout the long-term period, the implementation of different incentive schemes aimed at limiting the sulfur content of motor oil, diesel fuel, and gasoline would serve to promote growth in the generation industry further. Highly efficient energy carriers, such as hydrogen, are anticipated to continue to expand into previously untapped markets. Throughout the projected period, it is expected that the worldwide demand for energy will increase by almost two-thirds of its current level.

For instance, in January 2024, TotalEnergies and Air Liquide announced the launch of TEAL mobility, a combined venture to form the leader in the distribution of hydrogen in Europe for heavy-duty vehicles.

New-age projects related to distributed energy and its usage are expected to boost the market growth. The market for hydrogen gas includes the on-site generation hydrogen system, a growing preference for advanced innovations, an increase in the usage of hydrogen amongst multiple industries, and the formation of green production technologies.

The United States is one of the world's pioneers in the use of sustainable energy solutions in industries like manufacturing, transportation, and power generation. In December 2006, the Department of Transportation (DOT) and the Department of Energy (DOE) in the United States unveiled the Hydrogen Posture Plan. Enhancing research and development (R&D) and validating technologies that can be used to set up hydrogen infrastructure were the goals of this initiative. Deliverables established by the federal government were included in this plan to aid in the nation's infrastructure development for hydrogen. It was created in accordance with the National Hydrogen Energy Roadmap and Vision. One of the main goals that government agencies have set for themselves is the development and installation of energy-efficient and reasonably priced hydrogen stations around the nation. It is anticipated that all of these causes will increase US demand for hydrogen generation.

What are the Market Drivers Driving the Demand for Hydrogen Generation Market?

Rising Industrialization and Development of Infrastructure is Driving the Demand for Hydrogen Generation Market

The increasing urban and industrial expansion is propelling the countries to adopt various power generation methods to fulfill the demand. Additionally, rapidly increasing development activities and increasing population throughout regions such as the Middle East, Africa, and Asia Pacific. Rising concern regarding sustainable energy consumption for reducing the dependency on traditional fossil fuels such as natural gas & crude oil has an important role in the worldwide market. Such kind of multiple factors are driving the demand for the hydrogen generation market.

Focusing Shift on Sustainable Energy is Boosting the Market Expansion

The market for hydrogen generation is dominated by a shift in emphasis toward cleaner energy sources and by rules that are advantageous to the industry. The worldwide energy problem has sparked interest in sustainable conservation efforts and research and development into alternate energy sources. The area of sustainability in energy generation is broad and involves several actions that must be adopted in the early phases due to the significant potential effects they may have on the environment and on business. Such reasons are driving the demand for the hydrogen generation market.

The last twenty years have seen a surge in the study of clean fuels and the desulfurization of petroleum products, which has stimulated environmental catalysis research worldwide. Air pollution levels, as defined by U.S. EPA laws that now regulate the manufacture and distribution of gasoline and diesel fuels, have significantly increased when compared to statistical data.

Which Factor is Restraining the Demand for Hydrogen Generation?

The Expensive Storage Tanks can Limit the Growth for Hydrogen Generation Market

Nowadays, tanks are the most popular place to store hydrogen for stationary and small-scale mobile applications, either as a gas or a liquid. Transporting and storing hydrogen requires the use of cooling and compression equipment. The storage tanks used to store hydrogen must have low temperatures, a non-reactive medium, and fast, reversible hydrogen adsorption/desorption that doesn't require heat energy. These specialized storage tanks are very expensive, which is the major restraint to the market and for its expansion. However, when hydrogen molecules are needed, the ammonia that has been stored as hydrogen must be broken down using thermal energy. From now on, the modified tanks' hydrogen storage comes at a high cost. Aside from this, the primary technological impediment to the advancement and broad use of fuel cell technology in fixed, mobile, and transportation applications is hydrogen storage. This is, therefore, anticipated to further limit market expansion in the upcoming years.

Report Segmentation

The market is primarily segmented based on technology, application, system, source, and region.

|

By Technology |

By Application |

By System |

By Source |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Technology Insights

Based on technology analysis, the market is segmented on the basis of coal gasification, steam methane reforming, and others. The steam methane segment is dominant in the hydrogen generation market. Due to its advanced innovation in the process of hydrogen generation. Since steam methane reformers are the most cost-effective means of producing hydrogen, the growing global need for hydrogen generation is a major driving force behind the technology breakthrough. Operational advantages like the steam methane reforming process's high conversion efficiency are further growth-promoting elements. Throughout the projected period, the steam methane reforming segment is anticipated to continue leading.

Coal gasification technology is anticipated to expand rapidly over the forecast period. For two centuries, hydrogen has been produced from coal using a process known as coal gasification. It is also recognized as a tried-and-true method of producing hydrogen, similar to steam methane reforming. The United States has a vast domestic coal resource. It is anticipated that using coal to produce hydrogen for the transportation sector will help America become less reliant on foreign petroleum supplies.

By Application Insights

Based on application type analysis, the market has been segmented on the basis of power generation, transportation, petroleum refining, ammonia production, methanol production, and others. Ammonia production is a dominant application in the context of the hydrogen generation market. Carbon-free fuel, energy storage, and hydrogen carrier are the potentials of ammonia, which shows the opportunity for renewable hydrogen innovations that can be practiced on a large scale. At ammonia facilities, hydrogen is usually produced on-site using a feedstock of fossil fuels. Demands for hydrogen-based power generation are rising since it is a dependable and reasonably priced source of energy. In developed areas where clean and efficient energy is a top priority, like North America and Europe, hydrogen-based power production technology has established a strong foothold.

By System Insights

Based on system analysis, the market has been segmented into captive and merchant generation systems. Of these two types of generation systems, the merchant generation system accounts for the significant revenue share of the market due to its feature of production being done at a central facility and later being delivered and sold to the consumer by pipeline.

Regional Insights

Asia Pacific

The Asia Pacific region dominated the global market with the largest market share in 2024 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to huge investments in research and development activities for creating eco-friendly solutions. This is booming the growth of the market in the Asia Pacific region. Also, the countries in respective regions have multiple refineries, which play an essential role in the process of hydrogen generation. Additionally, a few governments from some countries present in this region are focusing on the concept of clean and green technologies for the hydrogen generation market.

North America

North America is anticipated to grow rapidly over the forecast period. The region is experiencing huge growth due to the presence of giant solution-provider corporations such as Air Products, Chemicals, and Air Liquide. The production of blue hydrogen is done on a large scale in the region. Also, the chemical companies and oil refining industry are creating demand for the hydrogen driving the overall market.

Competitive Landscape

The market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Air Liquide S.A.,

- Cummins Inc.,

- Total Energies,

- ITM Power,

- Air Products and Chemicals, Inc.,

- FuelCell Energy, Inc.,

- Iwatani Corporation,

- The Messer Group GmbH,

- Taiyo Nippon Sanso Corporation,

- Linde Plc

- Uniper SE,

- Green Hydrogen Systems,

- Hydrogenics Corporation

- Tokyo Gas Chemical Co., Ltd

- INOX Air Products Ltd.

Recent Developments

- May 2025: Hitachi Energy revealed the successful demonstration of its new energy supply system, HyFlex. The company stated that the new system is based on zero-emission hydrogen-powered fuel cell technology. Its portable design allows for quick transportation and immediate use.

- May 2025: ITM Power signed an agreement with a confidential customer to supply over 300 MW of electrolyzers for a green hydrogen power plant in the Asia Pacific (APAC) region, aimed at reducing carbon emissions. The project has secured local government funding and is currently awaiting a Final Investment Decision (FID).

- March 2025: Air Liquide inaugurated a new hydrogen energy facility in Shanghai. The company stated that the new facility can supply 12 hydrogen refueling stations and has the capacity to fuel more than 1,000 medium- and heavy-duty trucks daily.

- April 2023: A long-term contract was secured by Linde plc to supply green hydrogen to evonik, a well-known manufacturer of specialized chemicals.

- In April 2024, SJVN Limited inaugurated India's first Multi-purpose Green Hydrogen Pilot Project at SJVN’s 1,500 MW Nathpa Jhakri Hydro Power Station (NJHPS) in Jhakri, Himachal Pradesh. The green hydrogen produced from the project will be utilized for the High Velocity Oxygen Fuel (HVOF) Coating Facility of NJHPS to meet its combustion fuel. requirements.

- March 2024: Chevrons New Energy received a 5-MW electrolyzer technology system from the company Accelera by Cummins in order to produce low carbon intensity electrolytic hydrogen at its capacity plants located at Lost Hills, California, USA.

- May 2024: The state-owned natural gas company GAIL Ltd. (India) contracted their first-ever green hydrogen project 2024 in central India. By electrolyzing water with renewable energy, this green hydrogen plant is expected to generate a whopping 4.3 TPD of hydrogen with the help of 10MW PEM electrolyzer units imported from Canada.

Report Coverage

The hydrogen generation market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, application, system, source, and their futuristic growth opportunities.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 199.11 billion |

|

Revenue forecast in 2034 |

USD 438.9 billion |

|

CAGR |

9.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Technology, By Application, By System, By Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Hydrogen Generation Market report covering key segments are technology, application, system, source and region.

Hydrogen Generation Market Size Worth $ 438.9 Billion By 2034

Hydrogen Generation Market exhibiting the CAGR of 9.20% during the forecast period

Asia Pacific is leading the global market

The key driving factors in Hydrogen Generation Market are Rising industrialization and development of infrastructure is driving the demand for hydrogen generation market.