Hydrogen Sulfide Scavengers Market Size, Share, Trends, Industry Analysis Report

: By Type (Water Soluble, Oil Soluble, and Gas Phase), Chemistry, End Use, and Region– Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5666

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

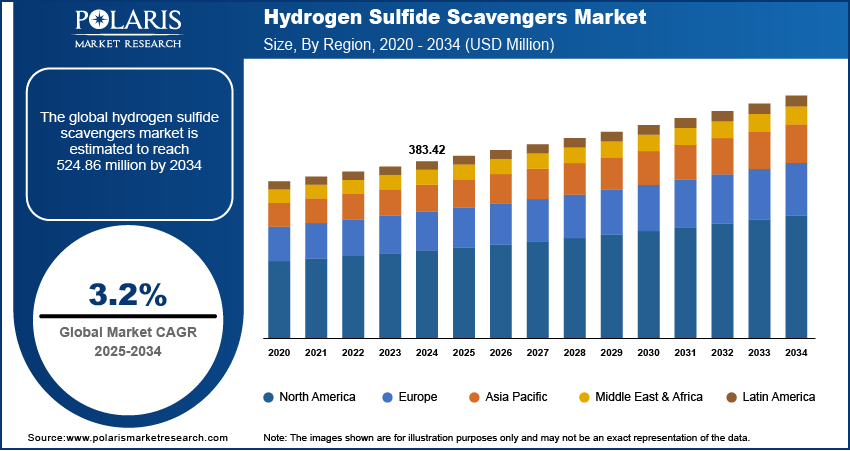

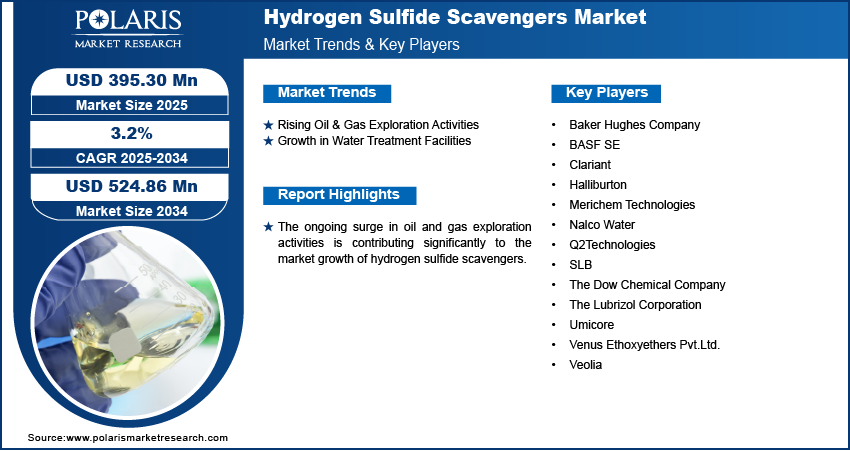

Hydrogen sulfide scavengers market size was valued at USD 383.42 million in 2024, exhibiting a CAGR of 3.2% during the forecast period. Strict environmental regulations, worker safety priorities, and rising H₂S levels in shale gas and wastewater streams are jointly driving market growth.

Key Insights

- Oil-soluble scavengers dominate due to high compatibility with hydrocarbon fluids and strong performance in upstream oilfield applications.

- Crude oil remains the largest end-use segment, driven by the constant need for H₂S removal to prevent corrosion and ensure safe operations.

- Asia Pacific leads due to increasing oil & gas activity, strong industrialization, and stricter regulations across emerging economies such as China and India.

- North America is experiencing the highest growth with the rise in shale and tight oil output, regulatory push, and advancements in efficient scavenger technologies.

Industry Dynamics

- Rising oil and gas exploration in high H₂S regions increases demand for scavengers to ensure safety and environmental compliance.

- Government regulations mandating H₂S emission limits drive industries to adopt efficient scavenging technologies for legal and operational compliance.

- Growth in industrial wastewater generation requires effective H₂S removal to protect water quality and meet discharge regulations.

- Urban population expansion increases municipal wastewater, driving demand for scavengers in large-scale water treatment facilities.

- Investments in green infrastructure and smart water systems support integration of H₂S scavengers in modern treatment plants.

- High operational costs and frequent replenishment limit adoption in cost-sensitive wastewater treatment operations.

Market Statistics

2024 Market Size: USD 383.42 million

2034 Projected Market Size: USD 524.86 million

CAGR (2025–2034): 3.2%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The hydrogen sulfide (H₂S) scavengers market refers to the industry focused on chemical solutions and technologies used to remove or neutralize hydrogen sulfide, a toxic and corrosive gas, from industrial processes, oil & gas production, refineries in wastewater treatment equipment’s, and other applications. Governments worldwide are enforcing strict regulations to limit H₂S emissions, pushing industries to adopt effective scavenger solutions which is further fueling market expansion.

Industries are prioritizing worker safety by eliminating toxic H₂S gas which is increasing the adoption of scavenger technologies thereby, contributing to the market growth. Additionally, the rise in unconventional shale gas extraction, which often contains high H₂S levels, is creating significant demand for scavengers, thereby propelling the growth.

Market Dynamics

Rising Oil & Gas Exploration Activities

The ongoing surge in oil and gas exploration activities is contributing significantly to the growth of hydrogen sulfide scavengers. For instance, according to the US Energy Information Administration, in 2022, the US produced 12.2 million b/d of oil and 121.1 Bcf/d of natural gas. By 2023, the production increased to 13.3 million b/d of oil and 128.8 Bcf/d of natural gas. The growth rates were 9.02% for oil and 6.36% for natural gas. Increased drilling and extraction efforts, particularly in unconventional reserves like shale gas, often release hazardous levels of H₂S gas. Industries are compelled to adopt advanced scavenger solutions to neutralize this toxic gas, ensuring operational safety and compliance with environmental regulations. The need for effective H₂S management is further amplified as deeper reserves, which typically contain higher H₂S concentrations, are tapped. This trend is driving demand for innovative scavenger technologies that enhance efficiency while minimizing costs.

Growth in Water Treatment Facilities

The escalating requirement for treating H₂S-contaminated wastewater from municipal and industrial sources is playing a pivotal role in boosting the market. Contaminated water poses significant health and environmental risks, prompting industries and municipalities to invest in effective treatment solutions. For instance, the Bipartisan Infrastructure Law invested over USD 50 billion in the EPA to enhance drinking water, wastewater, and stormwater infrastructure, addressing critical needs and improving water quality. Scavengers are widely utilized to neutralize H₂S, ensuring safe discharge or reuse of wastewater. Increasing urbanization and industrialization have led to a rise in wastewater generation, further amplifying the demand for scavenger technologies.

Segment Insights

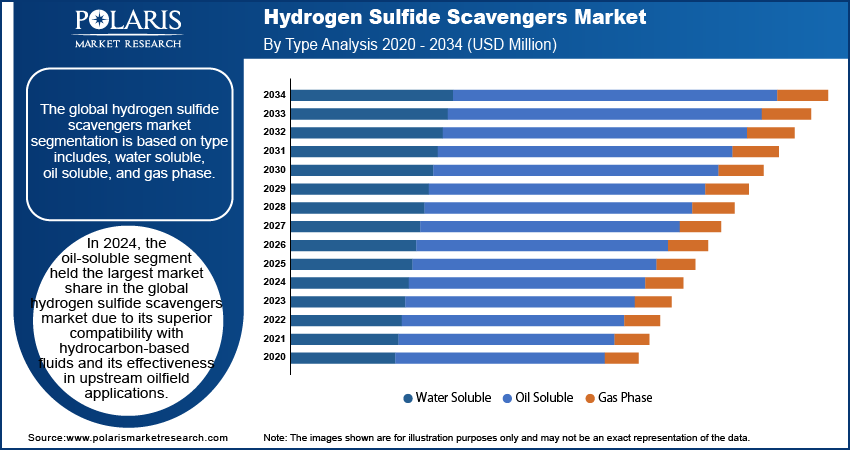

Hydrogen Sulfide Scavengers Market Assessment by Type Outlook

The segmentation is based on type includes, water soluble, oil soluble, and gas phase. In 2024, the oil-soluble segment held the largest market share due to its superior compatibility with hydrocarbon-based fluids and its effectiveness in upstream oilfield applications. The ability of oil-soluble scavengers to react efficiently in environments where water presence is minimal makes them critical for removing H₂S from crude oil and condensates during extraction and production. Their performance under high-pressure, high-temperature conditions and minimal impact on fluid properties further supports their widespread deployment. Oil-soluble scavengers continue to be the preferred choice in deep well and offshore drilling operations, reinforcing their dominant position in the market.

The water-soluble segment is expected to record the fastest CAGR over the forecast period, driven by increasing application in midstream and downstream processes where water-injected systems and aqueous phases are prevalent. These scavengers offer rapid and complete reaction with hydrogen sulfide without forming insoluble by-products, making them highly suitable for gas treatment, pipelines, and refinery operations. The growing demand for cost-effective, operationally safe H₂S mitigation solutions in gas processing plants and facilities for water treatment chemicals is contributing to increased adoption. Their ease of injection, operational flexibility, and broad compatibility with various system configurations are propelling the water-soluble segment's accelerated growth.

Hydrogen Sulfide Scavengers Market Evaluation by End Use Outlook

The segmentation is based on end use includes, crude oil, natural gas, geothermal energy, and others. The crude oil segment accounted for the largest market share in 2024 due to the consistent need for hydrogen sulfide removal during extraction, storage, and transportation. The presence of H₂S in crude oil poses severe risks, including corrosion, toxicity, and operational hazards, necessitating effective scavenging technologies. The oil and gas industry’s stringent health and safety regulations, along with the requirement to maintain crude quality for downstream processing, make H₂S scavengers indispensable in crude-handling operations. The large-scale deployment across onshore and offshore assets further supports this segment’s dominance in the market.

The geothermal energy segment is poised to grow at the fastest CAGR over the forecast period due to the increasing global emphasis on sustainable energy sources and the rising number of geothermal projects encountering hydrogen sulfide emissions. Geothermal reservoirs frequently contain H₂S, which effectively neutralized to ensure environmental compliance and worker safety. The need for high-performance, oxygen scavengers that operate under extreme geothermal conditions is driving innovation and product adoption in this space. The segment’s growth is also supported by favorable regulatory frameworks and investments in renewable energy infrastructure, contributing to a strong demand trajectory.

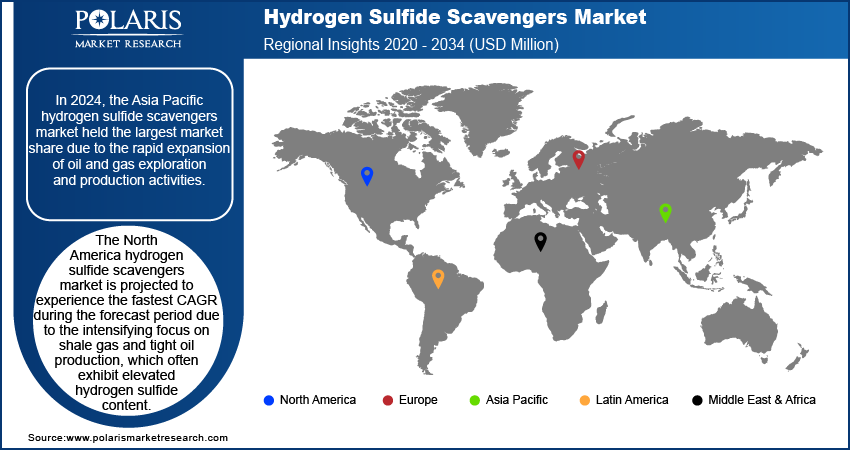

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific held the largest market share due to the rapid expansion of oil and gas exploration and production activities across major economies such as China, India, and Southeast Asian countries. Escalating demand for energy, combined with the need to address high hydrogen sulfide concentrations in upstream and midstream processes, has accelerated the deployment of scavenging solutions. For instance, according to the electricity demand in Southeast Asia is projected to increase by 4% per annum through 2035. Additionally, growing industrialization, increased investments in refining capacity, and strict regulatory requirements for workplace safety and environmental emissions are contributing to the robust adoption of H₂S scavengers. The market expansion is further supported by a rise in domestic production and the modernization of aging oilfield infrastructure across the region.

The North America is projected to experience the fastest CAGR during the forecast period due to the intensifying focus on shale gas and tight oil production, which often exhibit elevated hydrogen sulfide content. Rising regulatory scrutiny around emissions control and worker safety in the US and Canada is supporting the adoption of advanced H₂S scavenging technologies. Increased activity in midstream transportation and liquefied natural gas processing infrastructure, coupled with technological advancements in scavenger formulation, is driving demand. Additionally, the region’s leadership in adopting environmentally friendly and cost-effective treatment solutions is accelerating market growth.

Hydrogen Sulfide Scavengers Key Market Players & Competitive Analysis Report

The competitive landscape is characterized by dynamic strategic initiatives aimed at strengthening product portfolios and expanding global reach. Industry analysis indicates a strong emphasis on market expansion strategies, where leading players are investing in R&D to develop more efficient and environmentally sustainable scavenging solutions tailored to complex operational environments. Technology advancements in scavenger formulations, particularly those enhancing reactivity and reducing secondary by-products, are redefining product differentiation and driving competitive advantage. Strategic alliances and joint ventures are gaining traction as companies seek to combine technical expertise and regional market knowledge to improve penetration in high-growth geographies.

Mergers and acquisitions are playing a pivotal role in accelerating growth, enabling firms to gain access to established distribution networks and integrate innovative technologies. Post-merger integration efforts are focused on streamlining operations and achieving economies of scale, improving overall efficiency and profitability. Product launches are increasingly aligned with emerging regulatory standards and customer demands for safer, faster-acting scavengers across oil & gas, petrochemicals, and energy sectors. Competitive intensity is further shaped by collaborations with downstream operators and service providers, allowing companies to provide customized, application-specific scavenger systems.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions sector. Surface Technologies provide chemical solutions and automotive OEM services to the automotive and chemical sectors, including refinishing coatings, surface treatment, catalysts, battery materials, and base metal services. BASF SE offers hydrogen sulfide (H2S) scavengers under its Chemicals segment, providing essential solutions for gas treatment and purification across industries such as oil and gas processing, petrochemicals, and industrial manufacturing

Baker Hughes Company is a multinational company headquartered in Texas, United States. Founded in 1908, it is a technology-based company that provides products and services for industrial solutions. The company's portfolio of products includes subsea production systems, drilling equipment, pipe systems, compressors, energy recovery and storage systems, electricity generators, control systems, regulators, valves, pumps, and process control technologies. In addition, the company offers digital solutions such as sensor-based process measurement, plant controls, non-destructive testing and inspection, and pipeline integrity solutions. The key focus of the company is to provide services to other businesses, including state and national-owned oil companies and autonomous oil and natural gas companies. Baker Hughes Company is a major provider of hydrogen sulfide scavengers, supplying advanced chemical solutions for H2S removal in oil and gas production, refining, and other industrial applications to enhance operational safety and protect infrastructure.

Key Companies in the Hydrogen Sulfide Scavengers Market

- Baker Hughes Company

- BASF SE

- Clariant

- Halliburton

- Merichem Technologies

- Nalco Water

- Q2Technologies

- SLB

- The Dow Chemical Company

- The Lubrizol Corporation

- Umicore

- Venus Ethoxyethers Pvt.Ltd.

- Veolia

Hydrogen Sulfide Scavengers Market Developments

In November 2024, Baker Hughes partnered with SOCAR to deliver an integrated gas recovery and H2S removal system, aimed at significantly reducing downstream flaring at the Heydar Aliyev Oil Refinery in Baku, Azerbaijan.

In January 2022, Merichem Company awarded a contract to supply its LO-CAT Sulfur Recovery Technology to WIN Waste Innovations for Hydrogen Sulfide (H2S) removal at the Tunnel Hill and Sunny Farms Landfills in Ohio.

Hydrogen Sulfide Scavengers Market Segmentation

By Type Outlook (Volume, Kiloton; Revenue, USD Million; 2020 - 2034)

- Water Soluble

- Oil Soluble

- Gas Phase

By Chemistry Outlook (Volume, Kiloton; Revenue, USD Million; 2020 - 2034)

- Triazine

- Nitrite

- Iron Sponge

- Others

By End Use Outlook (Volume, Kiloton; Revenue, USD Million; 2020 - 2034)

- Crude Oil

- Natural Gas

- Geothermal Energy

- Others

By Regional Outlook (Volume, Kiloton; Revenue, USD Million; 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Sulfide Scavengers Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 383.42 million |

|

Market Size Value in 2025 |

USD 395.30 million |

|

Revenue Forecast in 2034 |

USD 524.86 million |

|

CAGR |

3.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume, Kiloton; Revenue, USD Million; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hydrogen sulfide scavengers market size was valued at USD 383.42 million in 2024 and is projected to grow to USD 524.86 million by 2034.

The global market is projected to grow at a CAGR of 3.2% during the forecast period.

In 2024, the Asia Pacific held the largest market share due to the rapid expansion of oil and gas exploration and production activities.

Some of the key players in the market are Arcosa Inc.; Argex; Ashtech Pvt. Ltd.; Boral Industries Inc.; Buildex, LLC; Cemex S.A.B. DE C.V.; Heidelberg Materials; Holcim Group; Laterlite S.P.A.; Leca International; Litagg Industries Pvt Ltd; Northeast Solite Corporation; Rock Solid Processing Ltd; Stalite Lightweight Aggregate; Utelite Corporation.

In 2024, the oil-soluble segment held the largest market share due to its superior compatibility with hydrocarbon-based fluids and its effectiveness in upstream oilfield applications.

The crude oil segment accounted for the largest market share in 2024 due to the consistent need for hydrogen sulfide removal during extraction, storage, and transportation.