Industrial Enzymes Market Size, Share, Trends, Industry Analysis Report

: By Source (Microorganisms, Plants, and Animals), Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM2116

- Base Year: 2024

- Historical Data: 2020-2023

Industrial Enzymes Market Overview

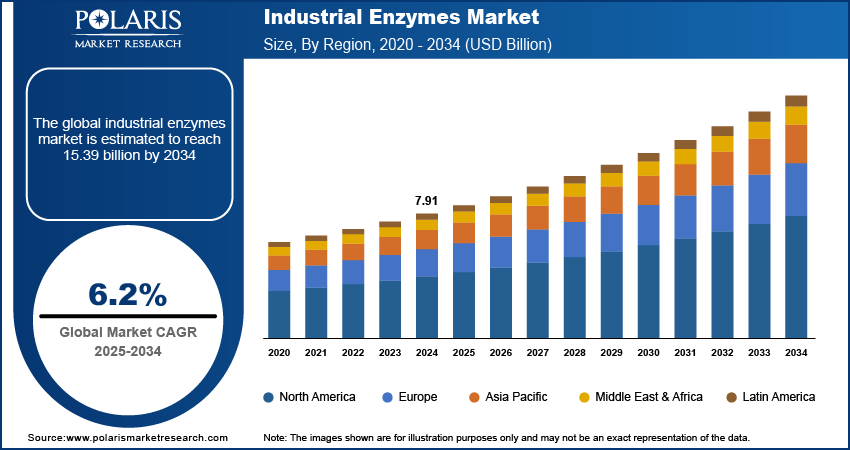

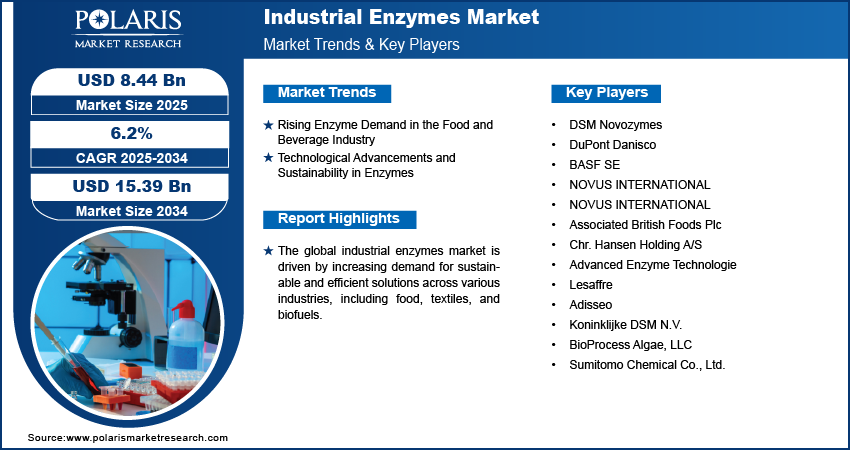

The global industrial enzymes market size was valued at USD 7.91 billion in 2024. The market is projected to grow from USD 8.44 billion in 2025 to USD 15.39 billion by 2034, exhibiting a CAGR of 6.2% during the forecast period.

Industrial enzymes are specialized biological catalysts derived from microorganisms, plants, or animals that accelerate chemical reactions in various indust rial processes, such as food production, pharmaceuticals, biofuels, and textiles. These enzymes improve process efficiency, reduce energy consumption, and support environmentally sustainable practices.

The industrial enzymes market growth is driven by increasing demand across various sectors, such as food and beverage, pharmaceuticals, biofuels, and detergents. These enzymes provide eco-friendly solutions by reducing energy and water consumption in manufacturing processes. Growing emphasis on sustainable production methods and advancements in enzyme engineering technologies are contributing to the market expansion. For instance, in May 2023, Novozymes launched the Novamyl BestBite solution, designed to improve the texture and extend the shelf life of baked goods. The solution is aimed at enhancing the freshness and quality of bakery products by optimizing their texture and maintaining longer freshness. Furthermore, the rising adoption of enzymes in the pharmaceutical and biofuel industries, along with increasing awareness of biodegradable alternatives, is further accelerating growth. Emerging economies, characterized by their growing industrial sectors and increasing environmental awareness, offer significant industrial enzymes market opportunities.

To Understand More About this Research: Request a Free Sample Report

The growth of urban centers and industries, particularly in developing nations, is driving a surge in the utilization of industrial enzymes. These catalysts offer a promising solution to optimize operational efficiency and mitigate resource consumption. Businesses can streamline production by integrating enzymes into various industrial processes, reducing energy expenditure and waste management, thereby contributing to sustainable development.

Industrial Enzymes Market Dynamics

Rising Enzyme Demand in Food and Beverage Industry

The food and beverage industry is experiencing strong industrial enzymes market growth, driven by increasing consumer preference for healthier and functional food products. Enzymes play a crucial role in improving food quality, extending shelf life, and enhancing overall process efficiency. Their applications cover the bakery, dairy, beverages, and starch processing sectors. For instance, in August 2022, Animal Nutrition and Health, a global company dedicated to nutrition, health, and sustainability, unveiled FDA approval of fumonisin esterase, a new enzyme, and released findings from their North America mycotoxin survey at a World Pork Expo event. Enzymes improve dough handling and the texture of baked goods in the bakery sector, and in dairy, they aid in cheese maturation and flavor development. This trend emphasizes the essential role of enzymes in meeting changing consumer demands and industry standards for safe, high-quality, and nutritious food products.

The increasing global population, projected to surpass 9.7 billion by 2050 and potentially reach nearly 11 billion by 2100, according to the UN DESA, is expected to drive higher demand for the food and beverage industry. This demographic growth indirectly influences the industry's need to expand to meet rising food requirements.

Technological Advancements and Sustainability in Enzymes

Technological advancements in enzyme engineering are driving improvements in enzyme performance. Researchers are continually developing new methods to enhance enzyme stability, specificity, and overall efficiency. These breakthroughs are expanding the range of industrial applications for enzymes. For instance, in July 2023, Infinita Biotech highlighted that need of enzymes in textile manufacturing to reduce harmful chemical use, promoting a safer, more sustainable process. These enzymes enhance efficiency by lowering energy consumption and eliminating toxic byproducts, contributing to a cleaner production method.

Additionally, increasing awareness about environmental sustainability and stringent regulations on chemical usage are driving the industrial enzymes market revenue. Industries are increasingly adopting eco-friendly practices, increasing demand for industrial enzymes as sustainable alternatives to traditional chemical processes.

Industrial Enzymes Market Segment Analysis

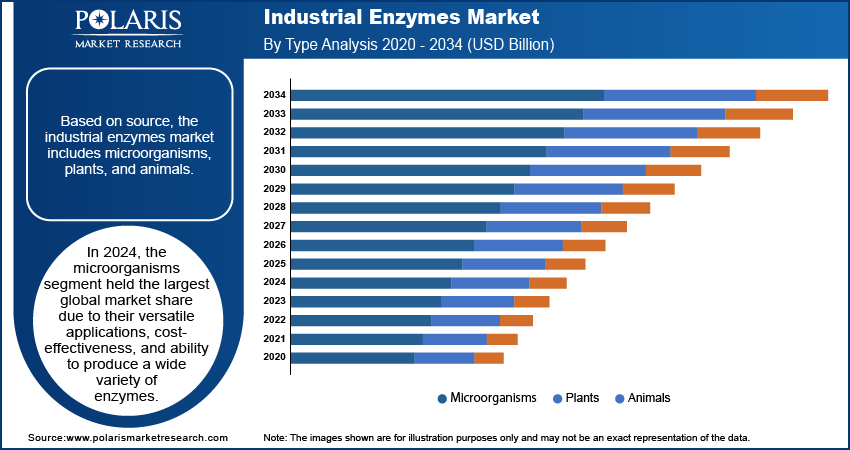

Industrial Enzymes Market Assessment by Source Outlook

The global industrial enzymes market segmentation, based on source, includes microorganisms, plants, and animals. In 2024, the microorganisms segment held the largest global industrial enzymes market share due to their versatile applications, cost-effectiveness, and ability to produce a wide variety of enzymes. Microorganisms, especially bacterial genera such as bacillus, clostridium, and pseudomonas, as well as fungi such as aspergillus, trichoderma, and penicillium, play a crucial role in industrial enzyme production due to their wide availability and efficiency. These microorganisms are extensively used in precision fermentation processes across various industries. In food production, they contribute to the development of flavors and textures in products such as cheese, bread, beer, and wine. Their enzymes improve the quality and strength of textiles by assisting in processes such as bleaching and removing impurities.

In the textile industry, enzymes derived from microorganisms are essential for enhancing fabric strength and quality, as well as for improving the efficiency of processes such as dyeing and finishing. Their versatility and effectiveness make them indispensable in modern industrial applications, driving advancements in both product quality and manufacturing efficiency.

Industrial Enzymes Market Evaluation by Application Outlook

The global industrial enzymes market segmentation, based on application, includes textile, bioethanol, food processing, detergents and cleaning agents, wastewater treatment, pulp & paper, animal feed, personal care and cosmetics, and others.

The food processing sector is poised for substantial growth in the coming years due to the rising standards of living and increasingly busy lifestyles, which are driving demand for convenient food products. Industrial enzymes play a crucial role in the production of dairy, meat, and baked goods, enhancing product quality, taste, and shelf life. This growing demand, coupled with the need for efficient and sustainable production processes, presents significant growth opportunities for the industrial enzymes market.

Industrial Enzymes Market Share by Region

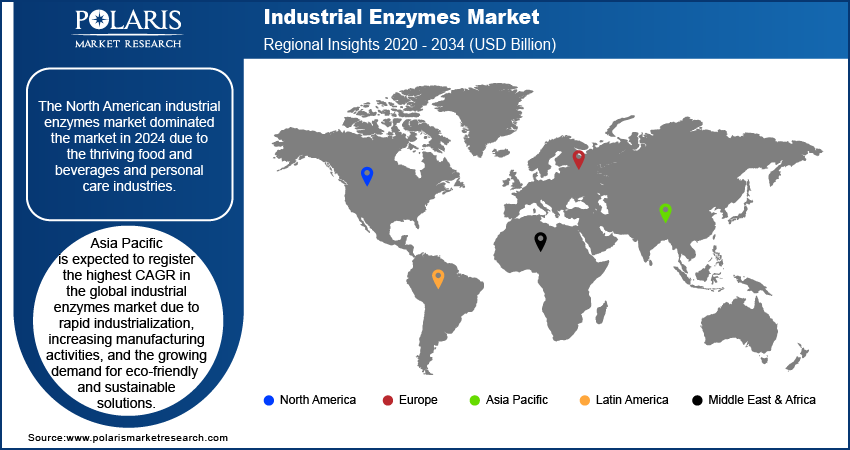

By region, the study provides industrial enzymes market insights into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominated the market in 2024 due to the thriving food and beverages and personal care industries. Furthermore, increasing investments in environmental protection and energy optimization, along with a decrease in reliance on traditional chemicals by the pharmaceutical and personal care sectors, are also driving market expansion in the region. For instance, a 2023 report by DSM-Firmenich states that the company is advancing North American sustainability with innovative animal nutrition solutions that reduce emissions, enhance animal welfare, and promote resource efficiency. The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

Asia Pacific is expected to register a significant industrial enzyme market CAGR due to rapid industrialization, increasing manufacturing activities, and the growing demand for eco-friendly and sustainable solutions. The rise of end-user industries such as food and beverages, textiles, detergents, and algae biofuels in countries such as China, India, and Japan are also contributing to the demand for industrial enzymes. Additionally, the region's favourable regulatory environment, expanding investments in biotechnology research, and increasing adoption of enzymes as a replacement for harsh chemicals are further boosting industrial enzymes market expansion.

Industrial Enzymes – Key Market Players & Competitive Analysis

The competitive landscape of the global industrial enzymes industry is characterized by a blend of prominent global leaders and emerging regional players competing for market share through innovation, strategic collaborations, and regional expansion. Major companies such as Novozymes, DSM, and DuPont leverage strong research and development (R&D) capabilities and extensive distribution networks to deliver advanced enzyme solutions across various industries, such as food and beverages, detergents, biofuels, and textiles. Market trends indicate a growing demand for enzyme products that offer more sustainable and eco-friendly alternatives to traditional chemical processes, reflecting the increasing emphasis on environmental sustainability. The global industrial enzymes market is projected to expand significantly, driven by rising awareness of the benefits of enzymes in reducing chemical use and energy consumption. Regional players, especially in Asia Pacific, are tapping into the rapidly growing demand by offering tailored solutions for localized industries. Competitive strategies in this market include mergers and acquisitions, partnerships with industrial sectors, and continuous innovation in enzyme applications. These developments highlight the role of technological advancements, market adaptability, and regional growth in propelling the industrial enzymes market forward. A few major players in the industrial enzymes market are AB Enzymes, Advanced Enzyme Technologies, Amano Enzymes, Associated British Foods plc, Aumgene Biosciences, BASF SE, Biocatalysts, Chr. Hansen Holding A/S., Creative Enzymes, Denykem, DuPont Danisco, Dyadic International, Enzymatic Deinking Technologies, Enzyme Solutions, Enzyme Supplies, Kerry Group, Koninklijke DSM N.V., Lesaffre, Megazyme, Metgen Oy, Novozymes A/S, Novus International, Inc., Sunson Industry Group, and Tex Biosciences.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In April 2024, BASF SE launched insecticide, Exponus, for Indian farmers to counter insects including Caterpillars & Thrips, and protect crops such as oil seeds, pulses, and vegetables. The product contains new ingredients namely Broflanilide in a specialized formulation.

Sumitomo Chemical Company, Limited, was founded in 1913 and is headquartered in Tokyo. The company operates in various sectors, including essential chemicals, plastics, energy, energy and functional materials, IT-related chemicals, health, crop sciences, pharmaceuticals, and others. It has a network of 203 subsidiaries and affiliates and is a significant player in the global chemical industry. In July 2022, Sumitomo Chemical launched ALLES (Oxazosulfyl) formulation-based insecticide in Japan to protect crops.

Key Companies in Industrial Enzymes Market

- DSM Novozymes

- DuPont Danisco

- BASF SE

- NOVUS INTERNATIONAL

- NOVUS INTERNATIONAL

- Associated British Foods Plc

- Chr. Hansen Holding A/S

- Advanced Enzyme Technologie

- Lesaffre

- Adisseo

- Koninklijke DSM N.V.

- BioProcess Algae, LLC

- Sumitomo Chemical Co., Ltd.

Industrial Enzymes Market Developments

December 2022: Novozymes disclosed its merger with Chr. Hansen, a Danish firm specializing in agricultural, pharmaceutical, and food ingredients. This strategic alliance aims to enhance Novozymes' market position significantly.

November 2021: Novozymes partnered with Novo Nordisk Pharmatech to advance technical enzymes for biopharmaceutical production. This collaboration aims to bolster Novozymes' capabilities in scaling processes for the regenerative medicine sector.

January 2023: BASF and Cargill expanded their collaboration to include the US production and distribution of feed enzymes. This partnership aims to develop cutting-edge enzyme solutions for animal feed, leveraging Cargill’s application expertise and market knowledge alongside BASF’s strengths in enzyme research and development. Together, they seek to innovate and enhance value for animal protein producers through a shared innovation pipeline.

Industrial Enzymes Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Microorganisms

- Plants

- Animals

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Lipases

- Carbohydrases

- Proteases

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Textile

- Bioethanol

- Detergents & Cleaning Agents

- Food Processing

- Pulp & Paper

- Wastewater Treatment

- Animal Feed

- Personal Care & Cosmetics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Enzymes Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.91 Billion |

|

Market Size Value in 2025 |

USD 8.44 Billion |

|

Revenue Forecast in 2034 |

USD 15.39 Billion |

|

CAGR |

6.2% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2024 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global industrial enzymes market size was valued at USD 7.91 billion in 2024 and is projected to grow to USD 15.39 billion by 2034.

The global market is projected to grow at a CAGR of 6.2% during the forecast period, 2025-2034.

North America had the largest share in the global market in 2024.

The key players in the market are AB Enzymes, Advanced Enzyme Technologies, Amano Enzymes, Associated British Foods plc, Aumgene Biosciences, BASF SE, Biocatalysts, Chr. Hansen Holding A/S., Creative Enzymes, Denykem, DuPont Danisco, Dyadic International, Enzymatic Deinking Technologies, Enzyme Solutions, Enzyme Supplies, Kerry Group, Koninklijke DSM N.V., Lesaffre, Megazyme, Metgen Oy, Novozymes A/S, Novus International, Inc., Sunson Industry Group, and Tex Biosciences

The microorganisms category dominated the market in 2024.

The food processing sector is poised for substantial growth.