Instrumentation Sterilization Containers Market Share, Size, Trends, Industry Analysis Report

By Material (Aluminium and Stainless Steel); By Type; By Product; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4647

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

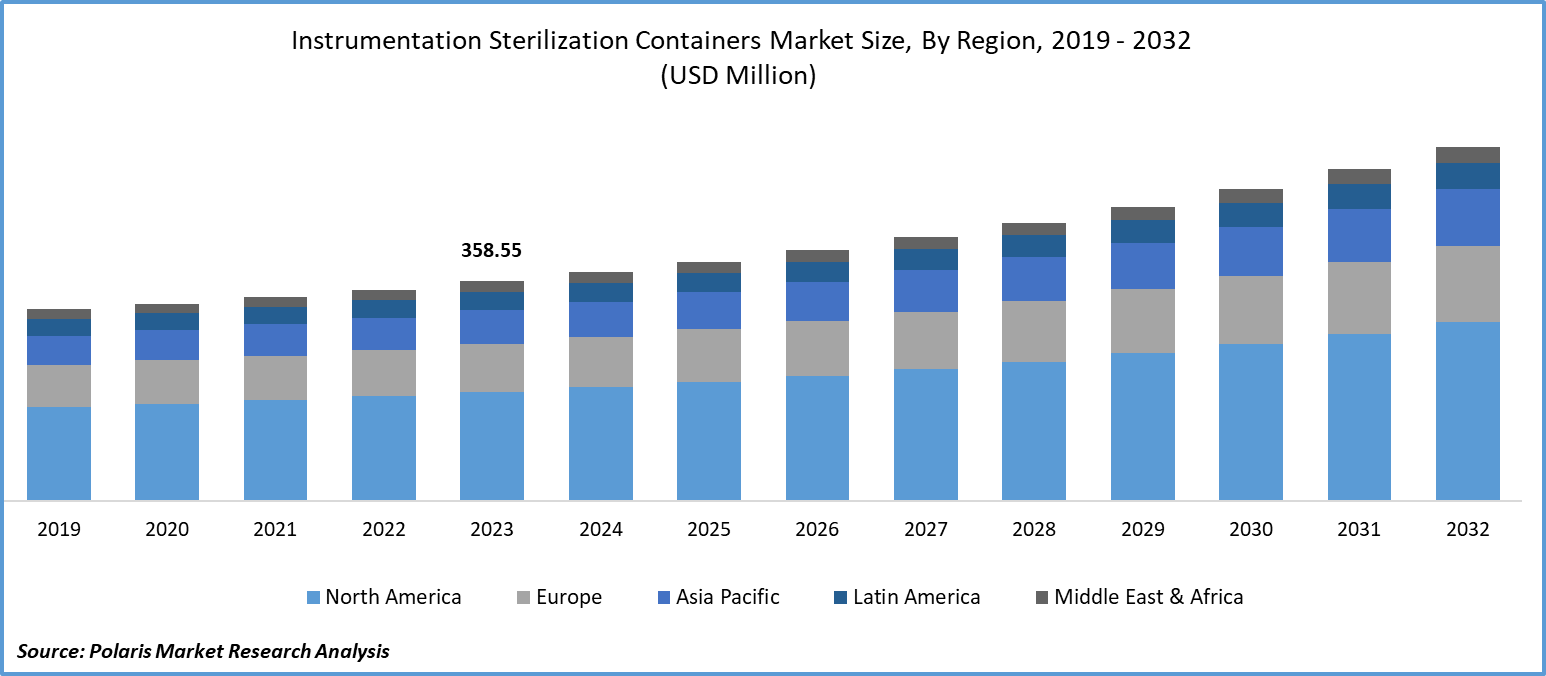

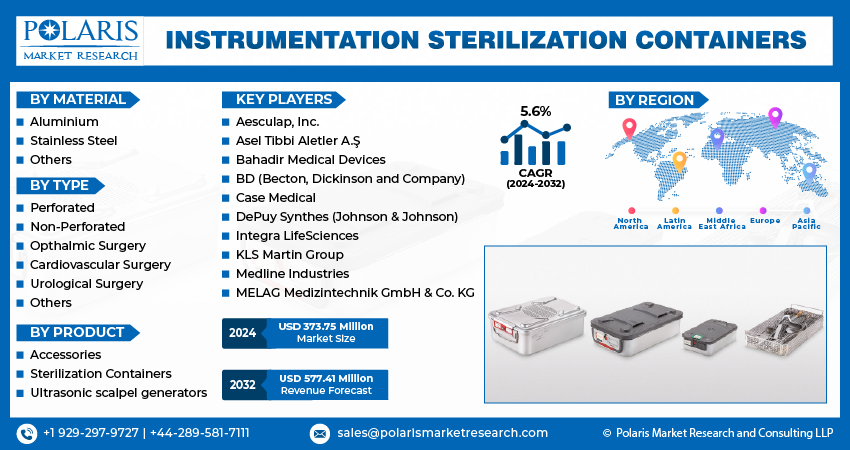

Instrumentation sterilization containers Market size was valued at USD 358.55 million in 2023. The market is anticipated to grow from USD 373.75 million in 2024 to USD 577.41 million by 2032, exhibiting the CAGR of 5.6% during the forecast period

Instrumentation Sterilization Containers Market Overview

The market growth for instrumentation sterilization containers is now expanding at a rapid pace and is at a high development stage, owing to the rapid technological advancement associated with sterilization containers. These advancements aim to improve safety, efficiency, and usability. New materials have been developed to enhance durability, heat resistance, and compatibility with different sterilization methods like steam, ethylene oxide, and hydrogen peroxide that help maintain the integrity of both the container and its contents during sterilization.

For instance, in November 2023, Medline signed a vendor distribution agreement with the University of Utah Health to exclusively supply a wide range of essential medical supplies and solutions to the university's network of doctor's offices and ambulatory surgery clinics, in addition to its inpatient acute care hospitals, are hubs for outpatient care.

To Understand More About this Research: Request a Free Sample Report

Additionally, there is a growing regulatory focus on market development. This is a result of worries over the effectiveness, safety, and caliber of medical equipment and supplies linked to sterilizing containers for patients. Governments all around the world are, therefore, creating regulations to control the creation and application of sterilizing containers. These restrictions may significantly impact the market growth.

In healthcare settings, sterilization of equipment is essential to stopping the COVID-19 virus from spreading. By correctly sterilizing medical equipment, during the outbreak, it is entirely possible to prevent the spread of medical device-borne pathogens from patient to patient. Hence surgical instruments, endoscopic equipment, and respiratory care devices might spread the COVID-19 virus if they are not adequately decontaminated, reprocessed equipment has been used more frequently to disinfect or sterilize medical supplies during the pandemic. The instrumentation sterilization containers are, therefore, much more essential to guaranteeing that medical supplies are adequately sanitized.

Instrumentation Sterilization Containers Market Dynamics

Market Drivers

Rising Numbers of Hospital Acquired Infections (HAIs)

Hospital-acquired infections (HAIs) are serious medical consequences that can cause disease and even death. Surgical site infections (SSIs) are a common type of HAI, often caused by the surgical placement of devices or implants, exposure to instruments and materials during surgery, surgical personnel, the operating room environment, and the body's own flora. Methicillin-resistant Staphylococcus aureus (MRSA), C. difficile, Klebsiella, E. coli, Enterococcus, and Pseudomonas are common bacteria associated with healthcare-associated infections (HAIs). The increasing prevalence of HAIs is the primary factor driving growth in the sterilization containers market trend.

Increasing Usage and Number of Surgical Instruments

Another important aspect that has been propelling this market's revenue growth in recent years is the rise in surgical instrument production. The surgical equipment market is anticipated to expand in revenue due to several benefits, such as reduced blood loss, quicker recovery, less bodily stress, lower chance of infection, and reduced need for painkillers. The increasing number of surgical procedures, including cosmetic surgery, performed worldwide, as well as the rising incidence of chronic diseases such as cancer and heart disease in the aging population are two major factors propelling the market's revenue growth.

Market Restraints

Adoption of Sterilization Pouches and Wraps is Likely to Impede the Market Growth

Surgical tools are frequently packed in sterilization wraps to keep them safe from moisture, airborne germs, and the elements. These wraps come in several sizes and work with both high- and low-temperature sterilizing techniques. In developing nations, medical practitioners are increasingly using disposable wraps alternative to instrumentation sterilization containers since they are a more cost-effective option.

Report Segmentation

The market is primarily segmented based on material, type, product, and region.

|

By Material |

By Type |

By Product |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Instrumentation Sterilization Containers Market Segmental Analysis

By Material Analysis

The stainless steel segment is projected to grow at a CAGR during the projected period. Specifically manufactured of premium stainless steel, stainless steel sterilization containers are intended for the safe storage and sterilization of medical equipment. They are essential to maintaining the sterility and cleanliness of surgical instruments and equipment in medical facilities.

The aluminium segment led the industry market with a substantial revenue share in 2023. The increasing demand for aluminum sterilization containers can be attributed to their durability, with a lifespan of over 5 years, making them a cost-effective long-term option. Aluminum is easy to cut and shape because of its special qualities, which include being lightweight, softer than other metals, and resistant to corrosion because of its chemical makeup. Moreover, aluminum is more cost-effective in the long run, with lifetime costs decreasing around 70% to 80% faster than those of single-use wraps. Anodizing is the preferred method for printing on aluminum sterilization containers as it embeds color in the anodized layer, providing resistance to high temperatures up to 650°C, as well as mechanical and chemical stress, which adds value to the containers. These factors are expected to drive the demand for aluminum sterilization container systems, leading to market growth.

By Type Analysis

The perforated segment accounted for the largest market size in 2023 and is likely to retain its position throughout the market forecast period. Perforated sterilization containers, designed for holding and sterilizing medical instruments in healthcare settings, are a significant factor in this trend. These containers, often constructed from robust materials like stainless steel, incorporate perforations or holes that enable steam or gas to penetrate and sterilize the instruments within. The perforated containers offer various benefits, including shorter sterilization times and reduced need for additional accessories, leading to widespread adoption. Additionally, they facilitate quick sterilization, requiring approximately half the time compared to non-perforated containers.

The non-perforated segment is expected to grow at the fastest growth rate over the coming years. Sterilization containers that aren't perforated are made expressly to keep and preserve medical equipment without any openings or openings. Non-perforated containers, as opposed to perforated ones, keep the instruments sealed or airtight during the sterilizing procedure. When a fully enclosed sterilization environment is necessary to avoid any possible contamination of the instruments following sterilization, these containers are frequently utilized. To preserve the contents' sterility, they are often constructed of materials like stainless steel and include safe locking systems.

By Product Analysis

Based on application analysis, the market is segmented on the basis of accessories, sterilization containers, and ultrasonic scalpel generators. Sterilization containers dominated the market revenue in terms of global revenue in 2023. This significant share can be attributed to their advantages, user-friendly nature, ability to protect against microorganisms, and financial benefits. These advantages are expected to drive the segment's growth. The growing requirement for sterile and safe medical equipment is driving up demand for sterilization containers. Factors fueling this demand include the rising incidence of Hospital-Acquired Infections (HAIs), an increasing number of surgeries, and a greater emphasis on infection prevention and control strategies.

Instrumentation Sterilization Containers Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. This significant market share is due to the growing number of older adults and the rising incidence of chronic diseases caused by lifestyle changes. This has led to an increase in the number of surgeries performed in hospitals. As a result, there is a growing demand for instrumentation sterilization containers to ensure safety and reduce hospital-acquired infections.

Additionally, the presence of major players in the region is a key factor driving market development. In terms of market share for wound dressings in North America in 2023, the United States dominated. Some of the key drivers driving market expansion include the rising use of surgical procedures, the high rate of hospital-acquired infections (HAIs), and the advantages associated with sterilization containers. Furthermore, according to WHO estimates, approximately 1.4 million patients globally are impacted by HAIs, making them the most common adverse event in healthcare. Over a million HAI cases occur in the U.S. healthcare system each year, significantly increasing morbidity and mortality.

The Asia Pacific region is expected to be the fastest-growing region, with a healthy CAGR during the projected period. This is mainly due to the significant presence of major key players and the rising incidence of chronic diseases, surgical procedures, and hospital-acquired infections (HAIs) in the country. China held the largest share of the Asia Pacific market in 2023. Market growth is driven primarily by the increasing prevalence of chronic diseases, a rise in surgical procedures, and the expanding elderly population.

Competitive Landscape

The instrumentation sterilization containers market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Aesculap, Inc.

- Asel Tibbi Aletler A.Ş

- Bahadir Medical Devices

- BD (Becton, Dickinson and Company)

- Case Medical

- DePuy Synthes (Johnson & Johnson)

- Integra LifeSciences

- KLS Martin Group

- Medline Industries

- MELAG Medizintechnik GmbH & Co. KG

Recent Developments

- In March 2022, Aesculap, Inc., a Braun company, introduced the AESCULAP Aicon Sterile Container System, which has features to improve sterilization operations by reducing the chance of wet sets and simplifying procedures.

Report Coverage

The instrumentation sterilization containers market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, material, type, product and their futuristic growth opportunities.

Instrumentation Sterilization Containers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 373.75 million |

|

Revenue forecast in 2032 |

USD 577.41 million |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Type, By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global instrumentation sterilization containers market size is expected to reach USD 577.41 million by 2032

Key players in the market are Aesculap, Asel Tibbi Aletler, Medline Industries, BD (Becton, Dickinson and Company), DePuy Synthes

North America contribute notably towards the global Instrumentation Sterilization Containers Market

Instrumentation sterilization containers Market exhibiting the CAGR of 5.6% during the forecast period

The Instrumentation Sterilization Containers Market report covering key segments are material, type, product, and region.