Japan Fitness App Market Size, Share, Trends, Industry Analysis Report

By Type (Workout & Exercise Apps, Disease Management), By Platform, By Devices – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM2150

- Base Year: 2024

- Historical Data: 2020-2023

Overview

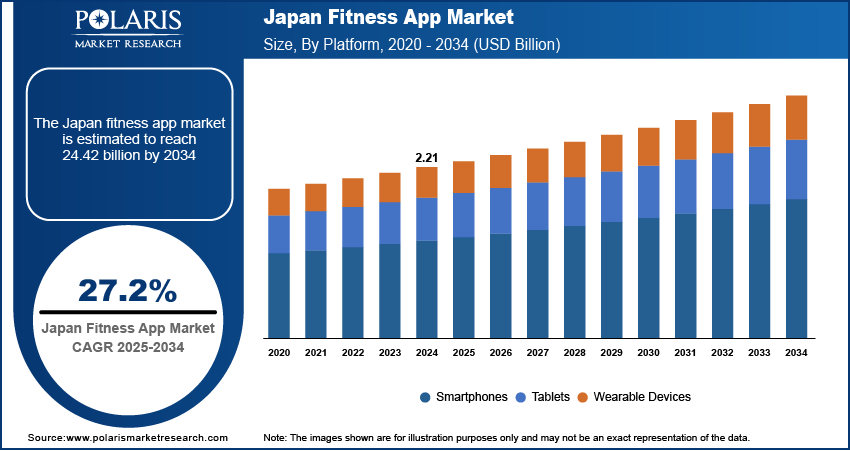

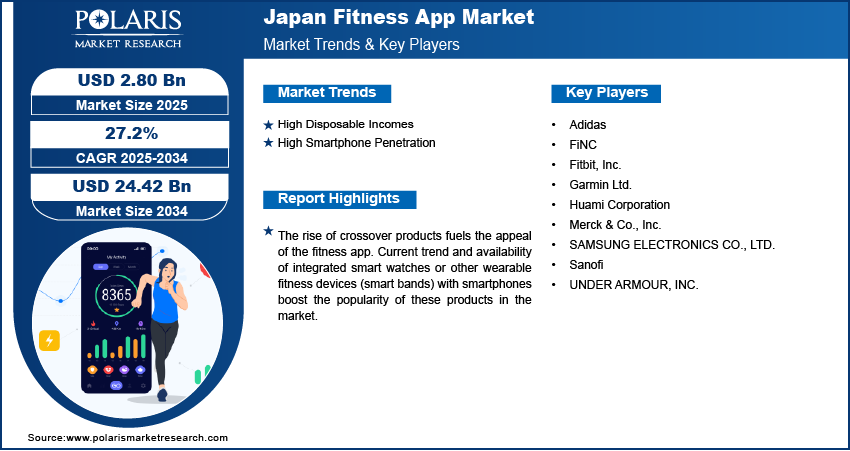

The Japan fitness app market size was valued at USD 2.21 billion in 2024, growing at a CAGR of 27.2% from 2025 to 2034. Key factors driving demand is high disposable incomes and high smartphone penetration.

Key Insights

- The workout & exercise apps segment is projected to register a CAGR of 27.1% over the forecast period driven by a growing awareness of health and lifestyle improvement.

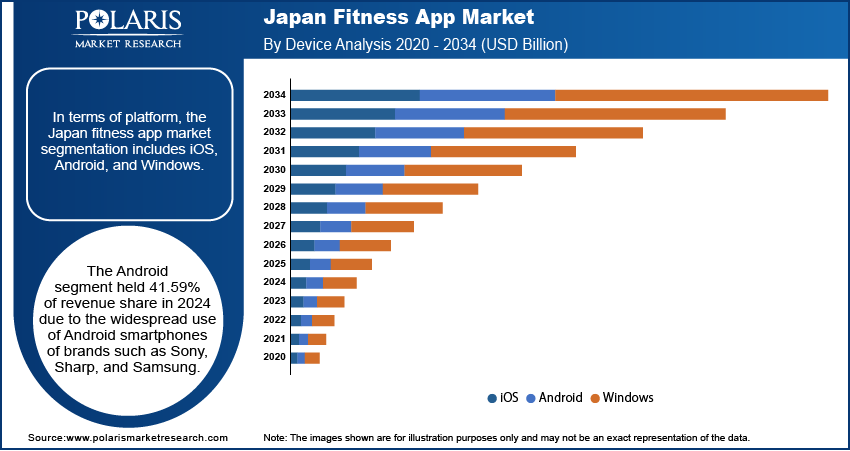

- The android segment held 41.59% of revenue share in 2024 due to the widespread use of Android smartphones of brands such as Sony, Sharp, and Samsung.

Industry Dynamics

- High disposable incomes are driving the demand.

- High smartphone penetration is driving the Japan fitness app market growth.

- The rise of crossover products fuels the appeal of the fitness app. Current trend and availability of integrated smart watches or other wearable fitness devices (smart bands) with smartphones is boosting the popularity of these products in the market.

- Limited user engagement and data privacy concerns limit the growth.

Market Statistics

- 2024 Market Size: USD 2.21 Billion

- 2034 Projected Market Size: USD 24.42 Billion

- CAGR (2025–2034): 27.2%

AI Impact on Japan Fitness App Market

- AI enhances personalization by analyzing user health data, workout habits, and goals to deliver customized fitness plans, improving user engagement and long-term app retention.

- AI-driven analytics offer valuable insights into user behavior and preferences, enabling developers to tailor features, recommend content, and optimize app interfaces for the Japanese market.

- AI supports virtual coaching and real-time feedback, using voice and motion recognition to guide workouts accurately, making fitness apps more interactive and accessible.

The smart fitness technology is one of the modern-day innovations, which has evolved over time, owing to the rigorous studies carried out by researchers and scientists, through extensive research and development. The technology has proved to be a boon in a wide variety of applications and has increased the number of advancements over the time. The main aspects leading to the growth of this technology is the smart fitness devices’ ability to enable real-time access to the fitness activities.

The Japan fitness app industry is anticipated to witness a significant growth during the forecast period. There are tremendous opportunities for advancements in the connected fitness devices owing to the increasing usage. Additionally, enhanced internet accessibility and growing penetration of Internet of Things (IoT) technology help direct digital controls for improved Machine-to-Machine (M2M) communication. This has encouraged users to adopt the smart fitness devices, thereby driving growth. The growing adoption of Internet of Things (IoT) technology, which enables machine to machine communication, presents a significant opportunity for the growth of this technology.

The rise of crossover products fuels the appeal of the fitness app. Current trend and availability of integrated smart watches or other wearable fitness devices (smart bands) with 5G smartphones is boosting the popularity of these products in the market. Manufacturers are launching fitness devices that provides the basic functionalities of a smartwatch. One such example is the introduction of fitness bands that has calling and texting functions, thus merging smartphone operations in one product. Such innovations will add value to the product and increases the functionality and comfort for the end-users. Wristbands or other smart fitness wearables are driving the consumers to exercise on a regular basis, which, in turn, reduces healthcare costs. A few of the devices available in the Japanese market include smart clothing, activity monitors, laser printed wristbands, non-printed wristbands, and RFID wristbands. These smart devices are used to identify and track changes in body signatures for various organs. The manufacturers in the market are focusing on investing in new technologies that integrate with smart fitness devices and its information handling systems to make them efficient and easy-to-use, thereby driving its adoption.

Drivers & Opportunities

High Disposable Incomes: Evolved urban lifestyle, high disposable income, and high-income levels stimulates individuals to spend on consumer utilities. Additionally, improved standard of living and upsurge in consumer awareness about smart fitness products are expected to contribute to Japan fitness app market growth. Innovations and technological advancements are making provisions for efficient & cheap products, subsequently driving market demand extensively. Changing consumer preference paired with quality standards may open avenues within the Japan smart fitness market.

High Smartphone Penetration: Growing adoption of smartphones by consumers contributes in the growth of various fitness applications across different categories in the Japanese market. Continuous improvement in the network infrastructure as well as growing network coverage boosts up the demand for mobile based health services. Mobile network operators view fitness apps as the beneficial opportunity for investment with the growing user adoption of smartphones coupled with rising awareness about health, nutrition, and diet, thereby driving the Japan fitness app market growth.

Segmental Insights

Type Analysis

Based on source, the Japan fitness app market segmentation includes workout & exercise apps, disease management, lifestyle management, nutrition & diet, medication adherence, and others. The workout & exercise apps segment is projected to register a CAGR of 27.1% over the forecast period. The growth is driven by a growing awareness of health and lifestyle improvement. Many users prefer guided workouts they can do at home or outdoors with urban lifestyles and limited time for gym visits. These apps offer video tutorials, progress tracking, and personalized workout plans, making fitness more accessible. The rising popularity of bodyweight training, yoga, and HIIT among young adults and working professionals fuels the segment growth.

Platform Analysis

In terms of platform, the Japan fitness app market segmentation includes iOS, Android, and Windows. The android segment held 41.59% of revenue share in 2024. The widespread use of Android smartphones of brands such as Sony, Sharp, and Samsung drives the segment growth. Android’s open ecosystem allows a variety of local and international fitness apps to reach a broad user base. Many budget-conscious consumers prefer Android devices, making fitness apps on this platform more accessible to a wider demographic. Additionally, the Google Play Store offers a wide selection of fitness-related apps tailored to Japanese preferences, including Japanese language support, cultural relevance, and local wellness trends. This has led to steady growth in Android-based fitness app adoption, thereby fueling the growth.

Key Players & Competitive Analysis

The Japan fitness app market features a mix of global brands and strong domestic players. Adidas has made inroads with its fitness tracking apps and brand appeal among active Japanese consumers. FiNC, a homegrown leader, offers AI-driven health and wellness support tailored to Japanese cultural and lifestyle preferences, giving it a strong local edge. Fitbit, Inc. and Garmin Ltd. maintain steady popularity through wearable technology integration, appealing to tech-savvy users in urban areas. Huami Corporation, with its affordable Amazfit wearables, also sees growing adoption. SAMSUNG ELECTRONICS CO., LTD. remains competitive via its Samsung Health platform, supported by a large Android user base. While UNDER ARMOUR, INC. promotes fitness engagement through its connected fitness platforms, Merck & Co., Inc. and Sanofi participate indirectly, offering health-related digital solutions that support preventive care and wellness, aligning with Japan’s aging population and rising health awareness.

Key Players

- Adidas

- FiNC

- Fitbit, Inc.

- Garmin Ltd.

- Huami Corporation

- Merck & Co., Inc.

- SAMSUNG ELECTRONICS CO., LTD.

- Sanofi

- UNDER ARMOUR, INC.

Japan Fitness App Industry Developments

October 2024, ClassPass launched its services in Japan partnering with 200 gyms, mainly in Tokyo. The company aimed to attract both local users and international tourists by simplifying access to fitness facilities through its subscription-based app.

Japan Fitness App Market Segmentation

By Type Outlook (Revenue, USD Billion, 2021–2034)

- Workout & Exercise Apps

- Disease Management

- Lifestyle Management

- Nutrition & Diet

- Medication Adherence

- Others

By Platform Outlook (Revenue, USD Billion, 2021–2034)

- iOS

- Android

- Windows

By Device Outlook (Revenue, USD Billion, 2021–2034)

- Smartphones

- Tablets

- Wearable Devices

Japan Fitness App Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.21 Billion |

|

Market Size in 2025 |

USD 2.80 Billion |

|

Revenue Forecast by 2034 |

USD 24.42 Billion |

|

CAGR |

27.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.21 billion in 2024 and is projected to grow to USD 24.42 billion by 2034.

The market is projected to register a CAGR of 27.2% during the forecast period

A few of the key players in the market are Adidas; FiNC; Fitbit, Inc.; Garmin Ltd.; Huami Corporation; Merck & Co., Inc.; SAMSUNG ELECTRONICS CO., LTD.; Sanofi; and UNDER ARMOUR, INC.

The workout and exercise app segment dominated the market revenue share in 2024.

The android segment is projected to witness the fastest growth during the forecast period.