Latin America Artificial Lift Market Share, Size, Trends, Industry Analysis Report

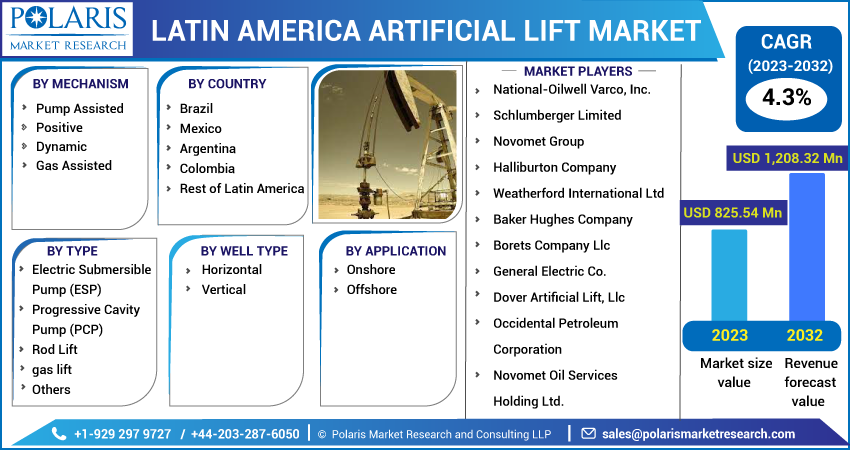

By Mechanism (Pump Assisted, Gas Assisted); By Type; By Well Type; By Application; By Country, And Segment Forecasts, 2023-2032

- Published Date:Jun-2023

- Pages: 116

- Format: PDF

- Report ID: PM3386

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

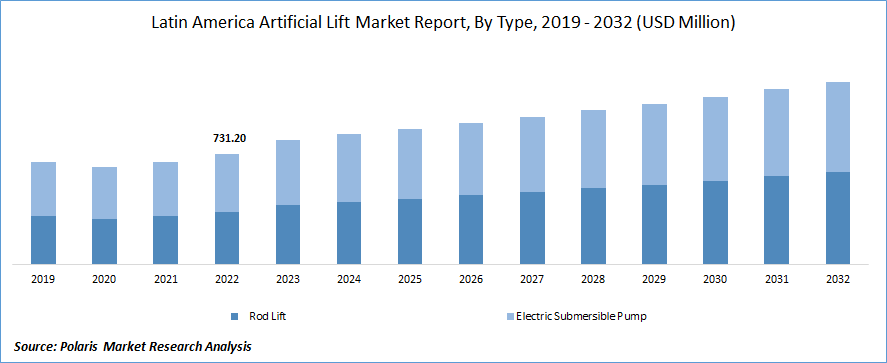

The Latin America artificial lift market was valued at USD 731.20 million in 2022 and is expected to grow at a CAGR of 4.3% during the forecast period. The Artificial Lift Market in Latin America refers to using various methods and equipment to enhance oil and gas production from wells. It involves using artificial lift, such as gas lift, rod lifts, and electric submersible pumps, to improve the flow of hydrocarbons from the reservoir to the surface. The Latin American region has a significant potential for oil and gas production, and the increasing energy demand has driven the growth of the artificial lift market in the area. The market in Latin America is characterized by major oil and gas-producing countries such as Brazil, Mexico, Venezuela, Colombia, and Argentina, among others. The adoption of advanced technologies and increasing investments in the exploration and production of oil and gas are expected to fuel the growth of the artificial lift market in the region in the coming years.

To Understand More About this Research: Request a Free Sample Report

The energy demand is increasing due to population growth, efforts to improve living standards and urbanization. However, this demand is outpacing the addition of new oil reserves, and the number and size of discoveries are decreasing. Therefore, a growing need exists to enhance productivity and efficiency in mature oil reservoirs. Artificial lifts are becoming increasingly important for exploring oil from these reservoirs. However, market growth is expected to be hindered during the forecast period due to the advancement of various IOR technologies and smart water flooding.

The offshore market for electric submersible pumps (ESPs) is expected to experience a surge in demand due to the abundance of resources and increased investments. ESPs are favored in huge oil wells that have stretched or crossed their highest oil creation phase. Furthermore, the growth of new exploration fields is anticipated to provide substantial opportunities for the LATAM artificial lift market shortly.

Brazil is anticipated to be a significant country propelling the artificial lift market in Latin America. Most new and older fields demand artificial lifts for production, resulting in major companies' widespread adoption of the artificial lift market across almost all wells.

However, the market growth may be hindered by the fluctuating oil prices and the COVID-19 pandemic, which have impacted the oil and gas industry in the region. Additionally, the increasing focus on renewable energy sources may also challenge the growth of the artificial lift market in Latin America.

For Specific Research Requirements, Request a Customized Report

Industry Dynamics

Growth Drivers

The rising demand for oil and gas has led to increased exploration and production activities in Latin America, which has, in turn, driven the need for an artificial lift market. Many oil wells in Latin America are aging, which means that they are producing less oil and gas than before. The artificial lift can help to increase production and extend the life of these wells.

The development of new technologies, such as intelligent control systems and real-time monitoring, has made the latin america artificial lift market more efficient and cost-effective, boosting their adoption in the region. Governments in Latin America are taking initiatives to promote the development of the oil and gas sector, including adopting an artificial lift market to increase production.

The increasing investment in oil and gas infrastructure in Latin America, including pipelines, refineries, and production facilities, is driving the demand for artificial lift to increase the production and transportation of oil and gas.

Report Segmentation

The market is primarily segmented based on mechanism, type, well type, application, and region.

|

By Mechanism |

By Type |

By Well Type |

By Application |

By Country |

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

The gas-assisted segment held the highest market share in 2022

In 2022, the gas-assisted segment held the highest market share in Latin America, attributed to several key factors. One significant factor is the relatively lower maintenance requirements of gas lifts compared to pump-type lifts. Gas lifts are known for their efficiency and ease of operation, reducing the need for frequent maintenance and contributing to their widespread adoption.

Furthermore, gas lifts offer cost-effectiveness compared to pump lifts, making them a good choice across various industries and applications. This versatility has led to their extensive use in mining, oil & gas, and other verticals.

Also, the pump-assisted segment is expected to experience growth during the forecast period. This segment includes positive and dynamic displacement pumps, which are increasingly being adopted, particularly electric submersible and progressive cavity pumps. Technological advancements in these pump technologies are anticipated to impact the pump-assisted mechanism segment's growth positively.

The rod lift segment held the largest market share in 2022

In 2022, the rod lift type held the largest market share in Latin America, primarily driven by its extensive applications in onshore operations. The rod lift method is widely regarded as the standard artificial lift technique, commonly known as a beam pump. It utilizes a pump jack at the surface, powered by gas or electricity, to facilitate the artificial lifting of oil and gas from the wellbore.

The rod lift system employs a sucker rod string and pump to pressurize the downhole well and transport the hydrocarbons to the surface through piping and equipment. It offers several notable advantages, including high system efficiency, optimized controls, positive displacement capabilities, and remarkable flexibility. The rod lift type can also operate in wells with depths of up to 15,000 feet.

The demand in Latin America is expected dominated the market in 2022

In 2022, Latin America is expected to dominate the Artificial Lift market due to the many oil reserves in the region. Several countries in Latin America, such as Brazil, Venezuela, and Mexico, have significant oil reserves and are major crude oil producers. The increasing demand for energy in the region has led to an increase in oil production, which, in turn, has boosted the demand for Artificial Lift market.

Additionally, the growing need to increase the efficiency of oil production and reduce the downtime of oil wells has also contributed to the growth of the Artificial Lift market in the region. The governments of several Latin American countries have also taken initiatives to increase oil production, which is expected to drive further the demand for Artificial Lift in the region. Furthermore, the presence of major oil and gas companies in the area has also contributed to the growth of the LATAM Artificial Lift market.

Competitive Insight

The major latin america artificial lift market market players include National-Oilwell Varco, Inc., Schlumberger Limited, Novomet Group, Halliburton Company, Weatherford International Ltd, Baker Hughes Company, Borets Company Llc, General Electric Co., Dover Artificial Lift, Llc, Occidental Petroleum Corporation and Novomet Oil Services Holding Ltd, Tenaris S.A., Borets International Limited, Kudu Industries Inc.

Recent Developments

- In October 2017, Dover Artificial Lift completed the acquisition of PCP Oil Tools in Argentina, which enabled the company to expand its operations in the San Jorge Basin by taking over the local firm.

- In July 2017, Halliburton Company declared the procurement of Summit ESP, a full electric submersible pump (ESP) technology and services provider. The inclusion of Summit's artificial lift solutions and remarkable customer service is anticipated to reinforce Halliburton's artificial lift portfolio and cater to its customers worldwide.

Latin America Artificial Lift Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 825.54 million |

|

Revenue forecast in 2032 |

USD 1,208.32 million |

|

CAGR |

4.3% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Mechanism, By Type, By Well Type, By Application, By Country |

|

Key companies |

National-Oilwell Varco, Inc., Schlumberger Limited, Novomet Group, Halliburton Company, Weatherford International Ltd, Baker Hughes Company, Borets Company Llc, General Electric Co., Dover Artificial Lift, Llc, Occidental Petroleum Corporation and Novomet Oil Services Holding Ltd. |

FAQ's

The latin america artificial lift market report covering key segments are mechanism, type, well type, application, and region.

Latin America Artificial Lift market Size Worth $1,208.32 Million By 2032.

The latin america artificial lift market is expected to grow at a CAGR of 4.3% during the forecast period.

Latin America is leading the global market.

key driving factors in latin america artificial lift market are increasing investment in oil and gas infrastructure.