Luxury Jewelry Market Size, Share, & Industry Analysis Report

: By Raw Material (Gold, Platinum, Diamond, Gemstones, Precious Pearls, and Others), Product, Distribution Channel, End User, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5599

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

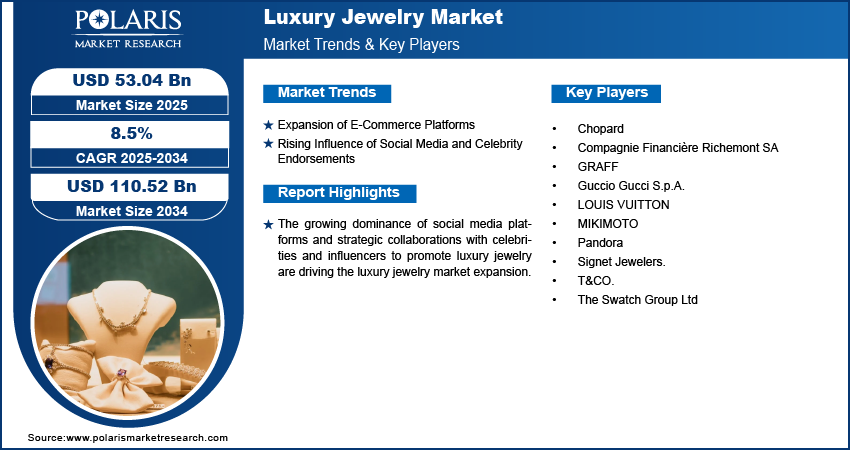

The luxury jewelry market size was valued at USD 48.93 billion in 2024 and is expected to reach USD 53.04 billion by 2025 and USD 110.52 billion by 2034, exhibiting a CAGR of 8.5% during 2025–2034. The rising consumer preference for modified and personalized jewelry is reshaping luxury jewelry market trends, with brands offering tailored designs that cater to individual tastes. Additionally, the growing demand for ethically sourced gemstones and sustainable production processes is driving market demand, as environmentally conscious consumers prioritize transparency and responsibility in luxury purchases.

Key Insights

- The gold segment led the market in 2024, driven by its timeless cultural value, high resale potential, and status as a safe-haven asset. Strong consumer trust and demand for investment-grade pieces further support its dominance.

- The offline segment dominated the luxury jewelry market in 2024, fueled by consumers' preference for personalized service, tactile evaluation of products, and immersive in-store experiences, which remain key drivers in high-value purchasing decisions.

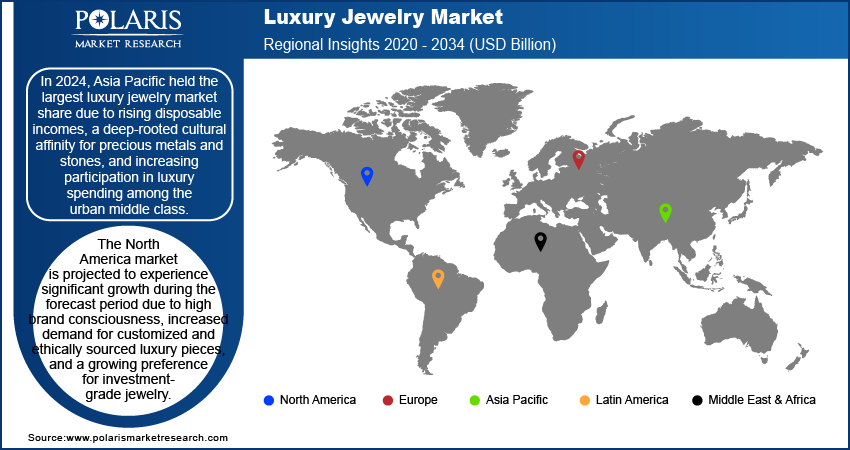

- Asia Pacific held the largest revenue share in 2024, supported by rising disposable income, cultural traditions favoring gold and gemstones, and growing luxury brand engagement among urban consumers, especially in India and China.

- North America's luxury jewelry market is set for strong growth, driven by increasing demand for ethically sourced, bespoke pieces, high brand loyalty, and rising interest in jewelry as a form of long-term financial investment.

Industry Dynamics

- Rising demand for premium, investment-grade accessories is driving adoption of luxury jewelry, as consumers seek timeless pieces that offer both aesthetic appeal and long-term value amid shifting fashion and wealth trends.

- Expanding use of luxury jewelry in personal gifting, weddings, and social expression is creating new growth opportunities, supported by rising disposable incomes, increasing brand consciousness, and growing demand for bespoke, ethically sourced designs.

- High product costs, market fragmentation, and growing concerns over authenticity and sustainability challenge broader adoption, particularly in emerging economies where luxury spending remains concentrated among limited consumer segments.

- Technological innovations in jewelry design, blockchain authentication, and omnichannel retailing are transforming the luxury jewelry market, enabling personalized experiences, enhanced traceability, and seamless consumer engagement across digital and physical platforms.

Market Statistics

- 2024 Market Size: USD 48.93 billion

- 2034 Projected Market Size: USD 110.52 billion

- CAGR (2025-2034): 8.5%

- Asia Pacific Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Luxury jewelry encompasses high-end, premium jewelry products crafted from precious metals, gemstones, and other rare materials. These products are often associated with exclusivity, craftsmanship, and brand heritage, targeting affluent consumers who value luxury, status, and personal expression. The market includes fine jewelry, bespoke designs, and branded collections sold through exclusive retail outlets, e-commerce platforms, and auctions. The increasing global population of high-net-worth individuals is contributing to the luxury jewelry market growth, as these individuals seek luxury goods such as jewelry as a symbol of wealth and status.

Market Dynamics

Expansion of E-Commerce Platforms

The rising penetration of e-commerce platforms is bridging the gap between high-end brands and digitally native consumers, which is significantly contributing to the luxury jewelry market development. According to the Census Bureau of the Department of Commerce, in the US, retail e-commerce sales for Q4 2024 were estimated at USD 352.9 billion. This shows a 22.1% increase as compared to Q3 2024. Digital storefronts are enhancing accessibility, especially for younger demographics who prefer the convenience and transparency offered through online channels. E-commerce platforms offer sophisticated digital experiences such as virtual try-ons, personalized recommendations, and AI-driven customer engagement. These innovations are elevating consumer confidence in purchasing high-value items online, resulting in higher transaction volumes and broader market penetration. The ease of global access through online platforms is reshaping traditional retail models, enabling brands to tap into emerging markets and expand the market across new geographic and socioeconomic segments.

Rising Influence of Social Media and Celebrity Endorsements

The growing dominance of social media platforms and strategic collaborations with celebrities and influencers for advertising products are reshaping market trends. Highly curated digital campaigns, influencer-driven storytelling, and real-time content dissemination are amplifying brand visibility and emotional resonance. This trend is accelerating consumer engagement, driving aspirational value, and reinforcing brand authenticity. Targeted influencer marketing and celebrity endorsements serve as powerful tools to shape purchasing decisions, particularly among Gen Z and millennial audiences. The integration of shoppable content on platforms such as Instagram and TikTok is facilitating seamless consumer journeys, boosting demand for luxury jewelry, and opening new channels for growth that align with evolving consumer behavior.

Segment Insights

By Raw Material Outlook

The global luxury jewelry market segmentation, based on raw material, includes gold, platinum, diamond, gemstones, precious pearls, and others. In 2024, the gold segment accounted for the largest market share due to its enduring cultural significance, high liquidity, and established status as a symbol of prestige. Consumer preferences for traditional yet timeless designs continue to favor gold over other materials, especially in markets where gold is deeply embedded in social and ceremonial practices. The market statistics reflect a consistent consumer inclination toward gold jewelry, particularly in bridal and heritage collections. Leading brands are also innovating gold craftsmanship using advanced design techniques, increasing product desirability and contributing to the demand for gold jewelry across both established and emerging economies.

The platinum segment is projected to witness the highest CAGR over the forecast period due to growing consumer interest in rare and hypoallergenic materials. Its unique aesthetic appeal, marked by a silvery-white luster and superior durability, caters to the preferences of affluent buyers seeking exclusivity. The expansion of this segment is being further propelled by the increasing use of platinum in contemporary bridal collections and high-end bespoke designs. Additionally, marketing strategies emphasizing platinum’s purity and strength are influencing purchasing behavior, particularly among younger consumers inclined toward minimalism and individuality, thereby enhancing the platinum segment’s share in luxury jewelry market revenue.

By Distribution Channel Outlook

The market segmentation, based on distribution channel, includes online and offline. In 2024, the offline segment dominated the luxury jewelry market share as experiential retail remains a critical factor in consumer decision-making. The ability to physically inspect high-value items, receive personalized consultations, and experience brand exclusivity in store contributes significantly to the purchase of luxury jewelry through offline channels. Flagship stores and boutique environments reinforce customer trust and play an essential role in maintaining brand image and client relationships. Tailored services such as custom design, private viewings, and in-person events offer a value proposition difficult to replicate online, thus sustaining the prominence of offline sales in overall market.

The online segment is expected to register a higher CAGR during the forecast period. Digital transformation across the luxury sector is enabling a rapid shift toward e-commerce, driven by evolving consumer behavior and technological innovation. Luxury jewelry purchases on online channels are increasing due to the availability of virtual try-on tools, high-resolution product visualization, and secure digital payment options. Younger, tech-savvy consumers are increasingly comfortable making significant purchases online, particularly when aided by AI-powered customer service and transparent return policies. Social commerce integrations and influencer partnerships further enhance reach and trust. These advancements are transforming the digital customer journey, fueling market growth through online platforms at an accelerated pace.

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific held the largest share of the market revenue due to rising disposable incomes, a deep-rooted cultural affinity for precious metals and stones, and increasing participation in luxury spending among the urban middle class. For instance, according to the India Brand Equity Foundation, India's per capita disposable income has steadily increased, from USD 2,110 in 2019 to USD 2,540 in 2023. Projections indicate that it will reach USD 4,340 by 2029. Strategic brand localization and exclusive product launches tailored to regional tastes are elevating consumer engagement. The proliferation of premium retail spaces in metropolitan hubs and the influence of traditional gifting practices, particularly in countries such as China and India, are strengthening market dynamics. Additionally, strong consumer response to high-profile marketing campaigns and limited-edition collections highlighted the region’s leadership in the market for 2024.

The North America luxury jewelry market is projected to experience significant growth during the forecast period due to high brand consciousness, increased demand for customized and ethically sourced luxury pieces, and a growing preference for investment-grade jewelry. The market is benefiting from strong digital engagement, where luxury brands leverage omnichannel strategies and data-driven personalization to enhance the customer journey. Rising trend among the men’s jewelry and sustainability-driven innovation, including CVD lab-grown diamonds and rare earth metal recycling, is also gaining traction among environmentally conscious consumers. A surge in premium gifting occasions and rising millennial and Gen Z spending power are further positioning North America as a key contributor to future market acceleration.

Key Players & Competitive Analysis Report

The competitive landscape of the luxury jewelry market is characterized by intense brand positioning, high-margin offerings, and aggressive market expansion strategies. Industry analysis reveals a surge in mergers and acquisitions aimed at consolidating portfolios, extending global retail networks, and gaining access to niche customer segments. Strategic alliances between luxury houses and high-end fashion designers are reshaping the product narrative through curated capsule collections and co-branded initiatives. Joint ventures are being pursued to enter emerging markets more effectively, leveraging local cultural insights and distribution advantages. Post-merger integration efforts are increasingly focused on unifying brand identity and optimizing supply chain efficiencies to preserve exclusivity while scaling production. Technology advancements, particularly in blockchain for traceability and AI-powered customization engines, are being adopted to enhance product authenticity and customer engagement. Digital launches, virtual try-on features, and direct-to-consumer e-commerce platforms are also contributing to competitive differentiation. Furthermore, investments in sustainable practices, such as recycled metals and lab-grown gemstones, are becoming a key factor in consumer loyalty and regulatory compliance. The market is evolving into a more tech-enabled, sustainability-conscious, and experience-driven sector, where competitive edge relies on heritage, craftsmanship, and on innovation, agility, and brand storytelling across digital and physical touchpoints.

Guccio Gucci S.p.A., commonly known as Gucci, is engaged in the design, production, and distribution of luxury fashion and accessories. Founded in 1921 by Guccio Gucci in Florence, Italy, the company specializes in high-end products such as handbags, ready-to-wear apparel, footwear, jewelry, watches, and home décor. The company's product portfolio also includes fragrances and cosmetics under the brand name Gucci Beauty. The company is headquartered in Florence, Italy, and operates 529 stores globally. It serves customers worldwide through its physical stores and online platforms. As a subsidiary of the French conglomerate Kering, Gucci maintains a strong presence in Europe, North America, Asia Pacific, and other regions.

The Swatch Group Ltd is engaged in the manufacture and sale of luxury watches, jewelry, watch movements, and components. Founded in 1983 by Nicolas G. Hayek through the merger of ASUAG and SSIH, the company is headquartered in Biel/Bienne, Switzerland. The Swatch Group’s product portfolio includes renowned brands such as Omega, Longines, Tissot, Breguet, Blancpain, and Swatch. The company also operates retail brands such as Tourbillon and Hour Passion. In addition to luxury goods, it provides electronic systems for watchmaking and other industries. The Swatch Group serves as an official timekeeper for major international sports events and has a presence in over 50 countries. The company's operations span manufacturing to retail distribution across various regions worldwide.

List of Key Companies

- Chopard

- Compagnie Financière Richemont SA

- GRAFF

- Guccio Gucci S.p.A.

- LOUIS VUITTON

- MIKIMOTO

- Pandora

- Signet Jewelers.

- T&CO.

- The Swatch Group Ltd

Industry Developments

In July 2024, Marie Claire USA collaborated with luxury jewelry brand Tacori for the WORTH it content series, exploring the brand's heritage that began three generations ago. The story highlights the secret creation of wedding rings for a family friend in communist Romania

In December 2024, Jil Sander launched its first Fine Jewelry collection, strengthening its position within OTB’s luxury portfolio.

Market Segmentation

By Raw Material Outlook (Revenue – USD Billion, 2020–2034)

- Gold

- Platinum

- Diamond

- Gemstones

- Precious Pearls

- Others

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Necklace

- Ring

- Bracelet

- Earring

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Online

- Offline

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Male

- Female

- Children

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 48.93 billion |

|

Market Size Value in 2025 |

USD 53.04 billion |

|

Revenue Forecast in 2034 |

USD 110.52 billion |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 48.93 billion in 2024 and is projected to grow to USD 110.52 billion by 2034.

The global market is projected to register a CAGR of 8.5% during the forecast period.

In 2024, Asia Pacific held the largest market share due to rising disposable incomes, a deep-rooted cultural affinity for precious metals and stones, and increasing participation in luxury spending among the urban middle class.

A few of the key players in the market are Chopard, Compagnie Financière Richemont SA, GRAFF, Guccio Gucci S.p.A., LOUIS VUITTON, MIKIMOTO, Pandora, Signet Jewelers, T&CO., and The Swatch Group Ltd.

In 2024, the gold segment accounted for the largest market share due to its enduring cultural significance, high liquidity, and established status as a symbol of prestige.

In 2024, the offline segment accounted for a larger share of the market as experiential retail remains a critical factor in consumer decision-making.