Mackerel Market Size, Share, Trends, & Industry Analysis Report

: By Form (Frozen and Canned), By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 112

- Format: PDF

- Report ID: PM3560

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

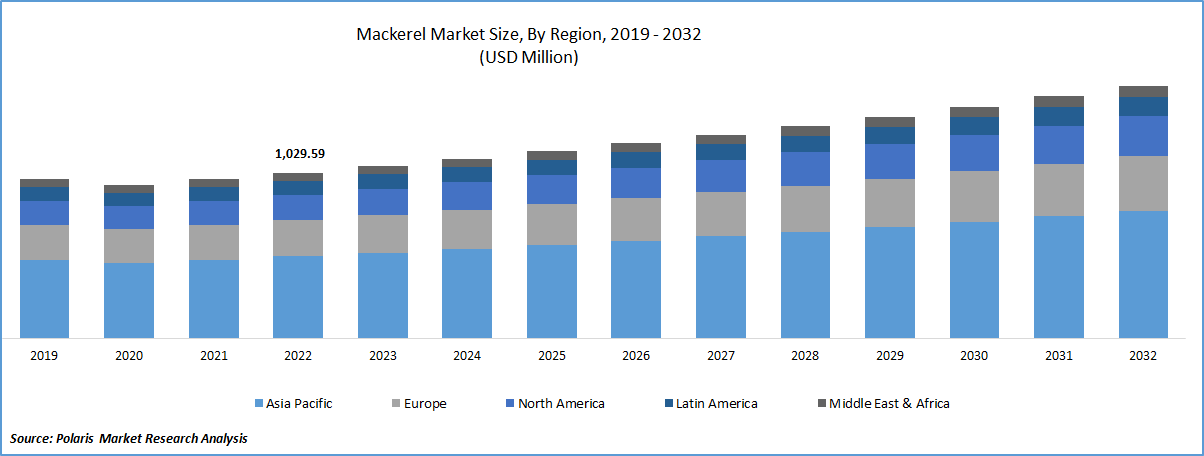

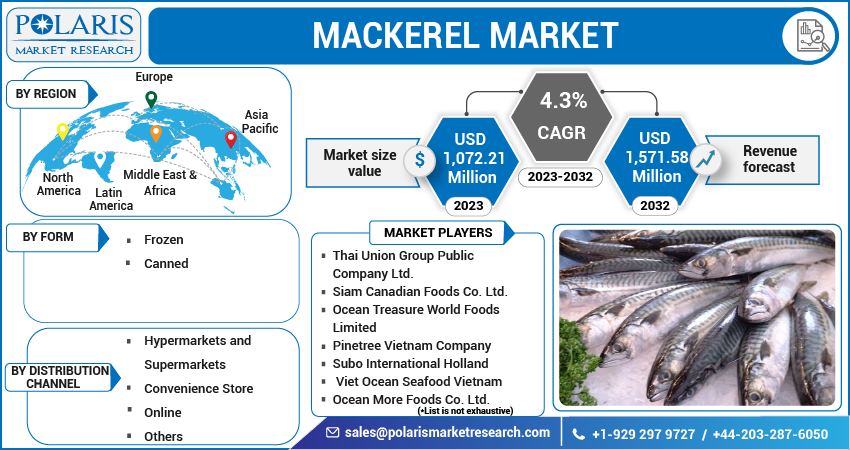

The mackerel market size was valued at USD 1,135.98 million in 2024 and is projected to exhibit a CAGR of 4.7% during 2025–2034. The growth is driven by rising health awareness and expansion of retail channels.

The industry encompasses the harvesting, processing, and distribution of various mackerel species, primarily for human consumption but also as a component in fishmeal and oil production. Mackerel is valued for its rich omega-3 fatty acid content and versatility in culinary applications, available in fresh, frozen, canned, and smoked forms. The increasing awareness of the health benefits associated with mackerel, particularly its high omega-3 fatty acids and protein content, are driving demand among health-conscious consumers. The rising global population and urbanization are further increasing the demand for convenient, ready-to-eat, and shelf-stable food products, further fueling expansion.

The growing global seafood consumption, particularly in emerging areas, and the expanding retail distribution networks are driving the growth. The increasing preference for sustainable seafood is prompting companies to focus on responsible sourcing and eco-friendly packaging. The industry is also witnessing a shift towards value-added products, such as mackerel in oil and tomato sauce. Emerging regions, like China and India, are experiencing growing demand, while online sales channels are further expanding accessibility.

Industry Dynamics

Rising Health Awareness

The consumer awareness regarding the health benefits of seafood, particularly oily fish such as mackerel is rising. Mackerel is a rich source of omega-3 polyunsaturated fatty acids, which are known to have positive effects on cardiovascular health, brain function, and reducing inflammation. A study from Case Western Reserve University in March 2025, revealed that 85% of the global population is deficient in omega-3 fatty acids. Mackerel is widely recognized as an excellent source of these essential nutrients, which are crucial for brain, eye, and cardiovascular health. This large number has raised the awareness among the general population due to which the adoption of healthy and nutrient rich food is increasing, thereby driving the growth.

Expansion of Retail Channels

The expansion of retail channels, including supermarkets, hypermarkets, convenience stores, and online platforms, has significantly improved the accessibility of mackerel products to a wider consumer base. These channels offer various forms of mackerel, such as fresh, frozen, canned, and processed, catering to different consumer preferences and convenience needs. In March 2025, US retail seafood sales saw an increase, with frozen seafood sales up 5.1% year over year and ambient seafood sales up 4.4%. This indicates a growing consumer propensity to purchase seafood, including mackerel, through retail avenues. Thus, expansion of retail channel is driving the growth.

Increasing Global Seafood Consumption

the world's population and disposable incomes is rising, particularly in developing economies due to which the demand for protein sources, including seafood, is on the rise. As per FAO SOFIA Report 2024, Global fisheries and aquaculture production surged to a new record high of 223.2 million tons in 2022, a 4.4% increase from 2020. This reflects the overall increasing availability and demand for aquatic foods. This rising sea food consumption is driving the expansion as to meet this high consumption manufacturers are launching innovative products in the local markets.

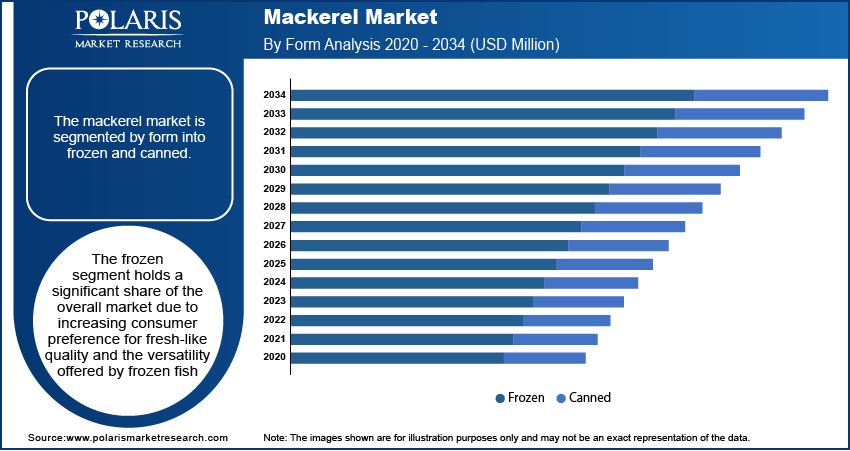

Segmental Insights

Form Analysis

The segmentation based on form include frozen and canned. The frozen segment dominated with largest share in 2024 due to increasing consumer preference for fresh-like quality and the versatility offered by frozen fish. Advances in freezing technologies have enabled better preservation of the taste, texture, and nutritional content of mackerel, making it an appealing alternative to fresh options, especially in regions with limited access to fresh seafood or during off-seasons. Additionally, the rising demand from the food service industry, including restaurants and catering services, for consistent quality and supply of mackerel is further boosting the growth of the frozen segment.

The canned segment is anticipated to exhibit the highest growth rate in the coming years attributed to several factors, including its affordability, long shelf life, and convenience for consumers. Canned mackerel offers a readily available source of protein and omega-3 fatty acids without the need for immediate cooking or refrigeration. This makes it a popular choice for households seeking budget-friendly and easily storable food options. Furthermore, the well-established distribution channels and widespread availability of canned mackerel like canned tuna fish in retail outlets drives the segment growth.

Distribution Channel Analysis

The segmentation based on distribution channel include hypermarkets & supermarkets, convenience store, online, and others. The hypermarkets & supermarkets segment accounts for the largest share in 2024 due to the wide variety of products offered under one roof, including fresh, frozen, and canned options, attracting a large consumer base. These retail formats benefit from high foot traffic and the ability to cater to diverse consumer needs through promotional activities and strategic product placements. The established infrastructure and widespread presence of hypermarkets and supermarkets in both urban and suburban areas further boost the segment growth.

The online distribution channel is poised to experience the highest growth rate. The increasing adoption of e-commerce and the growing preference for online grocery shopping are driving this expansion. Online platforms offer consumers the convenience of purchasing mackerel from the comfort of their homes, with a wide selection of products and the ease of home delivery. The ability to compare prices, access a broader range of brands, and the increasing trust in online transactions are contributing to the rapid growth of this segment. Furthermore, the online channel allows for direct-to-consumer sales and facilitates penetration in regions where traditional retail infrastructure may be less developed, thereby driving the segment growth.

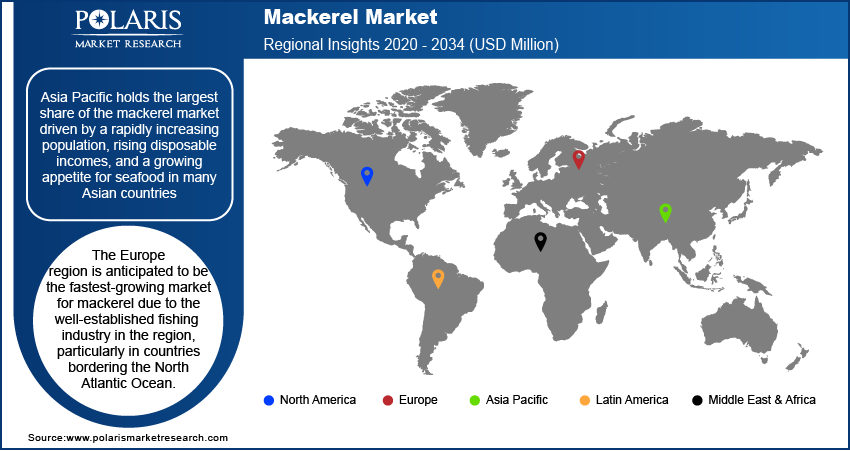

Regional Analysis

Mackerel Market in Asia Pacific

The Asia Pacific mackerel market recorded largest share in 2024. This growth is fueled by a rapidly increasing population, rising disposable incomes, and a growing appetite for seafood in many Asian countries. The expanding middle class and changing dietary habits are leading to higher consumption of fish, including mackerel. Moreover, the development of modern retail infrastructure and the increasing penetration of online sales channels in the Asia Pacific region are improving the accessibility of products. The presence of significant fishing activities in the region and the growing demand for affordable protein sources further drives the industry growth in the region.

Mackerel Market in Europe

Europe mackerel market is expected to record significant growth due to the well-established fishing industry in the region, particularly in countries bordering the North Atlantic Ocean. Mackerel is a traditional part of the diet in many European countries, supported by robust processing and distribution infrastructure. Furthermore, the high awareness of the health benefits of oily fish and the strong demand for both fresh and processed products contribute to Europe's leading position. The presence of stringent quality control measures and established retail channels further solidify its dominance in terms of size.

Key Players and Competitive Insights

Some of the major players in the mackerel market include Bumble Bee Seafoods (FCF Co., Ltd.), Starkist Co. (Dongwon Industries Co., Ltd.), Chicken of the Sea International (Thai Union Group PCL), Connors Bros. Clover Leaf Seafoods Company (Centre Partners), Frinsa del Noroeste S.A., Conservas Selectas de Galicia S.L. (Grupo Jealsa Rianxeira), Hottlet Frozen Foods NV, Leroy Seafood Group ASA, Austevoll Seafood ASA, Dongwon F&B Co., Ltd., and Tri Marine International (Bolton Group S.r.l.).

The competitive landscape is characterized by a mix of large multinational corporations and smaller regional players. Competition is based on factors such as product variety, pricing strategies, brand recognition, distribution network efficiency, and sustainability initiatives. Companies are continuously focusing on product innovation, such as introducing new flavors and packaging formats, to cater to evolving consumer preferences. The penetration strategies often involve expanding into new geographical regions and strengthening relationships with retail partners. Additionally, there is increasing emphasis on sustainable sourcing and environmentally friendly practices, which are becoming key differentiators among participants.

List of Key Companies in Mackerel Industry:

- Austevoll Seafood ASA

- Bumble Bee Seafoods (FCF Co., Ltd.)

- Chicken of the Sea International (Thai Union Group PCL)

- Connors Bros. Clover Leaf Seafoods Company (Centre Partners)

- Conservas Selectas de Galicia S.L. (Grupo Jealsa Rianxeira)

- Dongwon F&B Co., Ltd. (Dongwon Industries Co., Ltd.)

- Frinsa del Noroeste S.A.

- Hottlet Frozen Foods NV

- Leroy Seafood Group ASA

- Starkist Co. (Dongwon Industries Co., Ltd.)

- Tri Marine International (Bolton Group S.r.l.)

Mackerel Industry Developments

- In October 2024, Bumble Bee Seafoods introduced several new convenience-focused seafood products, including flavored albacore tuna pouches and "Snack on the Run!" kits.

Mackerel Market Segmentation

By Form Outlook (Revenue – USD Million, 2020–2034)

- Frozen

- Canned

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Hypermarkets & Supermarkets

- Convenience Store

- Online

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Mexic

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest f Latin America

Mackerel Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,135.98 million |

|

Market Size Value in 2025 |

USD 1,186.53 million |

|

Revenue Forecast by 2034 |

USD 1,793.90 million |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The mackerel market has been segmented into detailed segments of form and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A successful growth and marketing strategy should emphasize the nutritional benefits, particularly the omega-3 content, to health-conscious consumers. Highlighting the versatility of mackerel in various culinary applications through recipe suggestions and online content can also drive demand. Expanding distribution channels, especially through e-commerce platforms, will improve arket penetration and reach a wider audience. Collaborations with retailers for promotional campaigns and focusing on sustainable sourcing practices to appeal to environmentally aware consumers are crucial. Furthermore, exploring value-added product innovations, such as flavored or ready-to-eat mackerel options, can cater to convenience-seeking demographics and fuel development.

FAQ's

The global size was valued at USD 1,135.98 million in 2024 and is projected to grow to USD 1,793.90 million by 2034.

The market is projected to register a CAGR of 4.7% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

Some of the major players include Bumble Bee Seafoods (FCF Co., Ltd.), Starkist Co. (Dongwon Industries Co., Ltd.), Chicken of the Sea International (Thai Union Group PCL), Connors Bros. Clover Leaf Seafoods Company (Centre Partners), Frinsa del Noroeste S.A., Conservas Selectas de Galicia S.L. (Grupo Jealsa Rianxeira), Hottlet Frozen Foods NV, Leroy Seafood Group ASA, Austevoll Seafood ASA, Dongwon F&B Co., Ltd., and Tri Marine International (Bolton Group S.r.l.).

The frozen segment accounted for the larger share in 2024.

Following are some of the trends: ? Increasing Health Awareness: Consumers are becoming more aware of the nutritional benefits of mackerel, particularly its high omega-3 fatty acid content, driving demand for this healthy food option. ? Growing Demand for Convenience: There's a rising preference for convenient and ready-to-eat mackerel products like canned mackerel and mackerel-based snacks, catering to busy lifestyles.

Mackerel is a common name for a group of streamlined, fast-swimming fish that mostly belong to the family Scombridae. These fish are found in temperate and tropical seas around the world, often living in coastal or offshore oceanic environments. They are related to tunas fish and bonitos.