Mexico Plastic Additive Market Size, Share, & Trends Analysis Report

: By Product, By Plastic Type (Commodity Plastics, Engineering Plastics, and High Performance Plastics), By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM5681

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

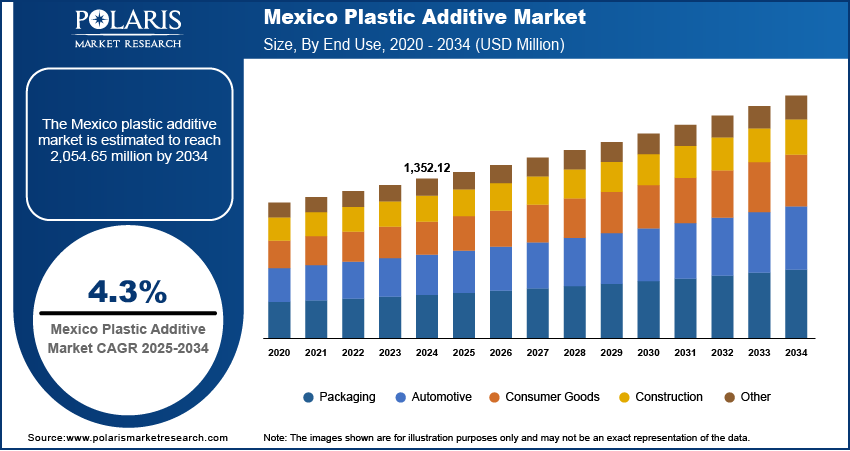

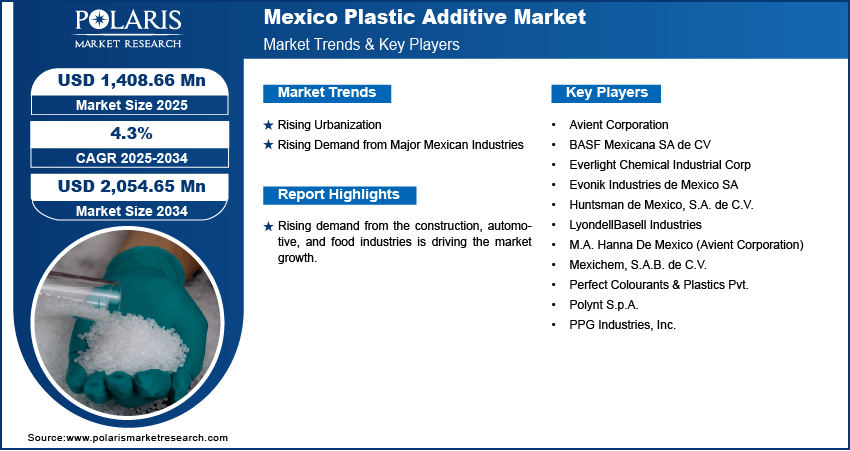

The Mexico plastic additive market size was valued at USD 1,352.12 million in 2024 and is projected to exhibit a CAGR of 4.3% during 2025–2034. Rising demand from the construction, automotive, and food industries is driving the market growth.

Key Insights

- Flame retardants are growing fast due to rising safety regulations in the construction, automotive, and electronics sectors.

- Commodity plastics such as PE, PP, and PVC dominate due to their low cost, versatility, and widespread use in daily products.

Industry Dynamics

- Strict regulations in Mexico require safer, more durable plastics, boosting demand for additives that enhance fire resistance and hygiene standards.

- Growth in automotive production increases the need for heat-resistant, lightweight plastic parts, driving the use of performance-enhancing plastic additives.

- Expanding construction projects need durable plastic components, creating a rising demand for additives that improve weather and structural resistance.

- Large-scale industrial use of plastic demands cost-effective additives to meet safety, flexibility, and durability standards across various sectors.

- High raw material prices and regulatory scrutiny on chemical safety may limit the adoption of plastic additives and increase production costs for manufacturers.

Market Statistics

2024 Market Size: USD 1,352.12 million

2034 Projected Market Size: USD 2,054.65 million

CAGR (2025–2034): 4.3%

To Understand More About this Research: Request a Free Sample Report

Plastic additives are substances added to polymers during manufacturing to improve their properties or processing characteristics, such as flexibility, durability, color, or flame resistance. These additives help tailor plastics for specific applications by improving performance, appearance, or longevity.

Mexico has stringent rules for plastic products used in homes, buildings, cars, and food packaging. These rules require plastics to be safe, durable, and nontoxic. Additives help plastics meet these requirements. For example, flame-retardant additives are needed in car parts or building materials, and antimicrobial coating additives are used in food packaging. Companies are including more additives in their products to meet these legal and industry standards, as safety and quality standards become more important. This leads to steady demand for a wide range of plastic additives across the country.

Mexico is one of the largest vehicle manufacturing hubs in the Americas. According to the International Trade Organization, in 2023, the automotive industry in Mexico contributed 18% of the manufacturing GDP. The automotive industry is using more plastic parts to make vehicles lighter and more fuel-efficient. Additives play a major role in ensuring these plastic parts are strong, heat-resistant, and long-lasting. For example, under-the-hood parts or interior panels need special additives to perform well in high temperatures or sunlight. The automotive industry drives strong demand for plastic additives as more vehicles are manufactured in Mexico, and as global demand for fuel-efficient cars rises, thereby driving the Mexico plastic additive market growth.

Market Dynamics

Rising Urbanization

Mexico is rapidly growing, with more cities expanding and new buildings being constructed. According to the World Bank Group, as of 2023, 82% of the population in Mexico lives in urban areas. The rising urbanization is creating a high demand for construction materials, many of which are made using plastics, such as pipes, cables, and insulation. Plastic additives help improve these materials by making them stronger, more flexible, or more weather-resistant. The need for reliable construction materials is increasing as more houses, commercial buildings, and infrastructure projects are built, thereby fueling growth.

Rising Demand from Major Mexican Industries

Many industries such as packaging, construction, and automotive are growing in Mexico. According to Data Mexico, as of the third quarter of 2024, 8.54 million people were employed in the construction industry. These industries use a lot of plastic products, and to make these plastics stronger, safer, or more flexible, additives are required. For example, packaging needs plastics that last longer and protect contents, while the automotive industry needs lightweight and durable parts such as automotive plastic fasteners. Additives help meet these needs by improving plastic properties such as flexibility, strength, and heat resistance. The demand for plastic additives is increasing as more products are made using plastics.

Mexico Plastic Additive Market Segment Analysis

Market Assessment by Product

The flame retardants segment is expected to witness the fastest growth during the forecast period, driven by the increasing use of flame-resistant plastics in construction, automotive, and electronics industries to meet safety standards and fire regulations. Manufacturers are using more flame retardant additives to improve fire resistance in plastic components as buildings and vehicles require safer materials, thereby driving the segment growth.

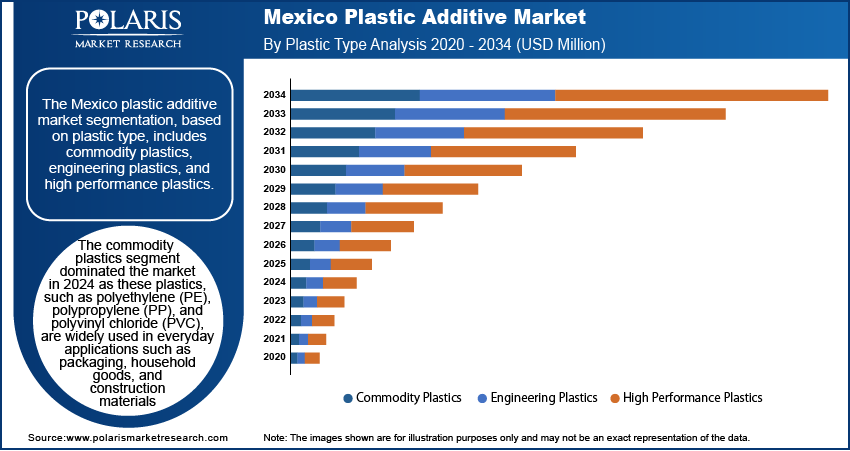

Market Evaluation by Plastic Type

The commodity plastics segment dominated in 2024. These plastics, such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), are widely used in everyday applications such as packaging, household goods, and construction materials. Their large-scale production, cost-effectiveness, and versatility make them highly popular among manufacturers. The high demand for affordable and functional plastic products across various industries in Mexico contributed to the strong dominance of commodity plastics.

Key Players and Competitive Analysis

The Mexico plastic additive market is undergoing a significant transformation, driven by a wave of innovation and the desire for differentiation among industry players. Major global firms are leveraging their extensive research and development capabilities, along with advanced technologies, to maintain competitive advantage in this increasingly dynamic environment. These organizations are actively pursuing strategic initiatives, including mergers and acquisitions, partnerships, and collaborative ventures, aimed at improving their product portfolios and penetrating new segments.

Emerging companies are making notable strides by introducing innovative products tailored to meet the specific demands of various industry niches. The continuous advancement of product technology and functionality intensifies the competitive landscape, compelling all participants to consistently adapt and elevate their offerings to stay relevant. This relentless evolution drives differentiation and fosters a more complex ecosystem where agility and responsiveness are paramount. A few major players are Everlight Chemical Industrial Corp; Perfect Colourants & Plastics Pvt.; Polynt S.p.A.; Mexichem, S.A.B. de C.V. (Orbia Advance Corporation S.A.B. de CV); BASF Mexicana SA de CV; Evonik Industries de Mexico SA; M.A. Hanna De Mexico (Avient Corporation); Avient Corporation; LyondellBasell Industries; Huntsman de Mexico, S.A. de C.V.; and PPG Industries, Inc.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products. BASF offers Plastic Additives with advanced solutions designed to improve the performance, durability, and sustainability of plastics, supporting circularity and resource efficiency across diverse applications with specialized stabilization and protection technologies

Evonik Industries AG is a specialty chemicals company headquartered in Essen, Germany, employing approximately 32,000 people and operating in over 100 countries. Evonik’s product portfolio includes surfactants, polymers, resins, additives, and a range of specialty chemicals. These products are used in various industries, including agriculture, renewable energy, paints and coatings, food and beverage, pharmaceuticals, personal care, plastics, automotive, and construction. The company’s business is organized into two main segments. The custom solutions segment focuses on developing customized, innovation-driven products for specific markets, such as additives for paints, coatings, cosmetics, and pharmaceuticals. The advanced technologies segment covers efficiency-driven businesses that require high technological expertise, such as high-performance polymers and hydrogen peroxide. Evonik’s operations are geographically diversified. In Europe, the company has a strong presence in Germany, Belgium, and France, among other countries. In North America, it operates in the US, Canada, and Mexico. Asia Pacific includes facilities and offices in China, Japan, India, Singapore, and Australia. In Central & South America, Evonik is present in countries such as Brazil, Argentina, and Chile. The company also operates in the Middle East & Africa, with locations in Saudi Arabia, South Africa, and the UAE. Evonik offers a broad range of additives and masterbatches for plastics, enhancing performance, processing, and recyclability across industries such as automotive, packaging, electronics, and consumer goods.

Key Companies

- Avient Corporation

- BASF Mexicana SA de CV

- Everlight Chemical Industrial Corp

- Evonik Industries de Mexico SA

- Huntsman de Mexico, S.A. de C.V.

- LyondellBasell Industries

- M.A. Hanna De Mexico (Avient Corporation)

- Mexichem, S.A.B. de C.V. (Orbia Advance Corporation S.A.B. de CV)

- Perfect Colourants & Plastics Pvt.

- Polynt S.p.A.

- PPG Industries, Inc.

Mexico Plastic Additive Industry Developments

In February 2025, SACO AEI Polymers announced expansion in the US, Mexico, and India amid rising demand for specialty compounds, with new facilities and capacity increases established to serve globally.

In July 2024, Avient opened a new ColorWorks Design and Technology Center in Mexico City to support early-stage plastic product development, offering CMF consultation, rapid prototyping, and global color consistency.

Mexico Plastic Additive Market Segmentation

By Product Outlook (Revenue USD Million, 2020–2034)

- Plasticizers

- Flame Retardants

- Impact Modifiers

- Antioxidants

- Antimicrobials

- UV Stabilizers

- Other

By Plastic Type Outlook (Revenue USD Million, 2020–2034)

- Commodity Plastics

- Engineering Plastics

- High Performance Plastics

By End Use Outlook (Revenue USD Million, 2020–2034)

- Packaging

- Automotive

- Consumer Goods

- Construction

- Other

Mexico Plastic Additive Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,352.12 million |

|

Market Size Value in 2025 |

USD 1,408.66 million |

|

Revenue Forecast in 2034 |

USD 2,054.65 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Mexico market size was valued at USD 1,408.66 million in 2024 and is projected to grow to USD 2,054.65 million by 2034.

The market is projected to register a CAGR of 4.3% during the forecast period.

A few key players in the market are Everlight Chemical Industrial Corp; Perfect Colourants & Plastics Pvt.; Polynt S.p.A.; Mexichem, S.A.B. de C.V. (Orbia Advance Corporation S.A.B. de CV); BASF Mexicana SA de CV; Evonik Industries de Mexico SA; M.A. Hanna De Mexico (Avient Corporation); Avient Corporation; LyondellBasell Industries; Huntsman de Mexico, S.A. de C.V.; and PPG Industries, Inc.

The commodity plastics segment dominated the market in 2024 as these plastics, such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), are widely used in everyday applications such as packaging, household goods, and construction materials.

The flame retardants segment is expected to witness the fastest growth during the forecast period, driven by the increasing use of flame-resistant plastics in construction, automotive, and electronics industries.