mHealth Apps Market Size, Share, Trends, Industry Analysis Report

By Type (Medical Apps, Fitness Apps), By Platform, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5899

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

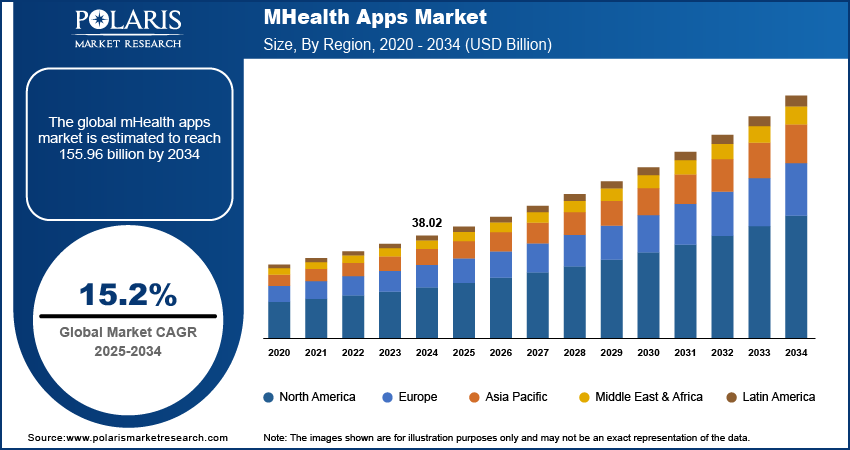

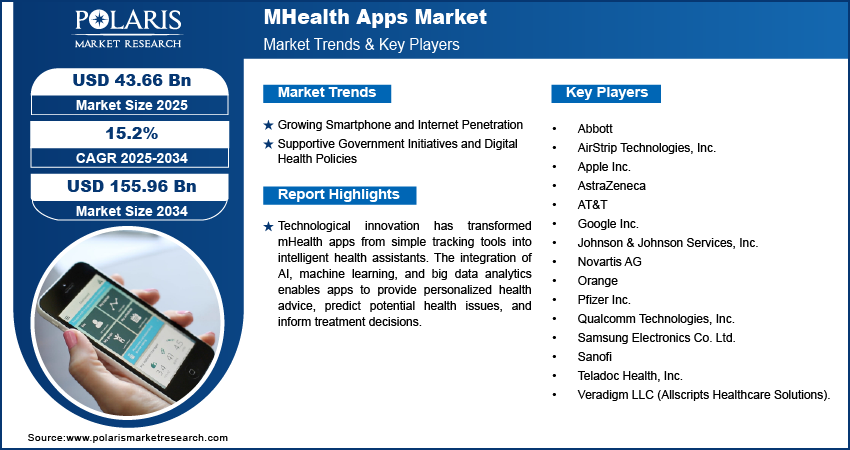

The global mHealth apps market size was valued at USD 38.02 billion in 2024, growing at a CAGR of 15.2% from 2025 to 2034. The market growth is driven by growing smartphone and internet penetration, and rising supportive government initiatives and digital health policies.

An mHealth app is a mobile application designed to support medical and public health practices through smartphones or tablets. It enables users to access healthcare services, track health data, manage conditions, and communicate with healthcare providers remotely.

More people are becoming proactive about managing their health, which has increased demand for tools that support wellness and disease prevention. mHealth apps offer features such as calorie counting, heart rate monitoring, sleep tracking, and stress management, helping users stay informed and engaged with their health. The ease of accessing these features through mobile phones has made self-care more approachable and routine. The popularity of health apps is rising, as users are becoming more aware about the benefits of early intervention and regular health tracking. This awareness shift plays a key role in fueling the mHealth app demand globally.

To Understand More About this Research: Request a Free Sample Report

Technological innovation has transformed mHealth apps from simple tracking tools into intelligent health assistants. The rising integration of AI, machine learning, and big data analytics enables apps to provide personalized health advice, predict potential health issues, and guide treatment decisions. Wearables such as fitness trackers and smartwatches improve data collection, allowing real-time health monitoring. AI-powered chatbots provide instant responses, symptom checks, and triage guidance. These smart capabilities make mHealth apps more interactive, accurate, and user-friendly. These advancements are expected to attract more users and healthcare providers to adopt mHealth solutions as technology continues to evolve, thereby driving the growth.

Industry Dynamics

Growing Smartphone and Internet Penetration

The rapid growth of smartphone users and better internet access has significantly fueled the adoption of mHealth apps. According to Apple Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022. Health services through apps have become more accessible and convenient as more people worldwide own mobile devices. In both urban and rural areas, individuals use smartphones to track fitness, consult doctors, and manage health records. Internet penetration has made it easier to download and use these apps, even in developing regions. This widespread connectivity ensures that health support is available 24/7, helping bridge the gap between healthcare services and underserved populations, thereby boosting the global mHealth app demand.

Supportive Government Initiatives and Digital Health Policies

Governments and healthcare authorities are increasingly investing in digital health technologies, including mHealth apps, to modernize healthcare delivery. Policies that support telemedicine, electronic health records, and data interoperability are creating a favorable environment for the development of advanced mHealth apps. Initiatives such as India’s National Digital Health Mission and the U.S. HITECH Act aim to digitize patient care, encourage remote consultations, and reduce hospital overload. Many governments are further funding startups and partnering with tech companies to develop robust mobile health platforms. These supportive regulations and financial incentives are accelerating the adoption of mHealth apps across both public and private healthcare sectors, thereby driving the growth.

Segmental Insights

Type Analysis

The segmentation, based on type, includes medical app and fitness app. In 2024, the medical app segment dominated with a larger share as these apps support a wide range of functions, such as appointment booking, virtual consultations, medication reminders, chronic disease management, and telehealth services. Both patients and healthcare providers increasingly rely on medical apps to streamline services with the growing need for remote healthcare access and hospital digitization. Additionally, the rising burden of lifestyle-related diseases such as diabetes and hypertension has boosted demand for apps that offer ongoing monitoring and care, thereby driving the segment growth.

The fitness app segment is expected to experience significant growth during the forecast period as these apps allow users to track physical activity, monitor calories, plan workouts, and maintain healthier lifestyles. The rise in health consciousness, especially post COVID-19 pandemic, has encouraged people to actively engage in fitness routines using digital tools. Fitness apps are becoming more personalized and engaging with the integration of wearable devices and AI-based features. Their appeal to both casual users and serious fitness enthusiasts is further driving the segment growth.

Platform Analysis

The segmentation, based on platform, includes Android, iOS, and others. The iOS segment held the largest share in 2024, owing to the strong market presence of Apple devices and the brand’s emphasis on secure, health-integrated ecosystems. Apple HealthKit, Apple Watch integration, and the availability of premium health and fitness apps on iOS contributed to higher adoption among users. The platform’s reputation for privacy and security further makes it a preferred choice for handling sensitive medical data. Healthcare providers and developers prioritize iOS due to its affluent user base and consistent software environment, ensuring smooth performance of complex mHealth applications, thereby driving the segment growth.

The Android segment is expected to experience significant growth during the forecast period, due to its vast global user base and affordability. They are more accessible in developing countries with Android devices available across all price ranges, where mobile health adoption is on the rise. The flexibility of the Android platform further allows developers to create a wide variety of apps catering to different languages, health needs, and regional regulations. The Android smartphone penetration is increasing in emerging markets, driving the segment growth.

Regional Analysis

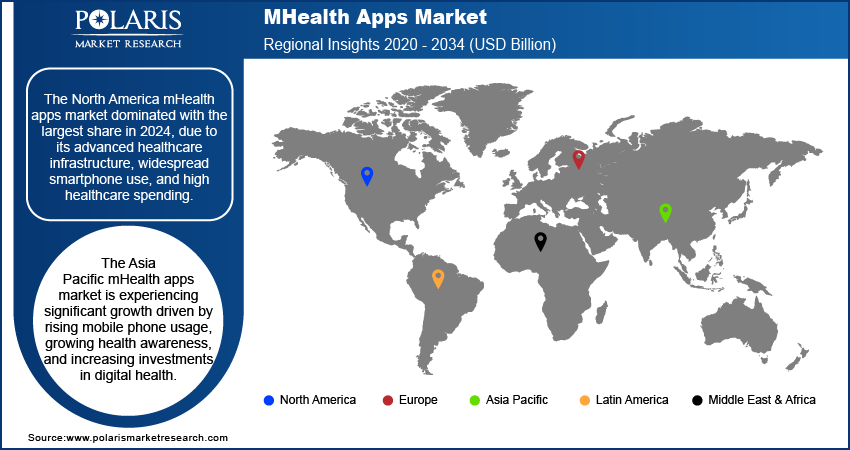

North America mHealth Apps Market Trends

The North America mHealth apps market dominated with the largest share in 2024, due to its advanced healthcare infrastructure, widespread smartphone use, and high healthcare spending. The region has embraced digital health tools, particularly for remote monitoring, chronic disease management, and telehealth services. The growing elderly population and rising demand for personalized care have further boosted mHealth adoption. Regulatory support from health agencies and strong investment in digital health startups contribute to continuous innovation. The region benefits from high awareness and a tech-savvy population, driving the adoption of personal health apps across North America.

U.S. mHealth Apps Market Insights

The mHealth apps market in the U.S. is expected to witness significant growth during the forecast period, as high smartphone penetration, supportive healthcare policies, and an increasing shift toward value-based care boost the adoption of digital health solutions. Consumers increasingly use medical and fitness apps for wellness tracking, virtual consultations, and chronic disease support. Additionally, the U.S. is home to leading health tech companies and startups that constantly innovate with AI, wearables, and telemedicine features. The strong focus on remote healthcare, especially post-pandemic, has cemented the U.S. as a global leader in mHealth app development and usage.

Asia Pacific mHealth Apps Market Overview

The mHealth apps market in Asia Pacific is projected to witness substantial growth during the forecast period, driven by rising mobile phone usage, growing health awareness, and increasing investments in digital health. Many countries in the region face healthcare access challenges, and mHealth apps offer a cost-effective way to bridge gaps in rural and urban care delivery. Governments are further supporting digital health initiatives through policy frameworks and funding. The growing middle class and younger population are more inclined toward fitness, wellness, and self-care apps, thereby driving the growth.

China mHealth Apps Market Assessment

The mHealth apps market in China is expected to experience significant growth in the coming years, driven by its large population and high smartphone penetration. The government’s strong push for digital healthcare through policies, such as Internet + Healthcare, has boosted innovation and app adoption across urban and rural areas. Chinese consumers actively use mHealth platforms for health tracking, online doctor consultations, prescription deliveries, and wellness monitoring. Local tech giants such as Tencent and Alibaba have heavily invested in health-focused platforms, accelerating expansion. The rising healthcare demand and digital literacy are further driving the growth of the industry in China.

Europe mHealth Apps Market Outlook

The mHealth apps market in Europe is expected to experience significant growth driven by high healthcare standards, widespread smartphone adoption, and supportive digital health policies from the European Union. Many countries in the region are integrating mobile health tools into their national healthcare systems to improve patient engagement, chronic disease management, and remote care. The region’s aging population also contributes to increased demand for health monitoring and teleconsultation services. Additionally, strict data protection regulations such as GDPR ensure user privacy, encouraging greater trust in digital health platforms, thereby driving the adoption.

Germany mHealth Apps Market Analysis

The mHealth apps market in Germany is expected to experience significant growth in the coming years, due to progressive digital health policies and a well-developed healthcare system. The country has made significant strides through its Digital Healthcare Act (DVG), which allows doctors to prescribe certified health apps covered by public health insurance. This legislative support has boosted adoption among both patients and providers. Germans are increasingly using apps for diabetes management, fitness, mental health, and virtual doctor visits. The market in Germany is growing with a rising number of regulated and evidence-based apps entering the market.

Key Players and Competitive Analysis

The mHealth apps market is highly competitive, with key players spanning the technology, telecommunications, and pharmaceutical sectors. Tech giants such as Apple, Google, and Samsung dominate through their integrated health ecosystems and wearable device connectivity. Apple Health, Google Fit, and Samsung’s health platforms serve millions of users globally, enabling real-time health tracking and personalized insights. Pharmaceutical companies such as Pfizer, AstraZeneca, Novartis, and Sanofi are increasingly investing in digital therapeutics and mobile platforms to support patient adherence and chronic disease management. Healthcare innovators such as Teladoc Health, Veradigm (Allscripts), and AirStrip Technologies are transforming virtual care and clinical data access. Telecom firms such as AT&T and Orange play a supportive role by enabling secure health data transmission and remote access. Qualcomm contributes through health-centric chipsets and wireless technologies. These players are actively forming partnerships, launching AI-driven solutions, and focusing on regulatory-compliant platforms to maintain their edge in this rapidly evolving digital health landscape.

Key Players

- Abbott

- AirStrip Technologies, Inc.

- Apple Inc.

- AstraZeneca

- AT&T

- Google Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Orange

- Pfizer Inc.

- Qualcomm Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Sanofi

- Teladoc Health, Inc.

- Veradigm LLC (Allscripts Healthcare Solutions)

Industry Developments

In October 2023, Cedars-Sinai and K Health launched the Cedars-Sinai Connect app, offering AI-powered virtual care access for patients across California. The app enabled 24/7 access to urgent and primary care, integrating patient data into existing health records for seamless treatment.

In November 2022, DocGo launched its first Epic-integrated app, enabling healthcare providers to request and track on-demand mobile medical services directly within the Epic EHR. The app streamlined workflows, improved data accuracy, and replaced the company’s previous Epic integration.

mHealth Apps Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Medical Apps

- Women's Health

- Chronic Disease Management Apps

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Other

- Fitness Apps

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Android

- iOS

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

MHealth Apps Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 38.02 Billion |

|

Market Size in 2025 |

USD 43.66 Billion |

|

Revenue Forecast by 2034 |

USD 155.96 Billion |

|

CAGR |

15.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 38.02 billion in 2024 and is projected to grow to USD 155.96 billion by 2034.

The global market is projected to register a CAGR of 15.2% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Abbott; AirStrip Technologies, Inc.; Apple Inc.; AstraZeneca; AT&T; Google Inc.; Johnson & Johnson Services, Inc.; Novartis AG; Orange; Pfizer Inc.; Qualcomm Technologies, Inc.; Samsung Electronics Co. Ltd.; Sanofi; Teladoc Health, Inc.; and Veradigm LLC (Allscripts Healthcare Solutions).

The medical app segment dominated the market share in 2024.

The Android segment is expected to witness the significant growth during the forecast period.