Motion Control Market Size, Share, Trends, Industry Analysis Report

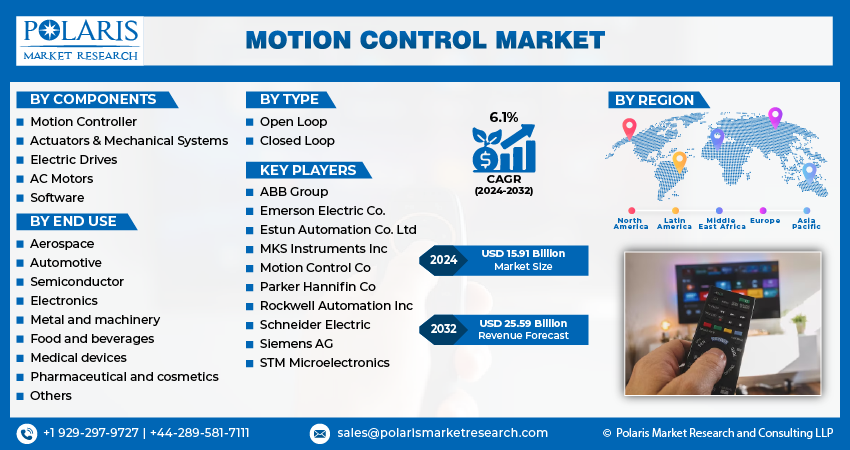

: By Components (Motion Controller, Actuators & Mechanical Systems, Electric Drives, Electric Drivers, AC Motors, and Software), By Type, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM4489

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The motion control market was valued at USD 17.47 billion in 2024, growing at a CAGR of 5.9% during 2025–2034. The rising need for high-precision automated processes and technological advancements in motion control systems are a few of the key factors driving market growth.

Key Insights

- The pharmaceuticals and cosmetics segment is projected to register significant growth, owing to the increased demand for automation and hygiene in production processes.

- The electric drives segment led the market in 2024, primarily due to the crucial role of electric drives in controlling the direction, speed, and torque in electric motors.

- Asia Pacific accounted for the largest market share in 2024. The regional market dominance is primarily attributed to the rapid automation and industrialization in major economies such as Japan and China.

- North America is projected to register the highest CAGR. The presence of several key industries fuels the demand for motion control solutions in the region.

Industry Dynamics

- The rising adoption of robotics across sectors such as electronics, automotive, and logistics for performing complex tasks is driving market demand.

- The expansion of electronics and semiconductor industries, which rely heavily on speed and accuracy during manufacturing, is fueling market growth.

- The increasing adoption of Industry 4.0 principles is expected to provide significant market opportunities.

- The high initial cost associated with motion control systems may present market challenges.

Market Statistics

2024 Market Size: USD 17.47 billion

2034 Projected Market Size: USD 30.98 billion

CAGR (2025-2034): 5.9%

Asia Pacific: Largest Market in 2024

AI Impact on Motion Control Market

- AI optimizes motion trajectories by analyzing real-time feedback. This helps reduce energy consumption and improves precision.

- AI models predict equipment wear, enabling timely maintenance and minimizing production downtime.

- AI-powered systems enhance robotic and CNC motion control. These systems allow for smoother, faster, and more adaptive operations.

- Advanced analytics enable dynamic adjustments in speed, torque, and positioning, supporting greater flexibility in automated manufacturing processes.

To Understand More About this Research: Request a Free Sample Report

Motion controllers are physical devices that are integrated with electrical components and designed to govern and regulate the movements of automated machinery. These controllers possess the capability to command specific sequences of actions on the axes they oversee.

The rising demand for motion controllers is driven by the increasing need for high-precision automated processes due to the growing need for energy-efficient solutions that improve production processes in factories. To meet this demand, ADVANCED Motion Controls introduced a compact, high-power density panel-mount FlexPro servo drive in 2021. This tool provides excellent accuracy and precision when producing delicate electronics, which is utilized in the electronics manufacturing sector. Businesses utilize automated processes to save costs associated with the product life cycle and boost productivity. Additionally, businesses use motion control solutions to reduce energy consumption and increase production, thereby driving the growth of the market.

Technological advancements in motion control solutions are driving their appeal to industries with improved accuracy. Advanced motion control devices are smarter, faster, and more energy-efficient than conventional solutions. These advancements also make the systems easier to use and integrate with other technologies such as AI and IoT technology. This, in turn, is driving the adoption of motion control devices in new areas of operation. Additionally, growing stringent regulations to avoid occupational accidents is driving the demand for advanced safety motion control solutions to ensure the safe interaction between humans and machines, monitor machine movements, and prevent potential hazards.

Market Dynamics

Growing Adoption of Robotics

Robots are being used more than ever across industries such as automotive, electronics, and logistics. According to the International Federation of Robotics, in 2024, 4,281,585 robots were operating in factories worldwide. These robots need to perform complex tasks such as assembling products or sorting packages with great precision. Due to this, the demand for motion control is rising to help guide a robot’s movements, from rotating an arm to picking up small components. Additionally, the global push for automation and smart factories has further led to increased investments in robotics, thereby driving the motion control market growth.

Expansion of Semiconductor and Electronics Industry

The semiconductor and electronics industries depend heavily on accuracy and speed during manufacturing. Making microchips and assembling electronic devices requires machines that make extremely precise movements. Motion control systems ensure these machines operate at such high precision levels, driving the demand for motion control solutions in the semiconductor and electronics industry. Additionally, the semiconductor industry is expanding worldwide, employing 345,000 individuals in the US alone, according to the Semiconductor Industry Association. This expansion of the industry is fueling the demand for motion control solutions to keep up with the fast-paced and high-precision demands of semiconductor manufacturing equipment, thereby propelling the growth of the market.

Segment Analysis

Market Assessment by End Use

The motion control market segmentation, based on end use, includes aerospace, automotive, semiconductor, electronics, metal and machinery, food and beverages, medical devices, pharmaceutical and cosmetics, and others. The pharmaceuticals and cosmetics segment is expected to witness significant growth during the forecast period due to the rising demand for precision, hygiene, and automation in production processes. In the pharmaceutical and cosmetics industries, motion control systems are used for accurate plastic packaging, filling, labeling, and quality inspection. Additionally, the rising focus on workers' safety and reduced downtime is further driving the demand for safety motion control in the industries, thereby driving segmental growth.

Market Evaluation by Component

The market segmentation, based on component, includes motion controllers, actuators and mechanical systems, electric drives, AC motors, and software. The electric drives segment dominated the motion control market share in 2024. Electric drives are essential components that control the speed, torque, and direction of motors in automated systems. Their popularity has grown due to their energy efficiency, precise control, and ability to work well with various types of motors. Industries such as manufacturing, robotics, and packaging rely heavily on electric drives to achieve smooth and accurate movement. The demand for electric drives is rising as more businesses adopt automation and look for eco-friendly, high-performance solutions.

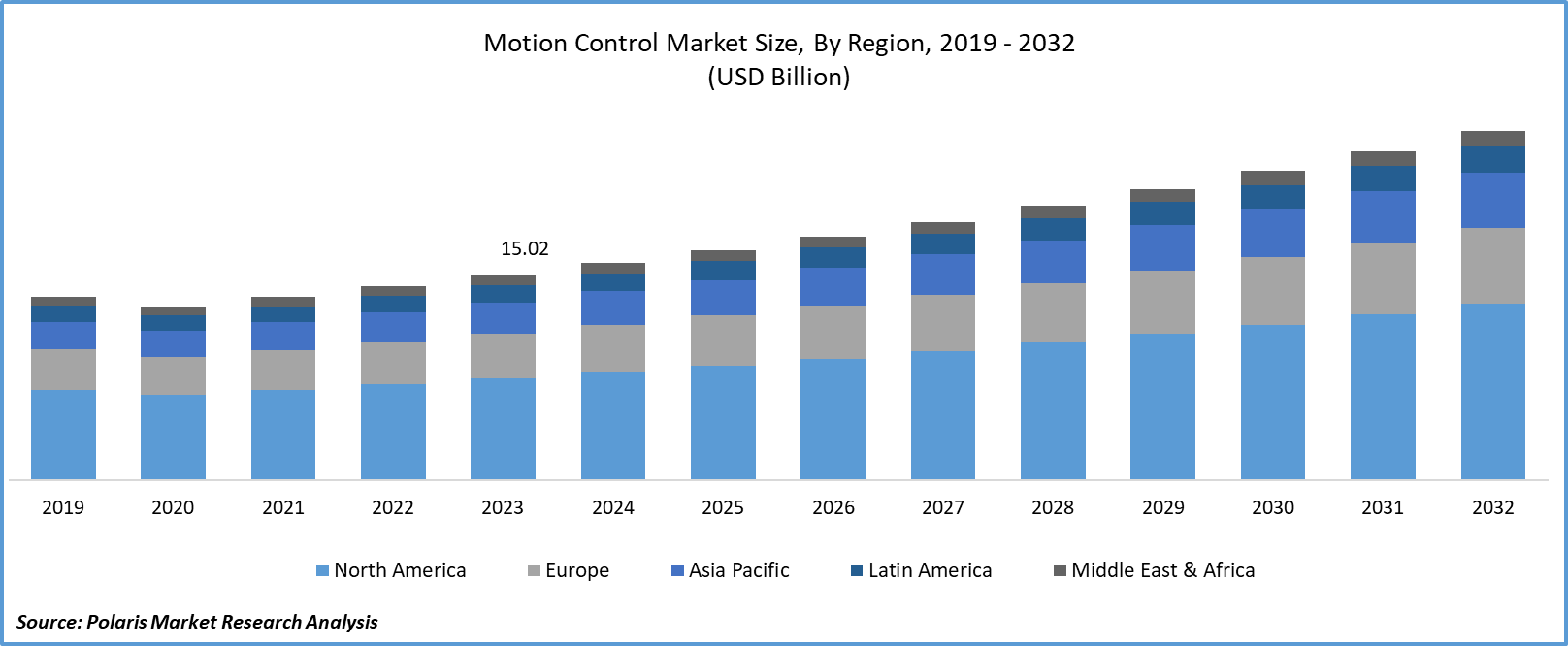

Regional Insights

The study provides the motion control market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the market, driven by rapid industrialization and automation in major Asian countries such as China, Japan, and South Korea. According to the National Bureau of Statistics, in 2024, China's value-added industrial output rose by 5.8% compared to 2023. These countries are major hubs for electronics, automotive, and semiconductor manufacturing, due to which the need for advanced motion control systems is rising. Additionally, government initiatives supporting smart factories and industrial upgrades are further fueling the demand for motion control solutions. The presence of a large manufacturing workforce combined with growing demand for quality production has led to an increase in automation adoption, thereby driving the industry expansion in Asia Pacific.

The market in India is experiencing significant growth due to the rising need for automation in the major Indian industries such as automotive, semiconductor, and pharmaceutical. This rising need for automation is propelled by government initiatives such as Make in India and Samarth Udyog Bharat 4.0. pushing manufacturers to adopt automated systems, driving the demand for motion control solutions to guide automation systems. Additionally, manufacturing facilities of major sectors of the country are expanding. According to the India Brand Equity Foundation, Honda Motor Japan announced plans to establish a dedicated electric motorcycle production facility in India by 2028. Such expansion of manufacturing facilities is driving the demand for motion control solutions in the country.

North America is expected to record the highest CAGR during the forecast period. North America is home to several major industries, such as aerospace, automotive, and healthcare, due to which the demand for motion control solutions is rising in the region. The investments in industrial automation and smart manufacturing in the US are increasing, thereby driving the need for motion control solutions in the country. Additionally, the rise of medical robotics and automation in the logistics and packaging sectors further boosts demand. North American companies are adopting new motion control technologies with innovation in energy efficiency and precision, driving the regional motion control market growth.

Key Players & Competitive Analysis Report

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and developments and advanced techniques. These companies pursue various strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market are ABB Group, Emerson Electric Co., Estun Automation Co. Ltd, MKS Instruments Inc, Motion Control Products Ltd., Parker Hannifin Co, Rockwell Automation Inc, Schneider Electric, Siemens AG, and STMicroelectronics.

ABB is a global manufacturer and seller of electrification, automation, robotics, and motion products. The company operates in various segments to serve a diverse range of industries. In the electrification segment, ABB provides a wide array of products, including renewable power solutions, electric vehicle charging infrastructure, distribution automation products, modular substation packages, and intelligent home and building solutions. The robotics & discrete automation focuses on industrial robots, autonomous mobile robotics, software, and digital services, offering solutions based on programmable logic controllers, industrial PCs, transport systems, servo motion, and machine vision. The Motion segment specializes in designing, manufacturing, and selling drives, generators, motors, and traction converters to drive the low-carbon future for industries, infrastructure, cities, and transportation. Process automation develops and sells control technologies, manufacturing execution systems, advanced process control software, marine propulsion systems, instrumentation, and turbochargers. It also provides services such as preventive maintenance, remote monitoring, emission monitoring, asset performance management, and cybersecurity. ABB serves a broad range of industries globally, including aluminum, chemical, automotive, data centers, mining, oil and gas, power generation, railway, food and beverage, water, wind power, and more. ABB’s AC500 PLC motion control offers scalable, user-friendly engineering with a wizard-driven setup, PLCopen function blocks, and real-time EtherCAT support for single to multi-axis, synchronized motion applications

Siemens operates in electrification, automation, and digitalization. The company operates in various industries, including energy, healthcare, financing, building technology, transportation, and manufacturing. Its products and services range from power generation systems, turbines, medical imaging equipment, trains, and automation software to building technologies and smart grid solutions. The company is divided into its business units, including Siemens Energy, Siemens Healthineers, and Siemens Mobility. Siemens Energy focuses on developing and producing sustainable power generation and distribution technologies. It offers solutions in gas and power, renewable energy, and oil and gas. Siemens Healthineers provides medical technology and services to healthcare providers worldwide. Its products and services include medical imaging, laboratory diagnostics, and healthcare IT. Siemens Mobility focuses on providing intelligent mobility solutions to improve the efficiency and sustainability of transportation systems. Its products and services include rail automation, road traffic management, and intermodal solutions. Siemens SIMATIC Motion Control delivers scalable automation for complex machine motion tasks, integrating safety functions and efficient engineering in the TIA Portal for rapid, flexible implementation of innovative machines and plants.

List of Key Companies

- ABB Group

- Emerson Electric Co.

- Estun Automation Co. Ltd

- MKS Instruments Inc

- Motion Control Products Ltd.

- Parker Hannifin Co

- Rockwell Automation Inc

- Schneider Electric

- Siemens AG

- STM Microelectronics

Motion Control Industry Developments

In April 2025, Elmo Motion Control launched the Titanium Maestro as a next-generation motion controller. It is designed to deliver high performance, speed, and precision for demanding multi-axis industrial automation applications.

In November 2024, leading manufacturers, including THK, Festo, Curtiss-Wright, and Tolomatic, launched four new motion control products to enhance speed, hygiene, force, and flexibility in industrial automation applications.

Motion Control Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Motion Controller

- Actuators & Mechanical Systems

- Electric Drives

- AC Motors

- Software

By Type Outlook (Revenue USD Billion, 2020–2034)

- Open Loop

- Closed Loop

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Aerospace

- Automotive

- Semiconductor

- Electronics

- Metal and Machinery

- Food and Beverages

- Medical Devices

- Pharmaceutical and Cosmetics

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Motion Control Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.47 billion |

|

Market Size Value in 2025 |

USD 18.48 billion |

|

Revenue Forecast in 2034 |

USD 30.98 billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 17.47 billion in 2024 and is projected to grow to USD 30.98 billion by 2034.

The global market is projected to record a CAGR of 5.9% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are ABB Group, Emerson Electric Co., Estun Automation Co. Ltd, MKS Instruments Inc, Motion Control Products Ltd., Parker Hannifin Co, Rockwell Automation Inc, Schneider Electric, Siemens AG, and STMicroelectronics.

The electric drives segment dominated the market in 2024. Electric drives are essential components that control the speed, torque, and direction of motors in automated systems.

The pharmaceuticals and cosmetics segment is expected to witness significant growth during the forecast period due to the rising demand for precision, hygiene, and automation in production processes.