Neurostimulation Devices Market Size, Share, Trends, Industry Analysis Report

: By Application (Pain Management, Epilepsy, Essential Tremor, Urinary & Faecal Incontinence, and Depression), Devices, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 116

- Format: PDF

- Report ID: PM3256

- Base Year: 2024

- Historical Data: 2020-2023

Neurostimulation Devices Market Overview

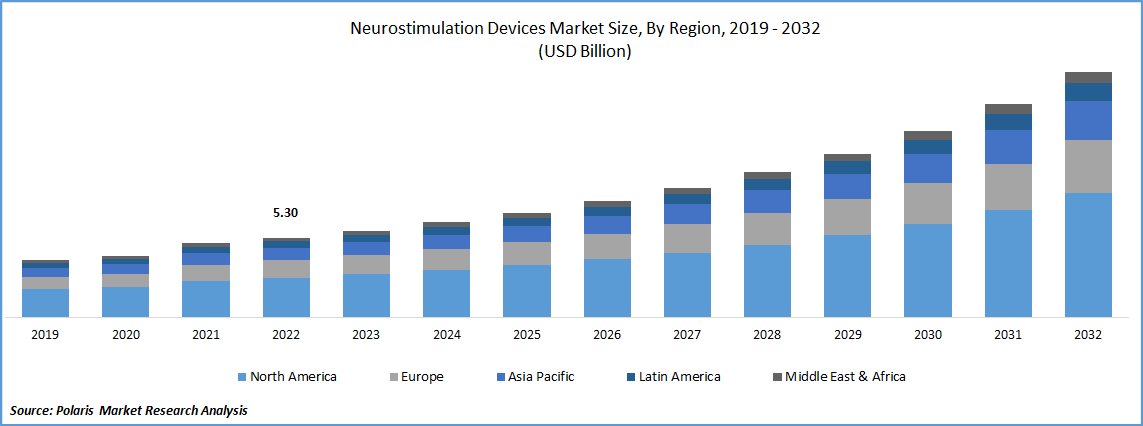

The global neurostimulation devices market size was valued at USD 7.16 billion in 2024. The market is projected to grow from USD 8.06 billion in 2025 to USD 23.63 billion by 2034, exhibiting a CAGR of 12.7% during 2025–2034.

The neurostimulation devices market encompasses medical devices that deliver electrical stimulation to specific nerves or brain regions to treat neurological disorders, chronic pain, and other medical conditions.

Key drivers include the increasing prevalence of neurological diseases, rising demand for minimally invasive treatment options, and advancements in device technology. The growing geriatric population and increasing awareness of neurostimulation therapies further support overall expansion.

Notable trends include the integration of artificial intelligence in neurostimulation devices, the development of wireless and rechargeable systems, and ongoing research into expanding clinical applications. Regulatory approvals and reimbursement policies also play a significant role in shaping the dynamics of neurostimulation devices.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Rising Prevalence of Neurological Disorders

The increasing incidence of neurological disorders significantly propels the industry. For instance, according to a March 2024 report from the Global Burden of Disease, 3.4 billion people were affected by a nervous system condition in 2021, ranging from tension-type headaches and migraines to stroke and dementia. This high prevalence highlights the growing demand for effective treatment modalities, positioning neurostimulation devices as a pivotal solution in managing these conditions.

Advancements in Neurostimulation Technology

Technological innovations have markedly enhanced the efficacy and appeal of neurostimulation devices. The development of adaptive deep brain stimulation (aDBS) systems, which adjust electrical stimulation in real-time based on neural activity, exemplifies this progress. For instance, in February 2025, the FDA approved an adaptive deep brain stimulation (aDBS) system developed by UCSF researchers. The implant monitors brain activity in real time and delivers calibrated electrical pulses to preemptively suppress Parkinson’s symptoms, improving symptom management. Such advancements improve patient outcomes and also expand the therapeutic applications of neurostimulation devices.

Integration with Digital Health Platforms

The convergence of neurostimulation devices with digital health platforms has revolutionized patient care. Features such as remote monitoring and data analysis enable healthcare providers to track device performance and patient progress in real-time, facilitating timely adjustments to therapy. This integration enhances patient engagement and adherence to treatment plans, thereby improving overall outcomes. For instance, in October 2023, Sooma launched Sooma Duo, a remote neuromodulation system for depression treatment. The FDA-cleared device, paired with a digital platform and patient app, enables at-home use with clinician monitoring, expanding access to drug-free therapy outside traditional clinical settings. The ability to remotely program and monitor neurostimulation devices has become increasingly valuable, especially in contexts where in-person consultations are limited. Thus, the rising integration of neurostimulation devices is propelling the expansion forward.

Segment Insights

Application-Based Insights

The application is segmented into pain management, epilepsy, essential tremor, urinary and faecal incontinence, and depression. Among these, pain management stands out as the largest segment. This prominence is due to the widespread prevalence of chronic pain conditions, such as neuropathic pain and failed back surgery syndrome, where neurostimulation offers an effective alternative to traditional therapies. The increasing demand for minimally invasive treatments further supports the adoption of neurostimulation devices in pain management.

Epilepsy represents a significant and rapidly growing segment within the industry. The rise in drug-resistant epilepsy cases has led to a heightened need for alternative therapies, positioning neurostimulation as a viable solution. Advancements in device technology, including responsive neurostimulation systems, have enhanced treatment efficacy, contributing to the expansion of this segment. Additionally, the integration of neurostimulation with digital health platforms allows for real-time monitoring and personalized therapy adjustments, improving patient outcomes and driving market growth.

Devices-Based Insights

The device segment is segmented into spinal cord stimulator, deep brain stimulator, sacral nerve stimulator, vagus nerve stimulator, and gastric electric stimulator. Among these, the spinal cord stimulators segment holds the largest revenue share, primarily due to their extensive use in managing chronic neuropathic pain. These devices function by delivering electrical impulses to the spinal cord, effectively masking pain signals and providing relief to patients unresponsive to conventional therapies. The high prevalence of chronic pain conditions, such as failed back surgery syndrome and complex regional pain syndrome, has led to increased adoption of spinal cord stimulators in clinical practice. Technological advancements, including the development of devices capable of delivering multiple stimulation waveforms and the integration of rechargeable battery systems, have further enhanced their clinical efficacy and patient convenience.

The deep brain stimulators segment is witnessing the fastest growth within the market. These devices are primarily utilized in the treatment of movement disorders, notably Parkinson's disease, where they modulate neural activity in specific brain regions to alleviate motor symptoms. The rising incidence of Parkinson's disease, coupled with the limitations of pharmacological treatments, has propelled the demand for deep brain stimulation (DBS) therapies. Innovations such as closed-loop DBS systems, which adjust stimulation parameters in real-time based on neural feedback, have improved therapeutic outcomes and expanded the potential applications of this technology to other neurological conditions, including epilepsy and obsessive-compulsive disorder. Ongoing research and favorable clinical trial results continue to support the growth and adoption of deep brain stimulators in the medical community.

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest revenue share. This dominance is attributed to a high prevalence of neurological disorders, advanced healthcare infrastructure, and substantial investments in research and development. For instance, a report from the NIH in April 2024 estimates that 6.9 million Americans aged 65 and older are currently living with Alzheimer's dementia. The presence of major key players and favorable reimbursement policies further support the market in this region. Europe also represents a significant portion of the market, driven by a well-established healthcare system and increasing adoption of neurostimulation therapies. Asia Pacific is experiencing rapid growth due to rising healthcare expenditures, increasing awareness of neurological disorders, and a large aging population. Emerging economies in this region are investing in healthcare infrastructure, contributing to the expansion of neurostimulation devices.

The Europe neurostimulation devices market is experiencing significant growth, driven by advancements in medical technology and a proactive approach to neurological research. The region has seen the development and clinical implementation of innovative brain implants, such as the Picostim, which has demonstrated an 80% reduction in daytime seizures for patients with severe epilepsy. This progress is supported by collaborative efforts between academic institutions and medical centers, leading to a robust pipeline of neurostimulation therapies targeting conditions like Parkinson's disease treatment, chronic pain, and incontinence.

Asia Pacific is emerging as a rapidly expanding industry for neurostimulation devices, propelled by increasing healthcare expenditures, a growing aging population, and heightened awareness of neurological disorders. Countries within this region are investing in healthcare infrastructure and research initiatives to address the rising incidence of conditions such as epilepsy, Parkinson's disease, and chronic pain. Collaborations between local healthcare providers and international medical device manufacturers are fostering the introduction of advanced neurostimulation technologies tailored to the specific needs of the population. This dynamic environment positions Asia Pacific as a key contributor to the global growth.

Key Players and Competitive Insights

The several key players actively contributing to advancements in medical technology. Prominent companies include Abbott Laboratories; Aleva Neurotherapeutics; Boston Scientific Corporation; Cognito Therapeutics; ElectroCore, Inc.; LivaNova PLC; Medtronic plc; Nalu Medical, Inc.; Neuronetics, Inc.; NeuroPace, Inc.; Nevro Corp.; and Synapse Biomedical Inc.

Medtronic plc, headquartered in Dublin, Ireland, is renowned for its comprehensive portfolio of neurostimulation devices, including spinal cord and deep brain stimulators. Boston Scientific Corporation, based in Marlborough, Massachusetts, offers a range of products addressing chronic pain and neurological disorders. Abbott Laboratories, from Abbott Park, Illinois, provides advanced neuromodulation technologies for pain management and movement disorders. LivaNova PLC, with operational headquarters in Houston, Texas, specializes in devices for neuromodulation and cardiac surgery. Nevro Corp., located in Redwood City, California, focuses on innovative solutions for chronic pain through its proprietary spinal cord stimulation systems.

Boston Scientific Corporation is a medical device company that offers a wide portfolio of neurostimulation devices. In the realm of neurostimulation, Boston Scientific focuses on developing innovative solutions for managing chronic pain and neurological conditions. Their spinal cord stimulator systems, such as the Precision Spectra and WaveWriter Alpha, are designed to provide personalized pain relief by delivering electrical impulses to the spinal cord, effectively interrupting pain signals to the brain. These systems are indicated for chronic intractable pain associated with conditions such as failed back surgery syndrome, complex regional pain syndrome, and degenerative disc disease. Boston Scientific also offers deep brain stimulation systems, such as the Vercise DBS, which is engineered for precise neural targeting to treat conditions such as Parkinson's disease, dystonia, and essential tremor. The company's commitment to innovation is clear in its continuous investment in research and development, expanding its product portfolio to solidify its position in neurostimulation. Boston Scientific aims to improve the quality of life for patients worldwide by offering meaningful solutions for debilitating chronic pain and neurological disorders by providing a range of implantable and minimally invasive therapies.

List of Key Companies in Neurostimulation Devices Market

- Abbott Laboratories

- Aleva Neurotherapeutics

- Boston Scientific Corporation

- Cognito Therapeutics

- ElectroCore, Inc.

- LivaNova PLC

- Medtronic plc

- Nalu Medical, Inc.

- Neuronetics, Inc.

- NeuroPace, Inc.

- Nevro Corp.

- Synapse Biomedical Inc

Neurostimulation Devices Industry Developments

- In January 2025, Boston Scientific announced plans to fully acquire Bolt Medical for up to USD 900 million. Bolt Medical specializes in intravascular lithotripsy (IVL) technology, which is used to treat calcified arteries. This acquisition aims to enhance Boston Scientific's portfolio in coronary artery disease treatments.

- In February 2024, the US Food and Drug Administration (FDA) approved Medtronic's BrainSense Adaptive deep brain stimulation device, a significant advancement for Parkinson's disease patients. This system, implanted in the chest with electrodes connected to the brain, adapts to real-time brain activity to manage involuntary muscle movements, offering more personalized treatment compared to previous continuous stimulation models.

Neurostimulation Devices Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Pain Management

- Epilepsy

- Essential Tremor

- Urinary & Faecal Incontinence

- Depression

By Devices Outlook (Revenue – USD Billion, 2020–2034)

- Spinal Cord Stimulator

- Deep Brain Stimulator

- Sacral Nerve Stimulator

- Vagus Nerve Stimulator

- Gastric Electric Stimulator

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Neurostimulation Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.16 billion |

|

Market Size Value in 2025 |

USD 8.06 billion |

|

Revenue Forecast by 2034 |

USD 23.63 billion |

|

CAGR |

12.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The neurostimulation devices market has been segmented into detailed segments of application and devices. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy focuses on product innovation, strategic partnerships, and geographic expansion. Companies are investing in research and development to enhance device efficacy, miniaturization, and wireless connectivity. Collaborations with healthcare institutions and acquisitions of emerging firms help strengthen market presence. Regulatory approvals and reimbursement policies play a crucial role in market penetration. Additionally, increasing awareness through clinical trials, physician training programs, and direct-to-consumer marketing strategies supports adoption among patients and healthcare providers.

FAQ's

The neurostimulation devices market size was valued at USD 7.16 billion in 2024 and is projected to grow to USD 23.63 billion by 2034.

The market is projected to register a CAGR of 12.7% during the forecast period.

North America had the largest share of the market in 2024.

Prominent companies include Abbott Laboratories; Aleva Neurotherapeutics; Boston Scientific Corporation; Cognito Therapeutics; ElectroCore, Inc.; LivaNova PLC; Medtronic plc; Nalu Medical, Inc.; Neuronetics, Inc.; NeuroPace, Inc.; Nevro Corp.; and Synapse Biomedical Inc.

The pain management segment accounted for the larger share of the market in 2024.

Neurostimulation devices are medical devices that deliver electrical impulses to specific areas of the nervous system to modulate neural activity. These devices are used for managing various neurological and chronic conditions, including chronic pain, epilepsy, Parkinson’s disease, essential tremor, depression, and urinary and fecal incontinence. They function by altering nerve signals to relieve symptoms, restore lost functions, or enhance neurological performance. Common types of neurostimulation devices include spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, sacral nerve stimulators, and gastric electric stimulators. These devices are increasingly being integrated with advanced technologies such as wireless control and AI-based programming to improve treatment outcomes.

A few key trends in the market are described below: