Next-gen Paper-based and Fiber-based Packaging Market Size, Share, Trends, Industry Analysis Report

: By Material Source (recycled fiber, virgin fiber), Application, and Region– Market Forecast, 2025-2034.

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5639

- Base Year: 2024

- Historical Data: 2020-2023

Next-gen Paper-based and Fiber-based Packaging Market Overview

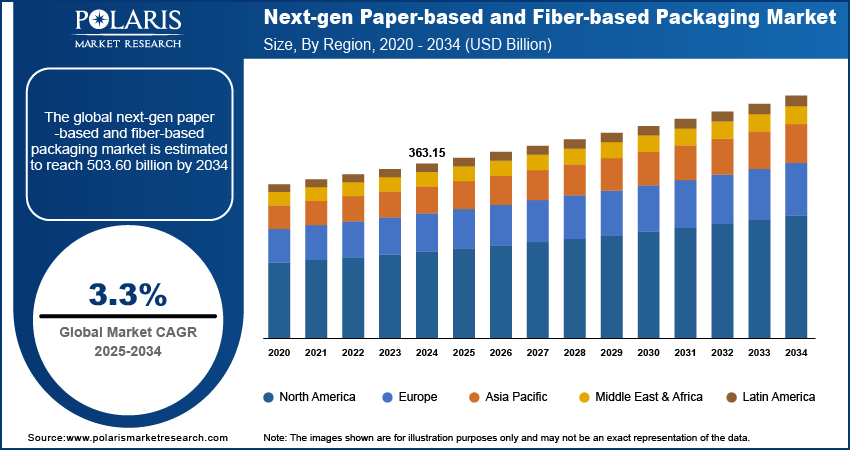

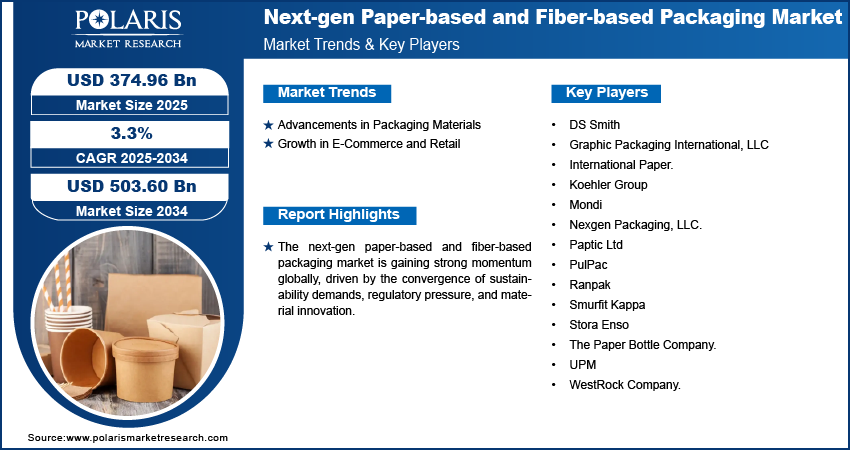

The global next-gen paper-based and fiber-based packaging market was valued at USD 363.15 billion in 2024. It is expected to grow from USD 374.96 billion in 2025 to USD 503.60 billion by 2034, at a CAGR of 3.3% during the forecast period.

Next-gen paper-based and fiber-based packaging refers to innovative, sustainable packaging solutions developed from renewable, biodegradable, or recyclable materials designed to replace conventional plastic-based packaging. These next-generation alternatives are increasingly gaining traction as brands and consumers alike shift toward eco-conscious choices. As of January 2023, a report by Protega states that 81% of consumers are demanding sustainable packaging. The rising consumer demand for sustainable packaging is driven by growing environmental awareness and the desire for low-impact lifestyles. Modern consumers are prioritizing recyclability and compostability and they are also seeking brands that visibly demonstrate sustainability commitments in their packaging. As a result, manufacturers are investing in advanced materials and design innovations that align with circular economy principles, fueling the adoption of next-gen paper and fiber-based formats across industries such as food, beverages, cosmetics, and e-commerce.

Strict policies such as bans, levies, and compliance standards are accelerating the shift toward next-gen paper-based and fiber-based alternatives by targeting single-use plastics and non-recyclable materials. These frameworks compel companies to adopt environmentally compliant packaging that reduces waste and aligns with sustainability goals. For example, in October 2024, in IUCN-Canopy COP16, panel experts emphasized fiber substitution’s role in conservation, estimating a USD 78 billion investment needed over a decade to transform supply chains. Such regulatory and industry efforts are fostering innovation in fiber engineering to meet both functional and ecological demands. Additionally, consumer expectations and regulatory mandates are transforming global packaging, making paper and fiber solutions essential for responsible product delivery.

To Understand More About this Research: Request a Free Sample Report

Driver Dynamics

Advancements in Packaging Materials

Advancements in packaging materials, such as paper-based and fiber-based options, enable the development of high-performance, sustainable alternatives to conventional plastics. Innovations in material science have led to improved durability, moisture resistance, barrier properties, and printability in fiber-based packaging, making it suitable for a wider range of applications. For instance, in April 2023, Koehler Paper and Nissha Metallizing Solutions launched METIVO Advanced, a recyclable metallized packaging paper based on Koehler NexPlus barrier technology. The material offers oxygen/grease resistance for food and cosmetic packaging while supporting circular economy goals. These improvements address previous limitations of paper-based materials, allowing them to compete with plastic in both functionality and shelf appeal. Next-gen packaging solutions are now capable of supporting more complex product needs without compromising environmental benefits with the integration of bio-coatings, molded fiber technologies, and nanocellulose, accelerating the market expansion.

Growth in E-Commerce and Retail

The growth in e-commerce and retail is another key factor propelling the demand for next-gen paper-based and fiber-based packaging. The need for efficient, protective, and sustainable packaging solutions has intensified as online shopping continues to expand. Retailers and e-commerce platforms are seeking eco-friendly alternatives to plastic that can withstand the rigors of shipping while aligning with consumer sustainability expectations. Paper-based packaging offers a compelling solution, combining structural integrity with recyclability, making it ideal for last-mile delivery and unboxing experiences. Additionally, branded fiber-based packaging enhances customer engagement and supports retailers’ environmental goals, reinforcing brand loyalty in a competitive market. For instance, in February 2024, ProAmpac introduced Recyclable FibreSculpt in Europe, a fiber-based thermoforming material with high-barrier properties for food packaging. The OPRL-compliant solution contains over 90% fiber and targets products such as meats, cheese, and fish. This surge in demand from the e-commerce and retail sectors is significantly contributing to the widespread integration of next-gen packaging solutions.

Segment Assessment

Next-gen Paper-based and Fiber-based Packaging Market Assessment by Material Source Outlook

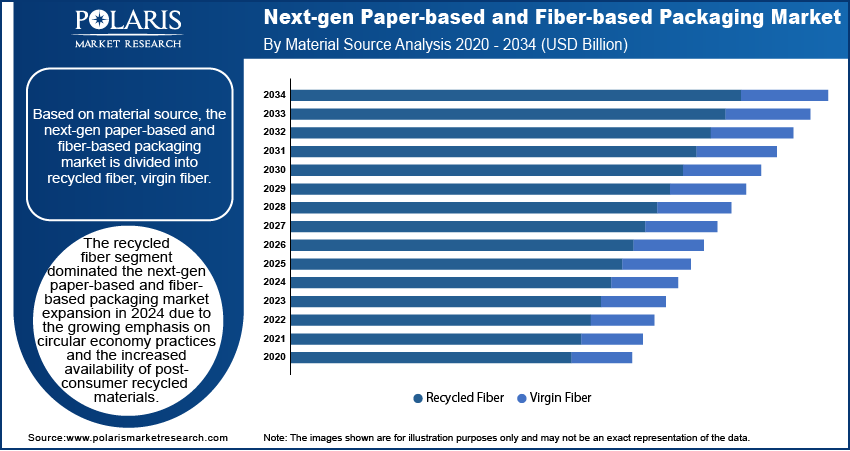

The segmentation based on material source, includes recycled fiber, virgin fiber. The recycled fiber segment dominated in 2024 due to the growing emphasis on circular economy practices and the increased availability of post-consumer recycled materials. Manufacturers are prioritizing recycled fiber to reduce environmental impact and minimize raw material extraction as sustainability goals become central to corporate strategies. Recycled fiber offers a viable and eco-efficient alternative, especially as advancements in processing technologies have improved its strength, quality, and consistency. Moreover, consumer and regulatory pressure to adopt environmentally responsible materials has positioned recycled fiber as the preferred choice across various packaging applications, driving its dominance in the market landscape.

Next-gen Paper-based and Fiber-based Packaging Market Evaluation by Application Outlook

The segmentation based on application, includes food & beverages, retail & e-commerce, healthcare & pharmaceuticals, personal care & cosmetics, others. The personal care & cosmetics segment is expected to witness the fastest market growth during the forecast period driven by a shift toward premium, sustainable packaging within the beauty industry. Brands in this sector are increasingly adopting eco-friendly packaging formats that align with the values of environmentally conscious consumers, particularly younger demographics. Fiber-based packaging offers an ideal combination of aesthetics, customizability, and sustainability, making it highly suitable for personal care products that prioritize brand identity and shelf appeal. The demand for biodegradable, recyclable, and plastic-free solutions in skincare, haircare, and beauty packaging is accelerating innovation and investment in this segment, fueling its rapid growth.

Regional Analysis

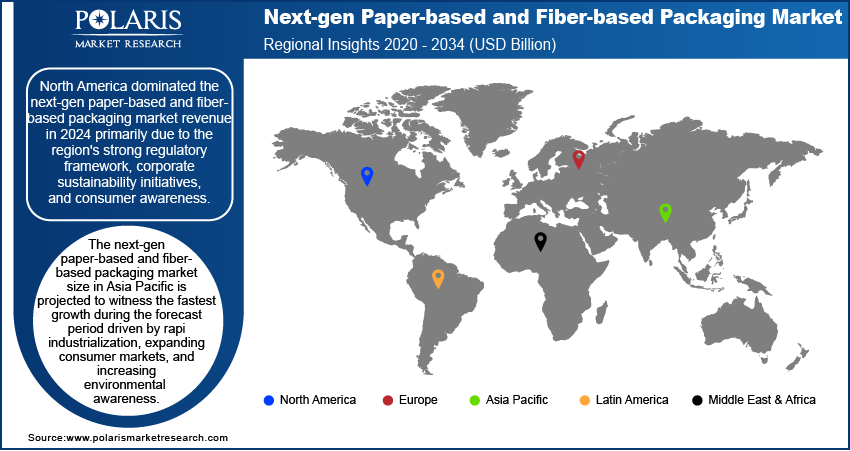

By region, the report provides insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated in 2024 primarily due to the region's strong regulatory framework, corporate sustainability initiatives, and consumer awareness. Leading brands and retailers in the US and Canada have made substantial commitments to phase out single-use plastics and adopt more sustainable alternatives, resulting in widespread implementation of paper- and fiber-based packaging. For instance, in July 2024, the Biden-Harris Administration launched a government-wide plastic pollution strategy, targeting production, waste, and cleanup. Key actions include phasing out federal single-use plastics by 2035, 275 million for recycling infrastructure, and 70 million for marine debris removal as plastic production has doubled in 20 years. The presence of advanced manufacturing capabilities, investment in R&D, and a mature recycling infrastructure further support the scalability of next-gen packaging solutions. Additionally, North American consumers show a high preference for environmentally responsible products, reinforcing demand and solidifying the region’s leadership position.

The market size in Asia Pacific is projected to witness the fastest growth during the forecast period driven by rapid industrialization, expanding consumer markets, and increasing environmental awareness. Governments across the region are implementing stricter environmental regulations and supporting green packaging initiatives to address waste management challenges. Simultaneously, rising disposable incomes and urbanization are fueling demand for packaged goods across food, personal care, and e-commerce sectors, creating new opportunities for innovative fiber-based solutions. Asia Pacific is poised to become a key growth hub for next-generation packaging technologies with growing investment in sustainable materials and evolving consumer preferences.

Next-gen Paper-based and Fiber-based Packaging Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for next-gen paper-based and fiber-based packaging market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are DS Smith; Graphic Packaging International, LLC; International Paper; Koehler Group; Mondi; Nexgen Packaging, LLC; Paptic Ltd; PulPac; Ranpak; Smurfit Kappa; Stora Enso; The Paper Bottle Company; UPM; WestRock Company.

DS Smith plc, founded in 1940 and headquartered in London, is a British multinational specializing in sustainable paper-based and fiber-based packaging solutions. The company operates as a subsidiary of International Paper, with a strong presence across Europe, North America, and Asia. DS Smith is recognized for its innovative approach to packaging, focusing on sustainability and circular economy principles. The company provides a wide range of products, such as corrugated packaging, retail-ready solutions, transit cases, and heavy-duty industrial products. It also offers consultancy services in creative design and supply chain optimization. DS Smith is a key player in the packaging industry, with over 30,000 employees globally. DS Smith has made advancements in next-generation paper-based and fiber-based packaging through its "Now & Next" Sustainability Strategy. They have replaced over 1.2 billion pieces of plastic with fiber-based alternatives, exceeding its target ahead of schedule by 2025. These innovations include replacing plastic carriers, shrink wraps, and fruit punnets with recyclable and biodegradable materials. DS Smith ensures its packaging solutions meet high standards for recyclability and reduced carbon emissions, positioning itself as a leader in sustainable packaging innovation.

The Koehler Group, headquartered in Oberkirch, Germany, is a family-owned company with over 200 years of history, specializing in sustainable paper and renewable energy solutions. The Koehler Group operates through multiple divisions, such as Koehler Paper, Koehler Renewable Energy, and Koehler Innovative Solutions with approximately 2,500 employees worldwide. The company is committed to sustainability and innovation, focusing on ecological responsibility, long-term investments, and cutting-edge technologies. Its paper division produces high-quality specialty papers and flexible packaging alternatives that aim to replace plastic in various applications. In 2025, the Koehler Group will continue to advance next-generation paper-based and fiber-based packaging solutions. A notable achievement includes the launch of a new flexible packaging paper with a water vapor barrier designed to meet the growing demand for sustainable packaging. Koehler's investments in advanced production lines and renewable energy projects further enhance its ability to create biodegradable and recyclable packaging materials. The Koehler Group positions itself as a leader in developing sustainable alternatives to conventional plastic packaging for global markets by combining technical expertise with a strong commitment to climate protection.

Key Companies in Next-gen Paper-based and Fiber-based Packaging Market

- DS Smith

- Graphic Packaging International, LLC

- International Paper.

- Koehler Group

- Mondi

- Nexgen Packaging, LLC.

- Paptic Ltd

- Protega Global Ltd

- PulPac

- Ranpak

- Smurfit Kappa

- Stora Enso

- The Paper Bottle Company.

- UPM

- WestRock Company.

Next-gen Paper-based and Fiber-based Packaging Market Development

October 2024, UPM Specialty Papers and Michelman developed three paper-based packaging solutions to replace non-recyclable multi-material packaging. Designed for food contact and recyclability, these innovations enhance fiber-based substrate performance while supporting sustainability goals.

September 2024: Koehler Paper launched Koehler NexPlus Seal WVB, a heat-sealable paper with a vapor barrier for food and non-food packaging. Made from certified virgin fiber pulp, it ensures product protection, recyclability, and compliance with EU sustainability regulations.

September 2024, ANDRITZ and PulPac collaborated to advance Dry Molded Fiber technology, a water-efficient method for producing recyclable and biodegradable packaging from wood pulp. The collaboration aims to replace single-use plastics in food and non-food applications.

Next-gen Paper-based and Fiber-based Packaging Market Segmentation

By Material Source Outlook (Revenue, USD Billion, 2020 - 2034)

- Recycled Fiber

- Virgin Fiber

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Food & Beverages

- Retail & E-commerce

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Next-gen Paper-based and Fiber-based Packaging Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 363.15 billion |

|

Market Size Value in 2025 |

USD 374.96 billion |

|

Revenue Forecast in 2034 |

USD 503.60 billion |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global next-gen paper-based and fiber-based packaging market size was valued at USD 363.15 billion in 2024 and is projected to grow to USD 503.60 billion by 2034.

The global market is projected to grow at a CAGR of 3.3% during the forecast period.

North America dominated the market in 2024.

Some of the key players in the market are DS Smith; Graphic Packaging International, LLC; International Paper; Koehler Group; Mondi; Nexgen Packaging, LLC; Paptic Ltd; PulPac; Ranpak; Smurfit Kappa; Stora Enso; The Paper Bottle Company; UPM; WestRock Company.

The recycled fiber segment dominated in 2024.

The personal care & cosmetics segment is expected to witness the fastest market growth during the forecast period.