Non-Dairy Ice Cream Market Size, Share & Trends Analysis Report

By Source (Coconut Milk, Almond Milk, Cashew Milk, Soy Milk, Other Sources); By Flavor; By Product; By Form; By Distribution Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 116

- Format: PDF

- Report ID: PM3437

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

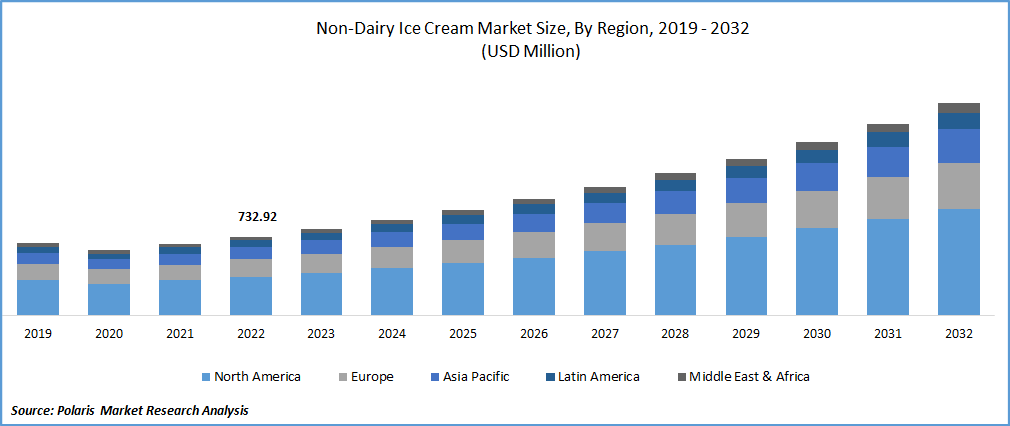

The non-dairy ice cream market was valued at USD 732.92 million in 2022 and is expected to grow at a CAGR of 10.4% during the forecast period. Increasing demand for vegan and lactose-free products is driving the market. Consumers are looking for healthier options that taste and texture similar to traditional ice cream. Many non-dairy ice creams are lower in calories, fat, and cholesterol and contain plant-based ingredients that offer additional nutritional benefits. The market is also benefiting from the growing number of people adopting a vegan lifestyle and seeking ethical and environmentally friendly alternatives to animal products. As a result, the market is expected to grow in popularity.

To Understand More About this Research: Request a Free Sample Report

Non-dairy ice cream refers to frozen desserts made without traditional dairy ingredients, such as milk and cream, and are made with plant-based alternatives like soy, almond, coconut, or cashew milk. Non-dairy ice creams are gaining popularity among consumers who are lactose intolerant or have dairy allergies, as well as those who follow vegan or plant-based diets. These products are often marketed as healthier alternatives to traditional dairy ice cream due to their lower fat and calorie content. Non-dairy ice creams come in various flavours and are available in various formats, including pints, single-serve cups, and bars.

The market is expected to see a boost in growth due to various product launches with unique flavors. For example, Bruster's Real Ice Cream re-released its non-dairy ice cream line in April 2022 with 14 different flavors, all made with oat milk. The company aims to offer a high-quality, creamier product with improved taste.

The COVID-19 pandemic had both positive and negative impacts on the market. On the positive side, the pandemic increased demand for non-dairy products as consumers became more health-conscious and focused on boosting their immune systems. Additionally, with many people spending more time at home and seeking comfort foods, the demand for frozen treats like ice cream also increased.

However, the pandemic also led to supply chain disruptions and consumer behavior changes, which negatively impacted the market. The closure of restaurants and other food service establishments led to a decrease in demand for non-dairy ice cream in bulk quantities, while panic buying and stockpiling by consumers resulted in temporary shortages of certain products. Furthermore, the pandemic led to changes in consumer purchasing patterns, with more people shopping online and seeking out contactless delivery options. This challenged smaller and artisanal non-dairy ice cream brands, as they often rely on in-person sales and farmer's markets to promote their products.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

As consumers are increasingly interested in healthier food choices, including plant-based options. Non-dairy ice cream is considered a healthier alternative to traditional ice cream, as it is often lower in calories, fat, and sugar. For example, So Delicious Dairy Free, a leading non-dairy ice cream brand, promotes its products with "good-for-you" ingredients such as coconut and almond milk. Also, the rise of veganism and plant-based diets drives demand for non-dairy ice cream among consumers who do not consume dairy products for ethical or environmental reasons.

Additionally, an increasing number of people are lactose intolerant, meaning they cannot digest lactose, a sugar found in dairy products. Non-dairy ice cream is a popular alternative for those who cannot consume traditional dairy products. According to the National Institutes of Health (NIH), lactose intolerance affects around 30 million adults in the United States before age 20.

Furthermore, the East Asian population has a high incidence rate of lactose intolerance, with more than 70% of the general population affected by the condition. Moreover, the non-dairy ice cream market is seeing a lot of innovation, with companies developing new flavors and ingredients to cater to different tastes and dietary needs. For instance, Coconut Bliss, a premium non-dairy ice cream brand, offers a variety of unique flavors such as Ginger Cookie Caramel and Mint Galactica, made with organic and sustainably sourced ingredients.

Report Segmentation

The market is primarily segmented based on source, flavor, product, form, distribution channel, and region.

|

By Source |

By Flavor |

By Product |

By Form |

By Distribution channel |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Coconut milk segment is expected to witness largest growth during forecast period

The coconut milk segment is expected to hold the largest share during the forecast period. This can be attributed to the wide-scale availability of coconut milk at low costs, which makes it an ideal alternative to dairy milk. Coconut milk is also easily processed and compatible, which further contributes to its popularity among consumers. The increasing demand for coconut milk can also be attributed to its high amount of saturated fat content, which lends a creamy texture to non-dairy ice cream and makes it highly compatible with several flavors. This has led to more consumers opting for non-dairy ice cream made with coconut milk, especially those who prefer a creamier texture in their ice cream.

Furthermore, coconut milk offers several health benefits to consumers, which also contributes to its popularity. For instance, it can help with weight management by increasing feelings of fullness and reducing calorie intake. Additionally, consuming coconut milk can increase the levels of good HDL cholesterol in the body, which is beneficial for heart health. It can also protect against cardiovascular diseases, making it a healthier alternative to traditional dairy ice cream.

Singles segment accounted to grow fastest at significant CAGR over forecast period

The singles segment is expected to expand at a significant CAGR during the forecast period. This growth can be attributed to the high demand for plain chocolate and vanilla flavors among consumers. These classic flavors have been popular for decades and continue to be a favorite among many consumers.

In addition to the classic flavors, there is also a high preference for various single-fruit flavors, including mango, orange, and strawberry, among millennials across the globe. These flavors are often combined with add-on chips, such as chocolate or cookie pieces, to enhance the taste and texture of the non-dairy ice cream. This trend has been driven by the desire for more unique and adventurous flavor combinations, which has led to an increase in the availability of non-dairy ice cream flavors in the singles segment.

Impulse segment is expected to hold the significant revenue share during forecast period

Impulse segment is expected to hold the significant revenue shares of the market. This growth can be attributed to the increasing young population and the rising number of female workers who require convenient and affordable food options due to their busy schedules. As a result, the demand for on-the-go food products has increased in both developed and developing economies.

Furthermore, the multiple benefits associated with impulse products, such as convenience and affordability, have led to a significant growth in the number of impulse buyers. For example, according to a survey conducted by the Slickdeals, average spending on the impulse purchase has increased from USD 276 in 2021 to USD 314, in 2022.

Chocolate segment is expected to hold the significant revenue share

Chocolate segment is a significant contributor to the market and is projected to expand rapidly during the forecast period. The growth of the chocolate segment is due to shifting consumer preferences for chocolate, the development of cocoa into new innovative flavors, and its association with health benefits such as preventing cardiovascular diseases.

For example, Haagen-Dazs has launched a non-dairy ice cream line that includes flavors like chocolate salted fudge truffle and peanut butter chocolate fudge, both made with high-quality cocoa. Additionally, cocoa is used to add texture to ice cream, expected to support the growth of the chocolate segment during the forecast period.

For instance, Ben & Jerry's has introduced a non-dairy chocolate fudge brownie ice cream that includes cocoa powder in the recipe to enhance the creaminess and texture of the ice cream.

Supermarkets segment is expected to hold the significant revenue share

The supermarket segment is projected to hold the largest revenue shares of the market. This growth can be attributed to the increasing preference for supermarkets as a shopping destination, particularly for food and beverage products. These stores offer numerous benefits to shoppers, including access to a wide variety of products, competitive pricing, a one-stop shopping experience, convenience, and attractive loyalty programs.

Moreover, significant investments in supermarket infrastructure development and the ongoing expansion of existing supermarket chains will further boost the sales of non-dairy ice creams through this distribution channel. For example, in June 2022, the U.S. Department of Agriculture (USDA) partnered with the Reinvestment Fund to infuse USD 22.6 million into improving access to healthy foods for underserved communities across the nation.

North America accounted to hold the largest share in 2022

North America held the largest shares of the market in 2022. Plant-based ice cream is experiencing significant growth, which can be attributed to increasing consumer awareness and changing dietary preferences. More than 40% of the Canadian population is adopting a vegan lifestyle by incorporating plant-based foods into their diets, while in the United States, there is a rising demand for vegan alternatives. This trend is expected to continue as consumers look for healthier and environmentally friendly food choices.

Furthermore, the rise in vegetarian and flexitarian lifestyles is also expected to contribute to the growth of the market, as more consumers seek out plant-based ice cream options. Flexitarianism, in particular, refers to a diet that is predominantly plant-based but still allows for some animal products. As more consumers adopt this type of diet, the demand for plant-based ice cream products is expected to increase, further fueling the growth of the market.

The market in Asia-Pacific is growing due to increasing demand for plant-based and vegan products, with China as the largest market in this region. Companies such as Nestle are expanding their non-dairy offerings, for example, Nestle launch a non-dairy ice cream brand "Nestle A+ Better Dairy" in China in 2020, and other local companies are emerging too. This trend is expected to continue due to growing health and environmental awareness among consumers.

Competitive Insight

Some of the major players operating in the global market include Unilever, General Mills, Nestle, Danone, Daiya Foods Inc., Tofutti Brands Inc., Coconut Bliss, So Delicious Dairy Free, NadaMoo!, Arctic Zero, Ripple Foods, Van Leeuwen Ice Cream, Luna & Larry's Coconut Bliss, Booja-Booja, Snow Monkey.

Recent Developments

- In Jan 2023, Ben & Jerry's, a brand owned by Unilever, has recently introduced a new flavor of non-dairy ice cream called Oatmeal Dream Pie.?

Non-Dairy Ice Cream Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 807.24 million |

|

Revenue forecast in 2032 |

USD 1,965.01 million |

|

CAGR |

10.4% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Source, By Flavor, By Product, By Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Unilever, General Mills, Nestle, Danone, Daiya Foods Inc., Tofutti Brands Inc., Coconut Bliss, So Delicious Dairy Free, NadaMoo!, Arctic Zero, Ripple Foods, Van Leeuwen Ice Cream, Luna & Larry's Coconut Bliss, Booja-Booja, Snow Monkey. |

FAQ's

key companies in non-dairy ice cream market are Unilever, General Mills, Nestle, Danone, Daiya Foods Inc., Tofutti Brands Inc., Coconut Bliss, So Delicious Dairy Free.

The non-dairy ice cream market is expected to grow at a CAGR of 10.4% during the forecast period.

The non-dairy ice cream market report covering key segments are source, flavor, product, form, distribution channel, and region.

key driving factors in non-dairy ice cream market are rising number of people adopting a vegan lifestyle.

The global non-dairy ice cream market size is expected to reach USD 1,965.01 million by 2032.