Ovulation Testing Kits Market Share, Size, Trends, Industry Analysis Report

By Product (Urine Ovulation Test, Digital Ovulation Test), By Distribution Channel (E-Commerce, Pharmacies and Drugstores), By Region, And Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4006

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

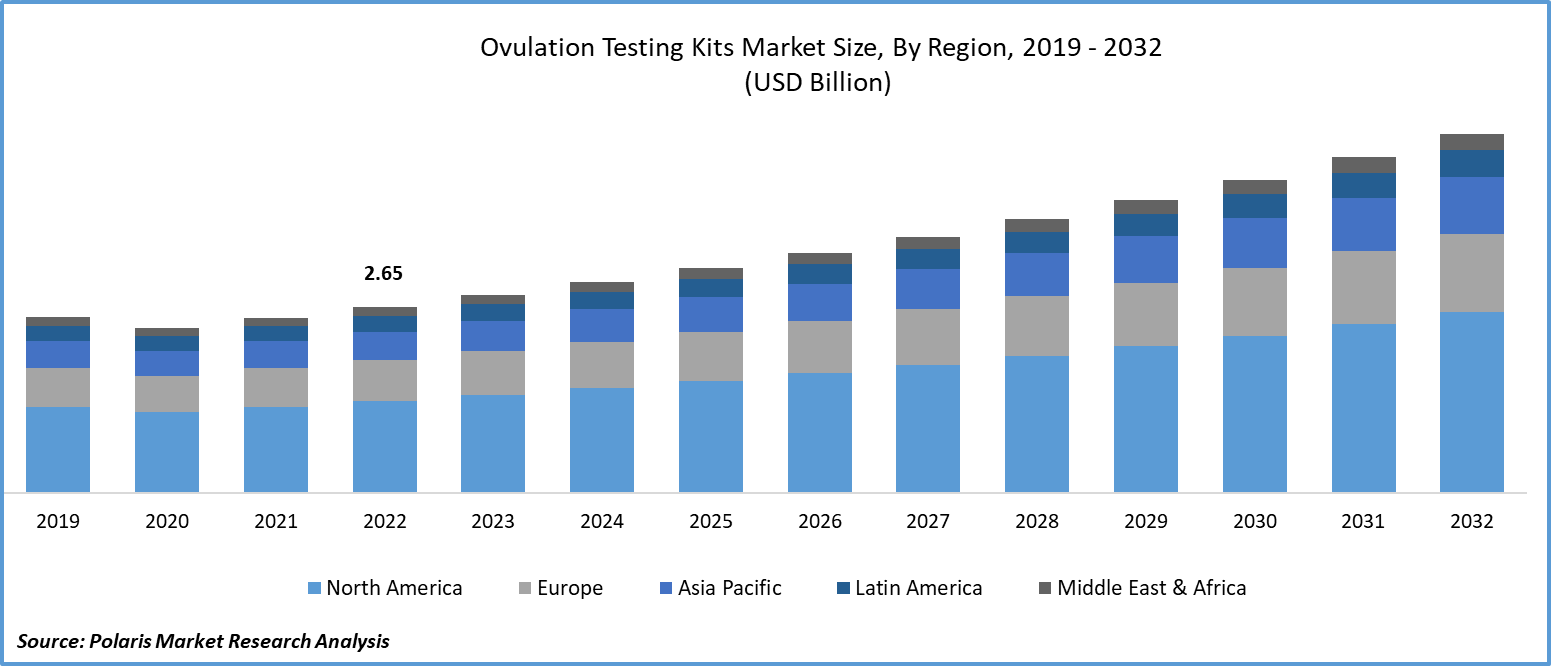

The global ovulation testing kits market was valued at USD 2.82 billion in 2023 and is expected to grow at a CAGR of 6.90% during the forecast period.

The market's expansion is linked to factors like the rising prevalence of conditions such as polycystic ovary syndrome (PCOS) and hormonal disorders affecting women in their reproductive years. Additionally, market growth is expected due to the delay in the age of first-time pregnancies, declining global fertility rates, and advancements in technology. Key drivers include the increasing success rates of In Vitro Fertilization (IVF) procedures, greater awareness about IVF techniques, and a trend toward postponing pregnancy. The growing understanding of advanced IVF methods and improved success rates has spurred a global demand for ovulation kits.

To Understand More About this Research: Request a Free Sample Report

In fertility support, keeping track of estrogen and progesterone levels is crucial for predicting and confirming ovulation, particularly in cases involving Polycystic Ovary Syndrome (PCOS), as Luteinizing hormone (LH) tests might yield unreliable results. Currently, serum Follicle Stimulating Hormone (FSH) testing is employed to forecast oocyte yield in assisted reproductive cycles, and it could potentially be entirely substituted with a more convenient urine testing alternative. Progesterone testing has shown encouraging outcomes in estimating the risk of pregnancy complications, diagnosing luteal phase deficiency, and identifying patients at high risk of miscarriage and ectopic pregnancy.

For sub-fertile couples trying to conceive, timing intercourse accurately with the woman's ovulation cycle is crucial. LH surge triggers the release of a mature egg from the ovary, marking the most fertile period in a woman's menstrual cycle. By measuring LH levels using LFAs, couples can pinpoint this surge, enabling them to predict the optimal time for sexual intercourse. This precise timing significantly increases the chances of successful conception, making LH testing a valuable tool in the journey toward achieving pregnancy for couples facing fertility challenges.

A report from the National Perinatal and Statistics Unit, published in September 2021, highlighted notable advancements in IVF success rates in recent years. The live birth rate per IVF cycle, where women used their own eggs, rose by 18%, with even more significant improvements observed in older age brackets. Moreover, the overall live birth rate per embryo transfer saw a substantial increase of about 28% in 2020.

Additionally, the rising prevalence of polycystic ovary syndrome (PCOS) has contributed significantly to the market's expansion. PCOS, a prevalent hormonal disorder, often leads to irregular ovulation. Moreover, the growing number of women experiencing fertility challenges, especially those with PCOS actively trying to conceive, is expected to drive the demand for ovulation testing.

- According to data released by the World Health Organization (WHO) in June 2023, approximately 8% to 13% of women in their reproductive years are affected by PCOS, with up to 70% of these cases going undiagnosed globally.

Moreover, the market is witnessing a significant uptick in the sales of home testing equipment, driven by ongoing product development initiatives. The accessibility of these products through e-commerce platforms, pharmacies, and physical retail stores has led to a rising demand for home testing devices. Many companies are forming strategic alliances to meet the requirements of women consumers.

The Ovulation Testing Kits Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

- For instance, in February 2019, NFI Consumer Healthcare expanded its partnership with Callitas Health to jointly distribute products, including NFI's e.p.t Numeric, the leading Over the Counter (OTC) digital ovulation test kit in the U.S.

Industry Dynamics

Growth Drivers

- Increasing Awareness of Fertility

As awareness about fertility and family planning continues to grow, more women and couples are looking for reliable methods to track ovulation. Ovulation testing kits provide an easy and accessible solution.

The increasing number of women in the workforce often leads to delayed childbearing. Ovulation testing kits can help women optimize their chances of conception within their busy schedules.

Manufacturers consistently allocate resources to research and development endeavors aimed at enhancing ovulation testing products. This involves creating kits that are not only more precise and user-friendly but also technologically advanced. Innovations may involve integrating digital technology, enabling connectivity with smartphone applications, and improving accessibility features.

Furthermore, manufacturers must continuously upgrade their products due to escalating competition, emphasizing affordability and the ability of ovulation test kits to provide 99% accurate results at home. This ongoing improvement in testing technology is crucial not only for preventing unintended pregnancies but also for ensuring better healthcare for children, contributing to the anticipated growth of the ovulation testing kits market in the coming years.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Urine test segment accounted for the largest share in 2022

Urine test segment held the largest share. This dominance can be attributed to its high accuracy in detecting the presence or absence of hCG (human chorionic gonadotropin), a pregnancy indicator. The growing trend of patients monitoring their medical conditions at home is fueling this growth, thanks to the accessibility and user-friendly nature of at-home testing equipment. Companies have introduced ovulation prediction kits tailored for home use, enabling individuals to detect ovulation-related hormones in saliva or urine. This trend is anticipated to drive the demand for ovulation kits in the forecast period.

Digital ovulation test segment will grow at substantial pace. The introduction of digital ovulation test kits is poised to offer startups a strong foothold, aiding their market presence. Certain digital ovulation tests come equipped with built-in memory or smartphone app connectivity, enabling users to monitor their fertility and understand their menstrual cycles over time. These advanced features in digital kits are projected to drive the demand for these innovative products. Additionally, the changing healthcare regulations landscape is creating favorable conditions for new entrants, providing them with opportunities to tap into this market.

By Distribution Channel Analysis

- Urine test segment accounted for the largest share

Pharmacies & drug stores segment held the largest share. This substantial market dominance is a result of the continuous expansion of retail pharmacies, especially in countries such as Brazil, India, & China. This shift is influenced by women's preference for conducting ovulation tests at home using these tools, bypassing the need for medical assistance at doctor's offices or hospitals. Additionally, the market's expansion is bolstered by strong and effective distribution channels.

E-commerce segment will grow rapidly. Segment's growth can be linked to the widespread impact of COVID-19, which has heightened the convenience of using online retail platforms. This trend is further bolstered by the rapid expansion of internet accessibility and the increasing popularity of online shopping platforms observed over the past decade. Additionally, the availability of diverse product options and access to knowledgeable customer service representatives for support and information are expected to positively impact the growth of this market segment.

Regional Insights

- The demand in North America garnered the largest share in 2022

The North America region dominated the global market. This can be attributed to the rising demand for ovulation test kits, driven by the availability of advanced features such as Bluetooth connectivity and smart countdown functions. The presence of a busy working-class population in the United States has contributed to the surge in unit sales of ovulation test kits since they often have limited time to visit healthcare providers. This factor further strengthens the regional market.

Asia pacific will grow at rapid pace. The growth in this region is primarily driven by the sharp rise in the number of women grappling with lifestyle disorders. Factors such as the easy availability of ovulation test kits and increased investments in the development of fertility and ovulation monitors are anticipated to boost the demand across various countries. The market is further propelled by the increasing trend of first-time pregnancies, declining fertility rates, rising disposable incomes, and ongoing advancements in ovulation testing techniques.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Accuquik

- Easy@Home Fertility

- Fairhaven Health

- Piramal Healthcare

- PREGMATE

- Proov

- Ro

- Runbio Biotech Co. Ltd

- Swiss Precision Diagnostics GmbH

- Wondfo

Recent Developments

- In September 2023, Prega News, introduced a new range of products. One of these offerings is the Ova News Ovulation Detection Kit, specifically designed to help women monitor their ovulation cycles.

- In June 2022, Sugentech, partnered with the CGETC. Many digital devices available in the market come with advanced features such as Bluetooth connectivity and intelligent countdown functionality.

Ovulation Testing Kits Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3 billion |

|

Revenue forecast in 2032 |

USD 5.11 billion |

|

CAGR |

6.90% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of Ovulation Testing Kits Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Traction Transformer Market Size, Share 2024 Research Report

SiC-On-Insulator and Other Substrates Market Size, Share 2024 Research Report

U.S. Postal Automation Systems Market Size, Share 2024 Research Report

North America MRO Distribution Market Size, Share 2024 Research Report

Veterinary Excipients Market Size, Share 2024 Research Report