Pentaerythritol Market Share, Size, Trends, Industry Analysis Report

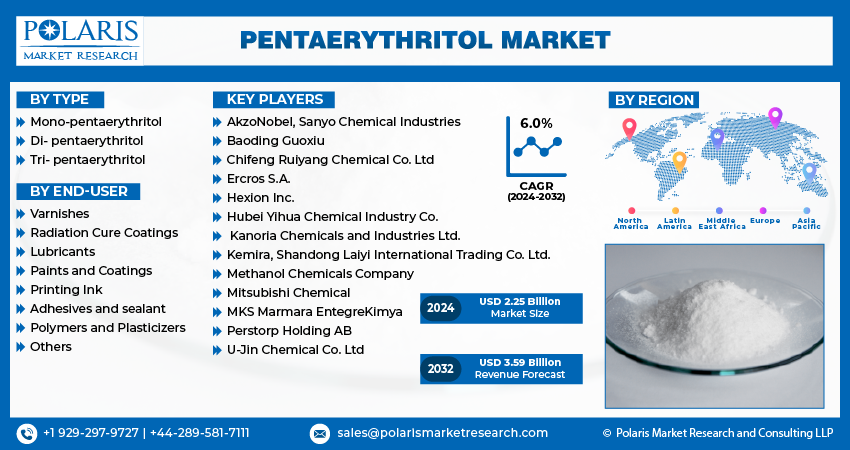

By Type (Mono-pentaerythritol, Di- pentaerythritol, Tri- pentaerythritol); By End-User; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 172

- Format: PDF

- Report ID: PM1561

- Base Year: 2024

- Historical Data: 2020-2023

The global pentaerythritol market was valued at USD 1.81 billion in 2024 and is expected to grow at a CAGR of 4.80% from 2025 to 2034. The market is witnessing steady growth driven by the rising application of the product in alkyd resins, protective varnishes, and industrial lubricants, owing to its desirable chemical and performance properties.

Pentaerythritol Market Overview

The market for pentaerythritol is anticipated to be driven by the rising demand for the substance from paint and coating applications, as well as the expanding use of pentaerythritol in the automotive sector. It is anticipated that rising raw materials will hamper the market's expansion. Throughout the projection period, the market is anticipated to have possibilities due to the increased demand for pentaerythritol from eco-friendly paints and coatings. Urbanization, rising middle-class incomes, and population growth are all contributing to the Asia-Pacific region's robust construction industry growth.

For instance, in March 2024, Minister of Housing and Urban Affairs Hardeep Singh Puri said that India's rapidly expanding construction sector is expected to overtake the United States as the third-largest in the world by 2025.

However, the worldwide economy suffered severely from the COVID-19 pandemic, which caused manufacturers to shut down their facilities in an effort to reduce viral transmission and harm their global supply chain. This led to significant influence on several industries, such as building and construction, textiles, appliances, and automobiles. The majority of industrial facilities closed as a result of the social distancing strategy, which reduced the amount of commodities produced.

To Understand More About this Research: Request a Free Sample Report

Moreover, recent developments and technology are leading to cutting-edge use of the substance, such as marine coatings, medicines, flame retardants, and explosives, which are driving the rise in demand for the pentaerythritol market. One of the primary uses of pentaerythritol is alkyd paint, which is anticipated to provide new prospects for the pentaerythritol market throughout the forecast period. Alkyd paints are used in both commercial and residential buildings. The fastest-growing applications of pentaerythritol are anticipated to be in plasticizers.

Pentaerythritol Market Dynamics

Market Drivers

Rising Demand in Construction Industry

The pentaerythritol market is significantly expanding due to the need for sealants, adhesives, and coatings required in the construction industry; these are some of the building chemicals made from pentaerythritol. The market is increasing as the building activity grows, experiencing fast urbanization and infrastructure development owing to the growing number of residential structures, business complexes, industrial facilities, and infrastructure projects, including bridges, highways, and airports. Further, pentaerythritol market demand is sustained by renovation and maintenance operations in already-existing structures, which increase the requirement for construction chemicals.

Rise in Demand for Automobile Sector

The rising demand for automobiles has led to the rise in demand for the usage of pentaerythritol in the automotive sector due to its potential application of being used as a renewable source of energy in heat production in IC engines, leading to energy conservation. The main reason propelling the market expansion is the widespread application of pentaerythritol in the automobile industry. Polyurethane foams and automotive lubricants that are included in dashboards, bumper systems, door handles, gear knob dashboards, and seat cushions are made with pentaerythritol. Moreover, the market is expanding due to the growing need for acetaldehyde and formaldehyde alternatives in the production of coatings, paints, alkyd adhesives, radiation-cured coatings, industrial inks, plasticizers, and synthetic rubber.

Market Restraints

Depending Cost and Fluctuation in Prices

The pentaerythritol raw materials market is continuously fluctuating as the cost of the raw materials depends on formaldehyde and acetaldehyde for the synthesis of pentaerythritol. Pentaerythritol is prepared by condensing formaldehyde acetaldehyde within an aqueous solution. The cost of producing pentaerythritol can be directly impacted by abrupt price increases or fluctuations in these raw materials, which would reduce the profit margins of producers. It is vulnerable to price variations due to a variety of reasons, including supply and demand dynamics, feedstock availability, and geopolitical tensions.

Furthermore, because it relies on these raw materials, the pentaerythritol market is susceptible to supply chain disruptions brought on by problems with manufacturing, limitations on transportation, or changes in regulations that influence the availability of these raw materials. For instance, in December 2023, the prices in the North American region decreased due to declined prices of formaldehyde, which in turn reduced the production cost of pentaerythritol. The consumption rates from insecticide industries were further depressed due to declining applications in the agriculture and horticulture sectors.

Report Segmentation

The market is primarily segmented based on type, end-user, and region.

|

By Type |

By End-user |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Pentaerythritol Market Segmental Analysis

By Type Analysis

The Mono- Pentaerythritol segment accounted for the largest market share and is likely to retain its market position throughout the forecast period due to the factor that Mono Pentaerythritol has a wide application in the production of fatty acid esters, alkyd resins for the synthesis of lubricant oils & additives. Pentaerythritol can be synthesized and converted into pentaerythritol esters, which have application in the ICE engines. This acts as biodegradable lubricating oil, aiding in environment conservation.

The Di-Pentaerythritol segment is expected to grow at the fastest growth rate over the next few years due to the rapid increase in demand for Di-Pentaerythritol as a chemical intermediary in the production of rosin esters, radiation-curing monomers, polymers, and oligomers, among many other products with wide applications in industries like aviation, refrigeration, cosmetics, detergents, and more.

By End-User Analysis

The paint and coatings segment holds the largest revenue share of the market owing to rising demand in the building and construction, aerospace, automotive, and other sectors driving the market for pentaerythritol. Paints for walls, doors, and windows are among the interior and exterior décor items used in buildings and the construction industry, including pentaerythritol. It is also employed as a fire retardant in plastics and, when heated, forms a thick carbon barrier to protect the surface. It is predicted to have an increase in the usage by the urban population throughout the forecast period as a consequence of the growing usage of paints and coatings in buildings and construction.

Polymers and Plasticizers are rapidly expanding at the fastest CAGR due to their wide applications in the plastic industry. These additives are usually cheaper than other additives used during polymer processing. Recent research and development have led to the advancements of eco-friendly bio-plasticizers, reducing the harmful environmental impact.

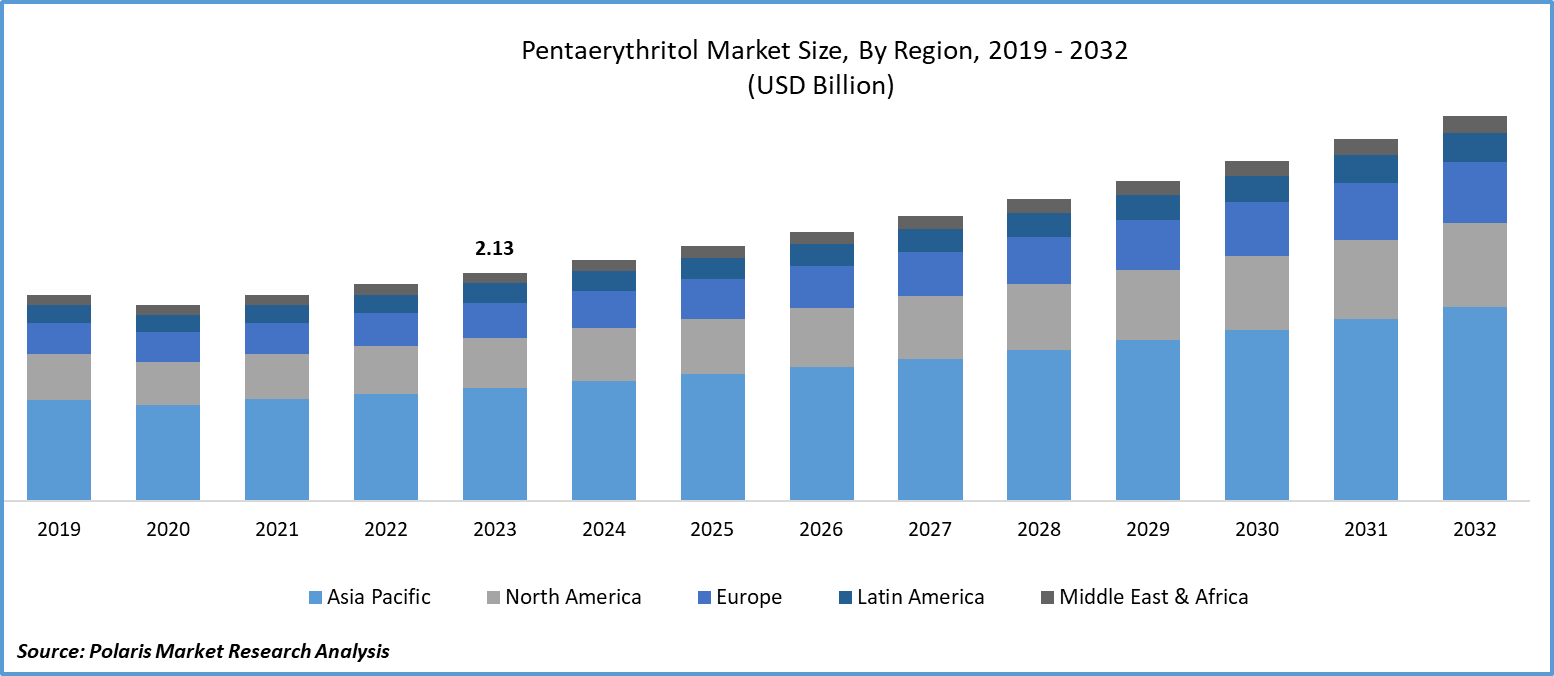

Pentaerythritol Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share

The Asia Pacific pentaerythritol market had the largest share in 2024 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to the constantly growing construction sector as a result of low labor costs and increased urbanization. Ever increasing population and their willingness to spend will lead to demand for urbanization, which will lead to the rise of construction industries. Furthermore, rising building activities and strong economic growth are contributing to the region's market expansion. It is anticipated that the area will continue to hold its leading position in the global construction sector, having emerged as its largest market.

Europe is expected to grow over the fastest CAGR due to a variety of political and economic variables, such as the need for greenhouses and government financing for non-residential construction projects. There is a sizable market for new construction and remodeling projects are giving rise to demand for pentaerythritol. Various ongoing residential and non-residential development projects will also probably raise the demand for pentaerythritol.

Competitive Landscape

The pentaerythritol market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AkzoNobel, Sanyo Chemical Industries

- Baoding Guoxiu

- Chifeng Ruiyang Chemical Co. Ltd

- Ercros S.A.

- Hexion Inc.

- Hubei Yihua Chemical Industry Co.

- Kanoria Chemicals and Industries Ltd.

- Kemira, Shandong Laiyi International Trading Co. Ltd.

- Methanol Chemicals Company

- Mitsubishi Chemical

- MKS Marmara EntegreKimya

- Perstorp Holding AB

- U-Jin Chemical Co. Ltd

Recent Developments

- In February 2024, Perstorp inaugurated a new ISCC Plus-certified Penta production plant in Gujarat, India, enhancing supply reliability for Asian markets. The facility addresses growing regional demand for specialty chemicals through advanced manufacturing capabilities.

- In April 2024, Mankiewicz Coatings- which produces coatings for cabin exteriors, interiors, and structural parts, with two awards in the supplier "Materials and Parts" category for its excellent performance by Airbus.

- In April 2024, the first Equity, Diversity, and Inclusion (ED&I) Charter for the UK coatings industry was unveiled by the British Coatings Federation. This public pledge honors and recognizes businesses in our industry that are dedicated to advancing a more equitable, balanced, and productive industry.

- In August 2023, Argentina Gas & Oil's new pipeline in Vaca Muerta was set to boost Paint & Coatings by being the primary source for key paints and other organic sources.

Report Coverage

The pentaerythritol market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-users and their futuristic growth opportunities.

Pentaerythritol Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1.89 billion |

|

Revenue forecast in 2034 |

USD 2.91 billion |

|

CAGR |

4.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global pentaerythritol market size is expected to reach USD 2.91 Billion by 2034

Key players in the market are Methanol Chemicals Company, Mitsubishi Chemical, MKS Marmara EntegreKimya

Asia Pacific contribute notably towards the global Pentaerythritol Market

Pentaerythritol Market exhibiting the CAGR of 4.80% during the forecast period

The Pentaerythritol Market report covering key segments are type, end-user, and region.