Phase-Transfer Catalyst Market Size, Share, Trends, Industry Analysis Report

By Type (Ammonium Salts, Potassium Salts, Others), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5968

- Base Year: 2024

- Historical Data: 2020-2023

Overview

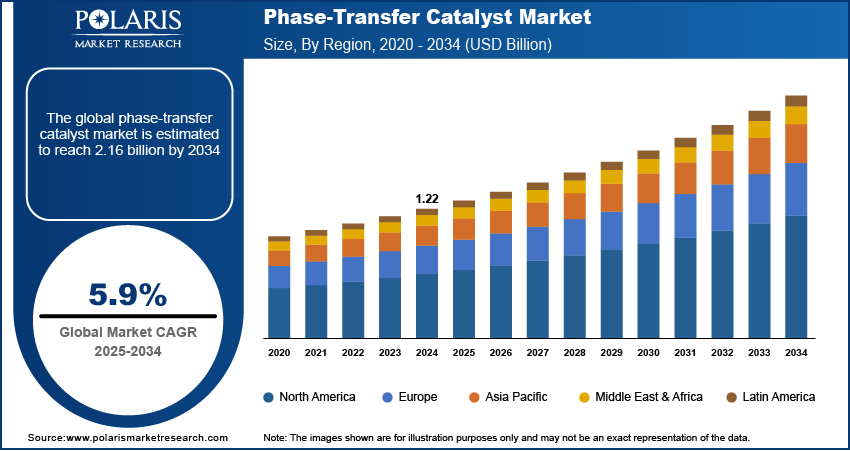

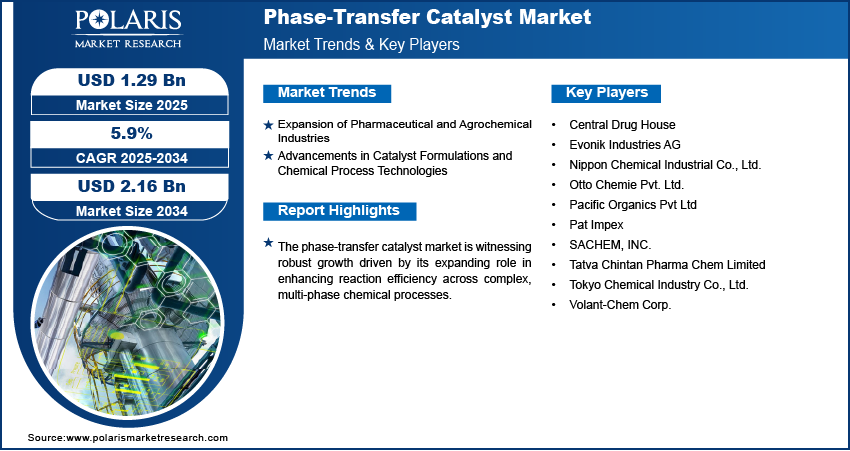

The global phase-transfer catalyst (PTC) market size was valued at USD 1.22 billion in 2024, growing at a CAGR of 5.9% from 2025 to 2034. Key factors driving demand for phase-transfer catalysts include the growing integration into custom synthesis by CMOs, expansion of the pharmaceutical and agrochemical industries, and advancements in catalyst formulations and chemical process technologies.

Key Insights

- The ammonium salts segment accounted for the largest revenue share in 2024.

- The agriculture segment is expected to register a significant CAGR during the forecast period.

- North America accounted for the largest revenue share of the global phase-transfer catalyst market in 2024.

- The U.S. held a significant share in North America phase-transfer catalyst landscape in 2024.

- The market in Asia Pacific is projected to register the highest CAGR during the forecast period

- The market in China is expanding due to rapid growth in its industrial chemical and pharmaceutical production capabilities.

Phase-transfer catalysts (PTCs) are chemical agents that facilitate the migration of a reactant from one phase to another, where the reaction occurs, thereby substantially improving reaction rates and selectivity in multi-phase systems. Their growing integration into custom synthesis by contract manufacturing organizations (CMOs) has emerged as a major driver of growth opportunities. CMOs rely on PTCs to optimize reaction conditions in complex chemical processes, particularly when dealing with unmixable reactants. The ability of PTCs to reduce the need for harsh conditions and expensive solvents improves the efficiency and cost-effectiveness of outsourced synthesis operations, making them essential for tailored production in pharmaceutical, agrochemical, and specialty chemical industries.

The development of innovative PTC applications across diverse industries is expanding the scope of their utility beyond traditional segments. In October 2024, researchers from the Phipps group developed a chiral catalyst derived from Cinchona alkaloids to enable stereoselective hydrogen atom transfer (HAT) in radical reactions. The photocatalyst enables precise control over molecular handedness, enhancing efficiency for pharmaceutical and fragrance synthesis. Advancements in green chemistry and cleaner production technologies are driving the development of novel applications for PTCs in polymers, dyes, personal care products, and electronics. These catalysts contribute to sustainability goals by minimizing waste and energy usage in chemical processes. The adaptability of PTCs to evolving technical demands positions them as a pivotal component in next-generation industrial formulations as industries aim to enhance operational efficiency and meet regulatory compliance requirements.

Industry Dynamics

- The expansion of pharmaceutical and agrochemical sectors is creating significant growth potential, as these industries depend extensively on multi-phase reactions for synthesizing active pharmaceutical ingredients (APIs) and crop protection chemicals.

- Innovations in catalyst formulations and chemical process technologies are improving catalytic performance, enhancing activity, selectivity, and stability, while aligning with green chemistry principles to unlock new efficiencies and application opportunities.

- The high production costs of specialized phase-transfer catalysts limit adoption, particularly among small manufacturers. Strict environmental regulations on chemical synthesis also increase compliance burdens for users.

- The growing demand for sustainable catalysts in the pharmaceuticals and agrochemicals sectors opens new opportunities. Innovations in recyclable PTC systems also reduce costs and align with green chemistry innovations.

Expansion of Pharmaceutical and Agrochemical Industries: The expansion of the pharmaceutical and agrochemical industries drives growth opportunities, as these sectors heavily rely on multi-phase reactions for the synthesis of active pharmaceutical ingredients (APIs). According to an April 2025 report from the Ministry of Commerce and Industry, India's pharmaceutical industry is projected to grow, reaching USD 130 billion by 2030 and expanding to USD 450 billion by 2047. PTCs enable the efficient conversion of reagents across immiscible phases, streamlining reaction pathways and improving product yield and purity. Manufacturers are turning to PTCs to enhance scalability, reduce processing costs, and ensure environmental compliance as demand for high-value intermediates and active ingredients continues to rise. Additionally, their role in facilitating smoother, more selective reactions aligns well with the industry's need for robust and cost-effective production technologies.

Advancements in Catalyst Formulations and Chemical Process Technologies: Advancements in catalyst formulations and chemical process technologies are enhancing catalytic activity, selectivity, and stability, with a particular focus on green chemistry and sustainable practices by opening up new efficiencies and application possibilities. In March 2025, UNESCO reported that the PhosAgro/UNESCO/IUPAC Green Chemistry program provides research grants of up to USD 30,000 each to scientists under 39 for innovative projects aligned with green chemistry principles, supporting their research implementation. Innovations in catalyst design, such as improved thermal stability, tunable selectivity, and reusability, have expanded the functional scope of PTCs in both traditional and emerging chemical processes. Additionally, integration with continuous flow and green chemistry techniques is elevating their value in modern synthesis environments. These technological improvements enhance reaction control and sustainability and also position PTCs as critical enablers of next-generation chemical manufacturing.

Segmental Insights

Type Analysis

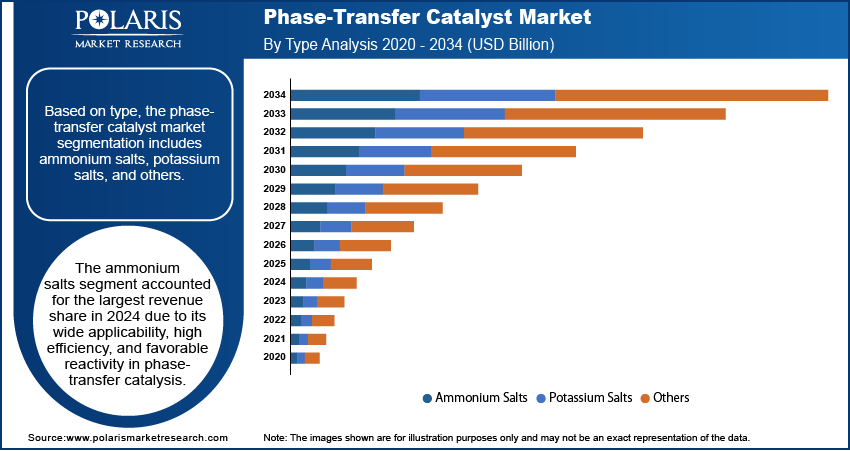

Based on type, the segmentation includes ammonium salts, potassium salts, and others. The ammonium salts segment accounted for the largest revenue share in 2024 due to its wide applicability, high efficiency, and favorable reactivity in phase-transfer catalysis. These compounds exhibit excellent solubility and compatibility with a wide range of organic and inorganic substrates, allowing them to accelerate diverse reactions in biphasic systems. Their versatility in supporting nucleophilic substitution, oxidation, and polymerization reactions makes them a preferred choice across various industries, such as pharmaceuticals and agrochemicals. Additionally, the cost-effectiveness and availability of various quaternary ammonium compounds enhance their adoption in large-scale industrial synthesis, further reinforcing their dominant position.

End Use Analysis

In terms of end use, the segmentation includes pharmaceuticals, agriculture, chemical, and others. The agriculture segment is expected to register a significant CAGR during the forecast period, owing to the increasing demand for crop protection chemicals and fertilizers that rely on phase-transfer catalysts during synthesis. The use of efficient synthesis processes for agrochemicals is becoming increasingly critical as agricultural productivity remains a global priority, particularly in regions with growing populations and limited arable land. Moreover, PTCs enable milder reaction conditions and improve yields during the formulation of herbicides, fungicides, and insecticides, thus driving their growth. This growing reliance on precision agrochemical manufacturing directly contributes to the rising use of PTCs in the agricultural sector.

Regional Analysis

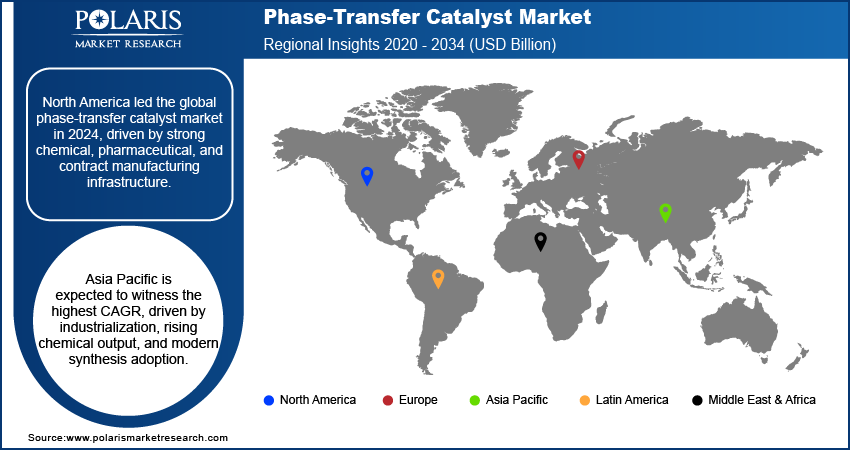

The North America phase-transfer catalyst market accounted for the largest revenue share in 2024. This dominance is attributed to the region’s well-established chemical manufacturing base, robust pharmaceutical sector, and strong presence of contract manufacturing organizations. According to a March 2024 report from the State of U.S. Science and Engineering, the U.S. leads global R&D investments, with gross domestic expenditures reaching USD 806 billion in 2021. The region’s focus on advanced synthesis techniques, regulatory compliance, and high product quality standards drives the demand for efficient catalysts, such as PTCs. Additionally, ongoing investments in research and innovation foster the development of next-generation catalytic processes, further supporting market expansion. These factors collectively contribute to North America's dominant position in the global phase-transfer catalyst landscape.

U.S. Phase-Transfer Catalyst Market Insight

The U.S. held a significant share of the North America phase-transfer catalyst landscape in 2024 due to its advanced chemical manufacturing infrastructure and strong presence of pharmaceutical and agrochemical industries. The widespread adoption of innovative synthesis technologies and high investment in R&D activities support the integration of PTCs across industrial applications. Additionally, the country’s well-established network of contract manufacturing organizations further amplifies demand for efficient catalytic processes.

Asia Pacific Phase-Transfer Catalyst Market Trends

The market in Asia Pacific is projected to register the highest CAGR during the forecast period, owing to rapid industrialization, increasing chemical production, and growing adoption of modern synthesis techniques across emerging economies. Expanding pharmaceutical and agrochemical manufacturing capacities, coupled with favorable government support for domestic chemical industries, are improving demand for efficient catalytic systems. Furthermore, the rising focus on cost-effective and scalable production processes in the region fuels the utilization of PTCs to meet high-volume demands. According to an April 2025 report by India's Ministry of Commerce and Industry, FDI in manufacturing surged to USD 165.1 billion, marking a 69% growth over a decade, fueled by PLI schemes, reflecting robust industrial expansion. These dynamics position Asia Pacific as a major growth engine for the global PTC market.

China Phase-Transfer Catalyst Market Overview

The market in China is expanding due to rapid growth in its industrial chemical and pharmaceutical production capabilities. Increasing domestic demand for fine chemicals and intermediates is encouraging manufacturers to adopt cost-effective and scalable production methods, where PTCs play a crucial role. Moreover, favorable government initiatives to boost chemical exports and upgrade production technologies contribute to the rising use of phase-transfer catalysts in the country.

Europe Phase-Transfer Catalyst Market Analysis

The market in Europe is projected to hold a substantial share by 2034, supported by the region’s focus on sustainable chemistry, regulatory-driven innovations, and high-value specialty chemical production. European manufacturers are increasingly incorporating advanced catalytic solutions to reduce environmental impact and improve process efficiency. Moreover, the presence of several global chemical and pharmaceutical leaders encourages the continuous adoption of advanced technologies, including PTCs. The alignment of industrial goals with green chemistry principles is likely to reinforce Europe's position as a mature and innovation-driven market for phase-transfer catalysts over the long term.

The Germany phase-transfer catalyst market growth is driven by its strong focus on chemical process innovation and sustainability. The country’s commitment to green chemistry and environmentally friendly manufacturing practices has led to increased incorporation of PTCs in various industrial applications. Additionally, Germany's leadership in specialty chemicals and its emphasis on high-performance, efficient catalysts continue to support the market’s upward trajectory.

Key Players and Competitive Analysis

The phase-transfer catalyst sector is witnessing strategic investments and technological advancements as major players, such as SACHEM, Evonik, and NAGASE, expand their product offerings to meet latent demand in the pharmaceuticals and agrochemicals sectors. Competitive intelligence reveals that developed markets dominate through high-value applications, while emerging markets drive revenue growth via cost-effective production and government-led sustainability strategies. Vendor strategies emphasize green chemistry innovations, such as recyclable PTCs, to align with economic and geopolitical shifts toward decarbonization. Small and medium-sized businesses are gaining traction in niche segments through specialized catalytic solutions. Supply chain disruptions and raw material volatility remain challenges, prompting the joint ventures for localized production. Additionally, future development strategies will rely on optimizing regional footprints and leveraging partner ecosystems to capitalize on expansion opportunities in high-growth sectors, such as biologics and renewable chemicals.

A few major companies operating in the phase-transfer catalyst market include Central Drug House; Evonik Industries AG; Nippon Chemical Industrial Co., Ltd.; Otto Chemie Pvt. Ltd.; Pacific Organics Pvt Ltd; Pat Impex; SACHEM, INC.; Tatva Chintan Pharma Chem Limited; Tokyo Chemical Industry Co., Ltd.; and Volant-Chem Corp.

Key Players

- Central Drug House

- Evonik Industries AG

- Nippon Chemical Industrial Co., Ltd.

- Otto Chemie Pvt. Ltd.

- Pacific Organics Pvt Ltd

- Pat Impex

- SACHEM, INC.

- Tatva Chintan Pharma Chem Limited

- Tokyo Chemical Industry Co., Ltd.

- Volant-Chem Corp.

Industry Developments

- March 2025: SACHEM agreed to sell its Asia operations to NAGASE & CO., enhancing Nagase's regional capabilities while allowing SACHEM to focus on core sectors. The transaction, with undisclosed terms, is expected to close within nine months.

- March 2024: Evonik launched Octamax, a sustainable catalyst system for refinery fuel desulfurization. The NiMo/CoMo-based technology enhances sulfur removal in cracked gasoline hydrodesulfurization units through optimized regeneration processes.

Phase-Transfer Catalyst Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Ammonium Salts

- Potassium Salts

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceuticals

- Agriculture

- Chemical

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Phase-Transfer Catalyst Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.22 Billion |

|

Market Size in 2025 |

USD 1.29 Billion |

|

Revenue Forecast by 2034 |

USD 2.16 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.22 billion in 2024 and is projected to grow to USD 2.16 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Central Drug House; Evonik Industries AG; Nippon Chemical Industrial Co., Ltd.; Otto Chemie Pvt. Ltd.; Pacific Organics Pvt Ltd; Pat Impex; SACHEM, INC.; Tatva Chintan Pharma Chem Limited; Tokyo Chemical Industry Co., Ltd.; and Volant-Chem Corp.

The ammonium salts segment accounted for the largest revenue share in 2024.

The agriculture segment is expected to register a significant CAGR during the forecast period.