Plastic Welding Equipment Market Size, Share, Trends, Industry Analysis Report

By Type (Automatic, Semi-automatic, Manual), By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5879

- Base Year: 2024

- Historical Data: 2020-2023

Overview

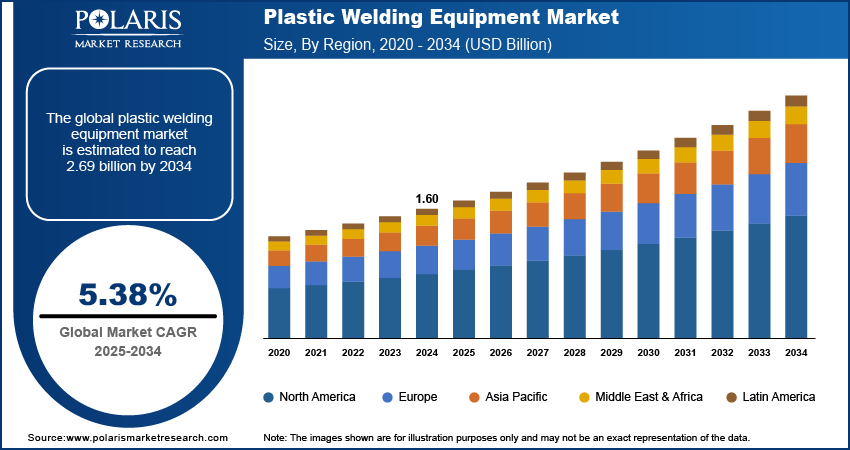

The global plastic welding equipment market size was valued at USD 1.60 billion in 2024, growing at a CAGR of 5.38% from 2025 to 2034. Key factors driving demand for plastic welding equipment include increasing production of automobiles, rising adoption of smartphones, growing urbanization, and rising investments in renewable energy.

Plastic welding equipment enables users to join or repair thermoplastic materials by applying heat and pressure, creating strong, seamless bonds. These machines are increasingly used in various industries such as automotive, medical device manufacturing, construction, packaging, and electronics, where the integrity and durability of plastic joints are critical. Users also value plastic welding equipment for its ability to handle a wide range of thermoplastics, including polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), acrylonitrile butadiene styrene (ABS), polyethylene terephthalate (PET), and polycarbonate (PC), making it a versatile solution for both production and repair tasks.

The increasing production of automobiles globally is driving the market growth. European Automobile Manufacturers' Association, in its report, stated that in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. This rise in automobile production is creating the need for more plastic parts, such as dashboards, bumpers, and interior panels, which require precise and efficient assembly. Plastic welding equipment provides a reliable and precise method to join these components quickly and securely, ensuring durability and meeting industry standards. Therefore, the increasing production of automobiles globally is driving the industry expansion.

The rising demand for plastic welding equipment is driven by the increasing adoption of smartphones worldwide. According to the Groupe Spéciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over 54% of the global population owns a smartphone. Smartphones contain plastic parts such as casings, internal frames, and battery housings, which require precise assembly to ensure structural integrity and aesthetic quality. Plastic welding offers a fast, efficient, and clean method for bonding these components without the use of adhesives or mechanical fasteners, making it ideal for high-volume production. Therefore, as smartphone adoption increases, manufacturers scale up their production lines, leading to higher purchases of plastic welding machines such as ultrasonic welders and laser welding systems.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growing Urbanization Globally

Urbanization requires durable and cost-effective materials for plumbing systems, electrical conduits, and construction panels, many of which manufacturers assemble using plastic welding techniques. The rise in urban populations is also driving higher consumption of appliances, electronics, and automotive parts, all of which use plastic welding equipment in production. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. The rising demand for lightweight, corrosion-resistant plastic products in wastewater treatment plants and oil and gas companies in urban areas is further pushing manufacturers to invest in advanced welding equipment for mass production. Therefore, as urbanization expands, the demand for plastic welding equipment also increases.

Rising Investments in Renewable Energy

Rising investments in renewable energy are boosting demand for plastic welding equipment as solar, wind, and hydropower systems increasingly rely on durable, lightweight plastic components. Manufacturers use plastic welding to assemble solar panel frames, wind turbine housings, and waterproof electrical enclosures, ensuring resistance to harsh weather and corrosion. The expansion of renewable energy projects requires the large-scale production of plastic parts such as piping for hydropower systems or protective covers for battery storage units, driving the need for efficient and precise welding equipment. Hence, as governments and companies invest more in renewable energy infrastructure, plastic welding equipment becomes essential for producing reliable and high-performance parts.

Segmental Insights

Type Analysis

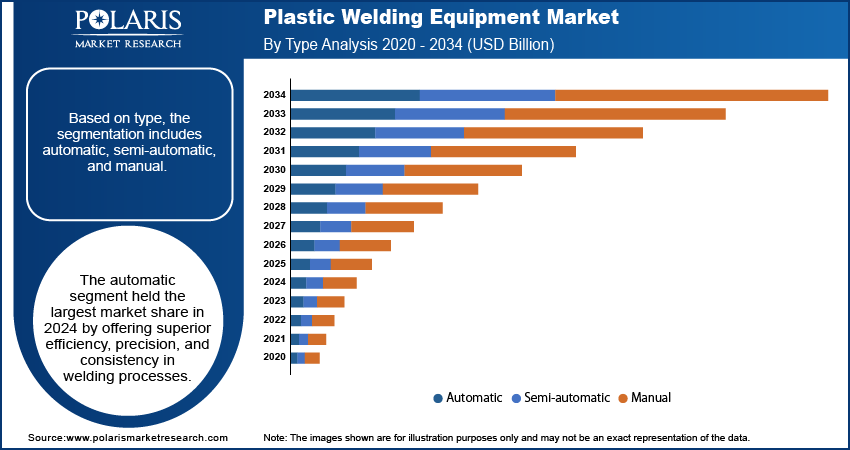

Based on type, the segmentation includes automatic, semi-automatic, and manual. The automatic segment held the largest market share in 2024 by offering superior efficiency, precision, and consistency in welding processes. Manufacturers across the automotive, electronics, and packaging industries increasingly prefer automatic systems due to their ability to reduce human error, improve repeatability, and enhance production speed. The growing demand for high-volume production lines, especially in emerging economies such as China and India, further strengthened the dominance of the segment. Additionally, the integration of automation with technologies such as robotics and Industry 4.0 solutions contributed to higher adoption rates among large-scale manufacturers seeking process optimization and cost reduction.

The semi-automatic segment is projected to grow at a robust pace in the coming years, owing to its ability to provide a balance between automation and operator control, making it an attractive option for businesses that require flexibility without the high capital investment associated with fully automated solutions. Furthermore, the increasing focus on energy efficiency and operator safety, combined with rising labor costs in various regions, is projected to propel the adoption of semi-automatic machines in the coming years.

Technology Analysis

In terms of technology, the segmentation includes ultrasonic welding, vibration welding, laser welding, infrared welding, spin welding, hot plate welding, and others. The ultrasonic welding segment accounted for a major market share in 2024 due to its widespread use across industries requiring high-speed, precise, and clean plastic joining. Manufacturers in sectors such as automotive, electronics, and medical devices favored this technology for its ability to produce strong, hermetic seals without adhesives or fasteners. Moreover, its suitability for thermoplastics and small, intricate components made it especially valuable in applications involving disposable medical products, sensors, and electrical enclosures, further contributing to its market dominance.

Application Analysis

In terms of application, the segmentation includes automotive, electronics & electrical, packaging, medical, consumer goods, and others. The automotive segment dominated the market share in 2024 due to surging demand for lightweight and durable plastic components in vehicle manufacturing. Automotive manufacturers increasingly rely on plastic welding solutions to assemble interior components, fluid reservoirs, bumper systems, and under-the-hood parts with enhanced structural integrity. The push for vehicle weight reduction to meet fuel efficiency and emission standards further fueled the adoption of advanced welding systems. Additionally, the rise in adoption of electric vehicles (EVs) boosted demand for precise and reliable joining techniques for battery components and plastic enclosures, leading to high adoption of plastic welding equipment.

The electronics & electrical segment is projected to grow at a robust pace in the coming years, owing to the rapid expansion of consumer electronics, wearable devices, and home automation products. Manufacturers in the electronics & electrical sector require plastic welding equipment to join small, intricate plastic parts without compromising performance or design. The growing complexity of electronic devices and the need for miniaturized components are further boosting reliance on ultrasonic and laser welding techniques. Furthermore, the global rise in demand for smart devices, coupled with ongoing advancements in 5G infrastructure and IoT technologies is projected to propel the use of plastic welding equipment in the future.

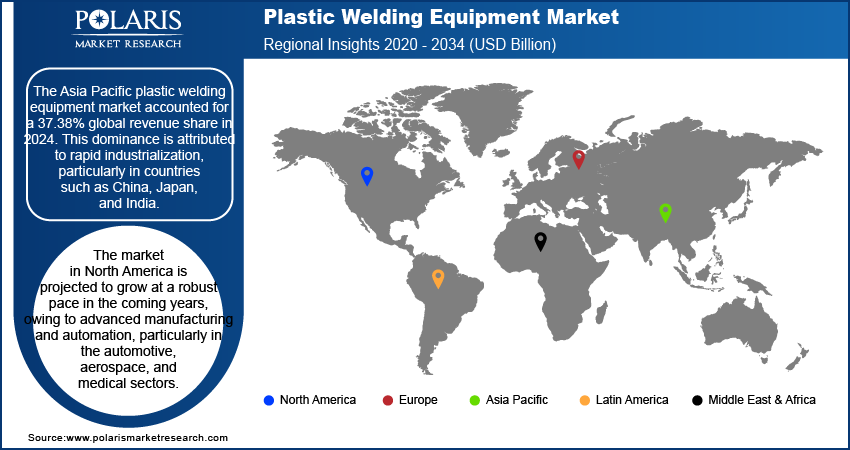

Regional Analysis

The Asia Pacific plastic welding equipment market accounted for 37.38% global revenue share in 2024. This dominance is attributed to rapid industrialization, particularly in countries such as China, Japan, and India. The automotive and electronics manufacturing sectors in the region are key contributors to the regional dominance, as plastic welding is essential for assembling lightweight and durable components. Additionally, infrastructure development, such as water and gas pipeline projects in countries such as India and China, increased the need for plastic welding equipment in the region. The growing adoption of automation and Industry 4.0 technologies further boosted demand for advanced welding equipment in Asia Pacific.

India Plastic Welding Equipment Market Insight

India held a substantial share in Asia Pacific in 2024, due to "Make in India" initiative, which promoted domestic manufacturing across the automotive, electronics, and medical device industries. The rising automotive sector, including electric vehicle (EV) production and adoption, propelled the demand for plastic welding equipment as EVs require plastic welding for battery casings and lightweight components. As of July 08, 2024, India witnessed a 16% rise in EV registrations in the first half of 2024. Urbanization and government investments in water supply and sanitation infrastructure in the country further drove demand for plastic pipe welding.

North America Plastic Welding Equipment Market Trends

The market in North America is projected to grow at a robust pace in the coming years, owing to advanced manufacturing and automation, particularly in the automotive, aerospace, and medical sectors. The shift from metal to high-performance plastics for weight reduction and corrosion resistance is increasing welding applications in the region, driving market expansion. Additionally, the renewable energy sector, including solar panel assembly, and the growing electronics industry, are contributing to market demand.

US Plastic Welding Equipment Market Overview

In the US, the demand for plastic wielding equipment is influenced by technological innovation and automated manufacturing. The automotive industry’s transition to EVs in the US is boosting the need for plastic welding in battery housings and interior components. The aerospace sector in the country heavily uses welded plastics for lightweight, fuel-efficient parts. Additionally, infrastructure upgrades, such as plastic piping for gas and water systems in the country, are driving demand for the welding equipment.

Europe Plastic Welding Equipment Market Assessment

The market in Europe is projected to hold a substantial market share by 2034, due to the imposition of stringent environmental regulations and a push toward sustainable manufacturing. The automotive industry, under EU emission norms, is increasingly adopting plastic welding for lightweight vehicle components. Circular economy policies are encouraging plastic recycling and repair, expanding welding applications. Additionally, rising construction and infrastructure projects, particularly in countries such as Germany, the UK, and France, are driving the market expansion in the region.

Key Players and Competitive Analysis

The global plastic welding equipment market is highly competitive, with key players such as Leister Technologies, Dukane, Herrmann Ultraschall, and Emerson leading the industry through innovation and advanced solutions. Leister Technologies dominates with its high-performance hot air and laser plastic welding systems, catering to the automotive, packaging, and construction sectors. Dukane specializes in ultrasonic welding, offering precision equipment for medical devices and electronics. Emerson, through its Branson division, provides a wide range of ultrasonic, vibration, and hot plate welding systems, serving industries requiring high-strength plastic joints. Regional dynamics also influence competition. North America and Europe lead in automated welding systems segment, while Asia Pacific shows rapid growth due to expanding manufacturing sectors and demand for affordable equipment. Environmental regulations and the push for sustainable manufacturing further drive innovation, with companies developing eco-friendly welding techniques to reduce emissions and plastic waste.

A few major companies operating in the plastic welding equipment industry include Bortte; Dukane Corp.; Emerson Electric Co.; Herrmann Ultraschall; Johnson Plastosonic; KING ULTRASONIC CO., LTD; Knmtech Ultrasonics; Leister AG; LPKF Laser & Electronics; Miller Weldmaster; MUNSCH Kunststoff-Schweißtechnik GmbH; ROTHENBERGER AG; Seelye Acquisitions, Inc.; Sibas Ultrasonics Pvt Ltd; and WEGENER Welding, LLC.

Key Players

- Bortte

- Dukane Corp.

- Emerson Electric Co.

- Herrmann Ultraschall

- Johnson Plastosonic

- KING ULTRASONIC CO., LTD

- Knmtech Ultrasonics

- Leister AG

- LPKF Laser & Electronics

- Miller Weldmaster

- MUNSCH Kunststoff-Schweißtechnik GmbH

- ROTHENBERGER AG

- Seelye Acquisitions, Inc.

- Sibas Ultrasonics Pvt Ltd

- WEGENER Welding, LLC

Industry Developments

May 2024: Emerson introduced its new Branson GLX-1 Laser Welder to meet the growing demand for joining small, complex, or delicate plastic components and assemblies.

October 2024: ROTHENBERGER AG announced plans to expand its attractive brand portfolio in the promising field of plastic welding equipment, with the acquisition of BAK Technology AG

Plastic Welding Equipment Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Automatic

- Semi-automatic

- Manual

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Ultrasonic Welding

- Vibration Welding

- Laser Welding

- Infrared Welding

- Spin Welding

- Hot Plate Welding

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Electronics & Electrical

- Packaging

- Medical

- Consumer Goods

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plastic Welding Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.60 Billion |

|

Market Size in 2025 |

USD 1.68 Billion |

|

Revenue Forecast by 2034 |

USD 2.69 Billion |

|

CAGR |

5.38% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.60 billion in 2024 and is projected to grow to USD 2.69 billion by 2034.

The global market is projected to register a CAGR of 5.38% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Bortte; Dukane Corp.; Emerson Electric Co.; Herrmann Ultraschall; Johnson Plastosonic; KING ULTRASONIC CO., LTD; Knmtech Ultrasonics; Leister AG; LPKF Laser & Electronics; Miller Weldmaster; MUNSCH Kunststoff-Schweißtechnik GmbH; ROTHENBERGER AG; Seelye Acquisitions, Inc.; Sibas Ultrasonics Pvt Ltd; and WEGENER Welding, LLC.

The automatic segment dominated the market share in 2024.

The electronics and electrical segment is expected to witness the fastest growth during the forecast period.