Point of Entry PFAS Treatment Systems Market Size, Share, Trend, Industry Analysis Report

By Technology (Reverse Osmosis, Granular Activated Carbon, Ion Exchange Filter, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5923

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

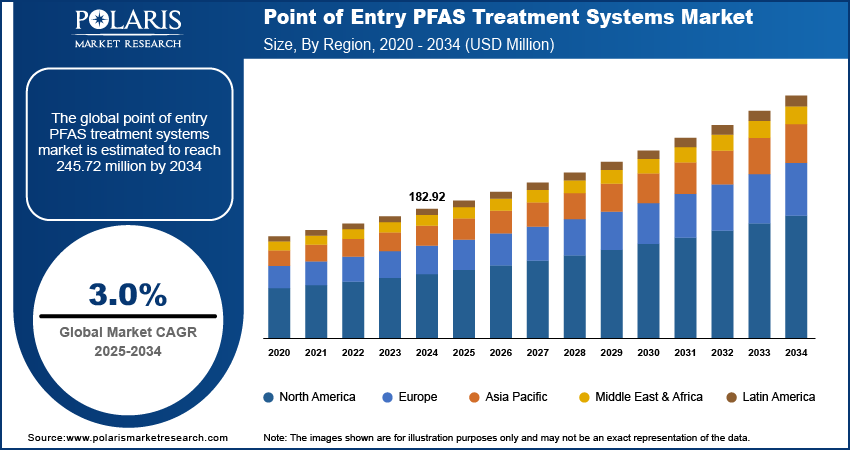

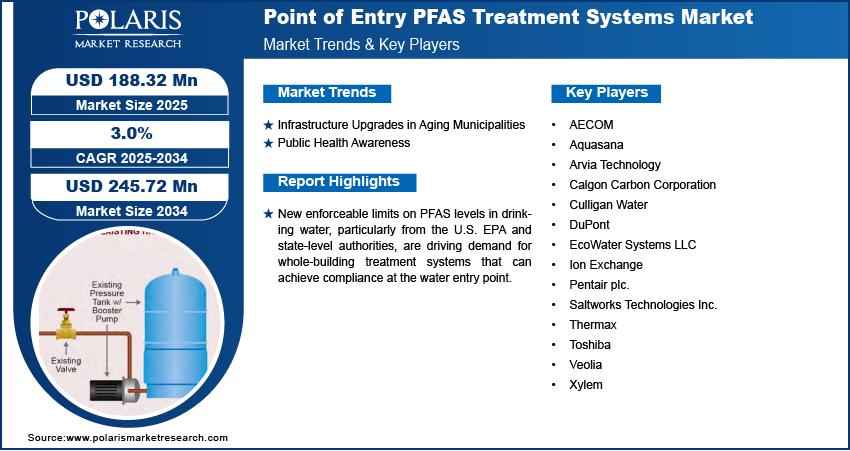

The global point of entry PFAS treatment systems market size was valued at USD 182.92 million in 2024 and is projected to register a CAGR of 3.0% from 2025 to 2034. New enforceable limits on PFAS levels in drinking water, particularly from the U.S. EPA and state-level authorities, are driving demand for whole-building treatment systems that can achieve compliance at the water entry point.

The point of entry (POE) PFAS treatment systems market focuses on water filtration technologies installed at the entry point of a building’s water supply to eliminate per- and polyfluoroalkyl substances (PFAS). These systems treat all incoming water, ensuring the safe and contaminant-free distribution of water throughout residential, commercial, and industrial facilities. Common technologies include activated carbon, ion exchange, and membrane filtration systems. The market is gaining momentum due to increasing regulatory pressure, public health concerns, and the need for building-wide PFAS mitigation. Widening identification of PFAS-contaminated sites near airports, military bases, and industrial areas has led to a surge in demand for POE systems to provide comprehensive, site-level water safety.

To Understand More About this Research: Request a Free Sample Report

Rising awareness about the health risks linked to long-term PFAS exposure is increasing public pressure on municipalities and private property owners to invest in advanced POE filtration solutions. Additionally, the development of high-capacity media such as advanced granulated activated carbon and novel ion exchange resins is enhancing the performance and lifecycle of POE systems, attracting wider adoption across sectors.

Market Dynamics

Infrastructure Upgrades in Aging Municipalities

Many municipalities across the U.S., Canada, and Europe are facing challenges due to outdated water infrastructure that was not designed to handle emerging contaminants such as PFAS. In September 2024, according to the Environmental Working Group (EWG), more than 2,719 PFAS-contaminated sites have been identified across the U.S., driving urgent deployment of advanced treatment technologies at both municipal and industrial levels. These older systems are under increased scrutiny, particularly in urban regions where dense populations and public institutions depend on safe water supply. Schools, hospitals, and government buildings are becoming early adopters of point-of-entry PFAS treatment systems as part of broader retrofitting programs. Integrating POE filtration solutions into ongoing infrastructure upgrades addresses contamination concerns and also aligns with federal and local funding priorities. The trend is driving sustained demand for scalable, building-wide treatment technologies that are installed cost-effectively while delivering long-term protection against hazardous chemicals. Hence, the rising infrastructure upgrades and aging municipalities boost the demand for point of entry PFAS treatment systems.

Public Health Awareness

Concerns around PFAS exposure and its links to serious health conditions, including cancer, developmental issues, and immune dysfunction, are gaining attention among the general public and advocacy groups. Media coverage, scientific publications, and government advisories have elevated PFAS to a top public health issue. This growing awareness is leading to increased expectations from communities for proactive water quality management. Building owners, municipalities, and school boards are being urged to adopt comprehensive mitigation systems. Point-of-entry PFAS treatment systems are emerging as a preferred solution due to their ability to protect all water outlets in a building. Public demand for safe, contaminant-free drinking water is creating momentum for widespread adoption, making health awareness a powerful market growth catalyst.

Segment Insights

Technology Analysis

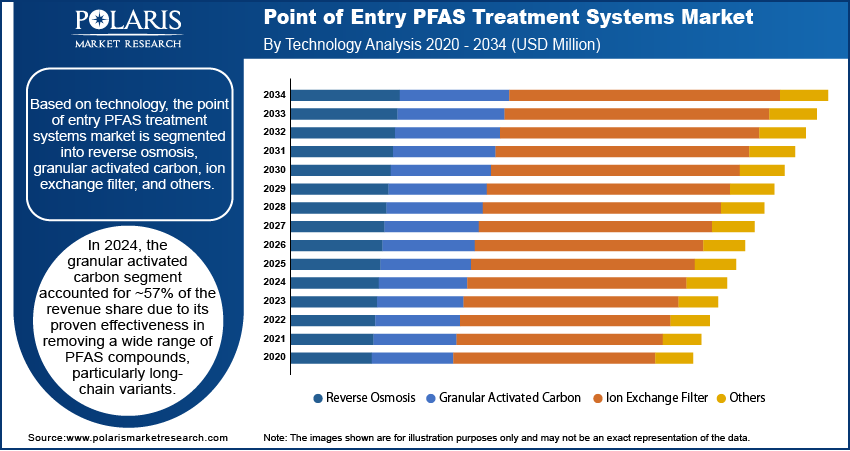

Based on technology, the segmentation includes reverse osmosis, granular activated carbon, ion exchange filter, and others. In 2024, the granular activated carbon segment accounted for ~57% of the revenue share due to its proven effectiveness in removing a wide range of PFAS compounds, particularly long-chain variants. The cost-efficiency, ease of installation, and availability of replacement media make it a preferred choice for large-scale point-of-entry systems. Regulatory bodies and water authorities recognize granular activated carbon (GAC) as a reliable method for compliance with PFAS limits, driving its widespread adoption across municipalities, industrial parks, and institutional facilities. Its scalability and compatibility with existing infrastructure enable quick deployment, especially in response to emergency contamination scenarios. Additionally, growing public-sector investments in GAC-based systems support its strong market penetration.

The ion exchange filters segment is expected to register the highest CAGR over the forecast period due to their high specificity and performance in removing both short- and long-chain PFAS molecules. These systems are gaining traction in environments where traditional methods such as activated carbon are less effective. Recent advancements in resin formulations have improved efficiency, reduced operational costs, and extended lifecycle. Industrial users seeking higher removal rates and lower footprint are shifting toward ion exchange technologies. Increasing regulatory requirements for trace-level PFAS removal are also encouraging utilities and facilities to adopt this precise and targeted approach. The ability to integrate ion exchange systems into modular POE configurations enhances appeal across commercial and industrial sectors.

Application Analysis

Based on application, the segmentation includes commercial and industrial. In 2024, the industrial segment accounted for ~90% of the revenue share due to the concentration of PFAS discharge from manufacturing activities, including electronics, semiconductors, textiles, and chemicals. Industries facing strict discharge regulations are investing in POE systems to treat water at the facility level before it enters or exits the premises. High-flow rate requirements and continuous operational demands favor the use of centralized POE setups. Additionally, many companies are integrating PFAS treatment as part of broader Environmental, Social, and Governance (ESG) commitments and sustainability reporting. Legal compliance, reputational risk management, and public pressure are pushing industrial operators to prioritize advanced water softening system.

The commercial segment is projected to register the highest CAGR during the forecast period due to the growing demand from sectors such as hospitality, retail, education, and healthcare that rely on clean water for daily operations. Increasing awareness among property owners and facility managers about PFAS exposure risks is leading to proactive installations of POE systems in commercial buildings. Green building certifications and ESG metrics are also influencing adoption, particularly in new constructions and LEED-compliant developments. As more states implement maximum contaminant levels (MCLs) for PFAS, commercial properties are preparing for future mandates. Smaller system footprints, modular design, and improved affordability make POE units a viable solution for this segment's varied infrastructure needs.

Regional Analysis

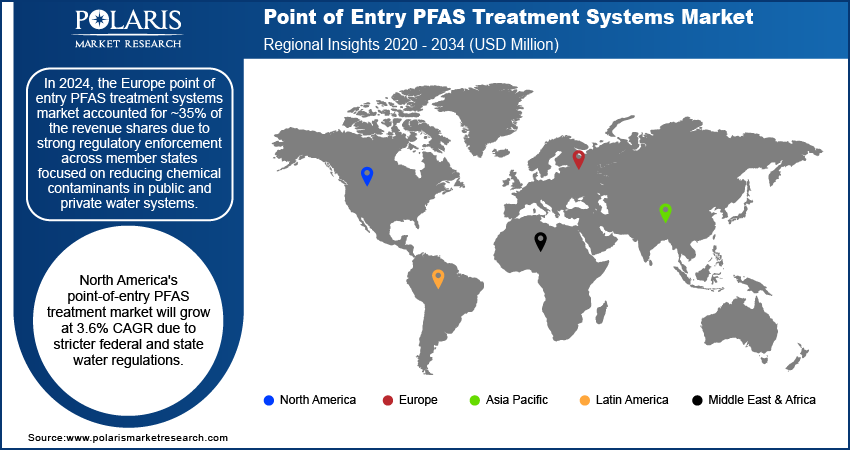

In 2024, the Europe point of entry PFAS treatment systems market accounted for ~35% of the revenue shares due to strong regulatory enforcement across member states focused on reducing chemical contaminants in public and private water systems. The implementation of the EU Drinking Water Directive and REACH regulations has encouraged both residential and industrial stakeholders to invest in whole-building filtration solutions. Government-led environmental initiatives and funding mechanisms are further accelerating adoption, particularly in countries such as Germany, France, and the Netherlands. This move significantly boosted the adoption of point-of-entry (POE) and point-of-use (POU) water treatment systems, especially in countries such as Germany, France, and the Netherlands. The demand is also being supported by growing awareness around PFAS-related health risks, prompting upgrades in schools, commercial facilities, and healthcare institutions. Local manufacturers and international players are actively expanding operations and introducing compliant, advanced POE technologies, aligning product offerings with evolving environmental standards and consumer preferences. In 2024, the European Commission strengthened its regulatory stance under the Drinking Water Directive, setting a maximum contaminant level of 0.1 µg/L for total PFAS in drinking water.

North America Point of Entry PFAS Treatment Systems Market Insight

The North America point of entry PFAS treatment systems market is projected to register a significant CAGR of 3.6% from 2025 to 2034 due to rising federal enforcement actions and state-level mandates requiring compliance with maximum contaminant levels for PFAS in drinking water. Key infrastructure investments supported by federal funding, including the Bipartisan Infrastructure Law, are being channeled toward water system modernization and remediation efforts. Increasing public scrutiny and class-action lawsuits related to PFAS contamination are also pushing municipalities, commercial buildings, and schools to implement point-of-entry solutions that guarantee compliance across their entire plumbing systems. Market growth is further supported by the region’s high awareness levels, coupled with strong innovation and availability of advanced filtration media designed specifically for PFAS removal.

U.S. Point of Entry PFAS Treatment Systems Market Trends

The U.S. market is witnessing significant growth driven by new national standards issued by the EPA for six PFAS compounds in drinking water, which are forcing municipal utilities, public institutions, and private property owners to adopt reliable treatment methods. Legal liabilities and pressure from advocacy groups are prompting swift action in high-exposure zones. POE systems are increasingly being installed in government buildings, correctional facilities, and healthcare centers where total water system protection is essential. The demand is also fueled by ESG-driven investors and green building certification bodies that promote water safety measures as part of sustainability frameworks. Local suppliers are expanding their portfolios to include modular, scalable POE units that are both cost-effective and compliant.

Asia Pacific Point of Entry PFAS Treatment Systems Market Overview

The Asia Pacific point of entry PFAS treatment systems market is expected to experience significant growth during the forecast period due to emerging national regulations, industrial pollution concerns, and rapid urbanization that is placing a spotlight on drinking water quality. Countries like Australia, Japan, and South Korea are leading early adoption of PFAS regulations and treatment mandates. For instance, Japan’s Ministry of the Environment launched a nationwide PFAS monitoring program in the beginning of 2025, identifying over 100 contaminated sites, primarily near industrial zones and military bases. This led to increased deployment of activated carbon and ion exchange systems in municipal water supplies. Urban residential complexes and public infrastructure in densely populated areas are increasingly adopting POE systems to mitigate contamination risks from legacy waste disposal and industrial activities. Accelerating infrastructure development, growing middle-class health consciousness, and support from government subsidies are collectively contributing to the market’s expansion. Additionally, increased investments in smart water purification technologies by local and international firms make POE systems more accessible.

China Point of Entry PFAS Treatment Systems Market Outlook

The market in China is growing rapidly due to high attention to environmental safety and recent government actions aimed at identifying and controlling PFAS discharge from manufacturing and industrial zones. Local regulations are becoming more stringent, particularly in areas where groundwater contamination has been documented. Real estate developers and municipal authorities are being encouraged to integrate POE filtration systems into new construction and infrastructure renovation projects. The country’s ongoing push for sustainable development and water conservation is creating opportunities for technology providers to introduce advanced treatment systems tailored for multi-residential and public sector use. Increased public awareness and demand for clean water in both urban and rural regions are accelerating the installations of POE PFAS treatment systems across sectors.

Key Players and Competitive Analysis

The competitive landscape of the point of entry PFAS treatment systems market is evolving rapidly, shaped by rising environmental regulations and growing consumer awareness. Industry analysis reveals a surge in strategic alliances and joint ventures as companies seek to expand their geographic reach and diversify treatment technologies. Market players are pursuing mergers and acquisitions to consolidate expertise in PFAS remediation and gain access to advanced filtration systems and patented media. Post-merger integration efforts are focused on aligning product development with emerging compliance framework, particularly around maximum contaminant levels set by environmental agencies.

Technology advancements in ion exchange resins, nanofiltration, and smart monitoring platforms are driving innovation, offering end users more efficient and cost-effective treatment options. Firms are also implementing market expansion strategies through OEM partnerships and collaboration with public utilities. Competitive intensity is further shaped by ESG considerations, as stakeholders prioritize sustainable water treatment solutions across residential, industrial, and commercial infrastructure projects.

Key Players

- AECOM

- Aquasana

- Arvia Technology

- Calgon Carbon Corporation

- Culligan Water

- DuPont

- EcoWater Systems LLC

- Ion Exchange

- Pentair plc.

- Saltworks Technologies Inc.

- Thermax

- Toshiba

- Veolia

- Xylem

Point of Entry PFAS Treatment Systems Industry Developments

In June 2025, Veolia launched a large-scale PFAS treatment plant in Delaware, investing USD 35 million, which utilizes 42 activated carbon units to deliver clean water to over 100,000 residents daily. The facility supports Veolia’s strategy to expand compliant, scalable water treatment solutions across North America.

In August 2023, Aquasana introduced the SmartFlow Reverse Osmosis system, capable of removing up to 99.99% of contaminants, including PFAS, lead, and fluoride, featuring higher efficiency, improved output, and NSF certification with a built-in remineralization process for better taste.

Point of Entry PFAS Treatment Systems Market Segmentation

By Technology Outlook (Revenue USD Million, 2020–2034)

- Reverse Osmosis

- Granular Activated Carbon

- Ion Exchange Filter

- Others

By Application Outlook (Revenue USD Million, 2020–2034)

- Commercial

- Industrial

- Surgical & medical instruments

- waterproof outerwear

- Broad woven fabric mills

- Perfumes & cosmetics

- Plastic films

- EV battery manufacturing

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Point of Entry PFAS Treatment Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 182.92 million |

|

Market Size in 2025 |

USD 188.32 million |

|

Revenue Forecast by 2034 |

USD 245.72 million |

|

CAGR |

3.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 182.92 million in 2024 and is projected to grow to USD 245.72 billion by 2034.

The global market is projected to register a CAGR of 3.0% during the forecast period.

In 2024, the Europe point of entry PFAS treatment systems market accounted for ~35% of the revenue shares due to strong regulatory enforcement across member states focused on reducing chemical contaminants in public and private water systems.

A few of the key players are AECOM, Aquasana, Arvia Technology, Calgon Carbon Corporation, Culligan Water, DuPont, EcoWater Systems LLC, Ion Exchange, Pentair plc., Saltworks Technologies Inc., Thermax, Toshiba, Veolia, and Xylem.

In 2024, the granular activated carbon segment accounted for ~57% of the revenue share due to its proven effectiveness in removing a wide range of PFAS compounds, particularly long-chain variants.

In 2024, the industrial segment accounted for ~90% of the revenue share due to the concentration of PFAS discharge from manufacturing activities, including electronics, semiconductors, textiles, and chemicals