Water Softening Systems Market Share, Size, Trends, Industry Analysis Report

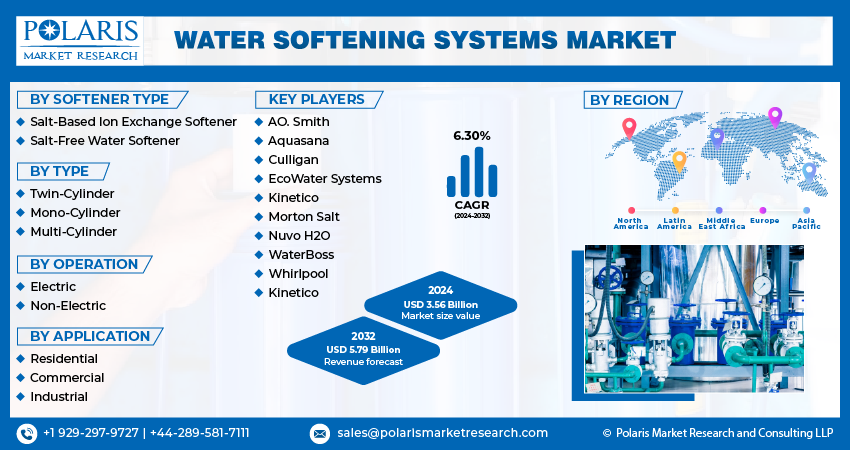

By Softener Type (Salt-Based Ion Exchange Softener, Salt-Free Water Softener); By Type; By Operation; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3908

- Base Year: 2023

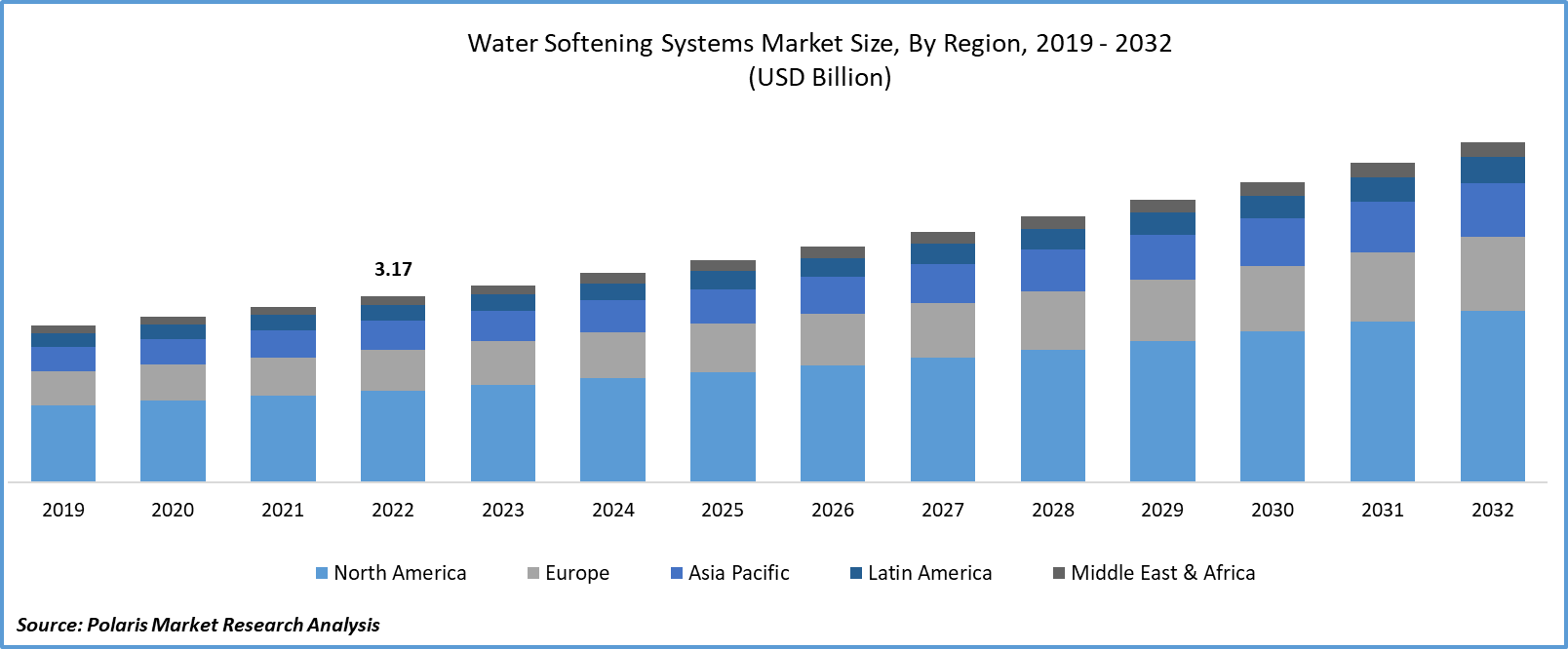

- Historical Data: 2019-2022

Report Outlook

The global water softening systems market size and share was valued at USD 3.36 billion in 2023 and is expected to grow at a CAGR of 6.30% during the forecast period.

Rising health consciousness among consumers is propelling the demand for water softening systems, as they are showing concern about health issues due to the usage of hard water in daily life. Water softeners reduce the mineral concentration, easing the health issues associated with hard water.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Water Softening Systems Market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Many minerals are found in water naturally, including magnesium and calcium. The amount of these minerals in your water determines how hard or soft your water supply is. Compared to hard water, soft water has lower amounts of calcium and/or magnesium. And, a water softener system is a whole-house filtering system that uses an ion exchange process to remove the calcium and magnesium minerals that cause hardness from your water. Hard water is one of the most common and destructive issues with water that is addressed by a water softener. Also, a water softener is constructed up of three parts: a control valve, a mineral tank, and a brine tank. These result in confluence to observe the flow of water, extract the minerals from hard water, and occasionally clean the system via a renewal process.

Moreover, modern homes are often damaged by hard water. By filtering hard water, installing a water softener may be a terrific addition to any home. There are various kinds, each with a specific purpose. While some water softeners are concealed under the sink or even affixed to your shower head, others are fixed to the faucet. This useful tool can enhance the flavor, smell, and quality of the water throughout the entire house. Therefore, The water softening systems market demand is growing as people become more aware of the potential health risks associated with using hard water on a daily basis.

To Understand More About this Research: Request a Free Sample Report

Growing product innovations in the global market are driving product expansion. Companies are looking forward to engaging consumers with their effective marketing strategies. It is enabling awareness about the product among a wide range of people. Companies aid end users in solving consumer queries with technological advancements. These developments are fueling awareness among consumers with user-friendly interfaces incorporated by key market players.

- For instance, in June 2023, Culligan Water, a water treatment and services company, introduced the first AI WatereBot, Cullie. The water industry trailblazer innovated this technology by using ChatGpt's conversational abilities to enhance website interactions.

Furthermore, rising awareness about the disadvantages of hard water is driving the need for water-softening systems. It leads to the development of soap scum, cloudy stains, clogged pipes, dry skin, brittle hair, faded clothes, and rusted and deteriorating appliances. Water softening systems are becoming essential to combat the drawbacks of hard water in households and industries. It will further create new growth potential for the market in the coming years.

In contrast, hard water also has some advantages. According to the World Health Organisation (WHO), drinking water can be a source of calcium and magnesium in the diet. It may be crucial for individuals who need to consume more of these minerals. Humans require minerals to remain healthy.

The market report provides a thorough analysis of the water softening systems market, covering all the major aspects stakeholders need to know. It sheds light on the key developments and trends that are anticipated to drive the water softening systems market demand over the forecast period. Besides, it maps the qualitative impact of various key factors on market segments and geographies. Furthermore, it examines the key steps taken by industry participants to strengthen their presence in the industry.

Growing concerns about minerals adoption in food and water intake will hamper the demand for water-softening systems, which soften the water by extracting minerals. Early on in the pandemic, supply chains and production processes were disrupted, which had an impact on several businesses, including the water treatment industry. It caused some short-term difficulties with water softening system availability and delivery.

Industry Dynamics

Key Growth Drivers

Growing awareness of the benefits associated with water softeners is driving demand for the product

Water softening systems assist in various fields by preventing the flow of heavy minerals in water. They effectively soften water and ensure its availability in domestic, professional, and industrial settings for a variety of uses. These systems are essential for preserving efficiency and effectiveness across a variety of industries and daily life, whether it's extending the lifespan of equipment, enhancing industrial processes, or upgrading water quality in households. Due to the various advantages of water softener systems in personal care, such as their ability to aid in cleaner hair and softer skin and reduce the amount of time spent on cleaning, they are fueling demand in the water softening systems market.

The construction of new residential and commercial buildings often includes water softening systems as part of the infrastructure to enhance water quality. Many industries, including food and beverage, pharmaceuticals, and manufacturing, require softened water for their processes, spurring demand for commercial and industrial water softening systems.

Report Segmentation

The market is primarily segmented based on softener type, type, operation, application, and region.

|

By Softener Type |

By Type |

By Operation |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Softener Type Analysis

The salt-based ion exchange softener segment is expected to witness the fastest growth during the forecast period.

Salt-based ion exchange softener segment is expected to witness the fastest market during the forecast period, primarily fueled by its ability to remove magnesium and calcium ions by replacing them with sodium ions. Higher consumer familiarity associated with this softener over the past few years is driving demand for this softener in the coming years. Salt-based softeners are often an affordable option for dealing with water hardness, especially for residential consumers. The system's original cost and future maintenance expenses are usually affordable, propelling its demand in the forecast period.

By Type Analysis

Twin tank cylinder segment accounted for the largest market share in 2022

The twin tank cylinder segment accounted for the largest market share in 2022 and is expected to continue this trend in future years. These tanks are designed with two resin tanks, facilitating the simultaneous functioning of water softener systems while one tank is in service mode and the other is in regeneration. Twin tank cylinders are more effective than single-tank softeners as a result of their ability to soften water continuously throughout the day. It is suitable for people who prefer cost-effectiveness, as these tanks work effectively for salt and water usage. Additionally, these tanks require less maintenance in contrast with single tank cylinders, as twin tank cylinders go through regeneration rarely due to less wear and tear, a longer service life, and fewer maintenance issues. These factors are contributing to a larger market share in the coming years.

By Operation Analysis

The electric segment held a significant revenue share in 2022

The electric segment held a significant revenue share in 2022, and this trend is expected to continue further due to its efficiency and user-friendliness. The presence of timer, sensor, and control panel features is frequently found in electric water softeners, which automate the regeneration process, driving user-friendliness and convenience for customers. Furthermore, Wi-Fi connectivity and smart functions are common characteristics of modern electric water softeners. In order to increase usability and accessibility, users can remotely monitor and operate the system via mobile apps or web interfaces.

The non-electric segment is expected to witness stable growth in the coming years due to the lower dependence on electricity in water softener operations. This option is appealing to people who prefer environmentally friendly machinery and is suitable for people who are conservative about energy. Moreover, the affordability of non-electric water softeners is expanding global market reach as the initial cost of purchase is in some way economical, driving demand from consumers in the future.

Regional Insights

North America dominated the largest market share in 2022

North America dominated the largest market share in 2022. Growing electricity consumption in this region is expanding the market for water-softening systems. The quantity of energy used in the United States in 2022 was around 4.05 Trillion kWh, which was a record-high number and was 14 times higher than electricity use in 1950. Rising energy costs are fuelling the need for water softening systems, as they reduce energy use and power consumption by decreasing the development of scale in electrical equipment like water heaters.

The Europe region is projected to be the fastest-growing region with a healthy CAGR during the forecast period, owing to the rising awareness of health issues due to hard water. According to the Bathing Water Report published in 2021, nearly 85% of bathing water destinations across Europe met the water quality standards for "excellent" bathing areas. It will further fuel the demand for water softening systems by households and companies to address water quality problems and rising water quality standards in the region.

Key Industry Players & Competitive Insights

The water softening systems market growth is expected to expand rapidly owing to the presence of market players equipped with these services. The growing expansion of the marketplace with the latest developments by competitors is fueling the global supply. Collaborations and partnerships are propelling technological advancements by industrial players, in turn driving new product innovations in the market.

Some of the major players operating in the global market include:

- AO. Smith

- Aquasana

- Culligan

- EcoWater Systems

- Kinetico

- Morton Salt

- Nuvo H2O

- WaterBoss

- Whirlpool

- Kinetico

Recent Developments

- In March 2023, Phyn, a company that deals with water monitoring solutions, partnered with the largest producer of water softeners, EcoWater Systems, to expand its smart water monitoring systems in North American dealer networks through EcoWater.

Water Softening Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.56 billion |

|

Revenue forecast in 2032 |

USD 5.79 billion |

|

CAGR |

6.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Softener Type, By Type, By Operations, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Explore the landscape of water softening systems in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Varicose Vein Treatment Market Size, Share 2024 Research Report

Genealogy Products & Services Market Size, Share 2024 Research Report

https://www.polarismarketresearch.com/industry-analysis/dupuytren-disease-market

AI in Medical Writing Market Size, Share 2024 Research Report

Animal Ultrasound Market Size, Share 2024 Research Report