Recycled Plastic Pipes Market Size, Share, Trends, Industry Analysis Report

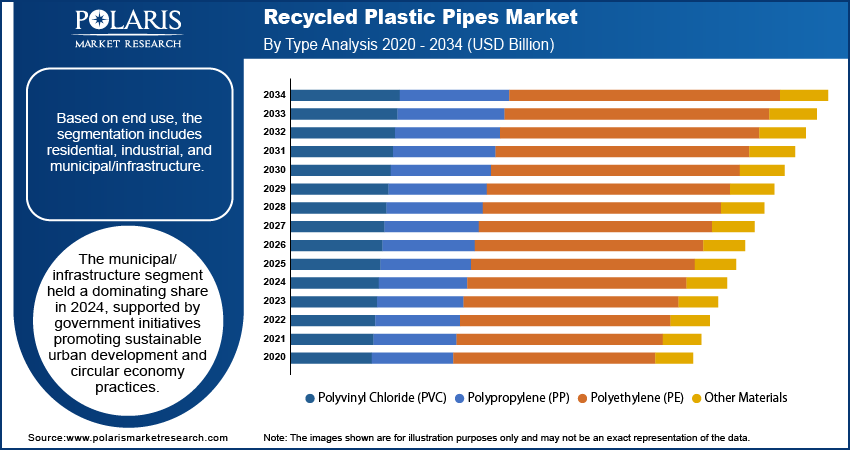

By Material Type (Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), and Other Materials), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6268

- Base Year: 2024

- Historical Data: 2020-2023

Overview

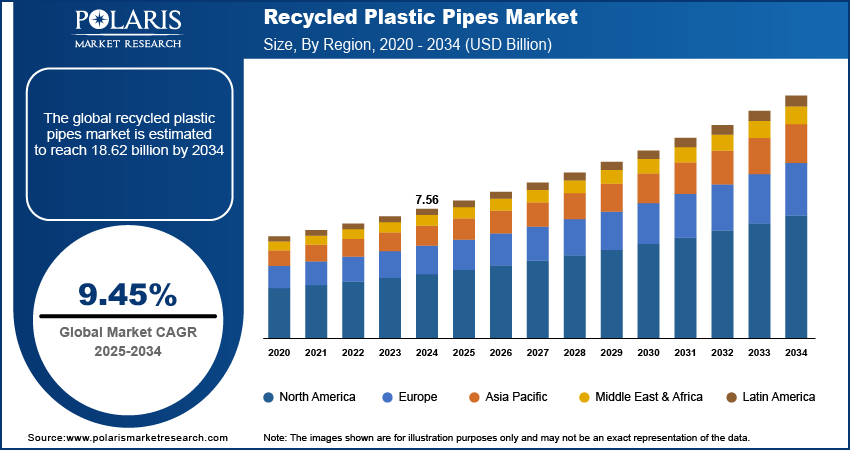

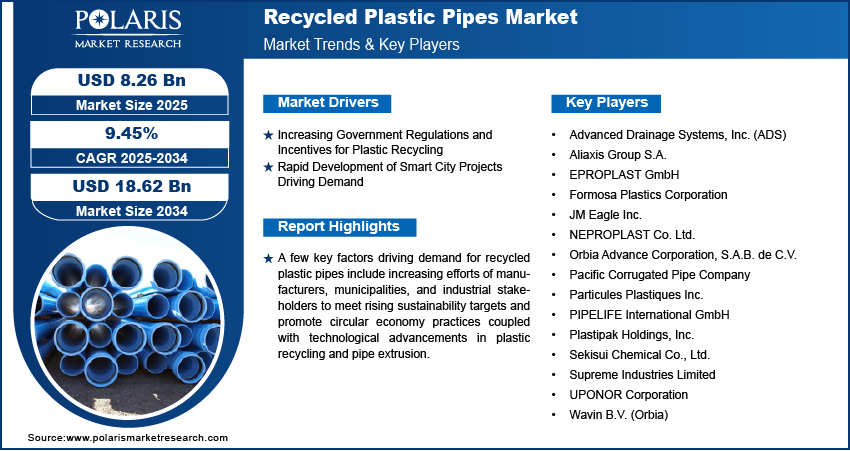

The global recycled plastic pipes market size was valued at USD 7.56 billion in 2024, growing at a CAGR of 9.45% from 2025 to 2034. Key factors driving demand for recycled plastic pipes include increasing government regulations and incentives for plastic recycling coupled with rapid development of smart city projects.

Key Insights

- The PVC segment held the largest market share in 2024, driven by its widespread use in water supply, sanitation, and sewer systems.

- The agricultural irrigation segment is expected to grow at the fastest rate, driven by drip irrigation adoption and demand for durable, sustainable recycled plastic pipes.

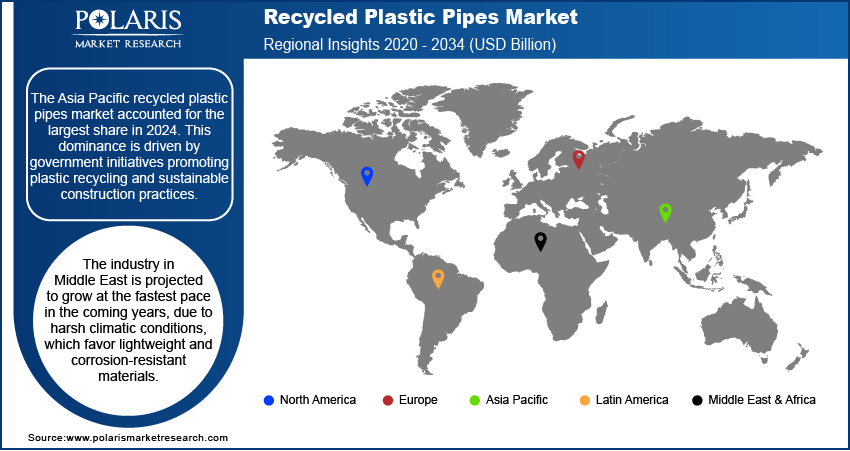

- The Asia Pacific recycled plastic pipes market dominated the market in 2024. This dominance is driven by government initiatives promoting plastic recycling and sustainable construction practices.

- China held the largest revenue share in the Asia Pacific recycled plastic pipes landscape in 2024, driven by rapid urbanization and expanding infrastructure projects.

- The industry in Middle East is projected to held significant market share in coming years, due to harsh climatic conditions, that favor lightweight and corrosion-resistant materials.

- Saudi Arabia is emerging as a key growth hub for recycled plastic pipes market, driven by growing oil & gas, petrochemical, and water infrastructure projects.

Industry Dynamics

- Strict government regulations and incentives for plastic recycling are boosting recycled plastic pipe adoption, supporting circular economy targets.

- Smart city expansions are fueling demand for sustainable, durable, and eco-friendly piping solutions.

- AI and machine learning integration in recycling processes offers opportunities to improve quality, reduce contamination, and enhance efficiency.

- High processing costs for advanced recycling technologies and quality control limit large-scale adoption.

Market Statistics

- 2024 Market Size: USD 7.56 Billion

- 2034 Projected Market Size: USD 18.62 Billion

- CAGR (2025–2034): 9.45%

- Asia Pacific: Largest Market Share

Recycled plastic pipes are manufactured from post-consumer and post-industrial plastic waste, offering an eco-friendly alternative to traditional materials while maintaining durability and performance standards. Advancements in recycling technologies and manufacturing processes improves the quality, strength, and reliability of recycled plastic pipes, enabling use in applications such as water supply, irrigation, drainage, sewage systems, and industrial fluid handling. The market reduces reliance on virgin plastics, supporting circular economy initiatives and minimizing the environmental footprint of pipeline projects.

The adoption of recycled plastic pipes is accelerating due to the increasing efforts of manufacturers, municipalities, and industrial stakeholders to meet rising sustainability targets and promote circular economy practices. These pipes leverage post-consumer and post-industrial plastic waste, reducing reliance on virgin materials while maintaining durability and performance standards. The integration of advanced recycling and extrusion technologies enables producers to deliver high-quality pipes that meet stringent regulatory and safety requirements.

Technological advancements in plastic recycling and pipe extrusion are further enhancing the quality, consistency, and performance of recycled plastic pipes, thus fueling the market growth. Innovations in sorting, cleaning, and compounding processes are enabling the production of high-grade materials that meet stringent industry standards for strength, durability, and safety. For instance, In June 2025, Versalis, Eni’s chemical arm launched a demonstration plant at its Mantua site, featuring the proprietary Hoop chemical recycling technology. This system converts mixed plastic waste into feedstock suitable for producing new plastics, including materials used in food and pharmaceutical packaging. These technological innovations are strengthening the proposition of recycled plastic pipes, positioning it as a reliable and sustainable alternative to conventional piping solutions.

Drivers & Opportunities

Increasing Government Regulations and Incentives for Plastic Recycling: Governments worldwide are implementing stringent regulations and incentive programs to promote plastic recycling and reduce environmental pollution. Policies accelerating the use of recycled materials in infrastructure projects are driving the adoption of recycled plastic pipes across municipal, industrial, and residential applications. For example, the Canadian Plastics Innovation Challenge (CPIC) in Canada is allocating nearly USD 19 million to drive the development of innovative solutions for plastics-related challenges. Selected winners receive up to USD 150,000 to create a proof of concept, followed by up to USD 1 million for prototype development if they advance to the next stage. These initiatives are enabling manufacturers to invest in advanced recycling facilities, enhance product quality, and expand sustainable pipe solutions that comply with environmental standards.

Rapid Development of Smart City Projects Driving Demand: The expansion of smart city initiatives is creating a strong need for sustainable and durable utility infrastructure, including water supply, sewage, and gas distribution systems. Recycled plastic pipes offer environmentally friendly, cost-effective, and high-performance alternatives to conventional materials. Under the Union Budget 2024–25, the Smart Cities Mission in India allocated USD 19.67 billion to advance urban infrastructure and development. As of March 2025, 7,502 out of 8,062 projects (93%) are completed, representing an investment of approximately USD 18,067 million, while the remaining 560 projects (7%), valued at around USD 1,717 million, are still in progress. Integration of advanced extrusion and pipe manufacturing technologies ensures consistent quality and reliability, supporting the deployment of long-lasting infrastructure solutions that meet with urban sustainability goals.

Segmental Insights

By Material Type

Based on material type, the market is segmented into polyvinyl chloride (PVC), polypropylene (PP), polyethylene (PE), and other materials. The PVC segment accounted for the largest share of the recycled plastic pipes market in 2024, driven by its widespread use in water supply, sanitation, and sewer systems. PVC pipes offer durability, chemical resistance, and cost-effectiveness, making it a preferred choice for residential, industrial, and municipal projects. Manufacturers are increasingly incorporating recycled PVC in production to meet sustainability goals while maintaining product performance and compliance with regulatory standards.

The polyethylene (PE) segment is expected to register the fastest growth during the forecast period. Advancements in recycling technologies and extrusion processes are enhancing the quality and mechanical properties of recycled PE pipes. These pipes are growing popular in agricultural irrigation, water distribution, and industrial applications due to flexibility, corrosion resistance, and long service life, supporting the shift toward sustainable infrastructure solutions.

By Application

Based on application, the market is categorized into water supply & sanitation, sewer/drainage, HVAC, agricultural irrigation, electrical/telecom conduit, and other applications. The water supply & sanitation segment held the largest share in 2024, driven by growing demand for durable, cost-efficient, and environmentally friendly piping systems for residential, commercial, and municipal projects. Recycled plastic pipes are increasingly used to replace conventional materials, offering enhanced lifespan, low maintenance, and compliance with environmental standards.

The agricultural irrigation segment is projected to grow at the highest CAGR during the forecast period. Rising adoption of drip irrigation and precision farming techniques is fueling demand for lightweight, corrosion-resistant, and durable recycled plastic pipes. Technological advancements in pipe extrusion and manufacturing are enabling production of high-performance irrigation systems that reduce water wastage and support sustainable agriculture.

By End-Use

Based on end-use, the market is segmented into residential, industrial, and municipal/infrastructure applications. The municipal/infrastructure segment accounted for the largest share in 2024, supported by government initiatives promoting sustainable urban development and circular economy practices. Recycled plastic pipes are increasingly implemented in large-scale water supply, sewage, and utility projects to reduce environmental impact and construction costs.

The industrial segment is anticipated to register the fastest growth over the forecast period. Expanding industrial operations, process piping requirements, and focus on eco-friendly materials are driving the adoption of recycled plastic pipes in chemical plants, food processing units, and manufacturing facilities. High-performance recycled pipes ensure safety, chemical resistance, and durability, making it suitable for diverse industrial applications.

Asia Pacific Recycled Plastic Pipes Market Trends

Asia Pacific is held the dominating share in the recycled plastic pipes market during the forecast period, driven by government initiatives promoting plastic recycling and sustainable construction practices. Rising investments in industrial and chemical sectors are increasing demand for corrosion-resistant, durable piping solutions. Countries such as India and Indonesia are focusing on circular economy strategies and infrastructure modernization, which is accelerating the adoption of recycled plastic pipes across municipal, industrial, and residential applications.

China Recycled Plastic Pipes Market Assessment

China is emerging as a key growth hub for recycled plastic pipes, fueled by rapid urbanization and expanding infrastructure projects. According to the National Bureau of Statistics, China’s urbanization rate reached 67% in 2024, sustaining an average annual increase of more than 1 percentage point over the past 45 years. Large-scale water supply, sanitation, and industrial development initiatives are driving demand for durable, cost-effective piping solutions. Technological advancements in plastic recycling and extrusion are enabling manufacturers to meet high performance and sustainability standards, pushing China as a major market for recycled plastic pipe deployment.

Middle East Recycled Plastic Pipes Market Outlook

The Middle East market is witnessing the fastest CAGR by 2034, due to the strong adoption of recycled plastic pipes due to harsh climatic conditions, which favor lightweight and corrosion-resistant materials. Rapid expansion of desalination plants, wastewater treatment, and municipal infrastructure projects is boosting demand for durable piping solutions capable of withstanding high temperatures and saline environments.

Saudi Arabia Recycled Plastic Pipes Market Trends

Saudi Arabia is experiencing increasing demand for recycled plastic pipes driven by growing oil & gas, petrochemical, and water infrastructure projects. For instance, in March 2023, Aramco CEO Amin Nasser revealed the company’s plan to allocate USD 45–55 billion in capital expenditure for FY2023, the largest in its history aimed at boosting oil production capacity to 13 million barrels per day by 2027. Also, the focus on sustainable materials and high-performance piping systems is propelling the integration of recycled plastics in large-scale construction and industrial applications.

North America Recycled Plastic Pipes Market Overview

North America held the substantial share in the recycled plastic pipes market in 2024, fueled by a strong regulatory framework boosting the use of recycled and sustainable materials in construction. High adoption of eco-friendly building practices in urban infrastructure, commercial projects, and municipal water systems is propelling the demand for recycled plastic pipes. The region benefits from advanced recycling technologies and well-established supply chains, enabling manufacturers to meet stringent performance, quality, and environmental standards.

Key Players & Competitive Analysis

The global recycled plastic pipes market is highly competitive, with key players such as Advanced Drainage Systems, Inc. (ADS), Aliaxis Group S.A., EPROPLAST GmbH, Formosa Plastics Corporation, and JM Eagle Inc. shaping the industry through advanced manufacturing capabilities, robust distribution networks, and strategic partnerships. Advanced Drainage Systems, Inc. leverages its extensive U.S. and international operations to provide high-performance recycled HDPE and PP pipes for water management and infrastructure projects. Formosa Plastics Corporation integrates cutting-edge extrusion technologies to produce durable and environmentally compliant piping solutions. JM Eagle Inc. focuses on sustainable manufacturing and product innovation to meet diverse applications, from municipal water supply to industrial projects. Aliaxis Group S.A. and Wavin B.V. (Orbia) emphasize global expansion and technology-driven solutions, addressing growing demand for corrosion-resistant, lightweight, and eco-friendly piping systems.

The market is witnessing increased adoption of recycled and sustainable materials in water supply, sanitation, and infrastructure projects to reduce environmental impact and support circular economy initiatives. Companies are investing in advanced plastic recycling, pipe extrusion technologies, and quality enhancement processes to deliver high-performance solutions that meet regulatory standards and industry requirements. Strategic collaborations between manufacturers, construction companies, and urban planners are expanding the application scope across residential, industrial, and municipal infrastructure projects. The competitive focus is also shifting toward sustainable product portfolios and energy-efficient manufacturing processes, enabling companies to strengthen market share and support long-term environmental objectives.

Prominent companies in the recycled plastic pipes market include Advanced Drainage Systems, Inc. (ADS), Aliaxis Group S.A., EPROPLAST GmbH, Formosa Plastics Corporation, JM Eagle Inc., NEPROPLAST Co. Ltd., Orbia Advance Corporation, S.A.B. de C.V., Pacific Corrugated Pipe Company, Particules Plastiques Inc., PIPELIFE International GmbH, Plastipak Holdings, Inc., Sekisui Chemical Co., Ltd., Supreme Industries Limited, UPONOR Corporation, and Wavin B.V. (Orbia).

Key Players

- Advanced Drainage Systems, Inc. (ADS)

- Aliaxis Group S.A.

- EPROPLAST GmbH

- Formosa Plastics Corporation

- JM Eagle Inc.

- NEPROPLAST Co. Ltd.

- Orbia Advance Corporation, S.A.B. de C.V.

- Pacific Corrugated Pipe Company

- Particules Plastiques Inc.

- PIPELIFE International GmbH

- Plastipak Holdings, Inc.

- Sekisui Chemical Co., Ltd.

- Supreme Industries Limited

- UPONOR Corporation

- Wavin B.V. (Orbia)

Recycled Plastic Pipes Industry Developments

In September 2024: Rollepaal Pipe Extrusion Technology entered a strategic partnership with Reifenhäuser Middle East and Africa (MEA) to strengthen its presence in Africa and the Middle East. Leveraging over 60 years of expertise, Rollepaal introduced advanced plastic pipe extrusion technologies designed to enhance efficiency and sustainability.

In September 2024: Borealis, in collaboration with Pipelife and Wiener Wasser, installed approximately 660 meters of polyethylene drinking water pressure pipes in Vienna, Austria, composed of over 90% chemically recycled plastic. Utilizing Borealis’ Borcycle C technology, the pilot project demonstrated the production of high-quality, sustainable pipes that comply with strict standards without requiring extensive reapproval.

Recycled Plastic Pipes Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene (PE)

- Other Materials

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Water Supply & Sanitation

- Sewer/Drainage

- HVAC

- Agricultural Irrigation

- Electrical/Telecom Conduit

- Other Applications

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Industrial

- Municipal/Infrastructure

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Recycled Plastic Pipes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.56 Billion |

|

Market Size in 2025 |

USD 8.26 Billion |

|

Revenue Forecast by 2034 |

USD 18.62 Billion |

|

CAGR |

9.45% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.56 billion in 2024 and is projected to grow to USD 18.62 billion by 2034.

The global market is projected to register a CAGR of 9.45% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Advanced Drainage Systems, Inc. (ADS), Aliaxis Group S.A., EPROPLAST GmbH, Formosa Plastics Corporation, JM Eagle Inc., NEPROPLAST Co. Ltd., Orbia Advance Corporation, S.A.B. de C.V., Pacific Corrugated Pipe Company, Particules Plastiques Inc., PIPELIFE International GmbH, Plastipak Holdings, Inc., Sekisui Chemical Co., Ltd., Supreme Industries Limited, UPONOR Corporation, and Wavin B.V. (Orbia).

The PVC segment dominated the market revenue share in 2024.

The agricultural irrigation segment is projected to witness the fastest growth during the forecast period.