Red Biotechnology Market Size, Share, Trends, Industry Analysis Report

By Product (Monoclonal Antibodies, Polyclonal Antibodies, Recombinant Proteins, Vaccines, Cell-Based Immunotherapy Products), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5961

- Base Year: 2024

- Historical Data: 2020-2023

Overview

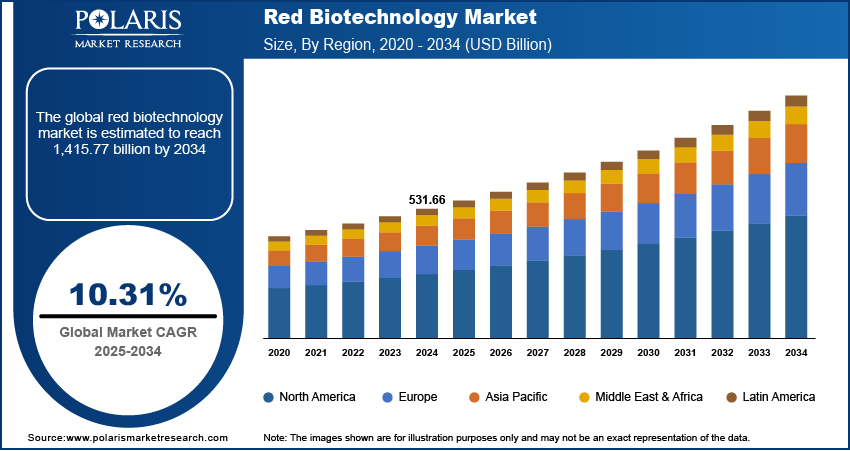

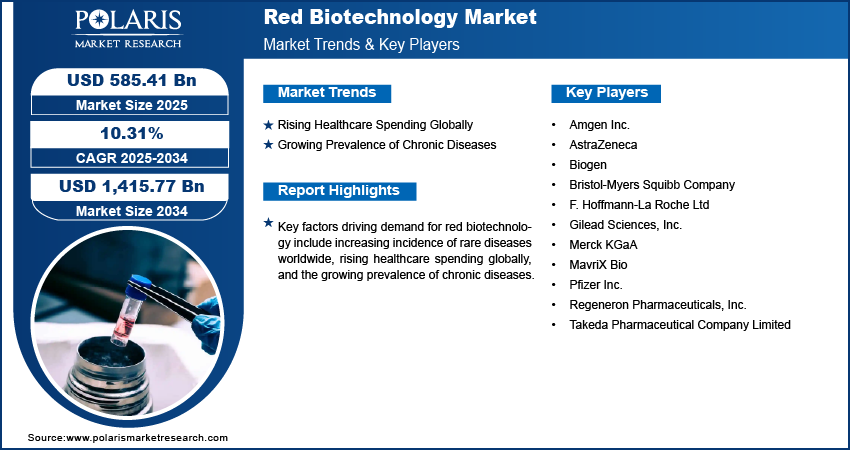

The global red biotechnology market size was valued at USD 531.66 billion in 2024, growing at a CAGR of 10.31% from 2025 to 2034. Key factors driving demand for red biotechnology include increasing incidence of rare diseases worldwide, rising healthcare spending globally, and growing prevalence of chronic diseases.

Key Insight

- The monoclonal antibodies segment accounted for 49.13% of market revenue share in 2024.

- The pharmaceutical & biotechnology companies segment accounted for a major revenue share in 2024.

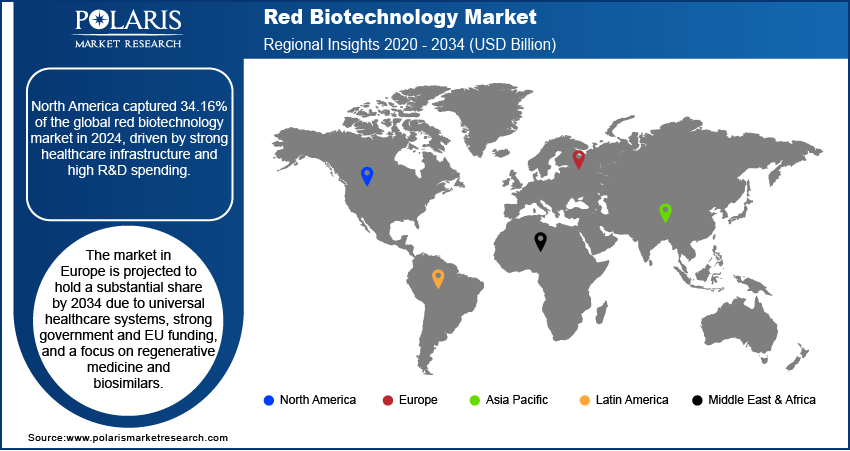

- North America accounted for a 34.16% share of the global red biotechnology market in 2024.

- The U.S. dominated the North America red biotechnology landscape in 2024.

- The market in Asia Pacific is projected to register a CAGR of 15.34% from 2025 to 2034.

- Countries such as China, Japan, and South Korea are investing heavily in biopharmaceutical innovation, with supportive government policies.

Red biotechnology, usually referred to as medical or healthcare biotechnology, is a specialized branch of biotechnology that focuses on the application of biological techniques and organisms to improve human health and medicine. This field encompasses a wide range of scientific disciplines, including molecular biology, genetics, biochemistry, and cell biology, all directed toward the development of innovative solutions for diagnosing, treating, and preventing diseases. Red biotechnology harnesses living cells, microorganisms, and biological molecules to create therapeutic products, vaccines, diagnostic tools, and regenerative therapies.

The scope of red biotechnology is vast, covering areas such as gene therapy, where defective or missing genes are replaced or modified to treat genetic disorders, and stem cell research, which aims to regenerate damaged tissues and organs, offering new hope for conditions such as spinal cord injuries, Parkinson’s disease, and heart disease. Red biotechnology also plays a crucial role in vaccine development, utilizing recombinant DNA technology and genetic engineering to produce safer, more effective vaccines against infectious diseases.

To Understand More About this Research: Request a Free Sample Report

The red biotechnology market demand is driven by the rising incidence of rare diseases worldwide. The United States Food and Drug Administration (FDA), in its report, stated that over 7,000 rare diseases affect more than 30 million people in the U.S. The rising incidence of these diseases prompt governments to invest in red biotechnology, as it enables the creation of personalized and precision medicines through gene therapy, monoclonal antibodies, and recombinant proteins, offering hope for patients with rare diseases. Therefore, as the incidence of rare diseases expands, the demand for red biotechnology also increases.

Industry Dynamics

- The rising global healthcare spending is fueling market growth by accelerating biotech research and development.

- The growing prevalence of chronic diseases is propelling the demand for red biotechnology by prompting governments and insurers to invest in high-value therapies.

- The rising aging population and increasing investments in cancer research are expected to create lucrative market opportunities during the forecast period.

- The high failure rate of drugs in the later stages of clinical trials restrains the market growth.

Rising Healthcare Spending Globally:

Governments and private payers are allocating more funds to innovative therapies, particularly for complex diseases, where traditional treatments fall short. This financial support is accelerating biotech research and development, enabling faster approvals and commercialization of breakthrough therapies, thereby driving market expansion. Moreover, rising healthcare spending is also allowing hospitals and healthcare providers to adopt red biotechnology solutions to improve patient outcomes, further driving market growth.

Growing Prevalence of Chronic Diseases:

Biotech firms are heavily investing in red biotechnology, including innovative therapies such as monoclonal antibodies, stem cell treatments, and gene-editing technologies, to target the underlying causes of expanding chronic diseases rather than just managing symptoms. World Health Organization, in its report, stated that noncommunicable diseases (NCDs) or chronic diseases caused at least 43 million deaths in 2021, equivalent to 75% of non-pandemic-related deaths globally. Additionally, the rising prevalence of chronic diseases is prompting governments and insurers to invest in high-value therapies that reduce hospitalizations and complications, thereby further accelerating the demand for red biotechnology.

Segmental Insights

Product Analysis

Based on product, the segmentation includes monoclonal antibodies, polyclonal antibodies, recombinant proteins, vaccines, cell-based immunotherapy products, gene therapy products, cell therapy products, tissue-engineered products, stem cells, cell culture, viral vector, enzymes, kits and reagents, animal models, molecular diagnostics, and other. The monoclonal antibodies segment accounted for 49.13% of the revenue share in 2024 due to their widespread adoption in the treatment of cancer, autoimmune disorders, and infectious diseases. Pharmaceutical companies fueled monoclonal antibody development owing to their high specificity, reduced side effects, and improved therapeutic outcomes compared to traditional drugs. The increasing prevalence of chronic illnesses, coupled with growing regulatory approvals for new antibody-based therapeutics, supported the segment’s dominance. Moreover, the surge in biologics research and increasing investments in antibody-drug conjugates further expanded the application of monoclonal antibodies across a range of clinical settings.

The gene therapy products segment is projected to register a CAGR of 23.32% from 2025 to 2034, owing to advancements in genomic technologies and the successful commercialization of gene-based treatments. Regulatory agencies across North America and Europe are rapidly approving several gene therapies, creating a favorable environment for continued growth. Additionally, strong R&D, growing patient demand for curative solutions, and rising investments from biotechnology firms and venture capitalists are propelling the expansion of the segment.

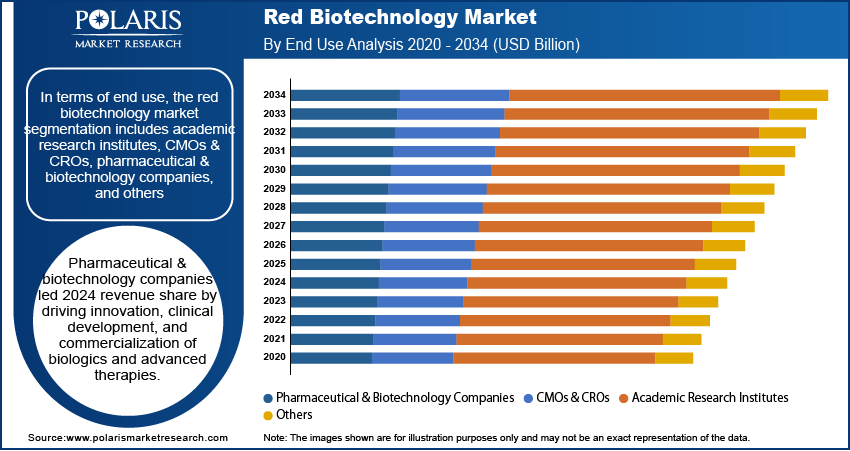

End Use Analysis

In terms of end use, the segmentation includes academic research institutes, CMOs & CROs, pharmaceutical & biotechnology companies, and others. The pharmaceutical & biotechnology companies accounted for a major revenue share in 2024 due to their role in driving innovation, clinical development, and commercialization of biologics and advanced therapies. These companies invested heavily in R&D to develop monoclonal antibodies, gene therapies, and cell-based treatments targeting cancer, autoimmune diseases, and rare genetic disorders. The demand for personalized medicine, combined with robust funding and strategic collaborations with academic institutions and contract organizations, strengthened their position. Additionally, the growing number of biologic drugs in pipeline and regulatory support for fast-track approvals enabled easy entry, contributing to their dominance.

The CMOs & CROs segment is expected to grow at a robust pace in the coming years owing to the increasing outsourcing trends across the pharmaceutical and biotech sectors. Companies in the industry are seeking to reduce operational costs, accelerate timelines, and access specialized expertise by partnering with CMOs and CROs for clinical trials, regulatory compliance, and manufacturing services. The rise of complex biologics and the need for scalable, GMP-compliant production facilities have made CMOs crucial to drug development. CROs also play a crucial role in managing data-intensive trials and navigating complex global regulatory environments, thereby contributing to their continued growth in the evolving industry.

Regional Analysis

The North America red biotechnology market accounted for 34.16% revenue share across the world in 2024. This dominance is attributed to established healthcare infrastructure, high R&D investments, and a growing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders. Centers for Disease Control and Prevention (CDC), in its report, stated that about 38 million people have diabetes in the U.S. The market in the region also benefited from strong government support, favorable regulatory frameworks, and increasing adoption of personalized medicine and biologics. Additionally, advancements in gene therapy, CRISPR technology, and monoclonal antibody treatments propelled market growth. The presence of major biopharmaceutical companies and academic research institutions further fueled the innovation and commercialization of red biotech products in North America.

U.S. Red Biotechnology Market Insight

The U.S. dominated the North America red biotechnology landscape in 2024 due to an advanced research ecosystem, substantial funding from NIH and private investors, and a high burden of chronic and rare diseases. The FDA’s accelerated approval pathways for orphan drugs and biologics encouraged rapid industry entry, leading to industry expansion. Precision medicine initiatives, such as CAR-T cell therapies and mRNA vaccine successes, have further propelled growth in the U.S. Additionally, a rising aging population and increasing healthcare expenditures in the country have driven demand for advanced therapeutics, which has propelled the adoption of red biotechnology in the U.S.

Europe Red Biotechnology Market Trends

The market in Europe is projected to hold a substantial share in 2034 due to universal healthcare systems, strong government and EU funding, and a focus on regenerative medicine and biosimilars. The high prevalence of age-related diseases is also driving demand for red biotechnology. Regulatory support from the EMA, along with collaborative research networks, fosters biotech advancements. Additionally, increasing investments in gene and cell therapies, as well as a growing emphasis on sustainable and affordable biologics, are contributing to market growth.

Germany Red Biotechnology Market Overview

Germany is a key region in Europe’s red biotechnology sector, driven by its strong pharmaceutical industry, world-class research institutions, and government initiatives such as the High-Tech Strategy 2025. Germany also leads in CAR-T cell therapy adoption and mRNA technology, bolstered by companies such as BioNTech. Increasing public and private R&D investments and rising focus on digital health integration are further stimulating market growth in the country.

Asia Pacific Red Biotechnology Market

The market in Asia Pacific is projected to register a CAGR of 15.34% from 2025 to 2034, owing to increasing healthcare spending, a rising middle class, and a high burden of infectious and noncommunicable diseases. Countries such as China, Japan, and South Korea are investing heavily in biopharmaceutical innovation, with supportive government policies. Japan’s aging population drives demand for regenerative medicine, leading to industry expansion. Additionally, the growth of clinical trial outsourcing and partnerships with Western biotech firms is propelling regional industry development.

Key Players and Competitive Analysis

The field of red biotechnology witnesses intense competition among leading pharmaceutical and biotech firms, including Amgen Inc., AstraZeneca, Biogen, Bristol-Myers Squibb, Roche, Gilead Sciences, Merck KGaA, Pfizer, Regeneron Pharmaceuticals, and Takeda Pharmaceutical. These companies drive innovation in gene therapy, biologics, regenerative medicine, and personalized treatments, leveraging technologies such as CRISPR, monoclonal antibodies, and cell-based therapies. Amgen Inc. and Roche dominate the biologics and oncology sectors, with Roche leading in monoclonal antibodies through blockbuster drugs such as Rituxan and Herceptin, while Amgen focuses on biosimilars and next-generation biologics. AstraZeneca and Pfizer excel in vaccine development and mRNA-based therapies, capitalizing on their COVID-19 vaccine successes to expand into other infectious diseases and cancer immunotherapies. Biogen and Regeneron specialize in neurology and rare diseases, with Biogen’s Alzheimer’s drug Aduhelm and Regeneron’s gene-editing advancements shaping the competitive landscape. Bristol-Myers Squibb and Merck KGaA compete in immuno-oncology, with Bristol-Myers’ Opdivo and Merck’s Keytruda driving revenue growth.

A few major companies operating in the red biotechnology industry include Amgen Inc.; AstraZeneca; Biogen; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd; Gilead Sciences, Inc.; Merck KGaA; MavriX Bio; Pfizer Inc.; Regeneron Pharmaceuticals, Inc.; and Takeda Pharmaceutical Company Limited.

Key Players

- Amgen Inc.

- AstraZeneca

- Biogen

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Gilead Sciences, Inc.

- Merck KGaA

- MavriX Bio

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

Industry Developments

May 2025: MavriX Bio, a company focused on the development of transformative genetic therapies for Angelman syndrome (AS), announced that the U.S. Food and Drug Administration (FDA) has cleared its Investigational New Drug application for MVX-220, a gene therapy for the treatment of AS.

April 2024: India launched its first home-grown anti-cancer CAR-T cell therapy.

August 2022: Kite, a Gilead Company, announced to launch CAR-T cell therapy operations in Brazil, Singapore, and Saudi Arabia.

Red Biotechnology Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Recombinant Proteins

- Vaccines

- Cell-Based Immunotherapy Products

- Gene Therapy Products

- Cell Therapy Products

- Tissue-Engineered Products

- Stem Cells

- Cell Culture

- Viral Vector

- Enzymes

- Kits and Reagents

- Animal Models

- Molecular Diagnostics

- Other

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Academic Research Institutes

- CMOs & CROs

- Pharmaceutical & Biotechnology Companies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Red Biotechnology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 531.66 Billion |

|

Market Size in 2025 |

USD 585.41 Billion |

|

Revenue Forecast by 2034 |

USD 1,415.77 Billion |

|

CAGR |

10.31% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 531.66 billion in 2024 and is projected to grow to USD 1,415.77 billion by 2034.

The global market is projected to register a CAGR of 10.31% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Amgen Inc.; AstraZeneca; Biogen; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd; Gilead Sciences, Inc.; Merck KGaA; MavriX Bio; Pfizer Inc.; Regeneron Pharmaceuticals, Inc.; and Takeda Pharmaceutical Company Limited.

The monoclonal antibodies segment dominated the market in 2024.

The CMOs & CROs segment is expected to witness the fastest growth during the forecast period.