Refurbished MRI Systems Market Size, Share, Trends, Industry Analysis Report

: By Architecture (Closed System and Open System), Field Strength, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM5645

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

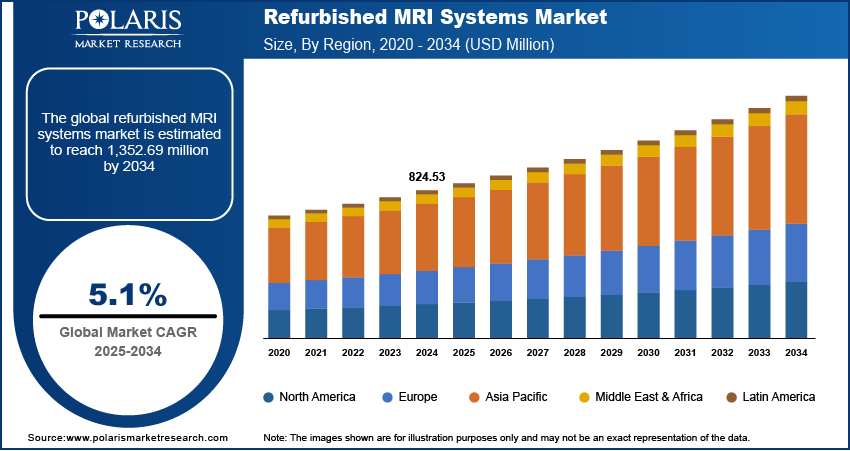

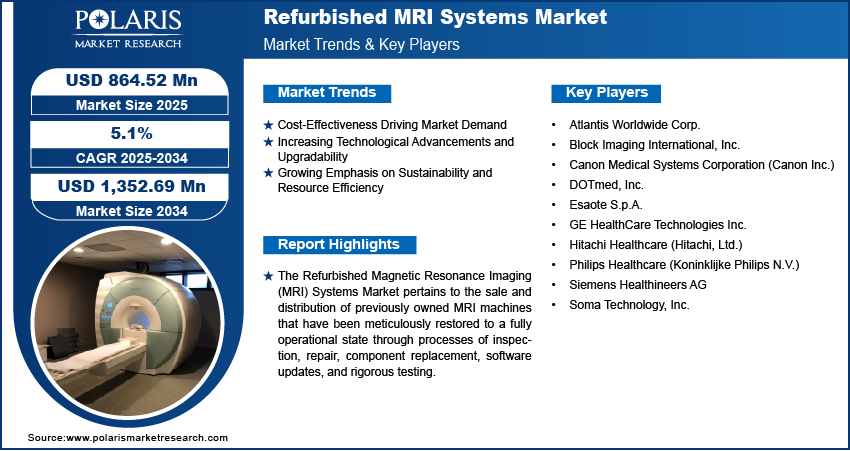

The refurbished MRI systems market size was valued at USD 824.53 million in 2024, exhibiting a CAGR of 5.1% during 2025–2034. Cost-effectiveness, technological advancements with upgrade options, and growing emphasis on sustainability collectively drive the growth of the market globally.

Key Insights

- Closed MRI systems dominate due to superior image quality and wide clinical application across medical specialties.

- High-field strength MRI systems are expanding fast due to increasing demand for advanced imaging in specialized medical fields.

- Hospitals hold the largest share as they require frequent MRI use for diverse patient needs and have budget constraints favoring refurbished units.

- North America leads the market with its mature healthcare infrastructure, large installed MRI base, and acceptance of refurbished equipment.

- Asia Pacific shows the highest growth potential, driven by rising healthcare investments and expanding access to advanced imaging technologies.

Industry Dynamics

- Cost savings drive demand as refurbished MRI systems are 40-60% cheaper than new ones, easing capital expenditure for healthcare providers.

- Technological upgrades improve refurbished systems’ performance, making them comparable to newer models and extending their useful lifespan.

- Expanding healthcare budgets in developing countries increase access to affordable refurbished MRI machines, supporting wider diagnostic imaging coverage.

- Limited awareness and trust issues regarding refurbished MRI systems restrict adoption among healthcare providers concerned about quality and reliability.

Market Statistics

2024 Market Size: USD 824.53 million

2034 Projected Market Size: USD 1,352.69 million

CAGR (2025–2034): 5.1%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The Refurbished Magnetic Resonance Imaging (MRI) Systems Market encompasses the trade of previously owned MRI machines that have undergone a process of inspection, repair, and potential upgrades to meet certain operational standards. MRI machines are also used in intraoperative imaging. These systems offer a cost-effective alternative to new MRI units, providing healthcare facilities with access to crucial diagnostic imaging capabilities at a lower capital investment. The market size of refurbished MRI systems is influenced by several market dynamics, including budgetary constraints faced by hospitals and clinics, particularly smaller establishments or those in developing regions. Furthermore, the increasing awareness of the viability and reliability of refurbished equipment acts as a significant market drive, contributing to higher market demand. The availability of advanced imaging technology in the pre-owned market also enhances its appeal, allowing facilities to acquire sophisticated systems that might otherwise be financially prohibitive.

Several market growth factors are shaping the market outlook for refurbished MRI systems. The longer lifespan of MRI technology allows for a substantial supply of viable pre-owned units entering the market. Technological advancements in imaging software and coil technology can often be integrated into refurbished systems, further enhancing their functionality and extending their useful life. Moreover, the growing emphasis on sustainable practices and resource efficiency within the healthcare sector contributes to the positive market trends for refurbished medical imaging equipment. The market potential is also significant in regions with limited healthcare budgets but a growing need for diagnostic imaging. Understanding these market insights is crucial for stakeholders involved in the market development and for those considering market entry assessments in this evolving landscape.

Market Dynamics

Cost-Effectiveness Driving Market Demand

A primary market drive for the refurbished MRI systems Market is the significant cost savings associated with acquiring pre-owned equipment compared to investing in new systems. Hospitals and diagnostic centers, particularly those with budget limitations or in regions with constrained healthcare spending, find refurbished MRI systems an attractive alternative to meet their imaging needs without incurring substantial capital expenditure. This cost-effectiveness extends beyond the initial purchase price, often encompassing lower maintenance costs in some cases, and potentially reduced insurance premiums. The initial investment for a new MRI system can range from $1 million to over $3 million, representing a significant capital expenditure for healthcare providers. Refurbished systems offer a viable alternative to manage these costs.

For instance, a study published on the National Center for Biotechnology Information (NCBI) website in 2023, titled "Cost-effectiveness Analysis of Refurbished Medical Equipment in Low- and Middle-Income Countries," highlighted the substantial financial benefits of utilizing refurbished medical devices, including imaging systems, in settings with limited resources. The research emphasized that the acquisition cost of refurbished equipment can be 40-60% lower than that of new equipment, allowing healthcare facilities to allocate their budgets to other critical areas while still providing essential diagnostic services. The tangible financial benefits and the increasing acceptance of refurbished technology as a viable and reliable option are key factors propelling the market growth of the refurbished MRI systems Market.

Increasing Technological Advancements and Upgradability

The continuous market development and technological advancements in MRI technology, coupled with the upgradability of existing systems, serve as another significant market drive for the refurbished MRI systems Market. While new MRI systems often boast cutting-edge features, many core functionalities and diagnostic capabilities of slightly older high-end models remain highly relevant and clinically effective. A research article published on PubMed in 2022, "Extending the Lifespan and Enhancing the Capabilities of Existing MRI Systems Through Strategic Upgrades," discussed the feasibility and benefits of retrofitting older MRI units with contemporary hardware and software. The study pointed out that upgrades such as advanced gradient systems and multi-channel coils can significantly enhance the imaging speed and resolution of refurbished systems, making them comparable to newer mid-range models. The perception of refurbished systems as not merely older equipment but as assets with the potential for significant performance enhancement fuels the market growth of the refurbished MRI systems Market.

Growing Emphasis on Sustainability and Resource Efficiency

The increasing global emphasis on sustainability and resource efficiency within the healthcare sector is emerging as a notable market trend and a significant market drive for the refurbished MRI systems Market. The manufacturing of new MRI systems involves substantial energy consumption and the use of raw materials, contributing to the environmental footprint of the healthcare industry. A publication on the National Institutes of Health (NIH) website in 2021, "Environmental Impact Assessment of Medical Equipment Lifecycles," highlighted the significant environmental costs associated with the production and disposal of medical imaging devices (NIH, 2021). The report underscored the potential for reducing waste and conserving resources through the adoption of refurbished equipment, thereby promoting a more sustainable healthcare ecosystem. The contribution of refurbished options to a more sustainable healthcare model is an increasingly important factor driving the market growth of the refurbished MRI systems Market.

Segment Insights

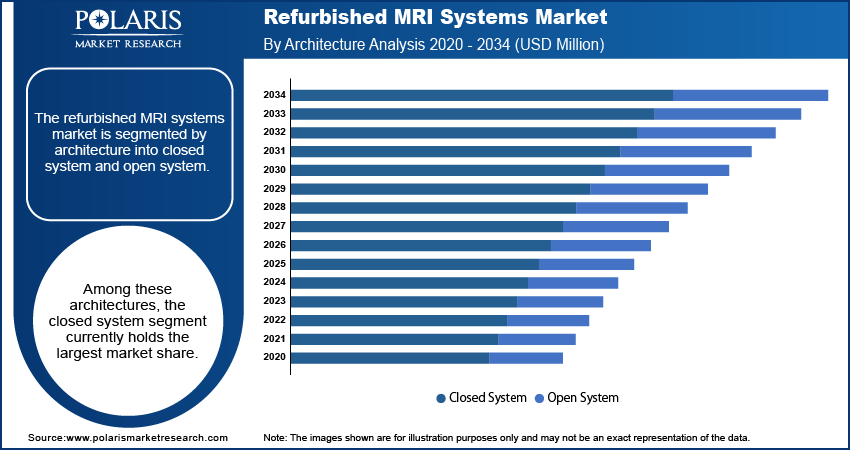

Market Assessment – By Architecture

The refurbished MRI systems Market is segmented by architecture into closed system and open system. Among these architectures, the closed system segment currently holds the largest market share. This dominance can be attributed to several factors, including the established presence of closed-bore MRI systems in the healthcare landscape and their wider range of clinical applications such as clinical trial imaging. Closed systems generally offer higher magnetic field strengths, leading to superior image quality and faster scan times, which are crucial for detailed diagnostic imaging across various medical specialties.

Conversely, the open system segment is anticipated to exhibit the highest market growth rate within the refurbished MRI systems Market. This growth is primarily fueled by the increasing patient preference for more comfortable and less claustrophobic imaging experiences. Open MRI systems are particularly advantageous for patients who are claustrophobic, obese, or pediatric, as they offer a wider bore and a more open design, reducing anxiety and improving patient compliance. The growing awareness of these patient comfort factors and the increasing focus on patient-centric care are driving the market demand trends for open MRI systems.

Market Evaluation– By Field Strength

The refurbished MRI systems Market is segmented by field strength into low field strength, mid field strength, and high field strength. Currently, the mid field strength segment accounts for the largest market share. This significant share is primarily due to the versatility and cost-effectiveness of mid-field MRI systems, which strike a balance between image quality, scan time, and capital investment. These systems are well-suited for a broad range of clinical applications, making them a popular choice for hospitals and diagnostic centers seeking a general-purpose MRI solution. The established presence of mid-field MRI systems in the market translates to a substantial availability of pre-owned units for refurbishment, further contributing to their dominant market share.

The high field strength segment is anticipated to experience the highest market growth rate within the refurbished MRI systems Market. This accelerated growth is driven by the increasing demand for advanced imaging capabilities, particularly in specialized areas such as neurology, cardiology, and musculoskeletal imaging. High-field MRI systems offer superior image resolution and signal-to-noise ratios, enabling the detection of subtle pathologies and providing more detailed anatomical information. As medical diagnostics become increasingly sophisticated and the need for high-resolution imaging for research and clinical applications expands, the market potential for refurbished high-field MRI systems is also increasing.

Market Evaluation– By End Use

The refurbished MRI systems Market is segmented by end use into hospitals, imaging centers, ambulatory surgical centers, and others. Currently, the hospitals segment holds the largest market share. This dominance is primarily attributed to the significant volume of diagnostic imaging procedures conducted in hospitals and their continuous need for MRI systems to cater to a wide range of medical specialties and patient demographics. Hospitals, being the primary healthcare providers in most regions, often possess a substantial installed base of MRI units, leading to a larger replacement market and a greater demand for cost-effective alternatives like refurbished systems. The budgetary pressures faced by many hospitals, coupled with the clinical necessity for advanced imaging, make refurbished MRI systems an attractive option for maintaining and expanding their diagnostic capabilities without incurring prohibitive capital expenditure. This consistent and substantial demand from the hospital sector solidifies its position as the leading end-use segment in the refurbished MRI systems Market, contributing significantly to the overall market size.

The ambulatory surgical centers segment is anticipated to exhibit the highest market growth rate within the refurbished MRI systems Market. This rapid growth is driven by the increasing trend of shifting certain surgical and diagnostic procedures from traditional hospital settings to more cost-efficient and patient-convenient ambulatory surgical centers (ASCs). The expansion of ASCs and their growing focus on providing a wider array of services, including advanced imaging, is creating a significant market potential for refurbished MRI systems. ASCs often operate with tighter budgets compared to large hospitals, making the cost-effectiveness of refurbished equipment particularly appealing.

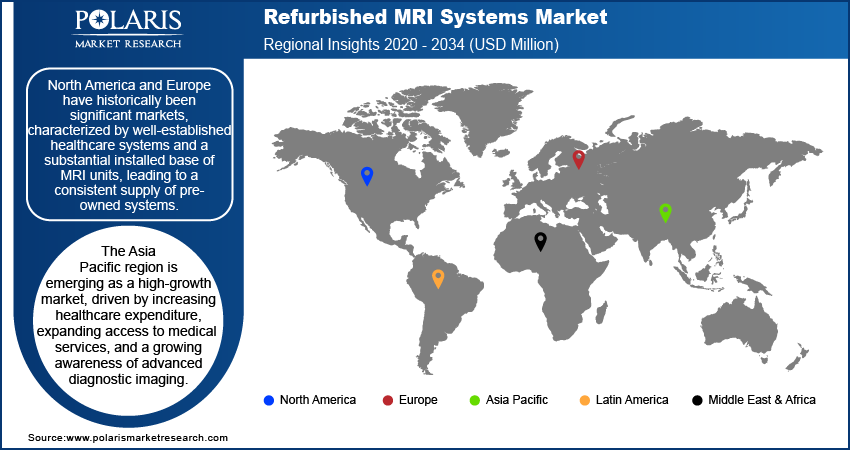

Regional Analysis

The refurbished MRI systems Market exhibits diverse regional dynamics influenced by factors such as healthcare infrastructure, economic conditions, regulatory landscapes, and the prevalence of chronic diseases. North America and Europe have historically been significant markets, characterized by well-established healthcare systems and a substantial installed base of MRI units, leading to a consistent supply of pre-owned systems. The Asia Pacific region is emerging as a high-growth market, driven by increasing healthcare expenditure, expanding access to medical services, and a growing awareness of advanced diagnostic imaging. Latin America and the Middle East & Africa represent markets with considerable market potential, where the cost-effectiveness of refurbished equipment plays a crucial role in improving healthcare accessibility.

North America currently holds the largest market share in the refurbished MRI systems Market. This dominance can be attributed to the region's mature healthcare infrastructure, a high volume of MRI procedures, and the presence of a well-established market for medical equipment, including pre-owned systems. The significant installed base of MRI units in hospitals and imaging centers across North America generates a substantial supply of systems entering the secondary market, which are then refurbished and redistributed. Furthermore, the awareness and acceptance of refurbished medical equipment are relatively high in this region, with healthcare facilities recognizing the economic benefits of acquiring quality pre-owned MRI systems. The presence of stringent regulatory frameworks ensuring the quality and safety of refurbished devices also contributes to the market's stability and size. The combination of a large existing base, a steady supply of used equipment, and a favorable perception of refurbished technology solidifies North America's position as the leading region in the refurbished MRI systems Market, contributing significantly to the global market size.

The Asia Pacific region is anticipated to exhibit the highest market growth rate in the refurbished MRI systems Market. This rapid expansion is fueled by several factors, including increasing healthcare expenditure, improving healthcare access in developing economies within the region, and a growing demand for advanced diagnostic imaging services. The rising prevalence of chronic diseases and the expanding middle-class population with greater affordability for healthcare are driving the need for more MRI systems. Refurbished MRI systems offer a cost-effective solution for healthcare providers in this region to meet the growing demand without the substantial capital outlay associated with new equipment.

Key Players and Competitive Insights

The prominent entities actively operating within the refurbished MRI systems Market include Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers AG, GE HealthCare Technologies Inc., Canon Medical Systems Corporation (Canon Inc.), Hitachi Healthcare (Hitachi, Ltd.), Esaote S.p.A., Block Imaging International, Inc., Soma Technology, Inc., Atlantis Worldwide Corp., and DOTmed, Inc. These companies are involved in various aspects of the refurbished MRI system lifecycle, including sourcing pre-owned units, performing comprehensive refurbishment processes, offering upgrades and maintenance services, and distributing these systems to healthcare facilities globally.

The competitive landscape of the refurbished MRI systems Market is characterized by a mix of original equipment manufacturers (OEMs) and independent specialized companies. OEMs leverage their technical expertise and established distribution networks to offer certified pre-owned systems, often providing warranties and service agreements that align with their new equipment offerings. Independent refurbishers and resellers play a crucial role in extending the lifespan of MRI systems from various manufacturers, offering a wider range of options and often more competitive pricing. Competition is based on factors such as system quality, pricing, warranty terms, service offerings, technological upgrades available, and the geographic reach of the providers. Market insights suggest that building trust through transparent refurbishment processes and reliable post-sales support are key differentiators. The increasing demand for cost-effective imaging solutions is intensifying competition, encouraging players to innovate in their service models and expand their market penetration strategies.

Siemens Healthineers AG, headquartered in Erlangen, Germany, provides a comprehensive portfolio of medical imaging equipment, including both new and refurbished MRI systems. Their offerings in the refurbished market encompass a range of field strengths and system architectures, catering to diverse clinical needs.

GE HealthCare Technologies Inc., with its principal place of business in Chicago, Illinois, USA, is another significant player in the medical imaging sector, actively participating in the refurbished MRI systems Market. Their refurbished MRI offerings include various models, from lower to higher field strengths, suitable for a wide array of diagnostic applications.

List of Key Companies

- Atlantis Worldwide Corp.

- Block Imaging International, Inc.

- Canon Medical Systems Corporation (Canon Inc.)

- DOTmed, Inc.

- Esaote S.p.A.

- GE HealthCare Technologies Inc.

- Hitachi Healthcare (Hitachi, Ltd.)

- Philips Healthcare (Koninklijke Philips N.V.)

- Siemens Healthineers AG

- Soma Technology, Inc.

Refurbished MRI Systems Market Industry Developments

- May 2023: Siemens Healthineers partnered with CommonSpirit Health to acquire Block Imaging, a company specializing in refurbished medical equipment, servicing, and parts. The acquisition was intended to support initiatives focused on repairing and reusing equipment, delivering greater value to customers and their patients, and minimizing environmental waste.

- January 2023: Radon Medical Imaging (Radon) announced its acquisition of Premier Imaging Medical Systems, a provider of maintenance services and sales for new, used, and refurbished imaging and biomedical equipment.

Refurbished MRI Systems Market Segmentation

By Architecture Outlook (Revenue-USD Million, 2020–2034)

- Closed System

- Open System

By Field Strength Outlook (Revenue-USD Million, 2020–2034)

- Low Field Strength

- Mid Field Strength

- High Field Strength

By End Use Outlook (Revenue-USD Million, 2020–2034)

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Refurbished MRI Systems Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 824.53 Million |

|

Market Size Value in 2025 |

USD 864.52 Million |

|

Revenue Forecast by 2034 |

USD 1,352.69 Million |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The refurbished MRI systems market has been segmented into detailed segments of architecture, field strength, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A robust growth and marketing strategy for the refurbished MRI systems Market should emphasize building trust and transparency regarding the refurbishment process and the quality of pre-owned systems. Highlighting the cost-effectiveness and the potential for significant savings compared to new equipment is crucial for attracting budget-conscious healthcare facilities. Demonstrating the availability of system upgrades and the integration of current software can address concerns about technological obsolescence. Targeted marketing efforts should focus on specific end-user segments, such as smaller hospitals, imaging centers, and ambulatory surgical centers, showcasing tailored solutions. Collaborations with group purchasing organizations and participation in industry events can further expand market reach. Emphasizing the environmental benefits of choosing refurbished equipment can also appeal to institutions with sustainability initiatives, fostering a positive brand image and driving market penetration.

FAQ's

The refurbished MRI systems market size was valued at USD 824.53 billion in 2024 and is projected to grow to USD 1,352.69 billion by 2034.

The market is projected to register a CAGR of 5.1% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the refurbished MRI systems market include Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers AG, GE HealthCare Technologies Inc., Canon Medical Systems Corporation (Canon Inc.), Hitachi Healthcare (Hitachi, Ltd.), Esaote S.p.A., Block Imaging International, Inc., Soma Technology, Inc., Atlantis Worldwide Corp., and DOTmed, Inc.

The closed system segment accounted for the larger share of the market in 2024.

Following are some of the refurbished MRI systems market trends: ? Increasing Acceptance of Refurbished Equipment: Growing recognition among healthcare providers regarding the quality, reliability, and cost-effectiveness of refurbished MRI systems is driving greater adoption. ? Rising Demand in Emerging Economies: Expanding healthcare infrastructure and increasing affordability in developing regions are creating significant demand for budget-friendly refurbished MRI solutions. ? Technological Upgradation of Pre-owned Systems: Refurbishment processes are increasingly incorporating software and hardware upgrades, enhancing the capabilities and extending the lifespan of older MRI units.

A Refurbished MRI (Magnetic Resonance Imaging) System is a pre-owned MRI machine that has undergone a comprehensive process to restore it to a fully functional and often cosmetically improved condition. This process typically involves thorough inspection, cleaning, repair or replacement of faulty or worn-out components, software upgrades to the latest compatible versions, calibration, and rigorous testing to ensure it meets the original manufacturer's specifications and safety standards. Refurbished MRI systems offer a cost-effective alternative to purchasing new equipment, allowing healthcare facilities to access advanced diagnostic imaging capabilities at a significantly reduced capital investment.