Satellite Solar Cell Materials Market Share, Size, Trends, Industry Analysis Report

By Material Types (Gallium Arsenide (GaAs), Silicon, Copper Indium Gallium Selenide (CIGS)); By Orbit; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4806

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

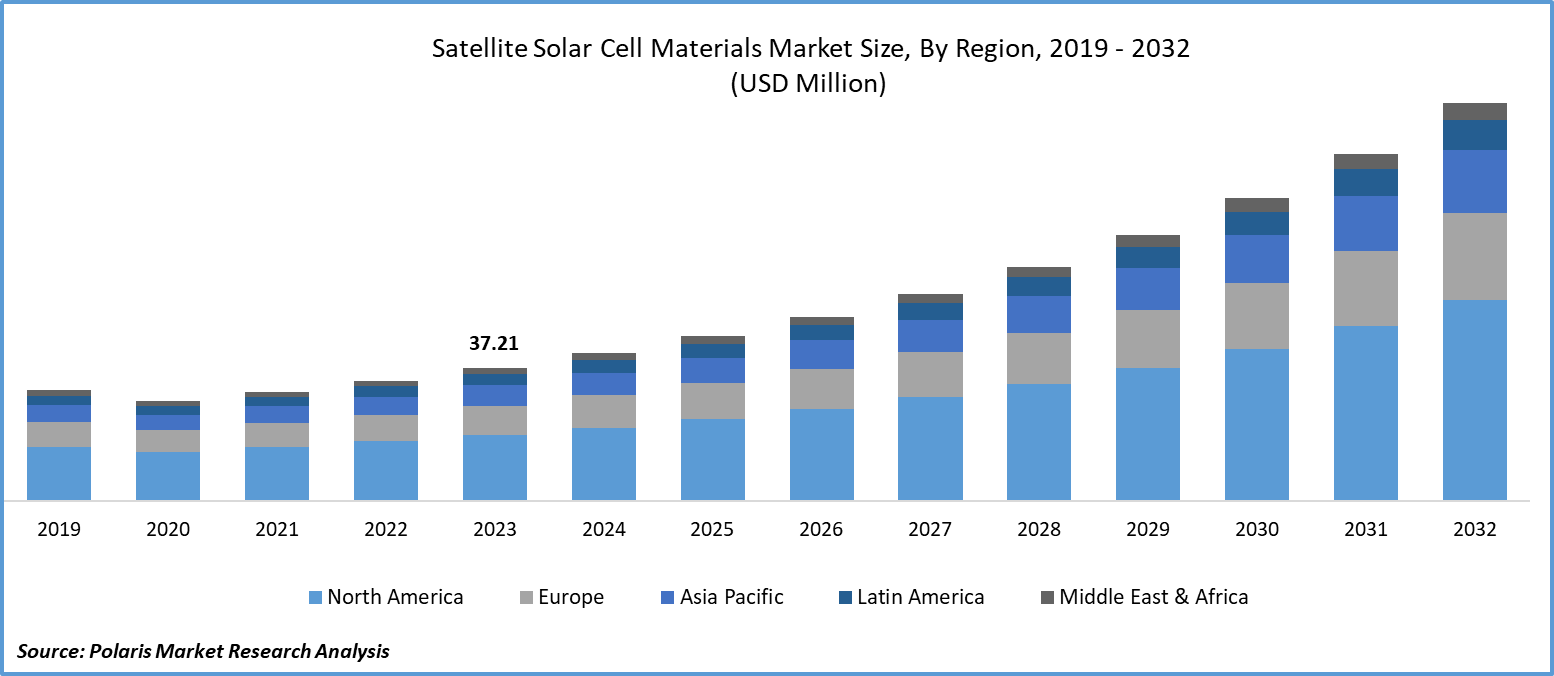

Global satellite solar cell materials market size was valued at USD 37.21 million in 2023. The market is anticipated to grow from USD 41.31 million in 2024 to USD 111.46 million by 2032, exhibiting the CAGR of 13.2% during the forecast period

Satellite Solar Cell Materials Market Overview

The satellite solar cell materials market development is expanding significantly due to the growing need for satellites for scientific research, communication, navigation, and Earth observation. In the hostile atmosphere of space, these satellites rely on solar cells to provide power. Governments, businesses, and academic institutions are increasingly deploying satellites for a range of uses, which is one of the major factors driving this industry. This has raised the need for solar cell materials that are strong, lightweight, efficient, and resistant to space radiation.

- For instance, in August 2023, Italian multinational CESI and the Italian Space Agency (ASI) entered into a significant agreement, valued at over 13 million euros, to support the Space Factory project. This project is a key asset for Italy and aims to enhance the capabilities of the national industrial supply chain in the space sector.

To Understand More About this Research: Request a Free Sample Report

The development of space technology has also aided in the satellite solar cell materials market's expansion. In order to increase solar cells' longevity and efficiency and increase their appeal for use in satellites, manufacturers are creating novel materials and technologies. Government initiatives and investments in satellite technology and space exploration are further stimulating the satellite solar cell material market growth. In order to strengthen national security, monitor environmental changes, and upgrade communication networks, many nations are investing in satellite programs. In addition, the use of solar power for satellites is being driven by the growing consciousness of environmental sustainability. As a clean and renewable energy source, solar cells support the worldwide movement to lower carbon emissions and slow down climate change.

Satellite Solar Cell Materials Market Dynamics

Market Drivers

Increasing Space Exploration and Deployment of Satellites

The satellite solar cell materials market demand is primarily fueled by the growing wave of space exploration and the deployment of satellites. For instance, in July 2023 Union of Concerned Scientists, posted a blog regarding the number of operational satellites in Earth's orbit reached 6,718 as of 2022, marking an astonishing increase of nearly 2,000 satellites in just one year. As more countries and private organizations invest in space exploration, satellite launches are becoming more and more necessary for scientific research, Earth observation, communication, and navigation. This increasing demand for satellite deployment has led to a parallel expansion in the demand for solar cell materials, which serve as the primary power source for satellites in orbit.

Additionally, as satellite technology and propulsion systems improve, launches become more frequent and economical, raising the demand for solar cell materials. The emergence of new uses like satellite-based internet services and remote sensing also raises the demand for solar cell materials and dependable and efficient power generation systems.

Market Restraints

Standards for Regulation and Compliance are likely to impede the market growth.

In order to guarantee the performance, safety, and dependability of materials used in space applications, the market for materials for satellite solar cells is governed by strict regulations. Regulatory standards cover a range of factors that are essential for satellite solar cells and are often established by government bodies and international organizations. Norms and standards established by space agencies such as ESA (European Space Agency), NASA, and others dictate the quality, functionality, and durability of materials in the challenging space environment. These requirements cover aspects such as thermal stability, radiation tolerance, mechanical strength, and electrical performance. Meeting these stringent specifications is essential for materials used in satellite solar cells to withstand harsh conditions such as vacuum, temperature fluctuations, micrometeoroid impacts, and high radiation levels.

Report Segmentation

The market is primarily segmented based on material types, orbit, application, and region.

|

By Material Types |

By Orbit |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Satellite Solar Cell Materials Market Segmental Analysis

By Material Types Analysis

- The Gallium Arsenide (GaAs) segment is projected to grow at the fastest CAGR during the satellite solar cell material market forecast period. In the dim lighting conditions often encountered in space, Gallium Arsenide (GaAs) solar cells surpass conventional silicon-based cells in efficiency. This heightened efficiency ensures sufficient power generation even in challenging orbital environments, thereby prolonging the lifespan and reliability of satellites. Additionally, GaAs exhibit remarkable resistance to radiation, a critical trait for satellites exposed to cosmic radiation in orbit. This resilience enhances the endurance of the solar cells and reduces the likelihood of performance degradation over time.

The increasing use of GaAs solar cells is partly attributed to advancements in manufacturing technology, which allow for large-scale, cost-effective production. GaAs solar cells are now the preferred choice for the next generation of space-based solar technologies, as space agencies and satellite manufacturers prioritize durable, high-performance, and efficient power sources. GaAs stand out for their ability to radiation resistance, blend efficiency, and lightweight construction, making them a leader in the rapidly growing field of materials for satellite solar cells.

By Orbit Analysis

- The low earth orbit (LEO) segment is expected to grow at the fastest CAGR over the satellite solar cell materials market forecast period. Altitudes ranging from approximately 180 to 2,000 kilometers above Earth's surface characterize Low Earth Orbit (LEO). This orbit has gained increasing popularity due to its strategic advantages, including improved accessibility, reduced communication latency, and longer satellite revisit periods. Unlike Geostationary Orbit (GEO) satellites, LEO satellites operate at lower altitudes. This helps minimize signal latency in communication networks. LEO is particularly well-suited for constellations of communication satellites, offering low latency essential for real-time data transfer, broadband internet services, and Earth observation applications.

Additionally, Earth observation programs benefit from the improved resolution and more frequent revisits made possible by LEO satellites being closer to Earth. In contrast to satellites at higher altitudes, those in LEO have shorter revisit times, enabling them to capture detailed images, monitor environmental changes, and facilitate scientific research more effectively.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of space stations, satellites, rovers, and others. The satellite segment accounts for growing with the fastest CAGR during the satellite solar cell materials market forecast period owing to its advancements in technological perspective, increasing dependency on space-based assets, and growing satellite launches. Satellites play a crucial role in various sectors, such as communication, navigation, Earth observation, and scientific research. The growing global demand for satellite services requires the advancement of advanced and efficient power sources to maintain these satellites in orbit.

Solar cells are crucial for satellite operations, converting sunlight into electrical energy to power onboard systems. The surge in satellite deployments led by commercial and government space agencies has increased the demand for cutting-edge solar cell technologies. Advanced solar cells are essential for satellite missions due to the challenges of the space environment, including long exposure to temperatures, intense radiation, and the requirement for lightweight, reliable power solutions. The demand for satellite solar cells is anticipated to continue growing rapidly with the advancement of space exploration, satellite constellations, and the commercial space industry. This will solidify satellites' role as the main driver of the rapid growth in the satellite solar cell market development.

Satellite Solar Cell Materials Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. North America leads the global market for materials used in satellite solar cells due to its strong position in satellite deployments and technology for space. The region boasts a robust space industry ecosystem featuring renowned aerospace firms, government bodies like NASA, and research institutions. This ecosystem drives North America's dominance in the sector, overseeing a range of satellite missions for communication, Earth observation, and scientific research, necessitating high-quality solar cell components.

The demand for satellite solar cell materials is further fueled by the booming commercial space sector in North America, which is home to both established players and creative entrepreneurs. The favorable legislative framework and easy access to funding in the region encourage the expansion of space businesses and create a favorable market for solar cell producers. Moreover, significant expenditures in satellite technology, including developments in solar power generation, are propelled by the strategic focus on national security and defense programs.

For military uses, including navigation, surveillance, and reconnaissance, satellites with powerful solar cells are essential for maintaining operational capabilities in orbit. Moreover, North America's leadership in satellite mega-constellations greatly influences the demand for solar cell materials, particularly for worldwide broadband internet coverage. As businesses such as SpaceX send thousands of satellites into space, each one needs dependable, high-performing solar cells to provide a constant power source for the duration of its operation.

The Asia Pacific region is expected to be the fastest growing region, with a healthy CAGR during the projected period. Several key factors are driving the rapid rise of the region. Increased investment in satellite technology and space research is fueled by the region's growing scientific and economic development. Nations such as China, Japan, and India are leading the way with ambitious space projects, creating a significant demand for solar cell materials to power satellite deployments. Additionally, Asia Pacific boasts a robust satellite manufacturing sector, with specialized businesses engaged in satellite construction and operation. This local expertise stimulates innovation and competition in the market, further driving demand.

Competitive Landscape

The satellite solar cell materials market is fragmented and is anticipated to witness competition due to several players' presence. Major solar cell materials providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AIRBUS

- AZUR SPACE Solar Power GmbH

- CESI .IT

- MicroLink Devices, Inc

- Mitsubishi Electric Corporation

- Northrop Grumman

- ROCKET LAB USA

- Sharp Corporation

- SPECTROLAB

- Thales Alenia Space

Recent Developments

- In February 2023, Thales Alenia Space has recently finalized the construction and testing of an engineering model of the solar array for the Space INSPIRE product line. This full-scale model, incorporating innovative technology, is scheduled for vibration tests in the coming days. The flexible solar array, known as SolarFlex, marks a significant milestone for Europe.

Report Coverage

The satellite solar cell materials market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, material types, orbit, application, and their futuristic growth opportunities.

Satellite Solar Cell Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 41.31 million |

|

Revenue forecast in 2032 |

USD 111.46 million |

|

CAGR |

13.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Material Types, By Orbit, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Satellite Solar Cell Materials Market are SPECTROLAB, AZUR SPACE Solar Power, GmbH, ROCKET LAB USA, Sharp Corporation, CESI .IT

Satellite solar cell materials market exhibiting the CAGR of 13.2% during the forecast period

The Satellite Solar Cell Materials Market report covering key segments are material types, orbit, application, and region.

key driving factors in Satellite Solar Cell Materials Market are Increasing Space Exploration and Deployment of Satellites

The global satellite solar cell materials market size is expected to reach USD 111.46 million by 2032