Seasoning Blends Market Size, Share, Trends, & Industry Analysis Report

By Product (Salt & Pepper Blends, Herb & Spice Blends, Marinades & Rubs, and Others), By Application, By Form, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5784

- Base Year: 2024

- Historical Data: 2020-2023

Overview

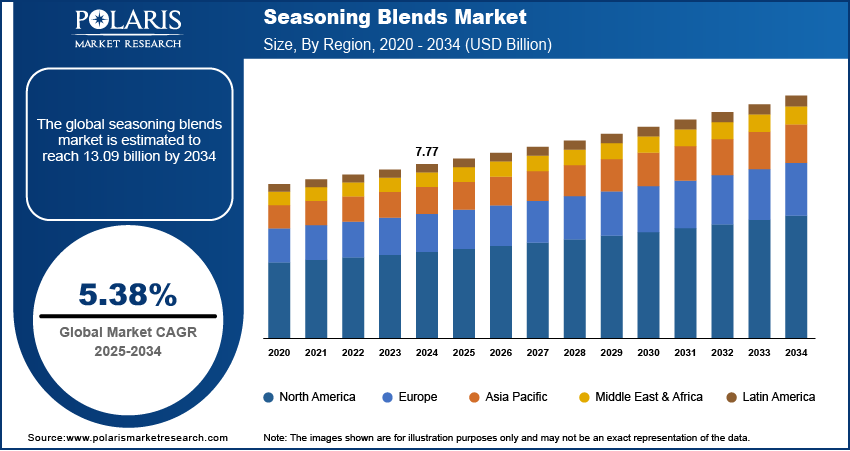

The global seasoning blends market size was valued at USD 7.77 billion in 2024, growing at a CAGR of 5.38 % during 2025–2034. A few key factors driving demand for seasoning blends include the rising popularity of home cooking, growing urbanization globally, expanding e-commerce platforms, and increasing demand for convenience and ready-to-cook meals worldwide.

Seasoning blends combine a variety of herbs and spices to create unique flavors that enhance the taste and aroma of food. Cooks use these blends to add depth, complexity, and taste to dishes without the need to mix individual spices each time. These blends usually include ingredients such as cumin, coriander, turmeric, pepper, oregano, basil, cinnamon, cloves, and others. Seasoning blends empower cooks to experiment with global flavors, transform simple ingredients into extraordinary dishes, and express creativity in the kitchen.

The rising popularity of home cooking is driving the market growth. Home cooks usually look for convenient ways to add variety, depth, and taste to their meals. Seasoning blends offer a simple solution to this by providing a mix of spices and herbs that transform ordinary dishes into gourmet ones. Additionally, social media and cooking shows are inspiring people and home cooks to try global dishes, which boosts the need for versatile and ready-to-use blends. Therefore, the rising popularity of home cooking is driving the demand for seasoning blends such as salt & pepper, herbs & spices, and others.

To Understand More About this Research: Request a Free Sample Report

The seasoning blends demand is driven by the growing urbanization globally. World Bank, in its report, stated that the urban population is expected to more than double by 2050. Urban people usually seek convenient and quick solutions to prepare meals without sacrificing flavor, and seasoning blends provide an easy way to enhance the taste of their food with minimal effort. Additionally, supermarkets and online grocery services in cities prominently display a wide variety of seasoning options, increasing visibility and impulse purchases. Therefore, as urbanization expands, the demand for pre-mixed seasonings also rises.

Industry Dynamics

Expanding E-Commerce Platforms

E-commerce platforms offer a vast selection of blends, including international flavors, which attract curious consumers looking to experiment with new tastes. Customer reviews and detailed product descriptions on these e-commerce platforms build trust and encourage purchases. Social media and targeted ads on these platforms further drive awareness, leading to high demand. The convenience of doorstep delivery and competitive pricing offered by e-commerce platforms also motivates buyers to explore and stock up on different seasoning varieties, fueling overall demand.

Rising Demand for Convenience and Ready-To-Cook Meals Worldwide

Busy lifestyles are driving people toward pre-packaged and ready-to-cook meals that require minimal preparation. Seasoning blends play a crucial role in this trend by providing an effortless way to add flavor and variety to these convenient meal options. Additionally, the global exposure to diverse cuisines through travel and media is encouraging people to experiment with different ready-to-cook meals, fueling demand for seasoning blends as it makes it easy to achieve authentic tastes. Hence, the rising demand for convenience and ready-to-cook meals worldwide is driving the adoption of seasoning blends.

Segmental Insights

By Product Analysis

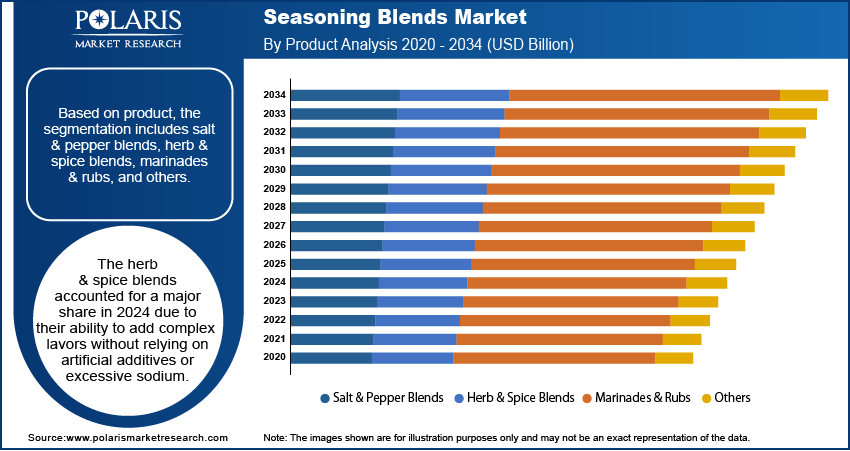

Based on product, the segmentation includes salt & pepper blends, herb & spice blends, marinades & rubs, and others. The herb & spice blends accounted for a major market share in 2024 due to their ability to add complex flavors without relying on artificial additives or excessive sodium. Food manufacturers and home cooks prefer herb & spice combinations for their versatility in a wide range of cuisines, including Mediterranean, Asian, and Middle Eastern dishes. The growing awareness of health benefits associated with natural herbs such as turmeric, oregano, rosemary, and thyme also played a key role in boosting demand for herb & spice blends. Additionally, the rise in plant-based diets encouraged manufacturers to develop herb-rich flavoring options, which fueled segment dominance.

By Application Analysis

In terms of application, the segmentation includes meat & poultry; snacks & convenience foods; bakery & confectionery; sauces, dressings, and condiments; ready-to-eat meals; and others. The meat & poultry segment dominated the revenue market share in 2024 due to the consistent global demand for flavored animal protein products. Consumers increasingly seek enhanced taste in everyday meat dishes, prompting food processors and home cooks to incorporate a wide range of spice and herb formulations. The growing popularity of grilled, roasted, and marinated meat dishes, particularly in North America, Europe, and parts of Asia, significantly contributed to the segment’s dominance. Additionally, the rise in consumption of processed and ready-to-cook meat products encouraged manufacturers to infuse diverse flavors to cater to shifting taste preferences. Health-conscious consumers also drove demand for natural seasonings as alternatives to high-sodium or synthetic flavoring agents traditionally used in meat preparation.

The ready-to-eat meals segment is projected to grow at a robust pace in the coming years, owing to the changing lifestyles, urbanization, and a rising number of working professionals. Consumers are increasingly opting for RTE products that deliver both nutrition and global flavors without the need for complex cooking. The expansion of e-commerce food delivery platforms and the growing acceptance of packaged gourmet-style meals across emerging economies are also expected to fuel the growth of the segment.

By Form Analysis

In terms of form, the segmentation includes powder, liquid, granular, and paste. The powder segment held a 39.02% revenue share in 2024 due to its widespread use across both household and commercial food applications. Food manufacturers favored powdered formulations owing to their longer shelf life, ease of storage, and precise dosing capabilities. Consumers also preferred powder-based products for their convenience in everyday cooking, whether seasoning meats, vegetables, or snacks. Moreover, the growing demand for dry seasoning sachets in instant noodles, frozen meals, and snack foods contributed to the segment's dominant position.

The paste segment is estimated to grow at a rapid pace during the forecast period, owing to the shifting consumer preferences toward bold, concentrated flavor and authentic culinary experiences. Foodservice operators and home chefs are now valuing paste formulations for their ability to deliver rich flavor intensity and streamline marination or cooking processes. The popularity of global cuisines such as Thai, Indian, and Mediterranean, which traditionally use spice pastes, is also fueling segment growth.

Regional Analysis

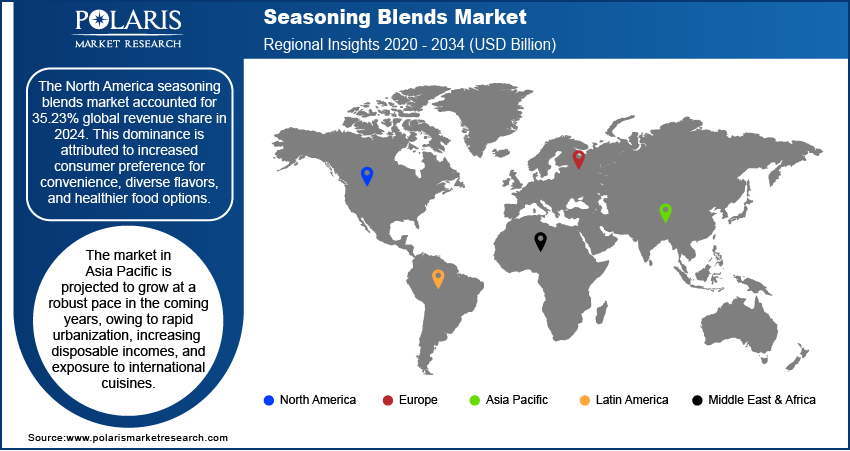

The North America seasoning blends market accounted for a 35.23% global revenue share in 2024. This dominance is attributed to increased consumer preference for convenience, diverse flavors, and healthier food options. Busy lifestyles in the region also led to increased demand for ready-to-use seasoning mixes that simplify cooking while enhancing taste. Additionally, the rise of global cuisines, such as Mexican, Asian, and Mediterranean, has spurred interest in ethnic seasoning blends in the region. The increased popularity of home cooking, fueled by food blogs and cooking shows, further propelled the demand for seasoning blends in North America.

US Seasoning Blends Market Insight

The US dominated the regional market share in 2024 due to the increased popularity of gourmet and ethnic foods, as well as the influence of multicultural dining trends. Consumers in the country are experimenting with global flavors, which drove demand for spice blends such as taco seasoning, curry powders, and Italian herbs in 2024. The shift toward plant-based diets in the country has also increased the need for flavorful seasoning blends to enhance the taste. Additionally, the rise of meal kits and subscription services introduced consumers to new seasoning varieties, contributing to market dominance in the country.

Asia Pacific Seasoning Blends Market

The market in Asia Pacific is projected to grow at a robust pace in the coming years, owing to rapid urbanization, increasing disposable incomes, and exposure to international cuisines. United Nations Human Settlements Programme stated that the urban population in Asia is expected to grow by 50% by 2050. Countries such as China, Japan, and South Korea are witnessing a surge in demand for convenience foods, including pre-mixed seasonings for home cooking. Traditional spice blends remain popular in the region, but Western and fusion flavors are gaining attraction, especially among younger consumers. The foodservice industry’s expansion, along with the growth of e-commerce, is supporting market expansion in the region by making a variety of seasoning blends accessible. Additionally, the rising popularity of instant noodles, ready-to-eat meals, and street food culture in the region is contributing to market growth.

India Seasoning Blends Market Overview

In India, the demand for seasoning blends is driven by a combination of traditional culinary practices and modern convenience trends. Indian households are increasingly adopting ready-made spice blends such as garam masala, curry powders, and biryani masala to save time without compromising on authentic flavors. The growing middle class, urbanization, and the influence of Western cuisines are also leading to experimentation with global seasoning blends, thereby driving market demand. World Bank, in its report, stated that India’s urban population is expected to reach 40% by 2036. Additionally, the rise of quick-service restaurants (QSRs) and packaged snack foods in the country is boosting the need for commercial seasoning blends.

Europe Seasoning Blends Market

The market in Europe is projected to hold a substantial share in the coming years, owing to the rising popularity of ethnic cuisines, gourmet cooking, and healthy eating trends. Consumers in the region are seeking convenient yet high-quality seasoning options, including Mediterranean, Middle Eastern, and Asian-inspired blends. The region’s growing foodservice industry and the rising trend of home cooking post-pandemic are further propelling demand for seasoning blends. Additionally, consumers in Europe are increasingly interested in bold and exotic flavors, leading to innovation in seasoning blends.

Key Players and Competitive Analysis

The global seasoning blends industry is highly competitive, characterized by the presence of established multinational players, regional brands, and emerging artisanal producers. Key industry leaders such as McCormick & Company and Kerry Group dominate the industry through extensive product portfolios, strong distribution networks, and aggressive marketing strategies. Regional players also hold a significant share in Asia Pacific, offering traditional and ethnic blends. Meanwhile, in North America and Europe, specialty brands such as Badia Spices are gaining traction by emphasizing gluten-free and sustainably sourced ingredients. The industry is witnessing a surge in startups and D2C (direct-to-consumer) brands, which focus on premium, exotic, and chef-crafted blends, appealing to gourmet and adventurous consumers. E-commerce platforms such as Amazon and specialty food websites have fueled their reach, enabling smaller brands to compete with industry giants.

Badia Spices; Baron Spices Inc.; House Foods Group Inc.; Kerry Group PLC; Kikkoman Corporation; McCormick & Company, Inc.; Olam International; Prymat Sp. z o.o.; Sensient Technologies; and Spiceology are among the major companies operating in the seasoning blends market.

Key Players

- Badia Spices

- Baron Spices Inc.

- House Foods Group Inc.

- Kerry Group PLC

- Kikkoman Corporation

- McCormick & Company, Inc.

- Olam International

- Prymat Sp. z o.o.

- Sensient Technologies

- Spiceology

Seasoning Blends Industry Developments

May 2025: Dan-O’s Seasoning announced a new line of bold, smoky, spicy BBQ blends known as Dan-O’s Outlaw.

August 2024: McCormick & Company, Inc. brand Lawry’s announced the launch of four new products: Jerk Seasoning, Seasoned Cajun, Salt & Pepper Vinegar, and Hot Garlic Parmesan.

September 2021: Olam Food Ingredients, a global company in natural and sustainable ingredients and solutions, announced the launch of 17 new spice blends.

Seasoning Blends Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Salt & Pepper Blends

- Herb & Spice Blends

- Marinades & Rubs

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Meat & Poultry

- Snacks & Convenience Foods

- Bakery & Confectionery

- Sauces, Dressings, and Condiments

- Ready-to-Eat Meals

- Others

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Powder

- Liquid

- Granular

- Paste

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Seasoning Blends Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.77 Billion |

|

Market Size in 2025 |

USD 8.17 Billion |

|

Revenue Forecast by 2034 |

USD 13.09 Billion |

|

CAGR |

5.38% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.77 billion in 2024 and is projected to grow to USD 13.09 billion by 2034.

The global market is projected to register a CAGR of 5.38% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Badia Spices; Baron Spices Inc.; House Foods Group Inc.; Kerry Group PLC; Kikkoman Corporation; McCormick & Company, Inc.; Olam International; Prymat Sp. z o.o.; Sensient Technologies; and Spiceology.

The herb & spice blends segment dominated the market share in 2024.

The paste segment is expected to witness the fastest growth during the forecast period.