Self-Sanitizing Plastics Market Size, Share, Trends, Industry Analysis Report

: By Product (Antimicrobial Additives, Coatings, Inherently Antimicrobial Plastics, Other Products), Application, and Region– Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5640

- Base Year: 2024

- Historical Data: 2020-2023

Self-Sanitizing Plastics Market Overview

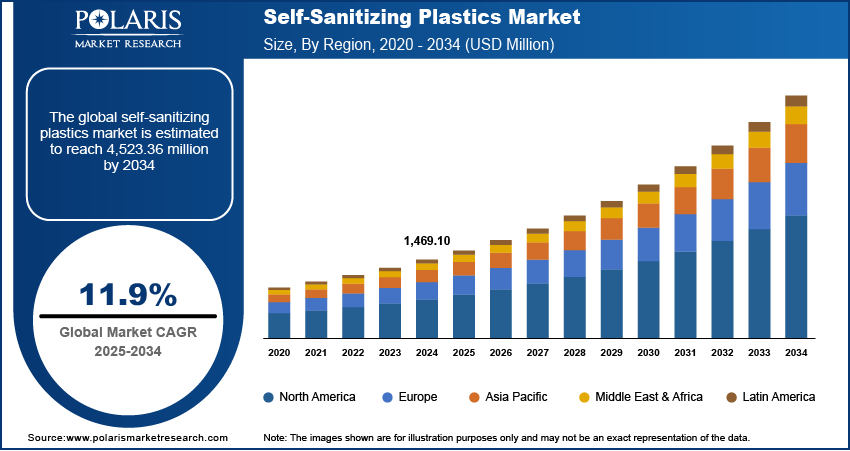

The global self-sanitizing plastics market was valued at USD 1,469.10 million in 2024. It is expected to grow from USD 1,640.32 million in 2025 to USD 4,523.36 million by 2034, at a CAGR of 11.9% during the forecast period.

Self-sanitizing plastics are advanced polymer materials engineered with antimicrobial properties that actively inhibit or eliminate microbial growth on their surfaces, ensuring prolonged hygiene and safety. These plastics are gaining traction across various industries, such as healthcare, packaging, consumer goods, and public infrastructure. This growing interest is raising awareness of cleaning & hygiene products and increasing regulatory focus on infection prevention and material safety. For instance, in October 2022, JICA partnered with IJ Kakehashi Services, the Delhi government, Japanese firms, and NGOs to launch a sanitation awareness campaign in India. Activities included street plays, school programs, handwashing events, and media outreach targeting over 35 million people. Governments and international bodies are encouraging or mandating the use of antimicrobial additives in high-touch environments to reduce pathogen transmission, especially in the wake of recent global health concerns. As a result, manufacturers are being prompted to integrate self-sanitizing solutions into products that prioritize public health and safety, leading to heightened demand and innovation in this segment.

To Understand More About this Research: Request a Free Sample Report

The market is also being shaped by urbanization and growth in emerging economies, where rapid industrialization and rising population density increase the need for materials that support hygienic living conditions. According to a 2020 report by CGIAR, urbanization will rise from 55% to 68% by 2050, with South Asia and Sub-Saharan Africa experiencing the most rapid growth; their urban populations are expected to more than double during this period. Expanding urban infrastructure in countries across Asia, Latin America, and Africa is generating demand for self-sanitizing surfaces in areas such as public transportation, smart cities, and healthcare facilities. Self-sanitizing plastics are positioned as practical, long-term solutions to support clean environments in densely populated urban settings as these economies continue to invest in modern public infrastructure and smart materials. The convergence of urban growth and increasing emphasis on public health is thus reinforcing the strategic importance of these materials in future-oriented development plans.

Driver Dynamics

Increasing Demand for Hygiene and Infection Control

The increasing demand for hygiene and infection control is propelling the growth of the market, as it aligns closely with rising global health consciousness. For instance, a May 2022 WHO report reveals that proper hand hygiene could prevent 70% of healthcare-associated infections (HAIs). Currently, 7 in 100 patients in high-income countries and 15 in low/middle-income countries acquire HAIs, with 10% of affected patients dying from these infections. In high-contact environments such as healthcare facilities, transportation systems, and consumer product applications, the need for materials that can actively reduce microbial contamination has become a priority. Self-sanitizing plastics offer an effective, long-term solution by continuously inhibiting bacterial and viral growth without the need for constant cleaning or chemical application. This functional advantage makes them highly valuable in maintaining sanitary standards across public and private sectors. Industries are increasingly adopting these advanced materials to meet both internal safety protocols and external regulatory expectations as awareness about cross-contamination risks continues to grow.

Technological Advancements in Antimicrobial Plastics

Technological advancements in antimicrobial plastics are greatly enhancing the performance, efficiency, and versatility of self-sanitizing materials. Innovations in additive technologies, surface engineering, and polymer chemistry have enabled the development of plastics with sustained antimicrobial activity, minimal environmental impact, and compatibility with a wide range of applications. For instance, in September 2023, Microban International launched Ascera, an antimicrobial technology for olefinic polymers and coatings. The metal-free, low-toxicity solution offers lasting protection while addressing sustainability concerns. These technological improvements are expanding the scope of use across diverse industries and are also addressing limitations related to durability, transparency, and recyclability. They are pushing the boundaries of functionality and cost-effectiveness as research and development efforts continue to evolve, thereby accelerating the market demand for next-generation products and systems.

Segment Assessment

By Product Outlook

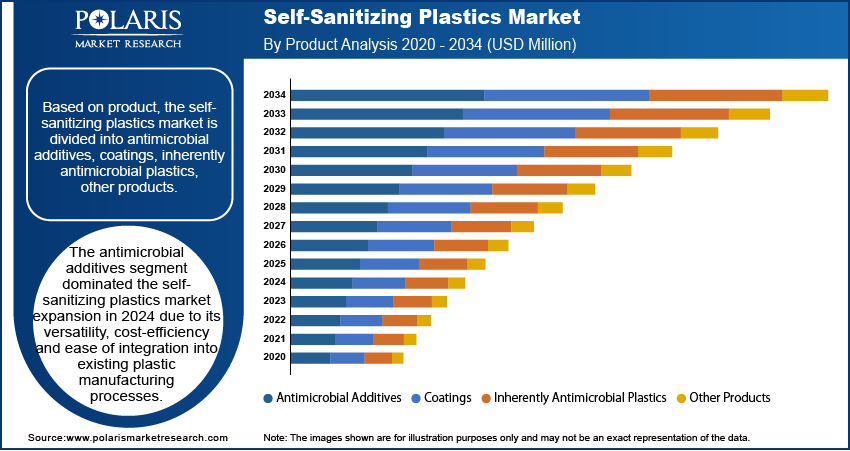

The global assessment, based on product, includes antimicrobial additives, coatings, inherently antimicrobial plastics, other products. The antimicrobial additives segment dominated in 2024 due to its versatility, cost-efficiency, and ease of integration into existing plastic manufacturing processes. These additives, which can be incorporated into a wide range of polymer types during production, provide consistent antimicrobial functionality without altering the base material’s mechanical properties. Their adaptability makes them suitable for diverse end use industries, such as healthcare, packaging, and consumer goods. Additionally, the ability to tailor additive formulations for specific microbial resistance and durability has driven widespread adoption, positioning this segment as the preferred choice among manufacturers seeking scalable and effective self-sanitizing solutions.

By Application Outlook

The global evaluation, based on application, includes healthcare, packaging, consumer goods, building & construction, other applications. The healthcare segment is expected to witness the fastest growth during the forecast period driven by the critical need for infection control in clinical and medical environments. Hospitals, diagnostic services, and outpatient facilities require materials that reduce the risk of cross-contamination and improve patient safety. Self-sanitizing plastics, when used in medical equipment, surfaces, and furnishings, offer a passive yet continuous defense against pathogens. Healthcare providers are prioritizing materials that improve infection control without compromising functionality with rising healthcare investments, increasing patient volumes, and strict hygiene protocols, thereby accelerating the market application.

Regional Analysis

By region, the report provides insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominated in 2024 supported by rapid industrialization, growing urban populations, and heightened awareness of hygiene standards. The region’s strong manufacturing base and increasing investments in healthcare infrastructure have created favorable conditions for the adoption of antimicrobial materials. For instance, A March 2025 IBEF report indicates India's healthcare and pharmaceutical sector received USD 30 billion in investments from 2022 to 2024, further contributing to the market demand. Additionally, rising consumer demand for safer and more hygienic products in densely populated countries such as China and India has further contributed to expansion. Government support for innovation and local production of advanced materials also reinforces Asia Pacific’s leadership in this market.

Europe is projected to witness significant growth during the forecast period, driven by strict regulations around material safety and environmental health. The region’s proactive approach toward sustainability, combined with high standards for public hygiene in sectors such as healthcare, transportation, and packaging, has created a strong demand for innovative antimicrobial materials. Moreover, the presence of established industry players and research institutions focused on developing advanced polymer solutions supports the region’s transition toward cleaner and safer plastic applications. This regulatory and innovation-driven environment is expected to fuel the steady growth of self-sanitizing plastics across Europe.

Self-Sanitizing Plastics Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are Addmaster (U.K.) Limited; Avient Corporation; BASF; BioCote Limited; DuPont; King Plastic Corporation; Microban International, Ltd.; Parx Plastics; Sanitized AG; Sciessent LLC; Teknor Apex.

BASF is an innovator in self-sanitizing plastics, leveraging advanced antimicrobial technologies to address hygiene challenges in healthcare and other industries. Its HyGentic product line includes specialized thermoplastics like HyGentic TPU, which integrates silver ions to prevent microbial contamination on surfaces, making it ideal for medical devices such as tubes and catheters. Other offerings include HyGentic SBC, a styrene-butadiene copolymer suitable for transparent medical device housings, and HyGentic PA, a glass-fiber-reinforced polyamide designed for durable operating elements. These materials are highly effective against pathogens, including antibiotic-resistant strains such as MRSA, and can be disinfected using conventional methods. BASF’s expertise extends to customized formulations tailored to specific applications, ensuring optimal antimicrobial performance without compromising material functionality. The company combines organic and inorganic antimicrobial agents to achieve synergistic effects, enhancing both the speed and longevity of protection. These innovations align with the growing demand for self-sanitizing plastics in healthcare and packaging sectors, where hygiene and safety are paramount.

DuPont has established itself as a leader in self-sanitizing plastics through innovative antimicrobial technologies that enhance hygiene across various industries. In collaboration with Ecolab, DuPont has developed advanced antimicrobial coatings aimed at reducing environmental contamination in food and beverage processing facilities. These coatings effectively control mold and pathogenic bacteria, such as Salmonella and Listeria monocytogenes, addressing critical challenges in the food industry. The partnership delivers solutions that are easily applied and removed, ensuring efficient hygiene management by integrating DuPont's expertise in polymer science and engineering with Ecolab's application development and regulatory knowledge. Additionally, DuPont’s MicroFree antimicrobial technology, now marketed under AirQual’s ACT brand, incorporates coated particles into polymers to prevent degradation caused by mold, mildew, and bacteria. This technology is EPA-registered for use in paints, coatings, adhesives, and building materials, expanding its applications beyond healthcare and food processing. DuPont continues to innovate in microbiome research through its Human Microbiome Venture, focusing on health solutions that modulate microbiota for improved immunity and overall wellness. These initiatives highlight DuPont’s commitment to leveraging science-driven innovations to create safer, healthier materials that meet industry needs while adhering to strict regulatory standards.

Key Companies in Self-Sanitizing Plastics Market

- Addmaster (U.K.) Limited

- Avient Corporation.

- BASF

- BioCote Limited

- DuPont

- King Plastic Corporation

- Microban International, Ltd.

- Parx Plastics

- Sanitized AG

- Sciessent LLC

- Teknor Apex

Self-Sanitizing Plastics Market Development

April 2025: Ampacet launched ProVital + GermsClean, an antimicrobial additive for healthcare plastics. It inhibits bacteria (e.g., MRSA, E. coli) and fungi growth on high-touch surfaces, addressing nosocomial infection risks from contaminated plastic materials.

March 2022: Berry Global and Pylote collaborated to develop an antimicrobial multidose ophthalmic dropper, merging Pylote’s mineral-based antimicrobial technology with Berry’s sustainable healthcare packaging expertise to reduce infection risks while maintaining barrier performance.

Self-Sanitizing Plastics Market Segmentation

By Product Outlook (Revenue, USD Million, 2020 - 2034)

- Antimicrobial Additives

- Coatings

- Inherently Antimicrobial Plastics

- Other Products

By Application Outlook (Revenue, USD Million, 2020 - 2034)

- Automotive

- Healthcare

- Packaging

- Consumer Goods

- Building & Construction

- Other Applications

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Self-Sanitizing Plastics Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,469.10 million |

|

Market Size Value in 2025 |

USD 1,640.32 million |

|

Revenue Forecast in 2034 |

USD 4,523.36 million |

|

CAGR |

11.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,469.10 million in 2024 and is projected to grow to USD 4,523.36 million by 2034.

The global market is projected to grow at a CAGR of 11.9% during the forecast period.

Asia Pacific dominated the self-sanitizing plastics market in 2024.

Some of the key players in the market are Addmaster (U.K.) Limited; Avient Corporation; BASF; BioCote Limited; DuPont; King Plastic Corporation; Microban International, Ltd.; Parx Plastics; Sanitized AG; Sciessent LLC; Teknor Apex.

The antimicrobial additives segment dominated the market expansion in 2024.

The healthcare segment is expected to witness the fastest market growth during the forecast period.