Space Cybersecurity Market Size, Share, Trends, & Industry Analysis Report

By Offering (Solution, Services), By Platform, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM5904

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

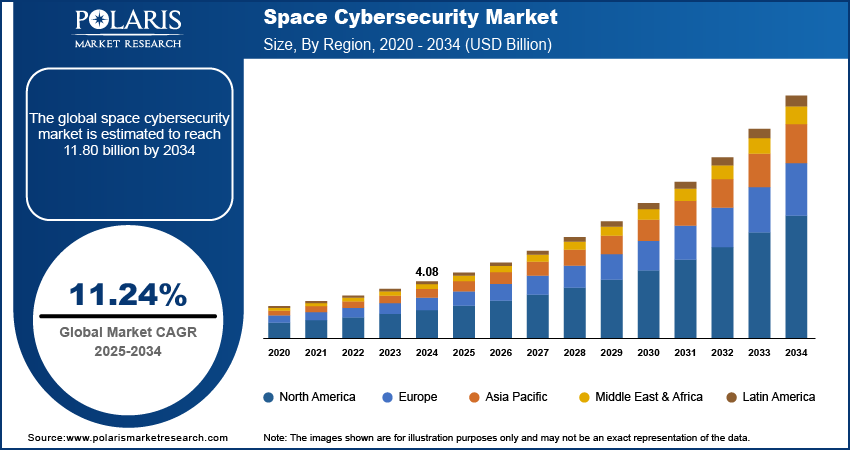

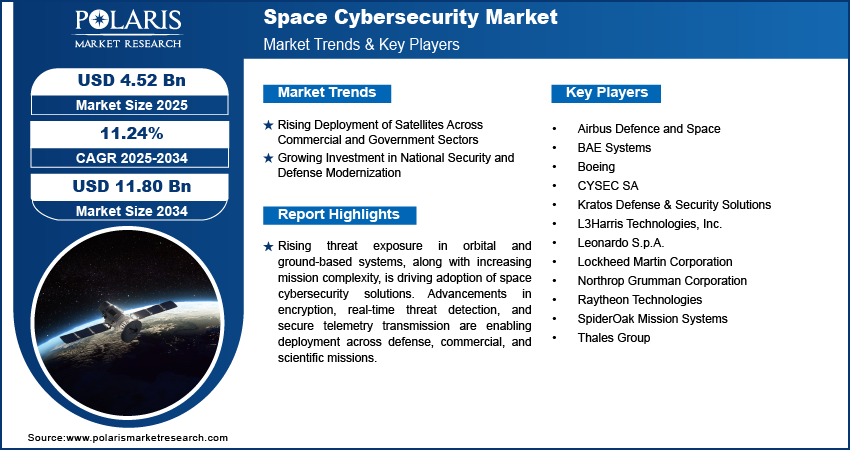

The global space cybersecurity market size was valued at USD 4.08 billion in 2024, growing at a CAGR of 11.24% during 2025–2034. Expanding satellite deployments and defense investments are driving demand for cybersecurity solutions for space.

Space cybersecurity systems are engineered to protect satellites, onboard software, and ground-based infrastructure from digital threats such as signal interference, unauthorized access, and data breaches. These systems incorporate encryption protocols, secure authentication, and intrusion detection to ensure communication integrity and prevent operational disruptions. As satellite networks grow more complex, real-time threat monitoring, anomaly detection, and lightweight firewalls are integrated to maintain system performance within limited onboard computing resources.

Growing demand for secure space operations is driving the adoption of modular cybersecurity frameworks that support rapid deployment, remote updates, and compliance with government and defense regulations. Developers are focusing on standardized components, automated vulnerability scans, and zero-trust architectures to ensure continuous protection throughout mission lifecycles. The addition of quantum-resilient encryption and telemetry protection tools is enhancing system resilience, positioning space cybersecurity as a core requirement for future commercial and governmental space missions.

To Understand More About this Research: Request a Free Sample Report

Rising cyber threats targeting satellite internet and ground stations are driving the need for stronger digital protection across the space sector. According to the Space Information Sharing and Analysis Center (Space ISAC), in 2024, over 100 cyberattack attempts on space systems were reported each week. As satellites handle essential tasks such as communication, navigation, and surveillance, risks including signal spoofing, unauthorized command access, and data interception are raising concerns among operators and regulators.

The growing involvement of private companies in satellite launches, software development, and data services is creating new cybersecurity challenges that require flexible and scalable solutions. Operators are now seeking cost-efficient systems that offer real-time protection, remote updates, and easy integration across mission profiles. At the same time, international cooperation and regulatory efforts are shaping standard practices for cybersecurity in space. Broader market trends such as increasing reliance on space-based infrastructure, expansion of digital economies, and global security concerns are making space cyber-attack solution as a key focus in future space planning and investment.

Industry Dynamics

Rising Deployment of Satellites Across Commercial and Government Sectors

The increase in satellite launches for communication, Earth observation, remote sensing, and navigation is increasing cyber risks, as a result driving the demand for the space cybersecurity industry. As per the United Nations Office for Outer Space Affairs (UNOOSA), there were total 11,330 satellites orbiting Earth by June 2023, marking a 37.94% increase since January 2022. Commercial enterprises are deploying satellite constellations to support global internet coverage, weather tracking, and asset monitoring, while government agencies are expanding their space capabilities for civil and strategic purposes. As the volume and variety of missions grow, the need to secure mission-critical data and maintain uninterrupted connectivity is becoming more pressing.

Each satellite added to orbit requires protection across its software, command systems, and communication channels. Without adequate cybersecurity, these assets remain vulnerable to threats such as data interception, control hijacking, or unauthorized system access. Operators are increasingly adopting modular security frameworks that can be integrated at both ground and space levels. As commercial and government missions become more dependent on real-time data exchange and remote system control, the demand for reliable, scalable, and continuously monitored cybersecurity solutions is rising steadily.

Growing Investment in National Security and Defense Modernization

Governments are accelerating investments in defense-focused space programs to enhance surveillance, communication, and intelligence-gathering capabilities. This in turn, boost the demand for the space cyber-attack solutions. As we know that space-based assets are playing an important role in military operations, including battlefield coordination, rockets and missile tracking, and secure command transfer. With space becoming a domain of strategic competition, safeguarding these platforms against cyber threats is now a priority in national defense planning. According to Novaspace, global government space investments rose to USD 135 billion in 2024, up 10% from 2023, and are projected to reach USD 944 billion by 2033. It highlights defense-focused space programs as space becomes crucial for strategic autonomy, alongside maritime, aerial, and cyber domains.

As military satellite programs expand, cybersecurity systems are embedded into mission lifecycles from initial design to post-deployment management. Cyber defense strategies are focusing on real-time threat detection, encryption of sensitive data, and prevention of unauthorized access to critical communication channels. Defense modernization efforts are also boosting the adoption of artificial intelligence and autonomous threat response tools, allowing faster mitigation of risks. These developments are strengthening the position of space cybersecurity as a key component of modern military readiness and national security architecture.

Segmental Insights

Offering Analysis

The segmentation, based on offering includes, solution and services. The solution segment is projected to grow substantially. This growth is due to the high demand for software tools that protect data transmission, manage system access, and detect unauthorized activity across space-based assets. Solutions such as encryption protocols, intrusion detection systems, and firewall protection are widely integrated into satellite payloads, ground control systems, and mission planning operations. As satellite networks expand and cyber threats increase in complexity, mission operators are prioritizing robust and pre-integrated software packages that support secure operations throughout the satellite lifecycle.

The services segment is projected to grow at a robust pace in the coming years, as operators seek continuous monitoring, threat intelligence, and incident response support from specialized providers. Managed security services and consulting are becoming essential for companies with limited in-house capabilities to address the evolving cybersecurity landscape. The need for compliance audits, vulnerability assessments, and post-launch protection strategies is contributing to the increasing reliance on third-party service providers that offer tailored and cost-effective solutions.

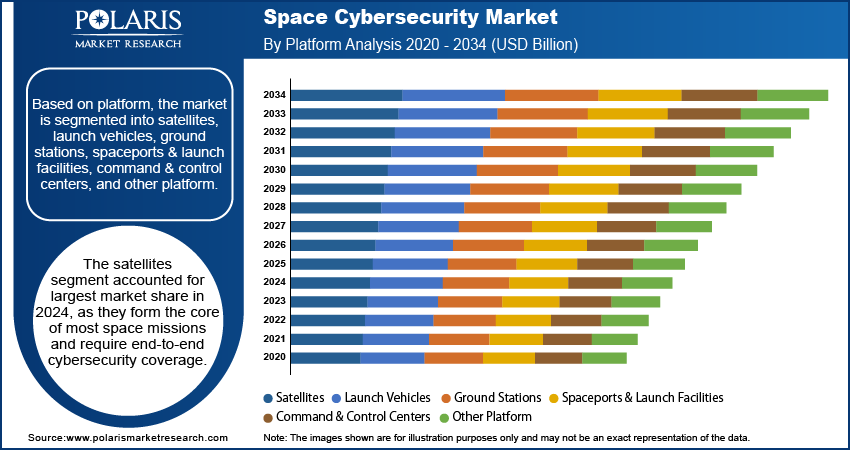

Platform Analysis

The segmentation, based on offering includes, satellites, launch vehicles, ground stations, spaceports & launch facilities, command & control centers, and other platform. The satellites segment accounted for largest market share in 2024, as they form the core of most space missions and require end-to-end cybersecurity coverage. Protecting satellite command systems, telemetry data, and onboard software become critical due to the growing number of commercial and governmental satellites in orbit. Cybersecurity integration during the design, launch, and operational phases is a standard practice, reflecting the central role of satellites in communication, Earth observation, and navigation services.

The ground stations segment is projected to grow at a significant pace during the assessment phase, as they serve as the main interface between orbiting assets and terrestrial operations. Satellite ground station facilities handle sensitive data transmission and command inputs, making them frequent targets for cyberattacks. For instance, in May 2025, the European Space Agency inaugurated its new Cyber Security Operations Centre to enhance cyber resilience and protect its space missions from digital threats. With increasing dependence on real-time communication and data processing, operators are upgrading ground infrastructure with secure networks, encrypted channels, and access control systems to prevent disruption and safeguard mission continuity.

End User Analysis

The segmentation, based on end user includes, government & defense and commercial. The government and defense segment dominated the market share, in 2024, due to rising investments in space-based surveillance, secure communications, and national security programs. Public agencies are adopting comprehensive cybersecurity protocols to protect high-value assets from cyber espionage and digital sabotage. In June 2025, Pentagon's proposed USD 1.01 trillion FY2026 budget prioritizes cybersecurity and space-based capabilities. It aims to strengthen satellite defenses and protect US assets from evolving cyber threats in space. The plan underscores the growing importance of secure space infrastructure in national defense. Strategic importance of satellite constellations in intelligence, navigation, and emergency response continues to drive demand for advanced space cyber-attack solutions.

The commercial segment is estimated to hold a substantial market share in 2034, as private companies increase their presence in satellite manufacturing, launch services, and data-driven applications. With more businesses entering the space economy, the demand for scalable and cost-effective cybersecurity frameworks is rising. Commercial operators are adopting secure-by-design models to meet regulatory standards, protect customer data, and ensure uninterrupted operations across space-based platforms.

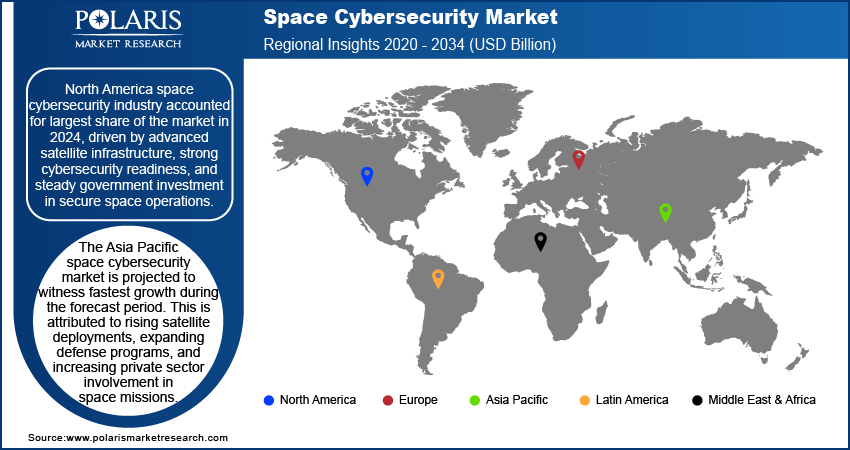

Regional Analysis

North America space cybersecurity industry accounted for largest share of the market in 2024, driven by advanced satellite infrastructure, strong cybersecurity readiness, and steady government investment in secure space operations. The region continues to lead in the development and deployment of cybersecurity frameworks that safeguard satellite communications, navigation systems, and space-based intelligence platforms. Widespread adoption of encryption technologies, secure telemetry systems, and real-time intrusion detection across federal and commercial missions is supporting market growth. The presence of key space agencies and private aerospace firms further strengthens regional leadership in this domain.

U.S. Space Cybersecurity Market Insight

The US dominated the regional market share in 2024, fueled by active initiatives from NASA, the US Space Force, and the Department of Defense. These institutions are deploying integrated cybersecurity protocols across satellites, launch vehicles, and command centers to secure national security assets. Enforcement of federal cybersecurity standards and growing awareness of space-based vulnerabilities are driving implementation across all mission stages. For instance, in April 2025, the US Government released a space cybersecurity roadmap for a potential Trump 2.0 administration focuses on strengthening satellite defense, enhancing public-private collaboration, and establishing clear cyber norms to protect US space assets from growing cyber threats. The country’s large network of private space firms and contractors is also accelerating the use of AI-driven threat monitoring, vulnerability scanning tools, and advanced encryption modules, supporting long-term resilience in both commercial and defense-related programs.

Asia Pacific Space Cybersecurity Market Trend

The Asia Pacific space cybersecurity market is projected to witness fastest growth during the forecast period. This is attributed to rising satellite deployments, expanding defense programs, and increasing private sector involvement in space missions. Countries such as China, India, Japan, and South Korea are investing in digital protection tools to secure Earth observation platforms, communication satellites, and launch systems. In February 2025, Japan announced to invest over USD 3.5 billion to boost space cybersecurity by upgrading X-Band satellites and expanding the Quasi-Zenith Satellite System (QZSS). The growing complexity of orbital networks and increased reliance on autonomous systems are creating demand for end-to-end cybersecurity solutions across both public and private missions. Regional governments are introducing cybersecurity regulations specific to satellite operations, driving the use of encryption, access control, and data integrity frameworks.

Europe Space Cybersecurity Market Overview

Europe space cybersecurity market growth is fueled by a mature space ecosystem, collaborative R&D programs, and well-established cybersecurity regulations. Agencies such as the European Space Agency (ESA), along with national governments, are integrating secure communication frameworks and encrypted protocols into satellite and ground station operations. As an example, in January 2025, the European Space Agency (ESA) and European Commission are jointly developing a quantum-secure space communications network to strengthen cybersecurity in space and protect sensitive data against future quantum threats. The region’s involvement in multi-nation defense missions and scientific satellite programs requires strong cybersecurity safeguards to protect cross-border data transmission and operational integrity. Demand is further fueled by growing concerns over cyber vulnerabilities in legacy systems and increasing pressure to comply with evolving international data security standards.

Key Players & Competitive Analysis Report

The space cybersecurity industry is moderately competitive, due to growing concerns over data integrity, satellite command protection, and mission continuity. Companies are focusing on secure-by-design frameworks, scalable software modules, and AI-based threat detection tools to meet evolving security requirements. Growing focus on developing real-time monitoring systems, autonomous response capabilities, and encrypted communication protocols suited for low-power, space-based platforms is boosting the space cybersecurity solutions. Moreover, strategic collaborations with space agencies, defense departments, and satellite manufacturers are supporting innovation and long-term project engagement. Continuous investment in modular security platforms, zero-trust architectures, and quantum-resilient encryption is further strengthening market competitiveness.

Key companies in the space cybersecurity industry include Thales Group, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, BAE Systems, L3Harris Technologies, Inc., Boeing, Kratos Defense & Security Solutions, CYSEC SA, Leonardo S.p.A., SpiderOak Mission Systems, and Airbus Defence and Space.

Key Players

- Airbus Defence and Space

- BAE Systems

- Boeing

- CYSEC SA

- Kratos Defense & Security Solutions

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies

- SpiderOak Mission Systems

- Thales Group

Industry Developments

June 2025: Wisesat Space and SEALSQ launched a satellite with SpaceX to enable the first DePIN from space, marking a key step toward quantum-safe space cybersecurity and communications.

December 2024: The Space Development Agency (SDA) expanded its contract with SpiderOak to enhance cybersecurity in space communications through advanced topic-level security solutions.

March 2022: SpiderOak and Lockheed Martin Space partnered to enhance space cybersecurity using blockchain technology, aiming to secure the space data supply chain against emerging threats.

Space Cybersecurity Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Network security

- Endpoint and IoT security

- Application security

- Cloud security

- Others

- Services

- Professional Services

- Managed Services

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Satellites

- Launch Vehicles

- Ground Stations

- Spaceports & Launch Facilities

- Command & Control Centers

- Other Platform

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- Government & Defense

- Commercial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Space Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.08 Billion |

|

Market Size in 2025 |

USD 4.52 Billion |

|

Revenue Forecast by 2034 |

USD 11.80 Billion |

|

CAGR |

11.24% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.08 billion in 2024 and is projected to grow to USD 11.80 billion by 2034.

The global market is projected to register a CAGR of 11.24% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Thales Group, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, BAE Systems, L3Harris Technologies, Inc., Boeing, Kratos Defense & Security Solutions, CYSEC SA, Leonardo S.p.A., SpiderOak Mission Systems, and Airbus Defence and Space.

The satellites segment accounted for largest market share in 2024.

The services segment is projected to grow at a robust pace in the coming years.