Super Apps Market Share, Size, Trends, Industry Analysis Report

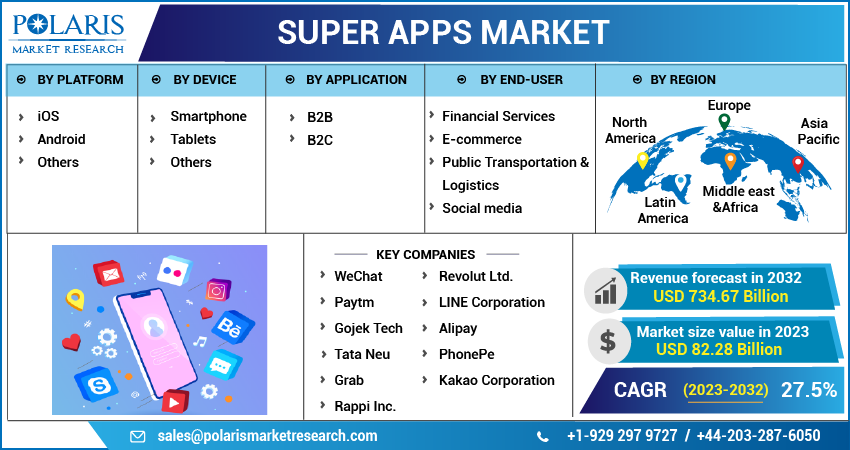

By Platform (iOS, Android, Others); By Device; By Application; By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM3415

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

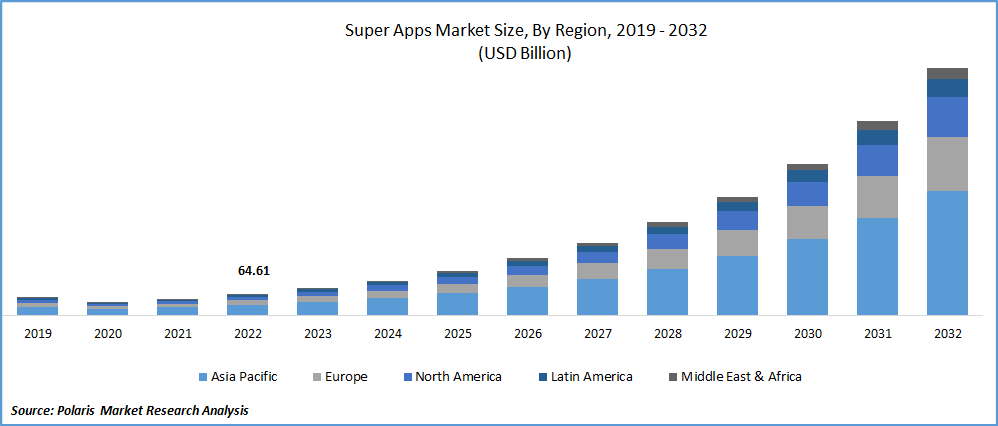

The global super apps market was valued at USD 64.61 billion in 2022 and is expected to grow at a CAGR of 27.5% during the forecast period. Increased comfortability of doing more online on the smartphone has enhanced the popularity of super apps among users. From shopping and transactions to attending meetings, booking, and many other things on smartphones, the adoption of super apps is increasingly growing. Smartphone users worldwide are primarily fuelling the super app market's growth.

To Understand More About this Research: Request a Free Sample Report

For instance, there were almost 6.6 billion smartphone users across the world in 2022. While China is leading with the most smartphone users. A super app is an application that offers end users (partners, customers, or employees) a set of core features as well as access to independently designed mini-apps. It provides a wide range of diverse services, such as messaging, payment, e-commerce, and various other facilities.

Super apps provide much more than standalone apps. Users get a seamless experience with a variety of services without having to download multiple apps to use them. These noteworthy advantages of the super apps have made users adapt to a large extent. Digitalization is one of the vital growth factors increasingly gaining traction in the super apps industry.

COVID-19 has accelerated the shift towards digitalization and many innovative technologies. People were staying at home due to the pandemic, and this enhanced the demand for online shopping, food delivery services, and more use of digital services.

For example, e-commerce sales soared by USD 244.2 billion, or 43%, in 2020, the first year of the pandemic, increasing from USD 571.2 billion in 2019 to USD 815.4 billion in 2020. As a result, the COVID-19 pandemic has forced many businesses to accelerate their digital transformation efforts. These factors resulted in the growing consumer preference for all-in-one solutions, i.e., super apps. As a result, COVID-19 has had a significant impact on the super apps industry.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

Spurring consumer trends in digital payment across many countries have generated an optimistic impact on the development of the super apps market. Over the last few years, the digital revolt has catalysed increases in global access to and use of financial services. For example, over 82% of Americans use digital payments. However, 2/3 of the adults currently receive digital payments, mostly from the emerging economies growing to 57% in 2021. As a result, growing digital payment use among users is heightening the growth of the super apps market.

Widespread usage of smartphones, internet penetration, and many other key aspects have boomed the e-commerce industry throughout the world. In 2022, all over 2.3 billion people were projected to buy goods and services online. Emerging and fast-growing technologies like data analytics, artificial intelligence, and online payment gateways like the Unified Payments Interface (UPI) are flourishing in the growth revolution in e-commerce. The boom in the e-commerce sector is increasingly promoting the super apps market.

Report Segmentation

The market is primarily segmented based on platform, device, application, end use, and region.

|

By Platform |

By Device |

By Application |

By End use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Android has held the largest market share in 2022

The android segment is dominating the market share. Android has continued to grow at a remarkable rate because of its popularity in emerging countries. Android is affordable, and it has all the facilities needed to perform several tasks. With the relatively low cost of android phones, a large customer base from developing regions like Asia Pacific, Latin America, the Middle East, and Africa is adopting the platform to a high extent. For instance, in Brazil, Indonesia, India, Turkey, and Vietnam, Android has almost 85% of the market.

Android involves a broad range of features and applications, as it has become more popular among its users. Huge adoption of android and remarkable feature market. made android achieve significant revenue in the super apps market.

Smartphone segment holds the largest revenue shares of the market in 2022

Smartphone devices garnered the largest revenue share. Technology has shifted the preferences of consumers towards more advanced facilities, devices, and services. Smartphone ownership is rapidly increasing in both developed and emerging economies due to its easy accessibility, convenience, and other beneficial features. Moreover, the integration of technology and digital solutions required compatibility of devices with 5G technology, which has become a vital growth factor for the upsurge in sales of smartphones.

The expanding digitization, remote working, virtual classes, and virtual socialization during the COVID-19 pandemic led to smartphones becoming an imperative part of life. To tap a huge number of customers in this market, market leaders like Apple, Samsung, Xiaomi, and many others are innovating new things. Subsequently, massive penetration of smartphone devices is anticipated to generate loads of prospects in the super apps market.

B2B segment projected to witness a significant CAGR throughout forecast period

The B2B segment is anticipated to grow at a high CAGR throughout forecast period, gaining a significant revenue share in the fiscal year of 2022. With commission fees, advertising costs, and other fees, super apps can generate significant revenue via the business-to-business (B2B) model. Whereas advertising is one of the prime factors producing significant revenue for super apps. With the super apps platform, brands advertise their goods and services and pay for each click those results from the advertisement.

Also, restaurants pay commissions and drivers are charged a percentage of their revenues. Henceforth, the B2B segment is leading the global market with a considerable growth rate.

Social media segment holds the largest market share during the forecast period

Social media segment is expected to dominate with the largest share in the market. Social features such as activity feeds and personalized promotions support creating a community around a super app. Social media has become an essential part of daily life. Social media is evolving at a rapid pace, which is further enhancing the demand for super apps.

For instance, globally, the number of social media users increased from 4.2 billion in January 2021 to 4.62 billion in January 2022. Therefore, the super apps market is generating a large revenue stream from the social media segment.

Asia Pacific dominated the global market in 2022

Asia Pacific is expected to account for the largest market share in the global super apps market in the fiscal year 2022. Asia-Pacific is a developing economy with emerging trends and technologies. Along with this, the growing population, smartphone, and internet penetration in the region are vital factors driving the market in the Asia Pacific. For example, the Asia-Pacific region has a nearly 4.2 billion population, and over 57% of households now have Internet access at home. Today, the Asia-Pacific region sells and produces the highest number of smartphones in the world. All these evolving technological arenas and digital trends are shaping the super apps market in the Asia Pacific region.

Middle East and Africa is expected to grow at the fastest CAGR in the global super apps market due to developing economies, digital advancements by industry participants, and internet penetration. For example, in February 2023, Tingo, a Nigerian Agri-FinTech company teamed with Visa to release digital payment offerings in Africa. In addition to this, Gozem, offers several services involving transport, & financial services in Africa, has raised around USD 5 million. These developments are gaining huge momentum in the region and are anticipated to improve the sales of super apps in the forthcoming years.

Competitive Insight

Some of the major players operating in the global market include WeChat, Paytm, Gojek Tech, Tata Neu, Grab, Rappi Inc., Revolut Ltd., LINE Corporation, Alipay, PhonePe, Kakao Corporation, and many others.

Recent Developments

- In November 2022, Angel One launched Super App on the Android platform, to a restricted set of users. The Super App combines comprehensive feedback received from clients over the years. Angel One has integrated this feedback to deliver a seamless experience to its clients.

- In August 2022, NPST developed a super app. With all banking, financial, and transactional services combined into a potent but clever app, super apps offer a seamless user experience.

Super Apps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 82.28 billion |

|

Revenue forecast in 2032 |

USD 734.67 billion |

|

CAGR |

27.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Platform, By Device, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

WeChat, Paytm, Gojek Tech, Tata Neu, Grab, Rappi Inc., Revolut Ltd., LINE Corporation, Alipay, PhonePe, Kakao Corporation, and many others. |

FAQ's

key companies in super apps market are WeChat, Paytm, Gojek Tech, Tata Neu, Grab, Rappi Inc., Revolut Ltd., LINE Corporation, Alipay, PhonePe, Kakao Corporation.

The global super apps market is expected to grow at a CAGR of 27.5% during the forecast period.

The super apps market report covering key segments are platform, device, application, end use, and region.

key driving factors in super apps market are growing adoption of mobile services.

The global super apps market size is expected to reach USD 734.67 billion by 2032.