System Integrator Market Share, Size, Trends, Industry Analysis Report

By Technology (HMI, MES, Functional Safety, SCADA, Industrial Robotics, IIoT, Machine Vision, Industrial PC); By Service Outlook; By Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4768

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

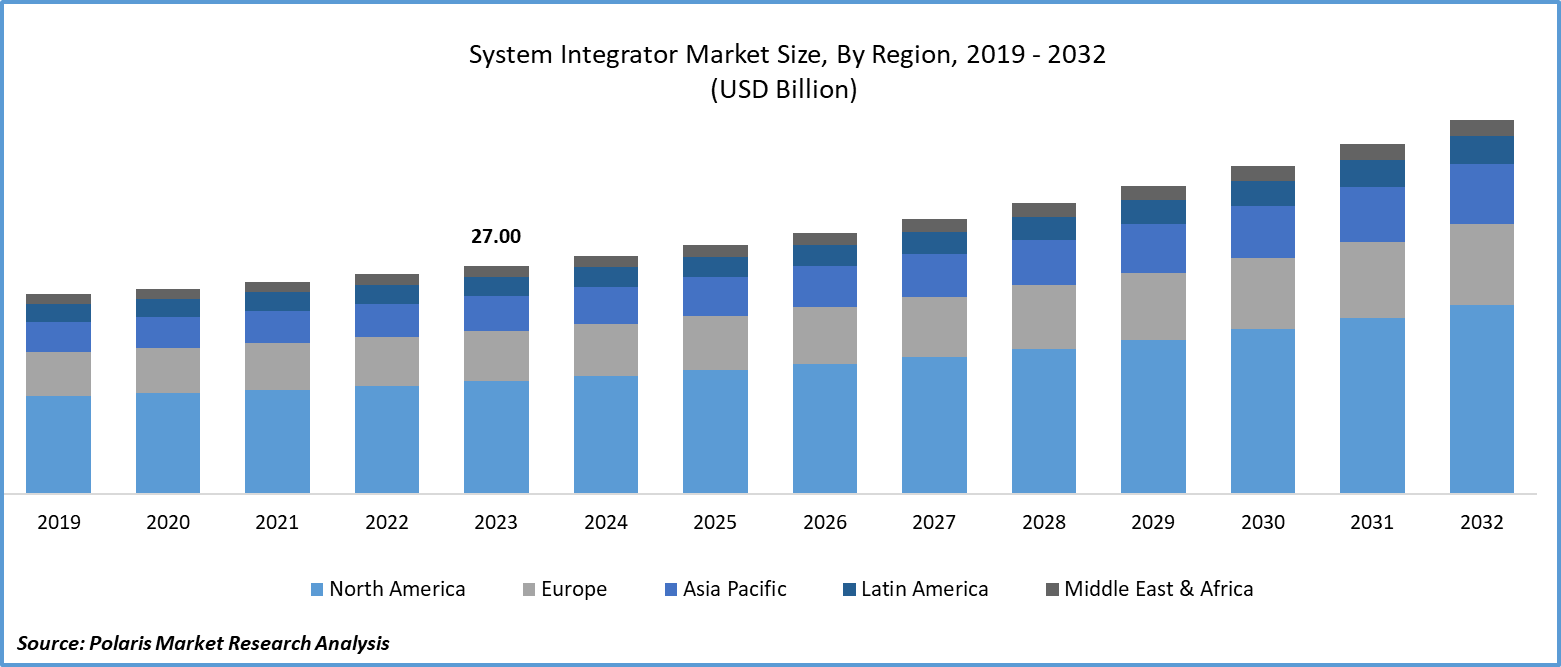

Global system integrator market size was valued at USD 27.00 billion in 2023. The market is anticipated to grow from USD 28.15 billion in 2024 to USD 44.27 billion by 2032, exhibiting the CAGR of 5.8% during the forecast period

System Integrator Market Overview

System integrators are organizations or people who carry out, organize, schedule, test, schedule, enhance, and maintain computer operations. Experts at integrating individual subsystems into larger systems and ensuring their smooth operation are known as system integrators. Modern-day industrial organizations are adopting Flexible Manufacturing Systems (FMS) to avoid the conventional trade-off between dependability and quality. The growing automation in industries and the widespread adoption of the Industrial Internet of Things (IIoT) have significantly increased the demand for system integrator market growth. As businesses seek to streamline their operations and enhance efficiency, they turn to system integrators to help them seamlessly integrate various technologies and systems.

For instance, in November 2023, INTECH obtained a contract to enhance control systems at a notable LNG plant located in West Africa. This project aims to update the existing control systems and set the stage for potential enhancements to vital infrastructure within the plant.

To Understand More About this Research: Request a Free Sample Report

Additionally, the expanding adoption of cloud computing in industries has further fueled the growth of the system integration market expansion. Cloud computing offers scalability, flexibility, and cost-effectiveness, making it an attractive option for businesses looking to optimize their operations. System integrators play a crucial role in integrating cloud-based services with existing systems, ensuring smooth and efficient operations.

However, the market is being driven by a need for cost-effective and energy-efficient production processes. Among the largest end-use sectors in terms of final energy demand and greenhouse gas emissions, the industry sector is particularly prominent. System integrators market development has been traditionally focused on improving efficiency through activities such as motor replacement and inverter installation, which directly reduce energy consumption. However, system integrators can also play a role in helping companies minimize their environmental footprint by optimizing operations.

System Integrator Market Dynamics

Market Drivers

The Growing Usage of IOT and AI in Multiple Industries

Since the inception of Industry 4.0, there has been a notable rise in the utilization of AI and IoT technologies in the industrial sector. These technologies have enabled the optimization of production processes, early detection of potential issues, enhancement of quality assurance practices, and prediction of machine malfunctions. Through the collection and analysis of precise data, businesses can gain a competitive edge by developing advanced AI applications tailored to their specific needs. The extensive adoption of IoT devices across diverse industries has led to a significant surge in data production. System integrators play a vital role in devising solutions that facilitate the effective gathering, processing, and interpretation of this vast amount of data.

Through the integration of analytics platforms, databases, and visualization tools, they aid organizations in extracting valuable insights from the data generated by IoT devices. This, in turn, enhances decision-making processes and boosts operational efficiency. Security is also a critical consideration. The interconnected nature of IoT devices introduces potential vulnerabilities that need to be addressed. System integrators are instrumental in implementing robust cybersecurity measures to safeguard IoT ecosystems from cyber threats.

A high level of implementation of industrial robots

In recent decades, robots have evolved from expensive, limited-capability gadgets to affordable machines capable of performing a variety of tasks. They are widely used worldwide, particularly in industrial settings. The increasing use of industrial robots in manufacturing facilities is driving progress, innovation, and industrial development, in line with current trends in the robotics industry. This surge in industrial robot deployment is fueling demand for system integrator market growth.

Market Restraints

Absence of Uniformity Likely to Impede the Market Growth

The process of uniformity involves creating and implementing common interfaces, protocols, and communication techniques that many industries and systems may use on a global scale. Lack of generally acknowledged standards can make it difficult for system integrators to create consistent connections between disparate components, which can cause compatibility problems that can slow down the integration process. A noteworthy consequence of the lack of uniformity is the requirement for unique connectors and interfaces for every integration effort. System integrators have to customize solutions to each system's specific requirements, which adds time and expense. Furthermore, the lack of standard interfaces makes it difficult to create reusable components, which restricts the effectiveness and scalability of subsequent integration projects.

Report Segmentation

The market is primarily segmented based on technology, service outlook, industry, and region.

|

By Technology |

By Service Outlook |

By Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

System Integrator Market Segmental Analysis

By Technology Analysis

The HMI (Human-Machine Interface) led the industry market with a substantial revenue share in 2023. In industrial settings, a human-machine interface (HMI) serves as a crucial bridge between machinery and human operators, utilizing a combination of software and components from a dedicated Manufacturing Execution System (MES). Its primary function is to optimize the transmission of information between machines and human operators, facilitating efficient operation and monitoring of industrial processes. By integrating with MES components, the HMI enhances visibility, control, and decision-making capabilities for operators, ultimately improving overall productivity and performance in industrial applications.

By Service Outlook Analysis

The hardware integration service segment accounted for the largest market share in 2023 and is likely to retain its position throughout the system integrator market forecast period. Hardware integration plays a vital role in system integration projects, seamlessly bringing together a variety of hardware components, such as storage devices, sensors, servers, and control systems, to create a unified and efficient system. As devices become increasingly prevalent across industries, the need for system integrators with expertise in hardware integration has grown significantly. This encompasses the integration of IoT devices, industrial machinery, computing hardware, and other physical components essential to modern technological environments. This specialized integration ensures that diverse hardware elements work harmoniously, enabling businesses to leverage the full potential of their technological infrastructure.

By Industry Analysis

Based on industry analysis, the market has been segmented on the basis of Metals & Mining, Electronics, Oil & Gas, Pharmaceutical, Pulp & Paper, Aerospace, Chemical & Petrochemical, Food & Beverage, Automotive, Energy & Power. The electronics segment is anticipated to grow at the fastest CAGR during the system integrator market forecast period. Innovations and advances in technology are constants in the electronics sector. The swift advancement of electronic gadgets and components demands the proficiency of system integrators to guarantee the smooth incorporation of cutting-edge technology into pre-existing systems. Additionally, the electronics manufacturing industry is a strong proponent of Industry 4.0, emphasizing the integration of digital technology to enable smart and connected manufacturing. Because they are adept at integrating digital technology into electronic manufacturing processes, system integrators play a crucial role in accelerating the adoption of Industry 4.0.

System Integrator Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. In North America, the increasing adoption of IoT in industrial automation and the widespread embrace of cloud-based services by major enterprises are catalyzing significant transformations in the system integration market development. This trend is particularly pronounced in the BFSI sector, where leading-edge technologies are being eagerly adopted, creating substantial growth within the system integrator market opportunities. In industrial automation, IoT devices play a crucial role in collecting and transmitting real-time data, thereby enabling superior monitoring and control of manufacturing processes. This advancement has resulted in heightened efficiency, reduced downtime, and enhanced overall productivity for businesses across the region.

Moreover, the BFSI sector in North America has swiftly integrated cloud-based services, which offer scalability, flexibility, and cost-effectiveness. This integration has empowered financial institutions to streamline their operations, elevate customer experiences, and maintain competitiveness in a rapidly evolving market landscape.

The Asia Pacific region is expected to be the fastest growing region, with a healthy CAGR during the projected period. China has undergone swift economic expansion in recent decades. This accelerated growth frequently prompts heightened investments in technology and infrastructure, spurring the need for system integration services. Additionally, China serves as a key global manufacturing center, manufacturing a considerable share of the world's electronics and industrial products. This manufacturing prowess is likely to fuel significant demand for system integration services, particularly in the automation and control sectors.

Competitive Landscape

The System Integrator market development is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ATS Corporation

- Avanceon

- Burrow Global LLC

- BW Design Group

- Intech

- John Wood Group PLC

- JR Automation

- Maverick Technologies LLC

- Prime Controls LP

- Tesco Controls

Recent Developments

- In July 2023, ATS Corporation announced the completion of the acquisition of Yazzoom BV, a Belgium-based firm that develops artificial intelligence and machine learning tools for industrial production. With a primary focus on sophisticated data analytics for overseeing and improving production processes, Yazzoom will play a crucial role in furthering ATS Corporation's strategy to boost productivity through digital innovations.

- In April 2023, INTECH was given the full automation mandate to equip a major water treatment plant in the United States with cutting-edge control and networking technology. With a project portfolio that extends across three continents over nearly two decades, this Houston-headquartered industrial automation and digitalization firm has continuously enabled its customers to improve the efficiency of their operations and systems.

- In February 2023, JR Automation unveiled FlexChassis, an innovative modular automation platform that enriches the company's suite of holistic solutions for manufacturers. Unveiled during ATX West 2023, this high-speed linear chassis minimizes the time required for initial system planning, design, and construction, providing customers with unprecedented flexibility for high-speed and high-volume assembly across diverse industries.

Report Coverage

The System Integrator market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, service outlook, industry, and their futuristic growth opportunities.

System Integrator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 28.15 billion |

|

Revenue forecast in 2032 |

USD 44.27 billion |

|

CAGR |

5.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Service Outlook, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global System Integrator market size is expected to reach USD 44.27 billion by 2032

Key players in the market are John Wood Group PLC, ATS Corporation, JR Automation, Tesco Controls, Avanceon, Burrow Global LLC

North America contribute notably towards the global System Integrator Market

System Integrator Market exhibiting the CAGR of 5.8% during the forecast period

The System Integrator Market report covering key segments are technology, service outlook, industry, and region.