Traumatic Brain Injury Biomarkers Market Size, Share, Trends, & Industry Analysis Report

By Type (Protein Biomarkers, Genetic Biomarkers, and Metabolomic Biomarkers), By Sample Type, By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5811

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

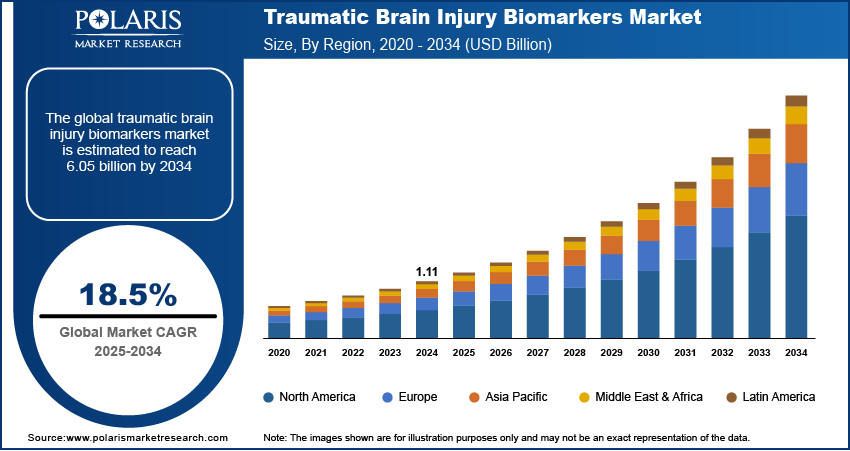

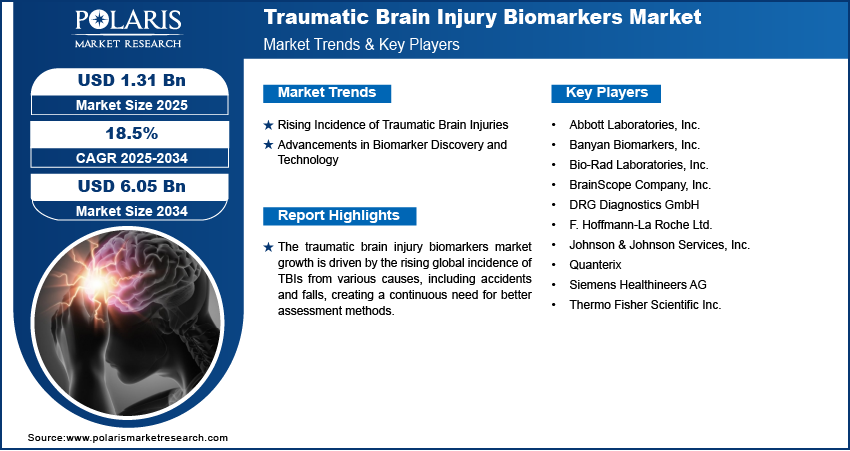

The global traumatic brain injury biomarkers market size was valued at USD 1.11 billion in 2024, and is anticipated to register a CAGR of 18.5% from 2025 to 2034. The increasing number of traumatic brain injury (TBI) cases worldwide and the growing demand for quick and easy diagnostic methods, such as blood tests, boost the adoption of TBI biomarkers.

The traumatic brain injury biomarkers (TBI) market involves the development and use of specific biological indicators, such as proteins (genetic biomarkers), to help diagnose, assess the severity of, and predict the outcome for individuals who have sustained a TBI. The brain biomarkers can be found in blood or other bodily fluids and offer a less invasive way to understand brain injury.

One major driver for this market is the increasing incidence of traumatic brain injuries globally. Accidents, falls, and sports-related concussions are common causes, leading to a rising number of individuals needing accurate TBI treatment. The growth in TBI cases directly increases the demand for effective diagnostic tools such as biomarkers.

Another key driver is the growing demand for rapid and objective diagnostic methods. Traditional methods, such as CT scans, sometimes miss subtle brain injuries or expose patients to radiation. Biomarkers offer a quicker, less invasive, and more objective way to detect TBI, even mild cases. For example, the Centers for Disease Control and Prevention (CDC) highlights that TBIs are a major public health concern, with millions of emergency department visits, hospitalizations, and deaths related to TBI occurring each year in the US alone. This high number of cases emphasizes the critical need for improved TBI diagnostic approaches, which biomarkers provide.

Industry Dynamics

Rising Incidence of Traumatic Brain Injuries

The increasing cases of traumatic brain injuries (TBIs) worldwide propel the demand for TBI biomarkers. These injuries, ranging from mild concussions to severe brain damage, can result from various causes such as road traffic accidents, falls, and sports-related incidents. According to the Global Burden of Disease (GBD) study published in a 2023 article in PMC titled "Global, regional and national burden of traumatic brain injury and spinal cord injury, 1990–2019," there were 27.16 million new cases of TBI globally in 2019. This high and persistent incidence of TBIs underscores the critical need for effective diagnostic tools to manage patient care, thereby driving the growth of the TBI biomarkers market.

Advancements in Biomarker Discovery and Technology

Significant progress in biomarker discovery, research, and the development of new diagnostic technologies boosts the market development. Scientists are continuously identifying novel biomarkers that can offer more precise and earlier detection of TBI, even in cases where traditional imaging methods might not show clear signs of injury. These advancements include improved analytical methods and the creation of rapid, point-of-care testing devices.

A notable example of technological advancement is the US Food and Drug Administration (FDA) clearance of Abbott's i-STAT TBI Plasma test, which was developed in collaboration with the US Department of Defense (DoD). This rapid test, mentioned in a 2024 article in Practical Neurology titled "Real-World Experience Using Biomarker Testing for the Evaluation of Acute Traumatic Brain Injury," uses blood samples to help evaluate patients for concussion and determines the need for a CT scan. Such innovations improve diagnostic accuracy and efficiency, accelerating the growth and adoption of TBI biomarkers.

Segmental Insights

By Type

The protein biomarkers segment held the largest share in 2024. This dominance is attributed to their established clinical utility and the significant technological advancements for their detection. Specific protein markers such as glial fibrillary acidic protein (GFAP) and ubiquitin carboxy-terminal hydrolase L1 (UCH-L1) are increasingly used to help diagnose TBI and guide decisions about further imaging, such as CT scans. For instance, the US FDA has cleared several blood-based protein tests that measure these biomarkers, which is a testament to their reliability and growing acceptance in clinical settings. The ease of obtaining blood samples and the ability to get rapid results further contribute to the widespread adoption of protein biomarkers.

The metabolomic biomarkers segment is anticipated to grow at the highest growth rate during the forecast period. This segment focuses on analyzing changes in metabolic processes after a brain injury, offering a deeper and more comprehensive understanding of the biochemical impact of TBI. Researchers actively explore metabolites that can indicate injury severity and recovery and even predict long-term outcomes. While still an emerging field compared to protein biomarkers, the potential for metabolomic biomarkers to provide detailed insights into the complex biological pathways affected by TBI drives considerable investment and research, positioning it for rapid expansion.

By Sample Type

The blood-based biomarkers segment held the largest share in 2024. This is primarily due to their noninvasive nature, ease of collection, and the rapid turnaround time for results, making them ideal for emergency and point-of-care settings. For instance, the US Food and Drug Administration (FDA) has cleared blood tests that measure specific proteins such as glial fibrillary acidic protein (GFAP) and ubiquitin carboxy-terminal hydrolase L1 (UCH-L1) to help assess TBI, as noted in a 2024 article in Practical Neurology titled "Real-World Experience Using Biomarker Testing for the Evaluation of Acute Traumatic Brain Injury.

The urine-based biomarkers segment is anticipated to register the highest growth rate during the forecast period. While still in earlier stages of development compared to blood-based tests, urine offers an extremely noninvasive and easily repeatable sample collection method. This makes it particularly promising for monitoring TBI recovery over time, especially in vulnerable populations such as children or in situations where frequent blood draws are not practical. Research continues to explore a variety of urinary biomarkers for TBI, as highlighted in a 2020 article in PubMed titled "Current Trends in Biomarkers for Traumatic Brain Injury," indicating a strong potential for future breakthroughs and increased clinical utility.

By Application

The diagnosis segment held the largest share in 2024, due to the critical need for rapid and accurate identification of TBI, especially in emergency settings, to guide immediate medical intervention and prevent further complications. Biomarkers offer a valuable tool to confirm injury, assess its severity, and help determine if a patient requires further imaging such as a CT scan, potentially reducing unnecessary radiation exposure.

The application of TBI biomarkers in monitoring treatment response is anticipated to record the highest growth rate during the forecast period. As the understanding of TBI pathology evolves and new therapies emerge, there is a growing need for objective measures to track how patients respond to interventions. Biomarkers can provide real-time insights into the effectiveness of treatments, allowing clinicians to adjust strategies for optimal patient outcomes. Although still a developing area, research is ongoing to identify and validate biomarkers that can reliably indicate changes in brain pathology during recovery.

By End Use

The hospitals & clinics segment held the largest share in 2024, as hospitals and emergency departments are often the first contact points for patients experiencing a suspected TBI. They are crucial in initial diagnosis, assessment, and patient management. The immediate need for quick and reliable TBI assessment in these settings drives the high adoption of biomarker tests.

The research institutes segment is anticipated to grow at the highest growth rate during the forecast period, fueled by continuous and intensive research efforts to discover novel biomarkers, understand TBI's complex pathology, and develop new diagnostic and prognostic tools. Academic and government research institutes are at the forefront of this innovation, working to identify more sensitive and specific biomarkers that can provide deeper insights into TBI severity, progression, and treatment response.

.webp)

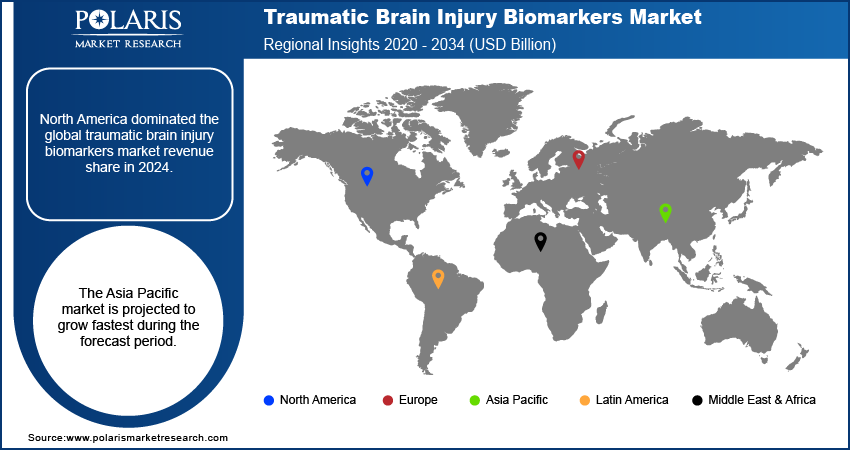

Regional Analysis

In the traumatic brain injury biomarkers market, North America held the largest share in 2024. This region benefits from a robust healthcare infrastructure, high TBI awareness, and substantial research and development investments. The presence of leading diagnostic companies and academic institutions actively involved in biomarker discovery and validation drives the regional market growth. Incidents of TBI from various causes, including sports injuries and accidents, remain notable across the region, contributing to a consistent demand for advanced diagnostic solutions.

US Traumatic Brain Injury Biomarkers Market Insight

The US has a high burden of TBI cases, which naturally drives the demand for effective diagnostic tools. For example, millions of emergency department visits each year are attributed to TBI in the US, as reported by the Centers for Disease Control and Prevention (CDC). Strong government funding for TBI research, rapid adoption of advanced medical technologies, and clear regulatory pathways for new diagnostic tests play a major role in the US TBI biomarkers market's leadership and ongoing development.

Europe Traumatic Brain Injury Biomarkers Market Trend

Europe represents another important region in the field of TBI biomarkers, characterized by advanced healthcare systems and a growing emphasis on early and accurate TBI diagnosis. The region reports a high incidence of TBI, owing to factors such as an aging population prone to falls and a considerable number of road traffic accidents. European countries are actively engaged in collaborative research efforts to identify and validate new biomarkers, contributing to the overall market growth. The rising focus on improving patient outcomes and reducing healthcare burdens related to TBI drives the adoption of these diagnostic tools. The Germany traumatic brain injury biomarkers market is a major contributor in Europe. The country comprises a highly developed healthcare system and a strong research landscape with numerous academic and clinical institutions focused on neurology and brain injuries. It records a significant number of TBI cases annually, with falls and traffic accidents being common causes, as discussed in a 2021 BMJ Open article titled "Prospective observational cohort study on epidemiology, treatment and outcome of patients with traumatic brain injury (TBI) in German BG hospitals." This sustained demand, combined with an emphasis on incorporating innovative diagnostic methods into clinical practice, helps propel the adoption of TBI biomarkers in Germany.

Asia Pacific Traumatic Brain Injury Biomarkers Market Overview

The Asia Pacific TBI biomarkers market is anticipated to register the highest growth rate during the forecast period. This is primarily due to the increasing awareness of TBI, improving healthcare infrastructure, and a rising prevalence of road accidents and other injuries across several countries in the region. Investments in healthcare facilities are increasing, making advanced diagnostic technologies more accessible. While still developing in some areas, the large patient pool and the growing focus on early and accurate diagnosis are driving significant demand. The China traumatic brain injury biomarkers market contributes a major share in Asia Pacific. The country has a large population and a high incidence of TBI, particularly from road traffic accidents and falls among the elderly. As healthcare expenditure increases and medical technologies become more widely adopted, there is a rising demand for modern diagnostic solutions for TBI. Research and development activities are also gaining momentum in China, contributing to the advancements and adoption of TBI biomarkers.

Key Players and Competitive Insights

The competitive landscape of the traumatic brain injury biomarkers market is dynamic, with players focusing on innovation in diagnostic technologies and expanding their product offerings. Companies are investing in research to discover new and more accurate biomarkers, particularly those quickly detected from easily accessible samples such as blood samples. A few prominent companies in the industry include Abbott Laboratories, Inc.; F. Hoffmann-La Roche Ltd. (Roche Diagnostics GmbH); Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; Quanterix; Banyan Biomarkers, Inc.; Thermo Fisher Scientific Inc.; Johnson & Johnson Services, Inc.; DRG Diagnostics GmbH; and BrainScope Company, Inc.

Key Players

- Abbott Laboratories, Inc.

- Banyan Biomarkers, Inc.

- Bio-Rad Laboratories, Inc.

- BrainScope Company, Inc.

- DRG Diagnostics GmbH

- F. Hoffmann-La Roche Ltd. (Roche Diagnostics GmbH)

- Johnson & Johnson Services, Inc.

- Quanterix

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Industry Developments

January 2025: Braini was launched with a focus on using blood biomarkers to improve the diagnosis and management of mild traumatic brain injury (mTBI). This initiative aims is being developed in collaboration with an industrial in vitro diagnostics partner (bioMérieux) along with clinical teams from Grenoble Alpes University (France) and Servicio Madrileño de Salud (Spain).

March 2024: The US Food and Drug Administration (FDA) cleared Abbott's i-STAT TBI whole blood cartridge. This rapid test is designed for use on a portable device and helps clinicians evaluate patients suffering from suspected mTBI.

Traumatic Brain Injury Biomarkers Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Protein Biomarkers

- Genetic Biomarkers

- Metabolomic Biomarkers

By Sample Type Outlook (Revenue – USD Billion, 2020–2034)

- Blood-Based

- Cerebrospinal Fluid (CSF)-Based

- Urine-Based

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Diagnosis

- Prognosis

- Monitoring Treatment Response

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals & Clinics

- Diagnostic Laboratories

- Research Institutes

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Traumatic Brain Injury Biomarkers Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.11 billion |

|

Market Size in 2025 |

USD 1.31 billion |

|

Revenue Forecast by 2034 |

USD 6.05 billion |

|

CAGR |

18.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 1.11 billion in 2024 and is projected to grow to USD 6.05 billion by 2034.

The global market is projected to register a CAGR of 18.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market are Abbott Laboratories, Inc.; F. Hoffmann-La Roche Ltd. (Roche Diagnostics GmbH); Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; Quanterix; Banyan Biomarkers, Inc.; Thermo Fisher Scientific Inc.; Johnson & Johnson Services, Inc.; DRG Diagnostics GmbH; and BrainScope Company, Inc.

The protein biomarkers segment accounted for the largest share of the market in 2024.

The metabolomic biomarkers segment is expected to grow fastest during the forecast period.