U.S. 4D Imaging Radar Market Size, Share, Trends, Industry Analysis Report

By Type (Short Range Radar, Medium Range Radar, Long Range Radar), By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5891

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

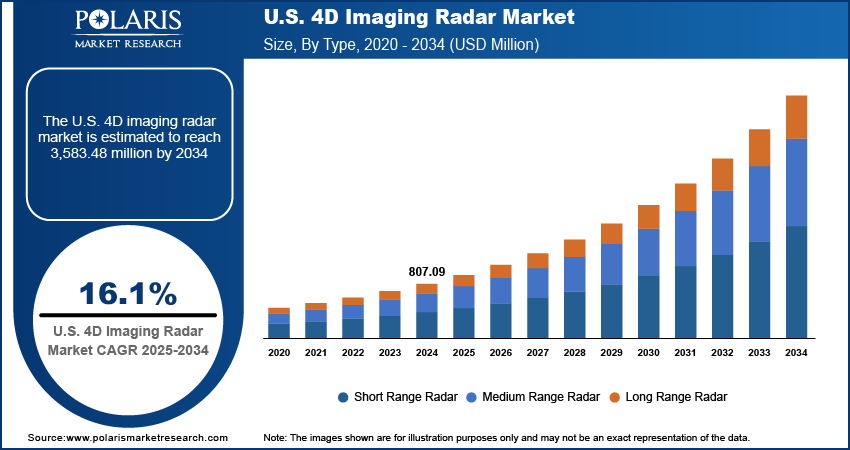

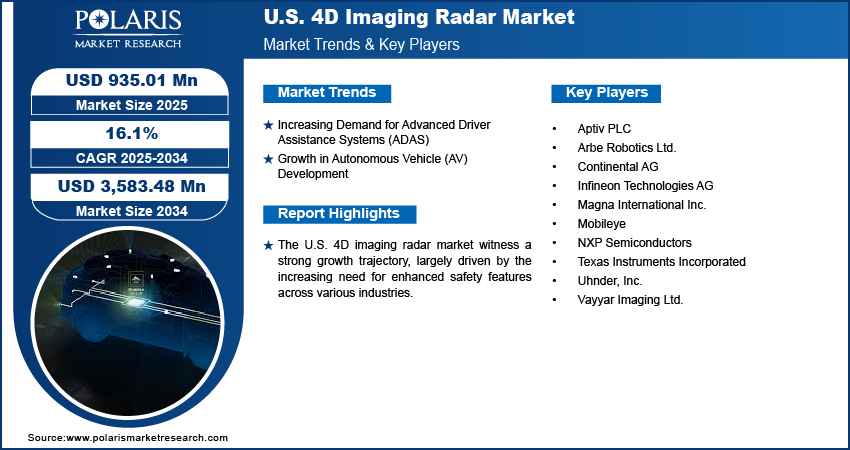

The U.S. 4D imaging radar market size was valued at USD 807.09 million in 2024, and is anticipated to register a CAGR of 16.1% from 2025 to 2034. The market growth is mainly driven by the increasing need for better vehicle safety and the growing adoption of autonomous and semi-autonomous cars.

The U.S. 4D imaging radar market consist of advanced sensor technology that adds a fourth dimension, elevation, to traditional 3D radar systems, allowing for a more detailed understanding of an object's precise position and height. This enhancement provides a richer "image" of the surrounding environment, crucial for various applications.

To Understand More About this Research: Request a Free Sample Report

Increasing regulatory support and the introduction of mandates for advanced safety systems are significantly driving the U.S. 4D imaging radar market. Governments and regulatory bodies are imposing various stringent safety standards in vehicles, such as the mandatory adoption of technologies that prevent collisions and protect vulnerable road users. As 4D imaging radar provides superior detection and classification capabilities in various conditions, it aligns well with these evolving safety requirements.

Ongoing advancements in radar technology, particularly those leading to cost reduction, are a crucial driver for the U.S. 4D imaging radar market. As manufacturing processes become more efficient and integrated chip solutions emerge, the overall cost of 4D imaging radar systems is decreasing. This makes the technology more accessible for wider adoption in high-end vehicles and across mid-range and entry-level segments.

Industry Dynamics

Increasing Demand for Advanced Driver Assistance Systems (ADAS)

The rising demand for ADAS features in vehicles is a significant factor boosting the U.S. 4D imaging radar market growth. Consumers are increasingly valuing safety technologies that can help prevent accidents and enhance their driving experience. These systems, which include features such as automatic emergency braking, adaptive cruise control, and lane-keeping assist, rely on accurate and reliable sensors to function effectively. 4D imaging radar, with its ability to provide detailed environmental data even in challenging weather conditions, is becoming a key component in these sophisticated systems.

The National Highway Traffic Safety Administration (NHTSA) stated in a June 2022 that new vehicle technologies have the potential to prevent crashes, reduce crash severity, and save lives. This highlights the ongoing focus by government bodies on improving road safety through advanced technologies such as ADAS. The continued push for safety improvements and the wider adoption of these systems directly translate to a higher demand for advanced sensing technologies, thus driving the market expansion.

Growth in Autonomous Vehicle (AV) Development

The ongoing development and testing of autonomous vehicles are major drivers for the U.S. 4D imaging radar market. Autonomous vehicles require a robust and redundant sensor suite to perceive their surroundings accurately and safely navigate without human intervention. While other sensors such as cameras and LiDAR play a key role, 4D imaging radar offers unique advantages due to its performance in various weather conditions and its ability to measure velocity and elevation with high precision. This makes it an essential technology for achieving higher levels of vehicle autonomy.

The World Health Organization's (WHO) "Global status report on road safety 2023," published in December 2023, indicates that road traffic crashes remain a leading cause of death globally, with approximately 1.19 million deaths each year. This persistent issue drives the push for safer vehicles, including fully autonomous ones, which aim to significantly reduce human error in driving. As autonomous driving technology advances and moves closer to widespread adoption, the need for advanced and reliable sensors such as 4D imaging radar will intensify, thus fueling the market growth.

Segmental Insights

Type Analysis

The short range radar segment held the largest share in 2024. This is primarily due to its widespread application in common vehicle safety features. Short range radar is crucial for systems such as blind spot detection, parking assistance, and rear cross-traffic alert, which are increasingly integrated into a broad range of vehicles. For example, these radars help detect obstacles and other vehicles in close proximity, enhancing safety during maneuvers at lower speeds. Their effectiveness in urban environments and for critical close-range sensing makes them a dominant segment in the current landscape.

The medium range radar segment is anticipated to grow at the highest growth rate during the forecast period. This is driven by the expanding capabilities of ADAS that require a broader detection range than short range radar but are not yet fully reliant on long-range capabilities. Medium range radars are vital for features such as adaptive cruise control, automatic emergency braking, and lane change assist, which operate at moderate speeds and distances. As the adoption of these sophisticated ADAS features continues to rise in consumer vehicles, the demand for medium range 4D imaging radar is expected to surge in the coming years.

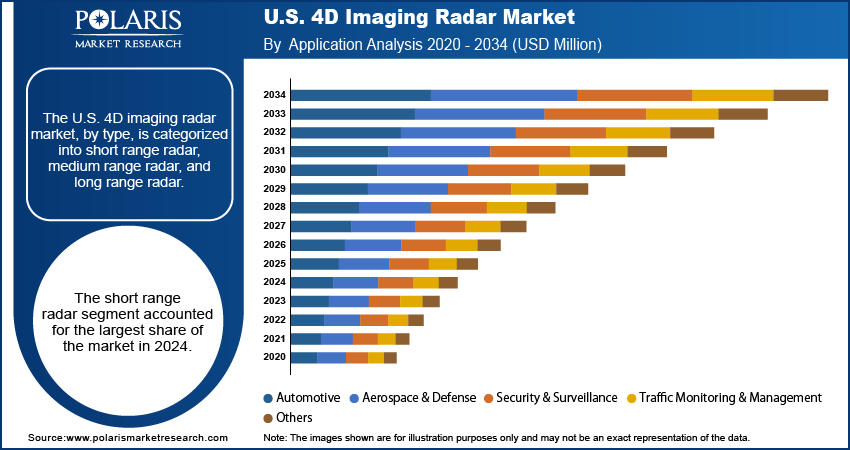

Application Analysis

The automotive segment held the largest share in 2024, primarily driven by the strong push for enhanced vehicle safety features and the rapid advancements in autonomous driving technologies. 4D imaging radar provides crucial real-time, high-resolution data on objects, enabling advanced driver assistance systems (ADAS) such as collision avoidance and adaptive cruise control to operate more effectively. The widespread integration of these systems in new vehicles, from passenger cars to commercial vehicles, underscores the significant demand from the automotive radar sector.

The security and surveillance application segment is anticipated to grow at the highest growth rate during the forecast period. This anticipated surge is attributed to the technology's superior performance in challenging environmental conditions, such as fog, heavy rain, or darkness, where traditional cameras and other sensors may struggle. 4D imaging radar offers reliable detection and tracking of intruders, unauthorized vehicles, and even small drones across large areas, making it ideal for critical infrastructure protection, border security, and urban monitoring. Its ability to provide detailed elevation data also enhances its utility in these sensitive applications.

Key Players and Competitive Insights

The U.S. 4D imaging radar market features a dynamic competitive landscape, with established technology companies and innovative startups vying for market share. Competition centers on developing more precise, reliable, and cost-effective radar solutions that can meet the stringent demands of various applications, especially in the automotive sector.

A few prominent companies in the industry include Continental AG, Aptiv PLC, Magna International Inc., Infineon Technologies AG, NXP Semiconductors, Texas Instruments Incorporated, Mobileye, Vayyar Imaging Ltd., Arbe Robotics Ltd., and Uhnder, Inc.

Key Players

- Aptiv PLC

- Arbe Robotics Ltd.

- Continental AG

- Infineon Technologies AG

- Magna International Inc.

- Mobileye

- NXP Semiconductors

- Texas Instruments Incorporated

- Uhnder, Inc.

- Vayyar Imaging Ltd.

Industry Development

September 2024: Continental launched a significant product range expansion initiative for the aftermarket, including new product groups such as camera and radar sensors for driver assistance systems.

U.S. 4D Imaging Radar Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Short Range Radar

- Medium Range Radar

- Long Range Radar

By Application Outlook (Revenue – USD Million, 2020–2034)

- Automotive

- Aerospace & Defense

- Security & Surveillance

- Traffic Monitoring & Management

- Others

U.S. 4D Imaging Radar Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 807.09 million |

|

Market Size in 2025 |

USD 935.01 million |

|

Revenue Forecast by 2034 |

USD 3,583.48 million |

|

CAGR |

16.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 807.09 million in 2024 and is projected to grow to USD 3,583.48 million by 2034.

The market is projected to register a CAGR of 16.1% during the forecast period.

A few prominent companies in the industry include Continental AG, Aptiv PLC, Magna International Inc., Infineon Technologies AG, NXP Semiconductors, Texas Instruments Incorporated, Mobileye, Vayyar Imaging Ltd., Arbe Robotics Ltd., and Uhnder, Inc.

The short range radar segment accounted for the largest share of the market in 2024.

The security and surveillance segment is expected to witness the fastest growth during the forecast period.