U.S. AAMI Level 3 Surgical Gown Market Size, Share, Trends, Analysis Report

By Usability (Disposable Gowns, Reusable Gowns), By Gown Type, By Surgery, By End Use– Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5836

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

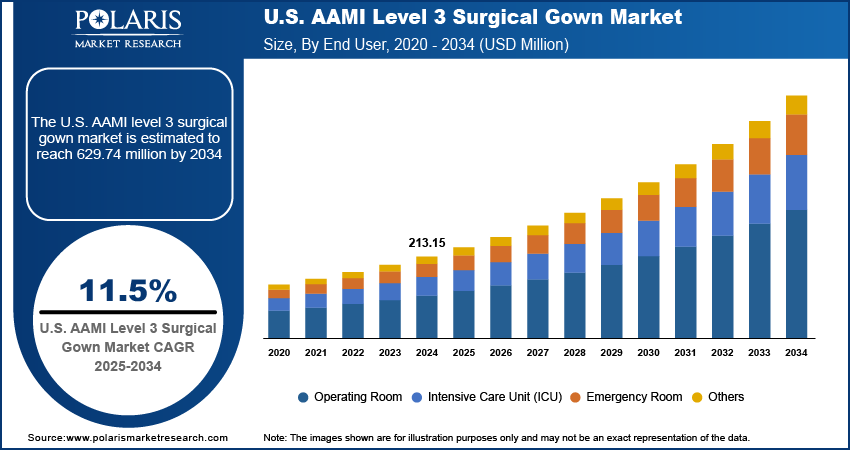

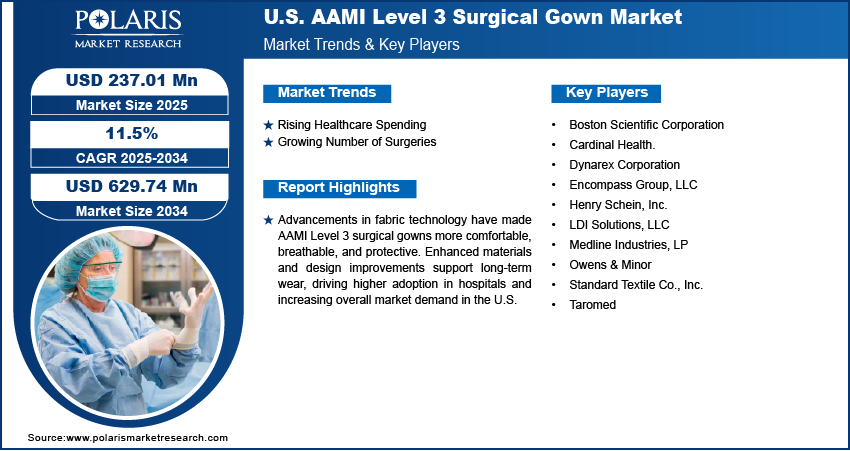

The U.S. AAMI Level 3 surgical gown market size was valued at USD 213.15 million in 2024, growing at a CAGR of 11.5% from 2025 to 2034. The growth is driven by rising healthcare spending and growing number of surgeries.

An AAMI Level 3 surgical gown is a medical garment designed to offer moderate protection against fluid penetration, particularly in critical areas such as the chest and sleeves. It is commonly used in moderate-risk scenarios, including blood draws, emergency rooms, and surgical procedures.

Healthcare professionals in the U.S. are focusing on controlling infections during and after surgery. Hospital-acquired infections (HAIs) are a serious issue, leading to longer patient stays, increased medical costs, and even deaths. According to the Centers for Disease Control and Prevention, every day, 1 in 31 people in the country contracts at least one infection in association with their healthcare. AAMI Level 3 surgical gowns provide effective protection against blood and fluid exposure, helping reduce the risk of spreading infectious agents. The growing emphasis on patient and staff safety has pushed hospitals to invest in better-quality gowns. Infection prevention protocols adopted by U.S. healthcare systems have made AAMI Level 3 gowns a standard choice for many procedures, thereby driving the growth.

To Understand More About this Research: Request a Free Sample Report

Advancements in fabric technology made AAMI Level 3 surgical gowns more comfortable, breathable, and effective. Manufacturers in the U.S. are using advanced synthetic materials that improve barrier protection without sacrificing comfort. Some gowns now feature lightweight, moisture-wicking layers that keep medical staff dry while ensuring safety. These improvements are particularly appealing in busy hospitals in the country where medical professionals wear gowns for long periods. Better product design and material science have made AAMI Level 3 gowns more attractive and functional, encouraging more healthcare facilities to adopt them, which boosts market demand.

Industry Dynamics

Rising Healthcare Spending

The U.S. has one of the highest healthcare expenditures in the world. According to the Centers for Medicare & Medicaid Services, the U.S. healthcare spending was USD 4.9 trillion in 2023. Healthcare providers spend more on high-quality protective equipment as hospitals receive more funding through government programs, insurance reimbursements, and private investments. A portion of this spending is allocated to upgrading personal protective equipment (PPE), including surgical gowns. Healthcare facilities prioritize investing in reliable, high-standard gowns such as AAMI Level 3 with a focus on improving patient outcomes and reducing liability, thereby driving the U.S. AAMI Level 3 surgical gown market growth.

Growing Number of Surgeries

The increasing number of surgical procedures in the U.S. is driving the demand for AAMI Level 3 surgical gowns. According to the Centers for Disease Control and Prevention (CDC), in 2023, 51.4 million in-patient surgeries were performed in the country. More people are undergoing surgeries as the population ages, and chronic conditions such as heart disease, cancer, and obesity rise. Hospitals and surgical centers are performing higher volumes of procedures for various treatments such as obesity treatment and cardiovascular disease treatment, from routine operations to complex surgeries. AAMI Level 3 gowns offer protection from fluid exposure, making them ideal for such procedures. The need for reliable and safe surgical apparel is growing due to the rising number of surgeries, especially in large hospital systems, thereby driving the growth.

Segmental Insights

Usability Analysis

Based on usability, the U.S. AAMI Level 3 surgical gown market is bifurcated into disposable gowns and reusable gowns. In 2024, the disposable gowns segment dominated with a larger share due to the country’s strong focus on infection prevention and healthcare efficiency. Hospitals and surgical centers in the U.S. prefer disposable gowns to avoid cross-contamination, meet CDC infection control guidelines, and reduce the time and labor involved in laundering reusable gowns. Healthcare providers across states, from large urban hospitals to rural clinics, are opting for disposable gowns for single-use safety with increasing surgeries and stricter hygiene standards post-COVID-19 pandemic. Their convenience and regulatory compliance have made them the preferred choice across nearly all surgical settings in the country, thereby driving the growth.

Gown Type Analysis

The segmentation, based on gown type, includes fabric reinforced and non-fabric reinforced. The fabric reinforced segment held a larger share in 2024 due to rising demand from major hospital systems such as those under Kaiser Permanente, HCA Healthcare, and the Mayo Clinic. These gowns are favored in longer surgeries where enhanced protection is necessary, including cardiovascular and orthopedic procedures. In the U.S., hospitals invest in fabric-reinforced gowns to meet OSHA and FDA safety regulations and to protect surgical teams from fluid exposure. Their reliability in high-risk procedures and favorable clinician feedback continue to make them a top choice among healthcare providers, especially in high-acuity operating rooms across the country, thereby driving the segment growth.

The non-fabric reinforced segment is expected to record significant growth during the forecast period, due to rising demand from ambulatory services such as ambulatory surgical centers (ASCs) and outpatient clinics. These settings are expanding rapidly across states such as Texas, Florida, and California due to demand for lower-cost, minimally invasive procedures. Healthcare providers in these facilities look for gowns that balance safety and affordability. Non-reinforced gowns, which offer moderate fluid resistance and improved breathability, are ideal for shorter procedures with lower fluid risk, thereby driving the segment growth.

Surgery Analysis

The segmentation, based on surgery, includes general surgery, orthopedic surgery, endoscopic surgery, gynecological surgery, mastectomy, and others. The endoscopic surgery segment is expected to record significant growth during the forecast period, as the rising popularity of endoscopic surgeries is boosting demand for AAMI Level 3 gowns. These minimally invasive surgeries procedures, such as laparoscopic gallbladder removal and arthroscopic joint repairs, are increasing in volume, especially in U.S. urban surgical centers and specialized outpatient facilities. Endoscopic surgery requires gowns that offer flexibility and moderate fluid protection, making Level 3 gowns a perfect match. Hospitals and ASCs continue expanding endoscopic offerings as insurers and patients in the U.S. push for faster recovery and lower healthcare costs, thereby driving the segment growth.

Key Players and Competitive Analysis

The industry is highly competitive, with companies such as Medline Industries, Cardinal Health, Owens & Minor, and Boston Scientific leading in innovation and scale. Additionally, Dynarex, Henry Schein, and Encompass Group provide extensive distribution networks and cost-effective solutions. Standard Textile and LDI Solutions focus on durable, reusable gowns, while Taromed and Alleset enhance their offerings through obtaining regulatory approvals. Competitive advantages arise from FDA clearances, advanced materials such as SMS and SMMS, and robust infection control capabilities. As healthcare demands continue to grow, differentiation relies on quality, comfort, and supply chain resilience, enabling top players to meet the evolving needs of hospitals and surgical centers.

Key Players

- Boston Scientific Corporation

- Cardinal Health.

- Dynarex Corporation

- Encompass Group, LLC

- Henry Schein, Inc.

- LDI Solutions, LLC

- Medline Industries, LP

- Owens & Minor

- Standard Textile Co., Inc.

- Taromed

Industry Developments

In January 2022, Alleset received FDA 510(k) clearance for its AAMI Level III Surgical Isolation Gown, expanding its protective apparel portfolio and reinforcing its commitment to safeguarding healthcare workers and patients from exposure to potentially infectious materials.

U.S. AAMI Level 3 Surgical Gown Market Segmentation

By Usability Outlook (Revenue, USD Million, 2020–2034)

- Disposable Gowns

- Reusable Gowns

By Gown Type Outlook (Revenue, USD Million, 2020–2034)

- Fabric Reinforced

- Non-fabric Reinforced

By Surgery Outlook (Revenue, USD Million, 2020–2034)

- General Surgery

- Orthopedic Surgery

- Endoscopic Surgery

- Gynecological Surgery

- Mastectomy

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Operating Room

- Intensive Care Unit (ICU)

- Emergency Room

- Others

U.S. AAMI Level 3 Surgical Gown Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 213.15 Million |

|

Market Size in 2025 |

USD 237.01 Million |

|

Revenue Forecast by 2034 |

USD 629.74 Million |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 213.15 million in 2024 and is projected to grow to USD 629.74 million by 2034.

The market is projected to register a CAGR of 11.5% during the forecast period.

A few of the key players in the market are Boston Scientific Corporation; Cardinal Health; Dynarex Corporation; Encompass Group, LLC; Henry Schein, Inc.; LDI Solutions, LLC; Medline Industries, LP; Owens & Minor; Standard Textile Co., Inc.; and Taromed.

The disposable gown segment dominated the market share in 2024.

The endoscopic surgery segment is expected to witness the significant growth during the forecast period.