U.S. Activated Carbon Market Size, Share, & Industry Analysis Report

: By Raw Material (Coal-Based, Coconut Shell, Hardwood-Based), By Distribution Channel, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6194

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

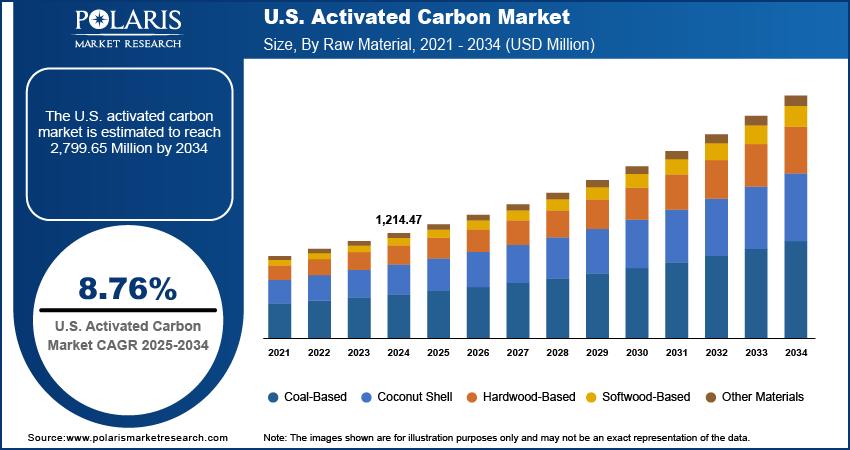

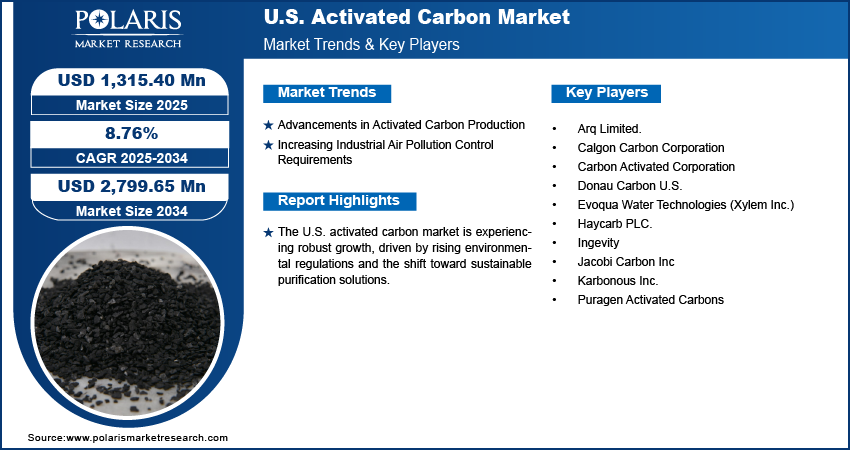

The U.S. activated carbon market size was valued at USD 1,214.47 million in 2024, growing at a CAGR of 8.76% from 2025–2034. The growth is driven by the technological advancement, growth in food & beverage processing, and increasing demand for water and wastewater treatment.

Activated carbon, also known as activated charcoal, is a form of carbon processed to have small, low-volume pores that increase the surface area available for adsorption or chemical reactions. It is typically derived from carbon-rich materials such as coal, wood, coconut shells, or peat. It is available in various forms, such as powdered activated carbon (PAC), granular activated carbon (GAC), and extruded or pelletized carbon. The versatility of activated carbon makes it a major component in numerous applications ranging from water and air purification to food processing and pharmaceuticals.

Its exceptional adsorption capacity is one of the primary benefits of activated carbon. Its porous structure enables it to effectively capture contaminants, toxins, and impurities from liquids and gases. In the U.S., this is widely used in water treatment facilities to remove chlorine, sediment, volatile organic compounds (VOCs), and other harmful substances from drinking water. According to a March 2025 U.S. EPA report, granular activated carbon (GAC) is capable of removing up to 99.9% of various volatile organic compounds (VOCs), such as trichloroethylene (TCE) and tetrachloroethylene (PCE). Additionally, industrial applications utilize activated carbon for water and wastewater treatment equipment and manage emissions, ensuring compliance with environmental regulations set by authorities such as the Environmental Protection Agency (EPA).

Air purification further drives the demand for activated carbon in the U.S.. Activated carbon filters are increasingly used in HVAC systems, medical gas equipment, and air purifiers to eliminate odors, gases, and airborne pollutants, with rising concerns about indoor and outdoor air pollution. Moreover, the strict environmental regulations imposed on industrial emissions, especially from manufacturing, energy production, and chemical processing plants, have made activated carbon essential in flue gas treatment and mercury emission control.

The U.S. market also benefits from the use of activated carbon in the food and beverage, medical, and pharmaceutical sectors. In these industries, it is used for decolorization, purification, and toxin removal. For instance, activated carbon is utilized to purify food additives and sweeteners and clarify beverages. In medical settings, it is used in the treatment of poisonings and overdoses due to its ability to bind toxins in the gastrointestinal tract. These varied benefits highlight the product's essential role in health, safety, and quality control across diverse sectors.

Overall, this sector is poised for growth, supported by increasing environmental awareness, regulatory pressures, and technological advancements in production and application. Therefore, as sustainability continues to be a top priority, the demand for effective purification solutions like activated carbon is expected to expand further, opening new opportunities for innovation and market development.

Industry Dynamics

Advancements in Activated Carbon Production

Ongoing innovations in activation techniques, such as steam, chemical, and microwave-based methods, have improved the performance of activated carbon. These technologies allow for better control over pore size distribution, adsorption capacity, and regeneration potential, allowing broader and more efficient applications. Customized grades are now being developed for highly specific needs, such as the removal of PFAS from water or the capture of trace VOCs from the air.

In the U.S., R&D investments and collaborations by both private firms and academic institutions are leading to breakthroughs in nanostructured carbon materials and hybrid systems combining activated carbon with other media such as zeolites or resins. For instance, In January 2025, Calgon Carbon and American Water signed a nine-year exclusive contract to supply granular activated carbon and reactivation services for PFAS treatment at over 50 water sites across 10 states, extending through 2033. These collaborations are expanding the usability of activated carbon in emerging applications, such as energy storage, pharmaceuticals, and water treatment, thereby driving growth from a technological front.

Increasing Industrial Air Pollution Control Requirements

Industrial emissions, especially from power plants, cement factories, and chemical manufacturing, contribute to air pollution. Activated carbon is a proven solution for capturing airborne toxins such as mercury, volatile organic compounds (VOCs), and sulfur compounds. The U.S. government's tightening of emission standards through policies such as the Mercury and Air Toxics Standards (MATS), stricter air quality standards, and others has driven industries to deploy air purification technologies. According to a March 2024 report from the Clean Air Fund, the U.S. EPA tightened US air quality standards, reducing the annual PM2.5 limit from 12μg/m³ to 9μg/m³ for power plants, industrial facilities, and automobiles, significantly boosting demand for activated carbon in vapor-phase applications.

Additionally, there is an increasing focus on sustainability and clean air technologies as environmental consciousness grows among corporations and the public. Many industrial facilities are adopting activated carbon systems as part of their ESG (Environmental, Social, Governance) strategies to meet regulatory thresholds and gain stakeholder trust. Thus, this shift is boosting continuous investment in the development and procurement of high-performance activated carbon for air purification across the U.S.

Segmental Insights

Raw Material Analysis

The segmentation, based on raw material, includes coal-based, coconut shell, hardwood-based, softwood-based, and other materials. The coal-based segment is projected to grow with a CAGR of 8.3% during the forecast year due to its widespread application in industrial-scale filtration and purification systems. Coal-based carbon is known for its high porosity and excellent adsorption capacity, making it suitable for treating large volumes of contaminated water and air. Its cost-effectiveness and availability in large quantities further improve its use across sectors such as municipal water treatment and flue gas cleaning. Moreover, continuous technological improvements in activation processes are improving the performance characteristics of coal-based variants, supporting its increasing preference in both developing and developed markets.

The softwood-based segment is expected to witness robust growth during the forecast period, as demand for more sustainable and renewable carbon sources continues to rise. Softwood-based carbon offers a lighter structure and higher macro porosity, making it ideal for specific applications such as decolorization and purification in the food and pharmaceutical industries. Additionally, the growing focus on green manufacturing practices and bio-based material usage is shifting consumer and industrial preferences toward softwood-derived products. These trends, coupled with regional afforestation efforts and the availability of softwood resources, are expected to drive strong growth for this segment.

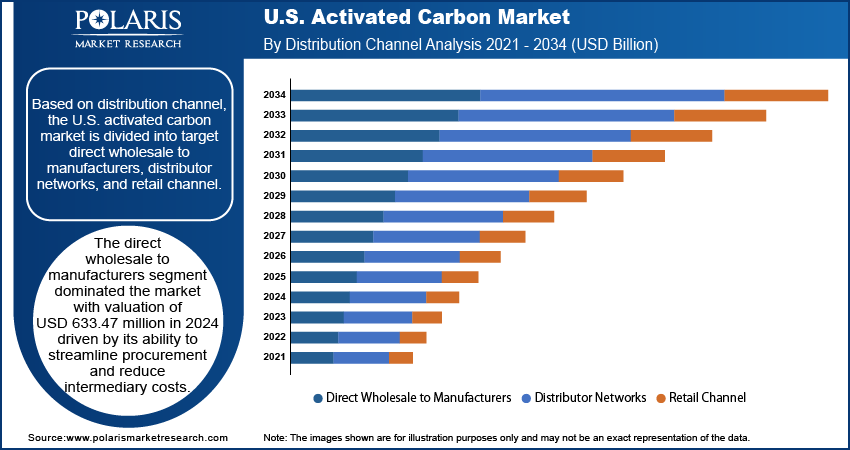

Distribution Channel Analysis

The segmentation, based on distribution channel, includes direct wholesale to manufacturers, distributor networks, and retail channel. The direct wholesale to manufacturers segment dominated the market with valuation of USD 633.47 million in 2024 driven by its ability to streamline procurement and reduce intermediary costs. This model allows manufacturers to maintain better control over product specifications, quality, and delivery timelines, which is particularly crucial in sectors with strict operational standards, such as pharmaceuticals and water treatment. Moreover, the increasing prevalence of long-term supply agreements and partnerships between activated carbon producers and end-use manufacturers has also strengthened this channel’s importance. Furthermore, this approach improves volume efficiency, allowing for economies to scale and improve profit margins.

The distributor networks segment is projected to grow with a CAGR of 9.1% during the forecast period driven by its role in bridging the gap between manufacturers and smaller-scale or regional buyers. Distributors enable widespread market penetration by managing logistics, warehousing, and localized customer service, which is particularly beneficial in emerging markets. Their ability to offer customized packaging, flexible pricing, and technical support adds value for various end users with changing demand profiles. Additionally, the growing complexity of activated carbon applications across industries is also boosting reliance on specialized distributors capable of offering tailored solutions.

End User Analysis

The segmentation, based on end user, includes water treatment, air & gas purification, food & beverage processing, pharmaceutical, mining & metallurgy, automotive & transportation, and others. The water treatment segment captured 36.27% share of the market in 2024 owing to the widespread use of activated carbon in municipal and industrial water purification processes. It is highly effective in removing organic contaminants, chlorine, and other chemical impurities, making it essential in achieving safe drinking water standards. Rising global concerns over water quality, coupled with strict environmental regulations, are further boosting the demand for reliable filtration materials. Additionally, increasing investment in water infrastructure and wastewater recycling initiatives are driving the segment’s growth.

The air & gas purification was valued at USD 294.39 million in 2024 due to the rising demand for air quality management solutions across industrial, commercial, and residential sectors. Activated carbon’s ability to adsorb a wide range of volatile organic compounds (VOCs), odors, and toxic gases has made it a critical material in emission control systems and indoor air purification units. Industries are increasingly deploying activated carbon-based filtration to ensure compliance and safeguard workers and public health with growing awareness about health hazards associated with air pollution and stricter emission norms.

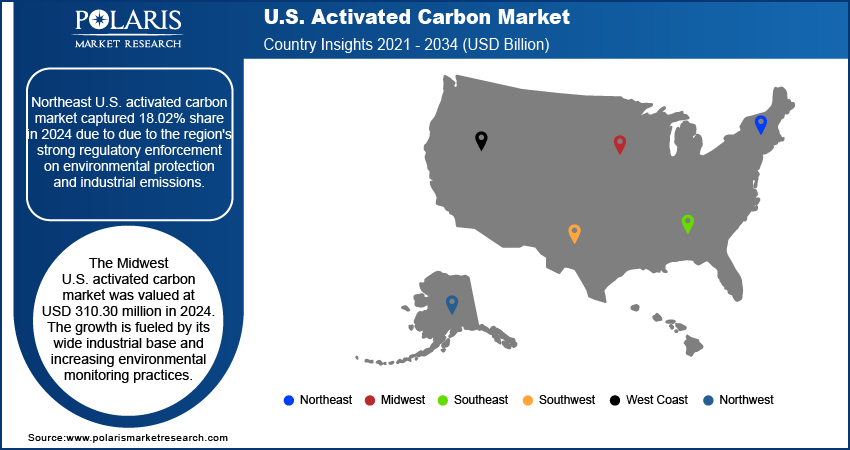

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North East U.S. activated carbon market captured 18.02% share in 2024 due to due to the region's strong regulatory enforcement on environmental protection and industrial emissions. The demand for high-performance filtration solutions remains consistently high, with a dense concentration of pharmaceutical, food processing, and water treatment facilities. Moreover, ongoing investments in upgrading municipal water systems and stricter compliance with EPA standards have driven the adoption across public utilities. For instance, in April 2025, Governor Hochul allocated more than USD 175 million to support critical water and sewer infrastructure upgrades across New York State, improving affordability for local communities. The region's commitment to sustainability and clean air initiatives further supports the steady consumption of activated carbon materials.

The Midwest U.S. activated carbon market was valued at USD 310.30 million in 2024. The growth is fueled by its wide industrial base and increasing environmental monitoring practices. The region has numerous manufacturing, chemical, and metal processing plants that require efficient filtration and purification systems, making activated carbon a critical component. Additionally, advancements in wastewater treatment infrastructure and an increasing focus on safe industrial discharge practices have driven the growth across municipal and private sectors. The sector also benefits from proximity to domestic sources of raw materials, which improves supply chain efficiency and reduces operational costs.

The Southeast U.S. activated carbon market is projected to grow with a CAGR of 9.3% during the forecast period due to the region's rapid industrial development and expanding urban population. Rising concerns over air and water pollution, especially in fast-growing metropolitan areas, are boosting investments in environmental control technologies. The adoption of activated carbon in air purification, water treatment, and energy generation sectors is accelerating, driven by both regulatory compliance and public health awareness. Furthermore, the region's favorable climate for agricultural and biomass activities presents opportunities for sourcing alternative raw materials for activated carbon production, further supporting long-term expansion.

Key Players & Competitive Analysis

The U.S. activated carbon industry is witnessing dynamic competition as companies leverage strategic investments and emerging technologies to address sustainable value chains and supply chain disruptions. Players such as Calgon Carbon and Ingevity dominate through region-wise market size advantages and technological advancements in PFAS removal and air purification. The revenue growth is driven by stricter EPA regulations and latent demand for water treatment solutions, while economic and geopolitical shifts impact raw material sourcing. Small and medium-sized businesses compete by specializing in niche applications like biogas purification. Additionally, future development strategies focus on hybrid sorbents and reactivation technologies to reduce costs. Expert insights highlight expansion opportunities in industrial emissions control, though competitive positioning depends on scaling production to meet municipal water treatment demands.

A few key players are Arq Limited, Calgon Carbon Corporation, Carbon Activated Corporation, Donau Carbon U.S., Evoqua Water Technologies (Xylem Inc.), Haycarb PLC, Ingevity, Jacobi Carbon Inc, Karbonous Inc., and Puragen Activated Carbons.

Key Players

- Arq Limited.

- Calgon Carbon Corporation

- Carbon Activated Corporation

- Donau Carbon U.S.

- Evoqua Water Technologies (Xylem Inc.)

- Haycarb PLC.

- Ingevity

- Jacobi Carbon Inc

- Karbonous Inc.

- Puragen Activated Carbons

Industry Developments

January 2025: Calgon Carbon Corporation and American Water, the largest regulated water and wastewater utility company in the U.S., have signed a nine-year exclusive supply contract for granular activated carbon, equipment, and reactivation

March 2025: Jacobi Group acquired Finex, a Finnish resin maker integrating Finex into Jacobi Resins business, analysing plant functionality and improving procedures.

December 2024: Xylem acquired a majority stake in Idrica, a water data management firm. The merger enhances Xylem Vue, combining digital solutions to address water scarcity and aging infrastructure with real-time analytics, improving operational efficiency for utilities.

U.S. Activated Carbon Market Segmentation

By Raw Material Outlook (Volume, Tons; Revenue, USD Million, 2020–2034)

- Coal-Based

- Coconut Shell

- Hardwood-Based

- Softwood-Based

- Other Materials

By Distribution Channel Outlook (Volume, Tons; Revenue, USD Million, 2020–2034)

- Direct Wholesale to Manufacturers

- Distributor Networks

- Retail Channel

By End User Outlook (Volume, Tons; Revenue, USD Million, 2020–2034)

- Water Treatment

- Air & Gas Purification

- Food & Beverage Processing

- Pharmaceutical

- Mining & Metallurgy

- Automotive & Transportation

- Others

By Regional Outlook (Volume, Tons; Revenue, USD Million, 2020–2034)

- Northeast

- Midwest

- Southeast

- Southwest

- West Coast

- Northwest

U.S. Activated Carbon Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,214.47 million |

|

Market Size in 2025 |

USD 1,315.40 million |

|

Revenue Forecast by 2034 |

USD 2,799.65 million |

|

CAGR |

8.76% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons; Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1,214.47 million in 2024 and is projected to grow to USD 2,799.65 million by 2034.

The market is projected to register a CAGR of 8.76% during the forecast period.

The Midwest U.S. activated carbon market held the largest share valued at USD 310.30 million in 2024.

A few of the key players in the market are Arq Limited, Calgon Carbon Corporation, Carbon Activated Corporation, Donau Carbon U.S., Evoqua Water Technologies (Xylem Inc.), Haycarb PLC, Ingevity, Jacobi Carbon Inc, Karbonous Inc., and Puragen Activated Carbons.

The direct wholesale to manufacturers segment dominated the market with valuation of USD 633.47 million in 2024.

The softwood-based segment is expected to witness robust growth during the forecast period.