U.S. Benign Prostatic Hyperplasia Surgical Treatment Market Size, Share, Industry Analysis Report

By Type [Transurethral Resection of Prostate (TURP), Prostatic Urethral Lift], By End User– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5888

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

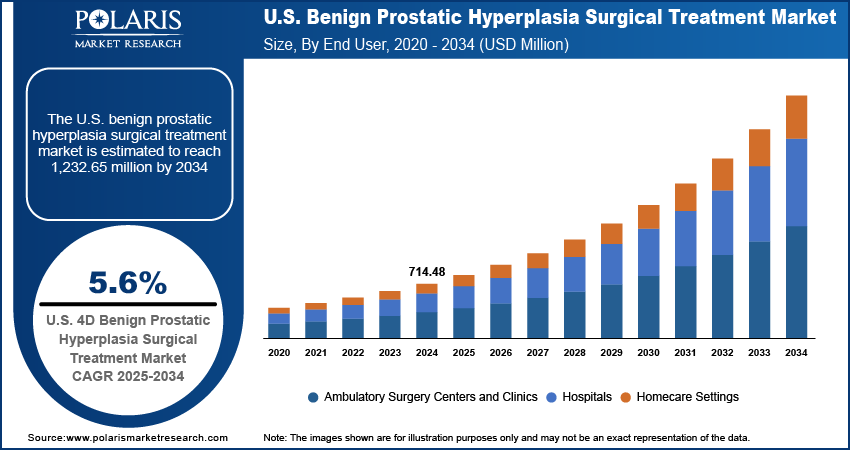

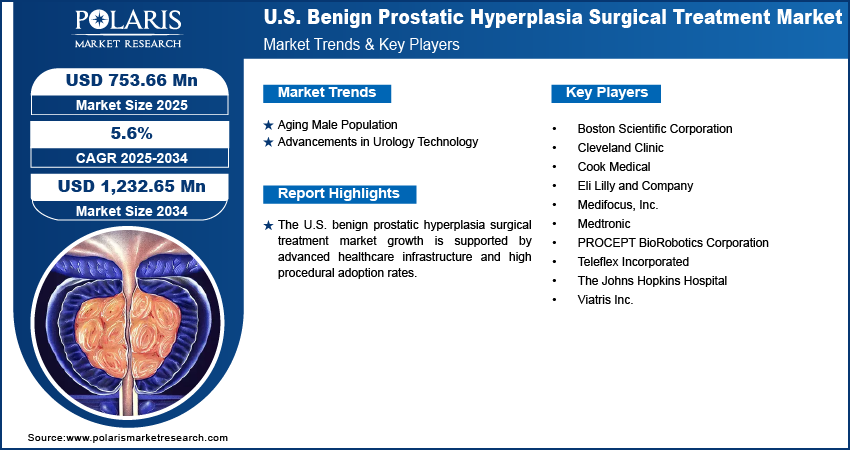

The U.S. benign prostatic hyperplasia (BPH) surgical treatment market size was valued at USD 714.48 million in 2024, growing at a CAGR of 5.6% from 2025 to 2034. The growing elderly male population is driving demand for BPH interventions, while technological innovations in minimally invasive procedures and increased public awareness are enhancing treatment efficacy and fueling growth opportunities.

BPH surgical treatment addresses urinary obstruction from noncancerous prostate enlargement through various medical procedures. The sector is experiencing consistent growth, fuelled by growing demand for minimally invasive techniques and increasing awareness of urological health among aging men. Modern approaches, such as laser therapy, TURP, and PUL procedures, are increasingly preferred due to their benefits, such as shorter recovery periods, fewer complications, and improved outcomes, making them attractive alternatives to traditional surgeries.

To Understand More About this Research: Request a Free Sample Report

Increased prostate health awareness, supported by public health initiatives and improved diagnostics, is driving earlier treatment-seeking behaviour, expanding the eligible patient base. In June 2025, Teleflex launched educational campaigns, including a "Prostate Monster" awareness drive and mobile outreach, to highlight BPH symptoms and radiation-related risks, thereby boosting both physician and patient knowledge.

The continuous improvement of healthcare infrastructure in the U.S. creates significant growth opportunities. According to a December 2024 CMS report, U.S. healthcare expenditures increased by 7.5% in 2023, totalling ~USD 4.9 trillion nationwide, or USD 14,570 per capita. This growth reflects continued expansion in medical service utilization and costs across the healthcare system. Better access to urological services, combined with increasing investments in advanced surgical technologies, enables providers to deliver more specialized and accurate BPH treatments. The growth of hospital systems, outpatient surgery centers, and specialized clinics facilitates wider adoption of modern surgical solutions and increases patient accessibility. Additionally, enhanced training initiatives and a growing pool of experienced urologists are improving surgical outcomes and operational efficiency. This wide-ranging infrastructure advancement enhances clinical capabilities while facilitating an ecosystem that helps drive innovation and the broader adoption of new procedures.

Industry Dynamics

Aging Male Population

The growing elderly male demographic is driving demand in BPH surgical treatments. Age-related hormonal changes and prostate enlargement lead to urinary complications requiring medical or surgical management. According to a June 2025 report by the U.S. Census Bureau, the population aged 65 and above increased by 3.1% between 2023 and 2024, reaching 61.2 million. This expanding patient population, often presenting with multiple health conditions, is increasing the need for effective, durable treatment options that alleviate symptoms and enhance daily functioning. The rising prevalence of age-associated BPH cases underscores the importance of accessible, high-quality urological interventions to address this progressive condition.

Advancements in Urology Technology

Advancements in urology technology are accelerating the market for BPH surgical treatment. Innovations such as medical laser-based procedures, surgical robots, and real-time imaging systems have greatly improved the precision, safety, and efficacy of BPH treatments. In April 2025, Medtronic announced its U.S. clinical trial for the Hugo robotic-assisted surgery system met all safety and effectiveness endpoints. The study, involving 137 patients across multiple centers, represented the largest robotic urologic surgery trial conducted to date. These technological developments enable minimally invasive techniques that reduce patient discomfort, shorten recovery periods, and improve clinical outcomes. The integration of advanced tools into surgical practice supports better procedural success. Additionally, it enhances the confidence of both healthcare providers and patients in opting for surgical intervention, thereby driving opportunities for expansion.

Segmental Insights

Type Analysis

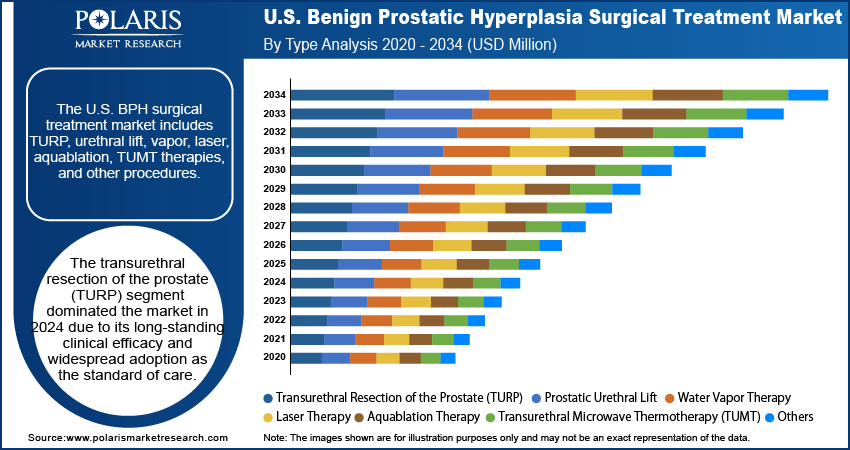

The segmentation, based on type, includes transurethral resection of the prostate (TURP), prostatic urethral lift, water vapor therapy, laser therapy, aquablation therapy, transurethral microwave thermotherapy (TUMT), and others. The transurethral resection of the prostate (TURP) segment dominated the market in 2024, due to its long-standing clinical efficacy and widespread adoption as the standard of care. TURP has been widely recognized for delivering reliable symptom relief and improved urinary flow in patients with moderate to severe BPH. The technique’s vast procedural familiarity among urologists, along with its well-established safety profile, has contributed to its preference in primary and referral healthcare sectors. Additionally, its integration into clinical guidelines and accessibility across diverse healthcare systems further support its position.

The prostatic urethral lift segment is expected to witness robust growth during the forecast period, driven by its minimally invasive nature and preservation of sexual function. This procedure has gained attention for offering rapid symptom relief without the need for extensive tissue removal, making it especially appealing to younger or sexually active patients. The outpatient-friendly approach, shorter recovery time, and reduced risk of complications are fueling its increased adoption. Furthermore, growing awareness among patients and providers about alternatives to traditional resection techniques is improving the segment’s momentum.

End User Analysis

The segmentation, based on end user, includes hospitals, ambulatory surgery centers and clinics, and homecare settings. The hospitals segment accounted for the largest revenue share in 2024, supported by their wide diagnostic capabilities, availability of specialized urologists, and access to advanced surgical infrastructure. Hospitals often serve as primary centers for urological interventions, particularly in cases requiring complex procedures or postoperative care. Their ability to manage a high volume of patients and perform a variety of BPH surgical techniques, such as TURP and laser therapies, makes them preferred for both elective and emergency treatments. Additionally, the presence of multidisciplinary teams further enhances procedural outcomes and patient trust.

The ambulatory surgery centers (ASCs) segment is projected to register the highest CAGR during the forecast period, due to the rising preference for outpatient procedures and cost-effective care delivery. ASCs offer a streamlined alternative for patients seeking minimally invasive BPH surgeries, often with shorter wait times and reduced hospital-associated costs. Technological advancements have enabled many BPH surgeries to be performed safely in these centers, enhancing procedural efficiency and patient satisfaction. Moreover, the expanding footprint of ASCs across urban and semi-urban areas is also making these facilities more accessible, driving their increasing role in the BPH treatment landscape.

Key Players and Competitive Analysis

The field of U.S. BPH surgical treatment market demonstrates robust revenue growth, driven by technological advancements in minimally invasive systems and an aging male population. Major players such as Boston Scientific and Medtronic are making strategic investments in robotic platform, while PROCEPT BioRobotics leverages technologies such as Aquablation therapy. Industry trends indicate a shift toward outpatient settings, with ambulatory surgery centers capitalizing on expansion opportunities through cost-effective care models. Competitive intelligence indicates that Teleflex and Olympus are strengthening their regional footprints through awareness campaigns and next-generation devices. Economic shifts, such as Medicare coverage policies, influence vendor strategies, while growth projections remain positive. Additionally, startups face barriers in developed markets due to reimbursement complexities, though latent demand continues in underserved demographics. The sector’s future development strategies rely on the integration of Artificial Intelligence, personalized therapies, and addressing supply chain disruptions for critical components.

A few key players in the U.S. benign prostatic hyperplasia surgical treatment market are Boston Scientific Corporation; Cleveland Clinic; Cook Medical; Eli Lilly and Company; Medifocus, Inc.; Medtronic; PROCEPT BioRobotics Corporation; Teleflex Incorporated; The Johns Hopkins Hospital; and Viatris Inc.

Key Players

- Boston Scientific Corporation

- Cleveland Clinic

- Cook Medical

- Eli Lilly and Company

- Medifocus, Inc.

- Medtronic

- PROCEPT BioRobotics Corporation

- Teleflex Incorporated

- The Johns Hopkins Hospital

- Viatris Inc.

Industry Developments

January 2025: Mount Sinai Hospital became the first facility in New York City to use the HYDROS Robotic System for managing benign prostatic hyperplasia. This advanced platform employs minimally invasive techniques to enhance treatment precision and patient outcomes for those with enlarged prostates.

December 2024: Teleflex Incorporated launched the UroLift 2 System with Advanced Tissue Control, designed to effectively treat all prostate types.

August 2024: PROCEPT BioRobotics received FDA clearance for the HYDROS Robotic System, an AI-driven platform for aquablation therapy. Its Robotic Resection feature ensures precise waterjet execution, standardizing the surgical experience across diverse prostate anatomies.

U.S. Benign Prostatic Hyperplasia Surgical Treatment Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Transurethral Resection of the Prostate (TURP)

- Prostatic Urethral Lift

- Water Vapor Therapy

- Laser Therapy

- Aquablation Therapy

- Transurethral Microwave Thermotherapy (TUMT)

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgery Centers and Clinics

- Homecare Settings

U.S. Benign Prostatic Hyperplasia Surgical Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 714.48 million |

|

Market Size in 2025 |

USD 753.66 million |

|

Revenue Forecast by 2034 |

USD 1,232.65 million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 714.48 million in 2024 and is projected to grow to USD 1,232.65 million by 2034.

The U.S. market is projected to register a CAGR of 5.6% during the forecast period.

A few of the key players in the market are Boston Scientific Corporation; Cleveland Clinic; Cook Medical; Eli Lilly and Company; Medifocus, Inc.; Medtronic; PROCEPT BioRobotics Corporation; Teleflex Incorporated; The Johns Hopkins Hospital; and Viatris Inc.

The transurethral resection of the prostate (TURP) segment dominated the market in 2024.

The ambulatory surgery centers (ASCs) segment is projected to register the highest CAGR during the forecast period.